Analysis of Boiler Room movie

This article written by Akshit Gupta (ESSEC Business School, Master in Management, 2022) analyzes Boiler Room movie.

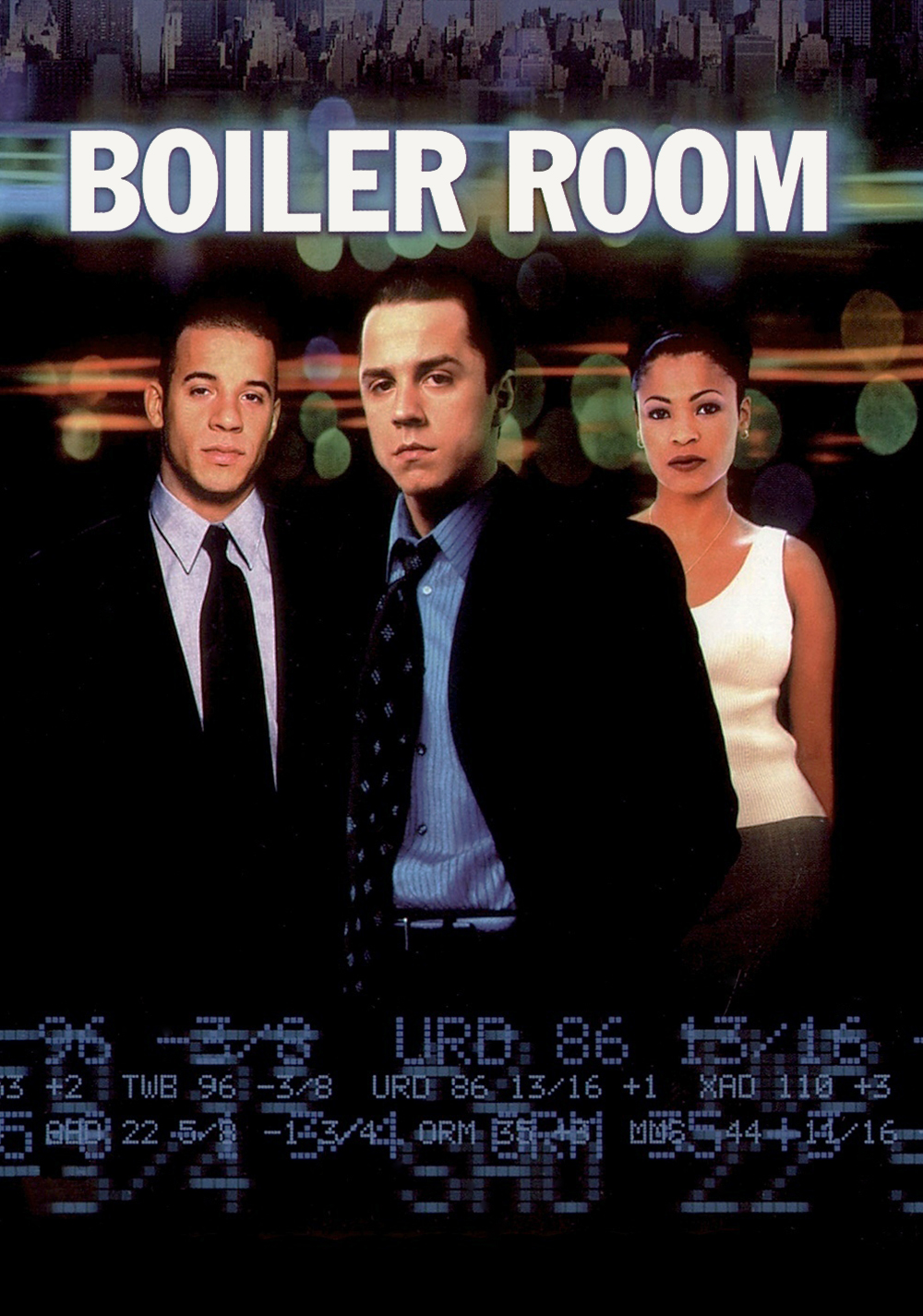

Boiler Room (2000) is an American drama movie based on financial crimes that take place through various stock brokerage houses across the globe. As defined by U.S. Securities and Exchange Commission (SEC), “the name Boiler Room refers to large-scale operations designed to lure in as many investors to an investment scam as possible, often using high-pressure sales tactics. Boiler room scheme operators may cold-call investors or solicit investors through emails, text messages, social media, and other means.” The movie gives a very good perspective of how greed clouds the thought processing ability in many investors and gives rise to such schemes.

Summary of the movie

The movie starts by introducing Seth Davis, a young college dropout from Queen’s College, who makes a handsome income by running an illegal casino in his home for college students. When his dad, Marty Davis, a federal judge, finds out about his son’s misdeed, he expresses his disappointment to him. In order to get things right with his father, Seth takes the job of a daytime broker at a stock brokerage firm named J.T. Marlin, situated on the expressway outside the New York City. The firm uses high-pressure telephonic sale tactics by cold calling people to convince them to invest their money. On the day of his interview, Seth is introduced to Jim Young, a co-founder at the firm. Jim explains the work Seth is expected to do and, recruits him as a stockbroker trainee. Seth starts making a good living from the firm and also wins his family’s support. Within 3 months of joining the firm, Seth clears his series 7 Exam and closes 40 new clients, becoming a well-recognized broker in the firm.

But, Seth senses the illicit nature of the business J.T. Marlin has been carrying out when he finds out the commission the brokerage firm has been earning is twice the legal limit as per SEC. When he asks his co-workers for the same, no one is able to provide him with a legitimate answer.

However, Seth continues to land new clients using his successful telephone tactics. He ends up with a new client named Harry Reynard, a purchasing manager working at a gourmet food company, and asks him to buy 100 shares at $8 per share of Farrow Tech, just to gain his trust. When the market starts plummeting, Seth convinces Harry to buy more shares as the company’s stock value is guaranteed to go up. Clouded by greed, Harry decides to invest his savings worth $50,000 in the company and ends up losing his entire wealth and his family.

Seth’s dad, Marty, finds out about the fraudulent business J.T. Marlin has been carrying out and how his son has been involved with a ‘chop-shop’ company. Showing his discontent, Marty disowns his son and asks him to never show up in front of him again. Driven by guilt, Seth decides to repay the money that Harry Reynard lost and also expose the scam done by J.T. Marlin. Seth loops in his father, Marty, to seek his help to invest in an IPO scheme the firm is looking for. Amidst fear of losing his judgeship, Marty decides to reconcile with his son by going for the IPO scheme. However, the FBI tapes all the telephonic conversation and arrests Seth under charges of violation of Section 26 of SEC and NASD regulations. Seth, in return for full immunity, decides to help the FBI by providing them with all the relevant key information about the firm.

Returning to the office, Seth convinces Michael Brantley, the founder of J.T. Marlin, to allot 10,000 shares of the new IPO to Harry Reynard by falsely portraying Harry as a very big client for the brokerage. He gets the sale ticket signed from Chris, a senior broker at the firm, to authorise Harry to sell the shares of the IPO in open market. Meanwhile, he also loads all the confidential data of the company in a floppy disk for the FBI. The movie ends with the FBI surrounding the office building of J.T. Marlin and Seth leaving the office with full immunity.

Relevance to the SimTrade course

The concepts shown in the movie blends with the practical learnings imparted on the SimTrade platform. J.T. Marlin, trading in chop-stocks, is a fraudulent company involved in pump and dump, a scheme where artificial demand is created to inflate prices for stocks of microcap and shell companies. Such companies claim to have sensitive information about the stock, unavailable in the public domain. When the stock prices rise substantially, these companies dump huge piles of stock in the market thereby crashing the stock prices and leaving investors bankrupt.

The movie aptly portrays the importance demand & supply play in the open market and how artificial demand can be created to generate high profits. Here, the concept of market news plays a key role in determining the authenticity of the hyped-up stock prices and investors should focus on them to take correct positions. Emotions such as fear, greed, and euphoria should be kept at bay while investing in the markets to take effective decisions.

Most famous quote from the movie

“And there is no such thing as a no sale call. A sale is made on every call you make. Either you sell the client some stock or he sells you a reason he can’t. Either way a sale is made, the only question is who’s gonna close? You or him.” – Jim Young

Trailer of the movie

Related posts on the SimTrade blog

▶ All posts about Movies and documentaries

▶ Akshit GUPTA Trader: job description

▶ Akshit GUPTA Analysis of the Wall Street: Money Never Sleeps movie

▶ Marie POFF Film analysis: The Wolf of Wall Street

About the author

Article written in October 2020 by Akshit GUPTA (ESSEC Business School, Master in Management, 2019-2022).