Unemployment Rate

In this article, Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022) explains in detail about Unemployment Rate.

This read will help you understand the types of unemployment, the categories of unemployed individuals and the measures to calculate the unemployment rate.

What is the unemployment rate?

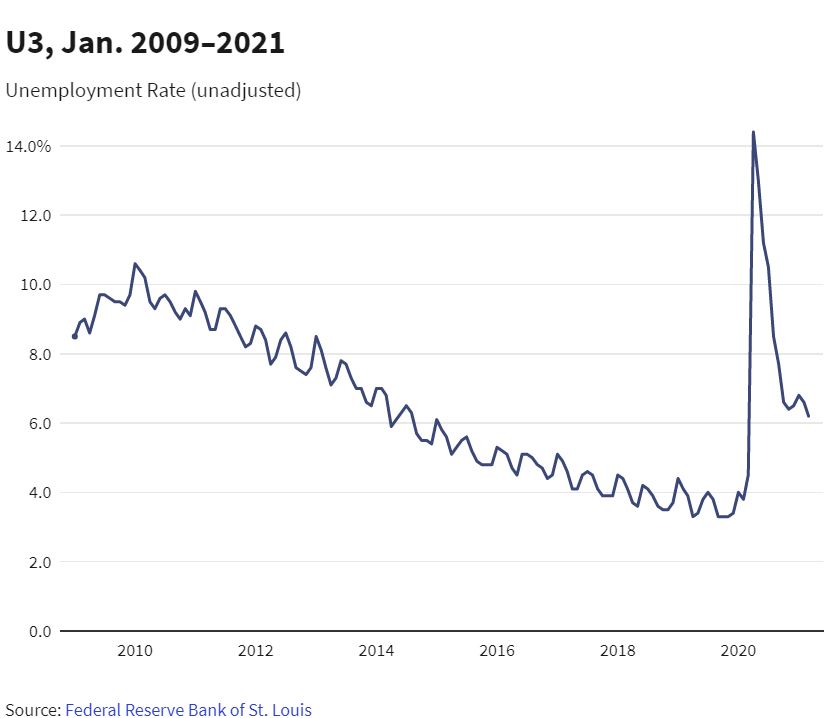

The unemployment rate is simply the percentage of the total labor force that is currently unemployed. These are individuals who are available to work and have taken measures to find work. The labor force is the total number of employed and unemployed people. This economic indicator is measured in percentage and is seasonally adjusted. The unemployment rate is considered a lagging indicator.

The unemployment rate is a very useful tool used to measure the underutilized labor force. It reflects the economy’s ability to generate employment. It basically helps in analyzing the effectiveness of the economy and its future performance.

Types of unemployment

Unemployment has been one of the most tenacious and unmanageable economic problems for several decades. Almost every country in the world has been affected by the same and therefore it is quite important to understand the types of unemployment and the reasons behind the same. There is a long list of unemployment types, but we will focus on the following important ones.

Structural unemployment

Structural unemployment is a result of technological shifts in the economy. It occurs when the existing skills of the workers are redundant due to mismatch of the skills that they possess versus the skills required. A common example would be automation of manufacturing processes, usage of robots, etc., which would cause unemployment as the workers might no longer be needed. The training of these workers may prove costly or time consuming, resulting in the workers often being displaced and unemployed for extended periods of time.

Frictional unemployment

Frictional unemployment refers to the period of unemployment after an individual leaves a particular job and till he/she finds a new one. It occurs when people voluntarily leave their jobs. It is generally short-lived. This short period of unemployment is caused naturally because it takes time for the individual to find the right job and for the companies to find the right employees. From an economic perspective, it is the least troublesome.

Cyclical unemployment

Cyclical unemployment is a result of economic downturns. It is caused during or before recessionary periods when the demand for goods and services drops drastically. The businesses to cut costs or save their companies would lay off workers resulting in unemployment.

These workers would now spend less, resulting in an even lesser demand for goods and services. Therefore, more workers would be laid-off. Cyclical unemployment creates more cyclical unemployment and therefore it becomes necessary for the government to intervene. The government may either use the monetary policy or the fiscal policy to stop this downward spiral.

How to calculate the unemployment rate?

The standard method for calculating unemployment would simply be:

Unemployment rate = Unemployed/Civilian Labor Force 100

The above formula is used to calculate the most cited unemployment rate called the U-3. For U-3 calculation, categories of individuals who work temporarily or part-time are considered employed and so are the individuals who perform at least 15 hours of unpaid family work like homemakers.

Alternative measures of calculation

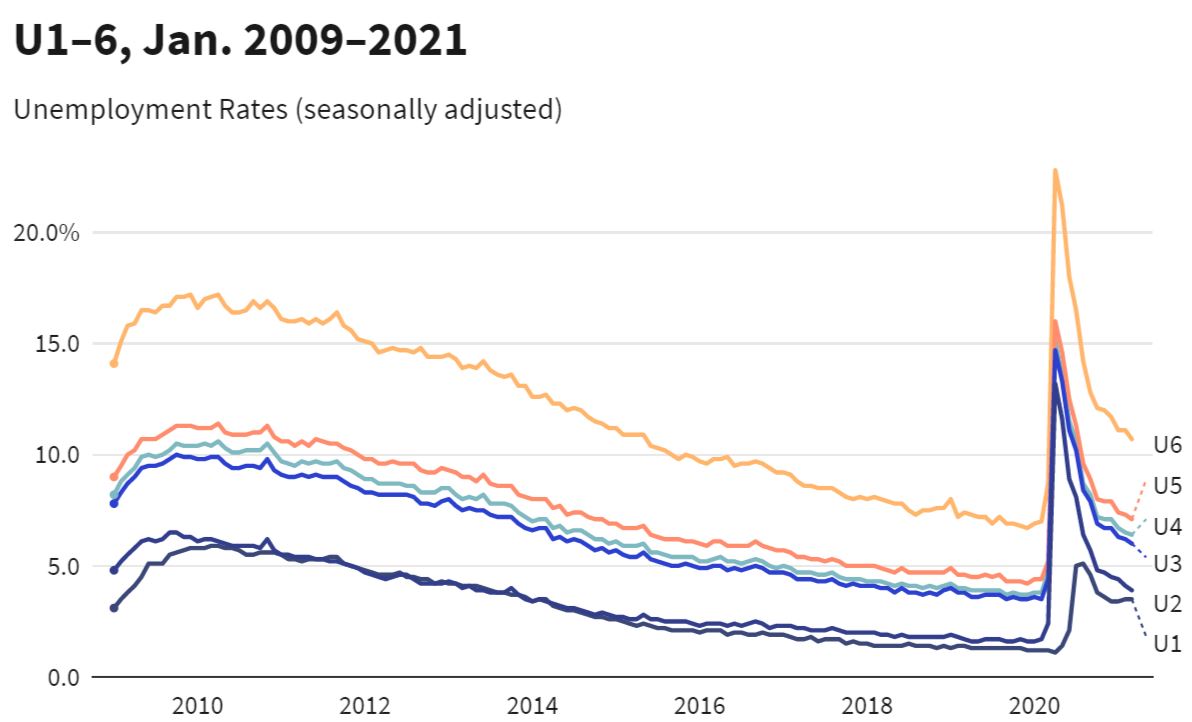

However, there are several other factors that need to be considered for calculation of the unemployment rate. Therefore, The Bureau of Labor Statistics (BLS) releases several variations of unemployment rates such as the U-1, U-2, U-4, U-5, and U-6. This is because the U-3 singularly does not convey the true picture of the unemployed labor force.

For example, the U-6 is considered as the “real unemployment rate” as it includes marginally attached workers and part-time workers unlike U-3. Marginally attached workers are the ones who have stopped looking for work in the past 4 weeks but have been looking for work for the entire year before. Those part-time workers are included who would like a full-time job if given the opportunity.

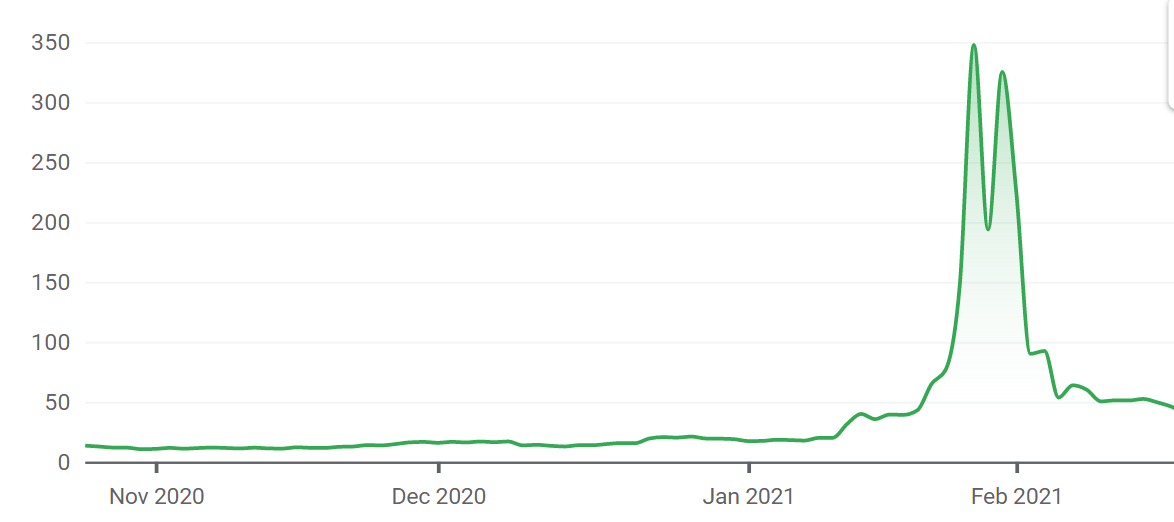

Source: Federal Reserve Bank of St. Louis

Related posts on the SimTrade blog

Useful resources

About the author

Article written in April 2021 by Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022). Bijal has two years of experience in the financial markets and is currently working as a financial analyst at Mega Biopharma.

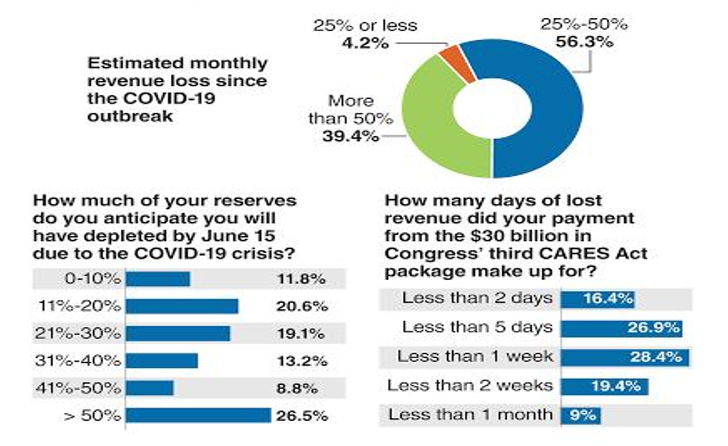

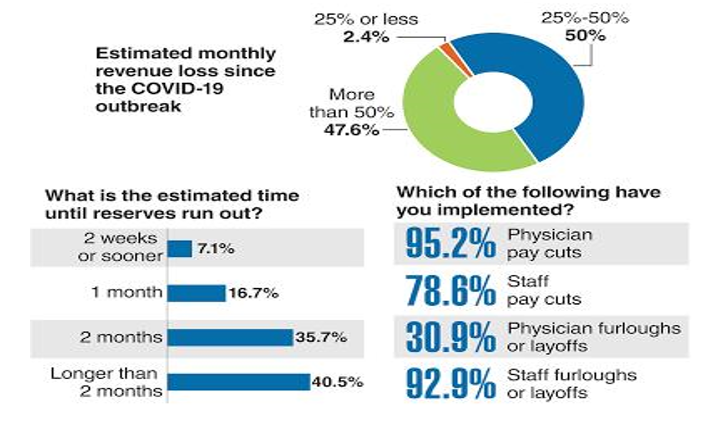

Source:

Source:

Source: Datacommons.org

Source: Datacommons.org

Source: GameStop

Source: GameStop