Corner

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) presents the technique of Cornering, which is a type of market manipulation in financial markets.

Introduction

Cornering a market refers to the acquisition of a significant amount of an asset which gives the manipulator a controlling interest in the market. This strategy is used to manipulate the market for the asset and the manipulator has the power to move the asset price in his/her favor. Cornering has been observed in the financial markets since a long time and strong regulations and rules have been put into place by regulators worldwide to prevent such activities to happen. In the United States, the Securities and Exchange Commission (SEC) and Federal Trade Commission (FTC) supervise the trading activities in the financial markets to catch the manipulators who indulge in such practices. While cornering can be considered as legal or illegal depending on the circumstances and the intention of the individual involved, most of the times it is done to deceit the honest investors and earn illegal profits.

In cornering, the manipulator acquires a controlling stake in the asset and pushes up the prices for the underlying asset. Once the prices have reached a significant level, the manipulator exits his/her position leading to market correction and a sharp fall in the asset prices.

Short squeeze

Short squeeze is a market situation where a mismatch of demand and supply (high demand and low supply) of an asset results in the asset price to rise significantly. In generally seen instances, when the share price of a company starts rising, short sellers rush to cover their positions to meet the margin requirements and avoid more losses. The sudden increase in demand is mismatched with the market supply, driving the asset price upwards in a frenzy manner.

Practices used to corner the market

Beyond the accumulation of assets in his/her position, the manipulator usually uses many practices to manipulate the price up or down in his/her favor. The most common practices used are the pump and dump scheme and the poop and scoop scheme detailed below.

Pump and dump scheme

In the pump and dump scheme, the manipulator circulates false positive information about a particular asset which leads to an increase interest amongst the investors for the particular asset and leads to more demand. As the demand for the asset rises, the prices also go up and the manipulator exits his/her position, thereby generating high profits and crashing the market for the asset. Such schemes are generally carried on lesser-known assets which have an information asymmetry, and the manipulator has the means to manipulate the market.

Poop and scoop scheme

In the poop and scoop scheme, the manipulator circulates false negative information about an asset in the market. Hearing the negative information, other investors undertake panic selling, thereby decreasing the prices for the asset. The manipulator buys the asset once the prices fall and manipulates the market.

Silver Thursday (1980)

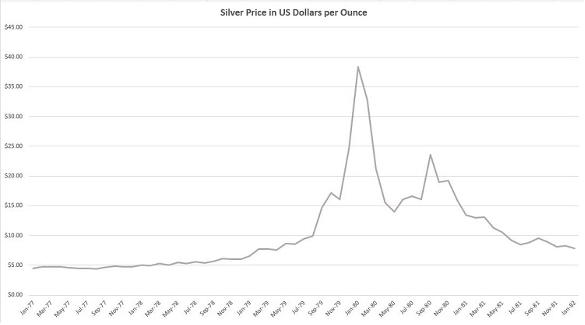

The manipulators who practice cornering in a market, hoard large quantities of a security in the initial accumulation phase. As seen in the graph above, in the silver market cornering that started in the 1970s, the Hunt Brothers bought large quantities of silver over a period of 10 years in an attempt to corner the silver market. They were holding approximately one third of the world’s deliverable silver supply. The price of silver went up drastically over this period. But as their practices came to be noticed, the regulatory bodies in the United States amended the rules and regulations regarding commodity trading, bringing an end to their manipulation practice. Then the silver market crashed on March 27, 1980, a day known as ‘Silver Thursday’.

‘Silver Thursday’ is infamous for recording one of the highest falls in the market price of silver. In the months preceding the Silver Thursday, the U.S. Federal Reserve brought in new regulations restricting banks to issue loans for commodity speculations. At the same time, the Chicago Board of Trade (CBOT) increased the margin requirements on silver futures contracts, leading to high margin calls for the Hunt Brothers. Due to lack of access to new leverage, they were unable to meet the margin requirements for the silver contracts they held. The new regulations led to the failure of the attempt made by the Hunt Brothers to corner the silver market. As soon as the news hit the market, investors starting panicking leading to a sharp selling of the silver futures contracts. This ultimately led to a fall in the silver price from around $50 per ounce to $11 per ounce over a short span of time. Hunt Brothers were charged with civil charges for manipulating the silver market over the years and artificially increasing the silver price. Due to the new regulations and stricter laws, they also had to pay heavy fines amounting to millions of dollars which led to their bankruptcy.

Conclusion

Illegal cornering has been regarding as a common market manipulation practice throughout the world and the regulators keep a tight watch to control such practices from occurring. Although many attempts of cornering the financial markets have been made by several manipulators in the past, most of them have been unsuccessful. The manipulators also take huge risks while trying to corner the market as the irregular market patterns can be observed by professional investors. The inefficiencies seen in markets manipulated through cornering can prompt other investors to take opposing positions leading to heavy losses to the manipulators.

Relevance to the SimTrade Certificate

The concept of cornering relates to the SimTrade Certificate in the following ways:

About theory

- By taking the Trade orders course, you will know more about the different type of orders that you can use to buy and sell assets in financial markets.

- By taking the Market information course, you will understand how information is incorporated into market prices and the associated concept of market efficiency.

About practice

- By launching the Send an Order simulation, you will practice how financial markets really work and how to act in the market by sending orders.

- By launching the Efficient market simulation, you will practice how information is incorporated into market prices through the trading of market participants, and grasp the concept of market efficiency.

Related posts on the SimTrade blog

Trading places: A Corner in the Orang Futures Market

About the author

Article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).