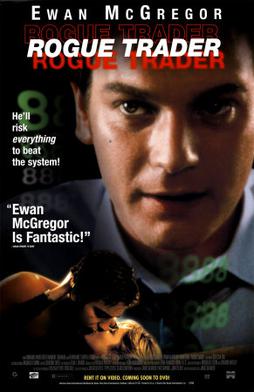

Film analysis: Rogue Trader

This article written by Marie POFF (ESSEC Business School, Global Bachelor of Business Administration, 2020) analyzes the Rogue trader film and explains the related financial concepts.

Based on a true story, ‘Rogue Trader’ details how risky trades made by Nick Leeson, an employee of investment banking firm Barings Bank, lead to its insolvency. This film explores how financial oversight and a lack of risk management from Leeson’s supervisors, lead to irrecoverable losses and the eventual fall of the banking giant.

Film summary

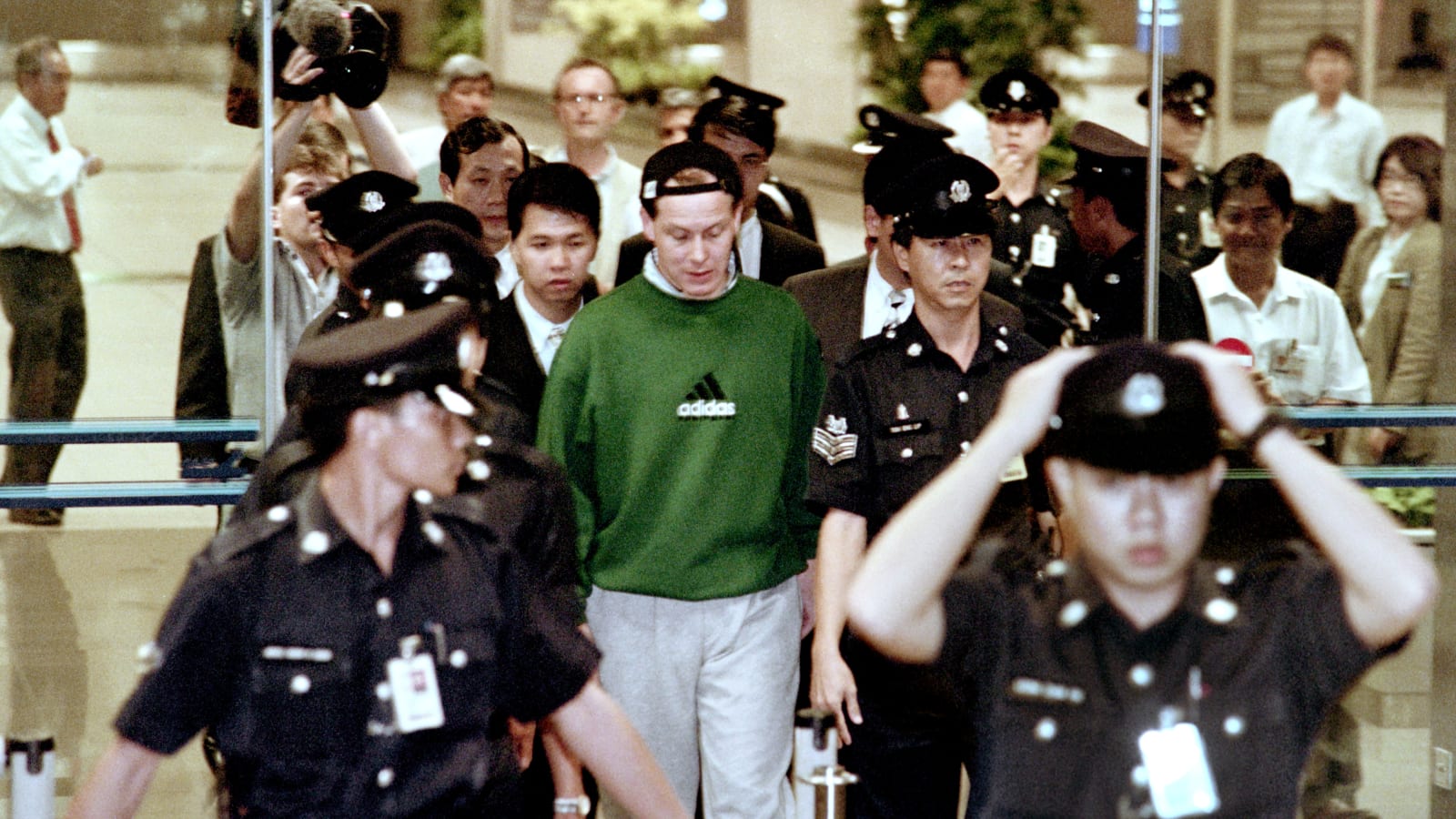

‘Rogue Trader’ recounts the exploits of Nick Leeson and his role in the downfall of Barings Bank, one of the single largest financial disasters of the nineties. Directed by James Dearden, this film encapsulates the economic and social changes of a tumultuous period. Leeson is a young derivatives trader sent to work in Singapore for Barings Bank, a major investment bank at the time. After opening a Future and Options office in Singapore, Leeson is placed in a position of authority where he takes advantage of the thriving Asian market by arbitraging between the Singapore International Monetary Exchange (SIMEX) and the Nikkei in Japan. He begins making unauthorised trades, which initially do make large profits for Barings – however he soon begins using the bank’s money to make bets on the market to recoup his own trading losses. At first, he tries to hide his losses in accounts, but eventually loses over $1 billion of Barings capital as its head of operations on the Singapore Exchange. He eventually flees the country with his wife, but inevitably, he must face how his actions lead to the bankruptcy of Barings Bank.

Financial concepts from the Rogue Trader film

Financial derivatives

For any new investors, financial derivatives describe a broad class of trading instruments that have no tangible worth of their own, but “derive” their value from a claim to some other financial asset or security. A few examples include futures contracts, forward contracts, put and call options, warrants, and swaps. Derivative trading started from the practice of fixing contracts ahead of time, as a way for market players to insure against fluctuations in the price of agricultural goods. Eventually the practice was extended to cover currencies and other commodities. As exchange rates became increasingly unstable, the derivatives trade facilitated huge profits for those estimating the future relative value of various commodities and currencies, through the buying and selling complex products.

Barings Bank

Founded in 1762, Barings Bank was the second oldest merchant bank in the world before its collapse in 1995. Barings grew from being a conservative merchant bank to becoming heavily reliant on speculation in the global stock markets to accumulate its profits. The derivatives market was somewhere this could be done in a very short space of time. Following the stock market crash of 1987, derivatives became central to the banks’ operations as they sought to offset their declining profits. The volume of their derivative trading soared from less than $2 trillion in 1987, to $12 trillion in 1993. As finance capital became increasingly globalised, Barings branched out to exploit these new markets in Latin America and the Far East.

Tiger Economies

The term “tiger economies” is used to describe the booming Southeast Asian economies of South Korea, Taiwan, Hong Kong, and Singapore. Following export-led growth and especially the development of sophisticated financial and trading hubs, Western interest spiked for these untapped markets in the 1990s.

Arbitrage

Profitable arbitrage opportunities are the result of simultaneously buying and selling in different markets, or by using derivatives, to take advantage of differing prices for the same asset. In the film, Leeson makes a profit by exploiting the small price fluctuations between SIMEX in Singapore and the Nikkei 225 in Japan.

Cash neutral business

A cash neutral business means managing an investment portfolio without adding any capital. For Leeson, any money made or lost on the trades should have belonged to the clients, and only a small proportion of the trades were meant to be proprietary. However, Leeson used Baring Bank’s money to make bets on the market to recoup his trading losses.

Short straddle position

A short straddle is an options strategy which takes advantage of a lack of volatility in an asset’s price, by selling both a call and a put option with the same strike price and expiration date, to create a narrow trading range for the underlying stock. Lesson used this strategy but sold disproportionate amounts of short straddles for each long futures position he took, because he needed to pay the new trades, the initial margin deposits, and meet the mounting margin calls on his existing positions.

Errors account

An errors account is a temporary account used to store and compensate for transactions related to errors in trading activity, such as routing numbers to an incorrect or wrong account. This practice allows for the separation of a transaction so that a claim can be made and resolved quickly. Leeson used this accounting to conceal the losses to Barings Bank which eventually amounted to over £800 million, though the account was supposedly activated to cover-up the loss made by an inexperienced trader working under Leeson’s supervision.

Key insights for investors

Don’t Lose Sight of Reality

An important insight is noticing how Leeson forgot to consider the real-world impact of his trades. He reflects on seeing trading as just artificial numbers flashing across screens, “it was all paid by telegraphic transfer, and since we lived off expense accounts, the numbers in our bank balances just rolled up. The real, real money was the $100 I bet Danny each day about where the market would close, or the cash we spent buying chocolate Kinder eggs to muck around with the plastic toys we found inside them.” Leeson saw the Kobe earthquake as nothing more than an opportunity and conducted more trading in one day than he ever had before as the market was butchered. Investors can avoid Leeson’s mistake by keeping a firm grasp on reality, and remembering the real companies and people represented by the stock exchange.

Destructive Practices

Other employees at Barings Bank most likely relied on internal auditors to discern wrongdoings or mistakes made by others, but as can be seen from Leeson’s case, regulators can be slow to catch on to any wrongdoing – especially when there are large profits involved. The lesson here is that an investor must be aware and proactive in helping to prevent other investors from engaging in destructive trading practices. This is especially true when it comes to newer markets or products, where regulators are unsure what entails best practice.

Tacit Agreement

While Leeson is assumed to be the villain, consider how Barings was able to contravene laws forbidding the transfer of more than 25 percent of the bank’s share capital out of the country for nearly every quarter during 1993 and 1994? Ignorance is not an excuse – tacit agreement is as effective as active engagement. A lesson here is that investors should remain informed on all their business engagements regardless of how much profit it being made.

Relevance to the SimTrade certificate

Through the SimTrade course, as well as a strong understanding about trading platforms and orders, you are taught about information in financial markets and how to use this to make successful trades. Several case studies teach you how to analyse market information to make valuations, and correctly assess how market activities will affect your own trades. The simulation and contest allow you to compete against others in the course and deepen your understanding of how a market reacts to different players.

Famous quote from the Rogue trader film

Nick Lesson: “Despite rumours of secret bank accounts and hidden millions, I did not profit personally from my unlawful trading. To be absolutely honest, sometimes I wish I had.”

Trailer of the Rogue trader film

Related posts on the SimTrade blog

All posts about financial movies and documentaries

▶ Akshit GUPTA Analysis of The Rogue Trader movie (another analysis)

▶ Akshit GUPTA The bankruptcy of the Barings Bank (1996)

▶ Jayati WALIA Value at Risk

About the author

Article written in November 2020 by Marie POFF (ESSEC Business School, Global Bachelor of Business Administration, 2020).