Analysis of “The Madoff Affair” documentary

In this article, Raphael TRAEN (ESSEC Business School, Global BBA, 2023-2024) analyzes “The Madoff Affair” documentary and explains the key financial concepts related to this documentary.

Key characters in the documentary

- Bernard Madoff: key person, the admitted mastermind of the Ponzi scheme

- Avellino: partner in Avellino and Bienes, advising its clients to invest with Madoff

- Bienes: accountant for Madoff’s father-in-law, later partner in Avellino and Bienes, advising its clients to invest with Madoff

Summary of the documentary

Bernard Lawrence Madoff (“Bernie”) was an American stockbroker, market maker and an unofficial investment advisor (because he did not have the necessary license to do so) who operated what has been considered the largest Ponzi scheme in history. He defrauded investors out of billions over a long period.

How did the scheme work?

Madoff’s Ponzi scheme was a classic example of a “pyramid scheme,” in which money from new investors is used to pay returns to earlier investors, creating the illusion of strong returns. Madoff claimed to be investing in a “secret” arbitrage strategy that generated consistent returns, even during periods of market downturn.

In reality, Madoff was simply lying to investors and using the money to pay returns to existing investors and to enrich himself. He kept his scheme going by attracting new investors, who were lured by the promise of high returns and the reputation of Madoff, who was a well-respected figure on Wall Street.

Bernard Madoff was able to maintain his Ponzi scheme for so long in part because he had help from two of his closest associates: Avellino and Bienes. Avellino and Bienes were investment advisors who were responsible for soliciting investments from Madoff’s funds. They were also responsible for creating false account statements that showed investors were making consistently high returns.

Avellino and Bienes first met Madoff and were impressed by his reputation and his consistent track record of high returns. They even approached Madoff about managing their own investments. Madoff agreed, and Avellino and Bienes began to introduce Madoff to their own clients.

Avellino and Bienes were instrumental in helping Madoff build his Ponzi scheme. They were able to attract new investors to Madoff’s funds by touting his track record and his reputation for integrity.

Technical details about the Madoff investment strategy

Bernie Madoff told his investors he was using a legitimate investing strategy called split-strike conversion. This strategy involves buying a stock index and simultaneously purchasing put options to limit the downside potential and selling call options to generate additional income.

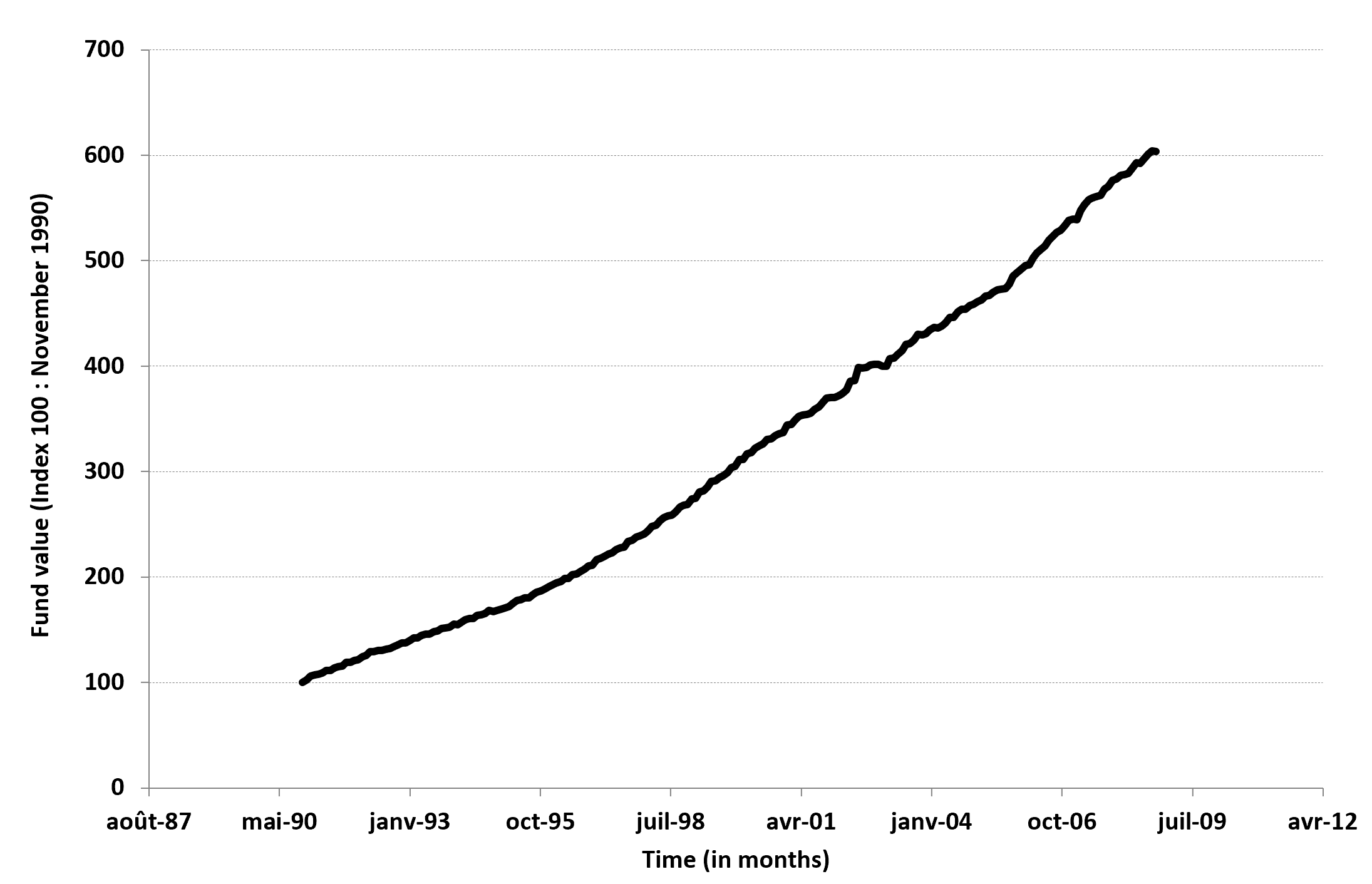

Evolution of the Fairfield Sentry fund of Madoff

Source: Madoff

Source: Madoff

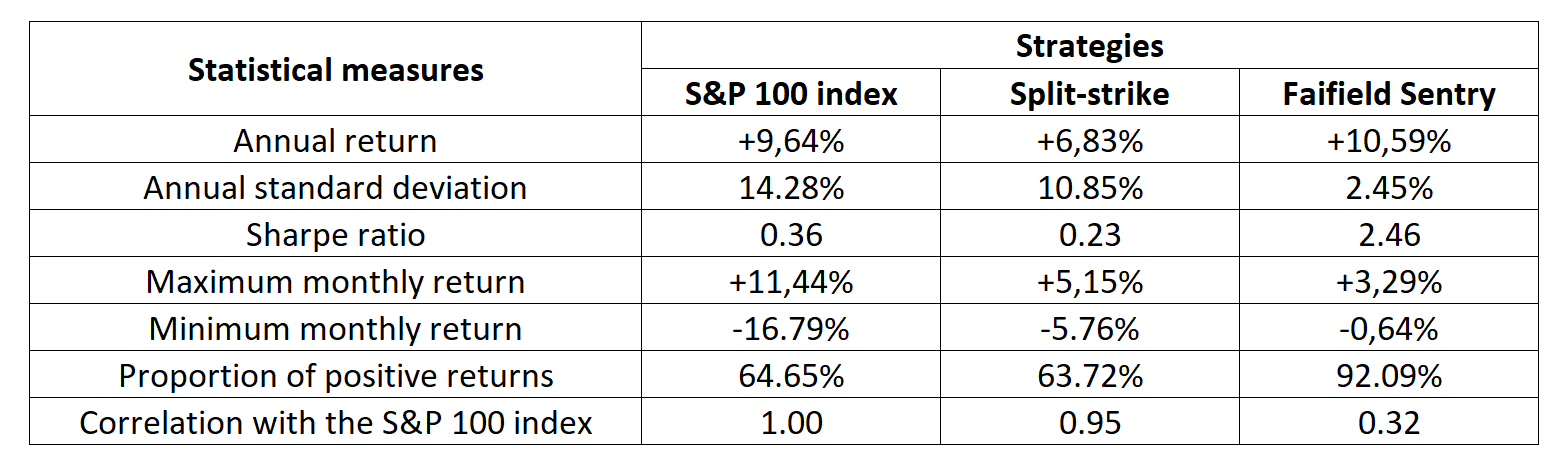

Statistical measures of the Fairfield Sentry fund of Madoff

Source: Bernard and Boyle (2009)

Source: Bernard and Boyle (2009)

Should you be more interested in this strategy I definitely recommend watching the following video explaining the strategy with an example:

Bernie Madoff’s infamous split-strike conversion strategyTheoretically, this strategy aims to provide a steady stream of income while protecting against significant losses. However, Madoff’s claims about his split-strike conversion strategy were entirely fabricated. He was not actually making these trades or generating the reported returns. Instead, he was using money from new investors to pay off existing investors, replicating a classic Ponzi scheme. This is also further confirmed by the picture I added above comparing the different strategies. The Fairfield Sentry fund was one controlled by Madoff. You can immediately see that the return is higher than what it would be according to the strategy and also that the standard deviation is much lower.

The downfall of the scheme

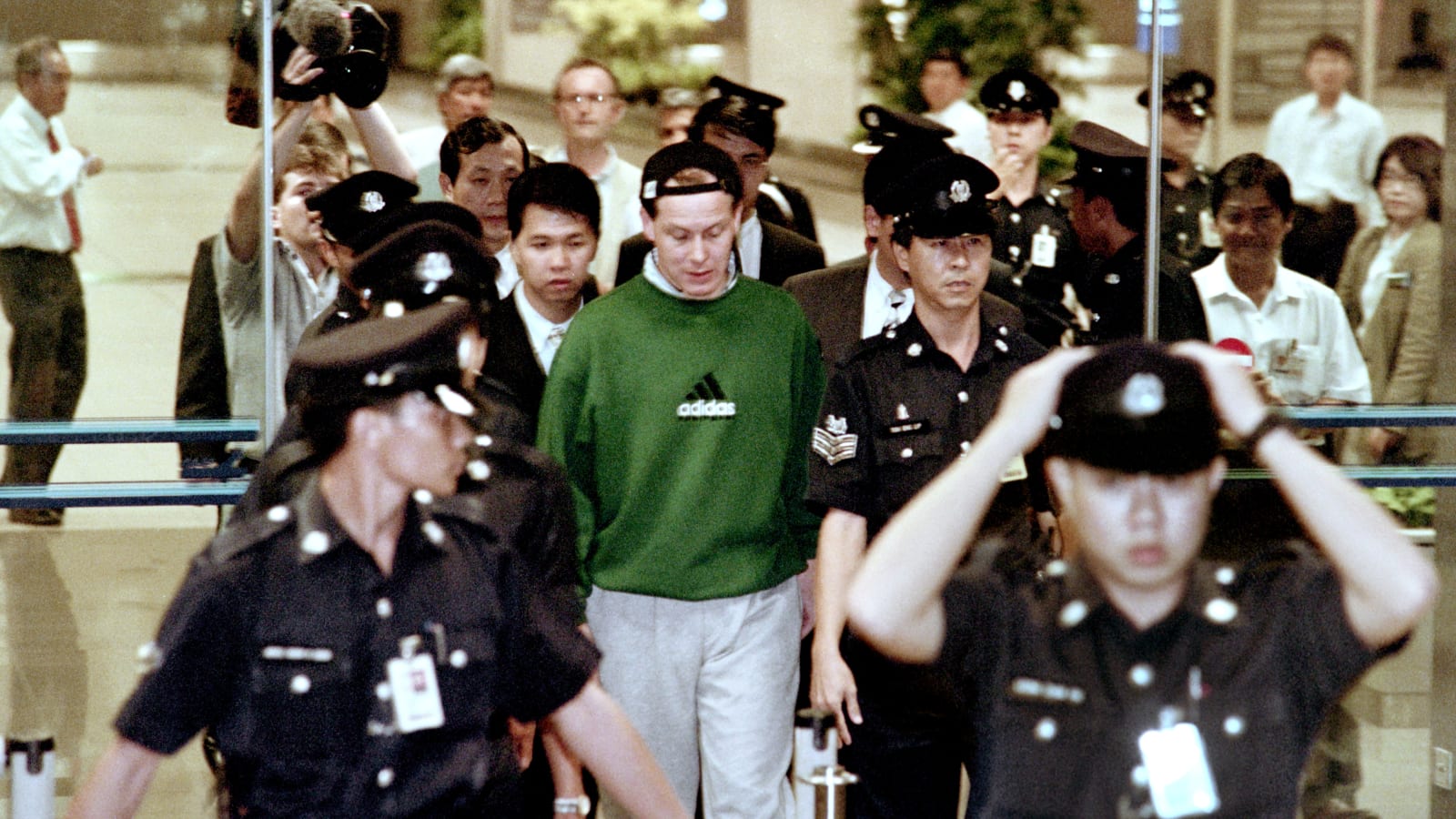

The Madoff Ponzi scheme began to unravel in the fall of 2008, as the global financial crisis took hold. As investors grew increasingly nervous about their investments, they began to withdraw their money from Madoff’s funds. Madoff was unable to meet these withdrawals, and the scheme collapsed.

In December 2008, Madoff’s sons, Mark and Andrew, confronted him about the scheme. Madoff confessed to his sons, and they immediately contacted the FBI.

One important person we should certainly not forget to mention is Markopolos, an American investor who accused Bernard Madoff of running a Ponzi scheme. He warned the SEC multiple times about Madoff’s suspicious investment returns and opaque investment strategy, but the SEC did not take action until after the collapse of Madoff’s Ponzi scheme in 2008. Markopolos was subsequently hailed as a hero for his efforts to expose the fraud.

Markopolos also believed that Madoff was using his position as a market maker to front-run his clients’ trades. This means that Madoff was using his knowledge of his clients’ impending trades to make profitable trades for himself before his clients’ trades were executed. This would allow Madoff to profit from the difference in price between the time his clients’ trades were executed and the time he made his trades.

Financial concepts related to the documentary

Investment returns

Madoff’s scheme relied on the promise of consistent, high returns even during periods of market downturn. This was a red flag for many investors, as it is unrealistic for any investment strategy to guarantee such consistent performance.

Greed

Madoff’s scheme was fueled by the greed of both investors and Madoff himself. Investors were willing to overlook red flags because they were attracted to the promise of high returns. Madoff was motivated by his own insatiable desire for wealth and power.

Regulatory oversight

The Securities and Exchange Commission (SEC) failed to detect Madoff’s scheme for many years. This failure allowed Madoff to operate his scheme for many years and highlights the need for stronger enforcement of financial regulations.

What lessons can be learned?

Beware of “too good to be true” opportunities

If an investment opportunity sounds too good to be true, it probably is. Investors should be wary of any investment that promises consistently high returns no matter which market conditions, especially if there is no clear explanation of how those returns are being generated.

Do your own research

Before investing in any fund or product, investors should thoroughly research the company or individual running the investment and understand the risks involved. The Madoff Ponzi scheme is a reminder that even seemingly respectable individuals can commit fraud on a massive scale. It is important for investors to be vigilant and to do their homework before investing their hard-earned money.

Madoff’s cynicism

« In an era of faceless organization owned by other equally faceless organizations, Bernard L. Madoff Investment Securities LLC harks back to an earlier era in the financial world: the owner’s name is on the door. Clients know that Bernard Madoff has a personal interest in maintaining the unblemished record of value, fair-dealing and high ethical standards that has always been the firm’s hallmark. »

Why should I be interested in this post?

As a student pursuing a business or finance degree at ESSEC, I think you will be very fascinated by the Madoff Ponzi scheme for its multifaceted lessons in ethics, financial practices, and regulatory oversight. The scale of the fraud, its longevity, and the involvement of high-profile individuals make it a very interesting case study in the financial world. It is one of the largest financial frauds ever. There are many lessons to be learned.

Related posts on the SimTrade blog

▶ All posts about Movies and documentaries

▶ Louis DETALLE Quick review of the most famous investments frauds ever

▶ Louis VIALLARD Ponzi scheme

▶ William LONGIN Netflix ‘Billions’ Analysis of characters through CFA Code and Standards

Useful resources

Academic articles

Bernard C. and P.P. Boyle (2009) “Mr. Madoff’s Amazing Returns: An Analysis of the Split-Strike Conversion Strategy” The Journal of Derivatives, 17(1): 62-76.

Monroe H., A. Carvajal and C. Pattillo (2010) “Perils of Ponzis” Finance & development, 47(1).

Videos

FRONTLINE PBS The Madoff Affair (full documentary on YouTube)

TPM TV Roundtable Discussion With Bernard Madoff (YouTube video about regulation by Madoff)

Associated Press Executive: SEC Ignored Warnings About Madoff (YouTube video about the testimony of Harry Markopolos)

TPM TV Roundtable Discussion With Bernard Madoff (YouTube video about the testimony of Harry Markopolos)

About the author

The article was written in December 2023 by Raphael TRAEN (ESSEC Business School, Global BBA, 2023-2024).