Financial leverage

In this article, Shruti CHAND (ESSEC Business School, Grande Ecole Program – Master in Management, 2020-2022) elaborates on the concept of financial leverage.

This read will help you get started with understanding financial leverage and understand its impact of the business, advantages and disadvantages.

Definition of financial leverage

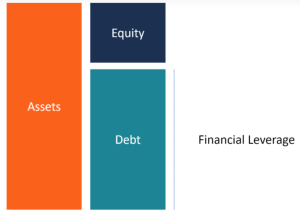

Financial leverage in simple words is the use of debt to acquire additional assets. Imagine this, if you are borrowing money and using it to expand your business’ assets, you are using financial leverage. Financial leverage is also known as gearing as it deals with profit magnification. Debt is important for a company because it’s an integral way to grow business. The most important question to ask here is why would someone borrow money to acquire assets? The answer is that financial leverage is based on the expectation that the income or capital gain from assets will exceed the cost of borrowing.

How does financial leverage work in real life?

Let’s say a company wants to acquire an asset, the financing options available to the company are: equity and debt.

- Equity: shares issued to the public by giving out ownership.

- Debt: funds borrowed through bonds, commercial papers and debentures to be paid back to lenders along with interest.

Here, in case of equity, no fixed costs are incurred, hence the profit/capital gain from the asset remains totally as profits, while in case of debt and leases, there are fixed costs associated in terms of interest that the company expects to be lower than the profit/capital gain expected.

How is financial leverage measured?

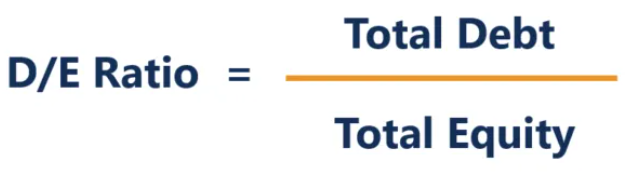

Since financial leverage is considered to be a measure of the company’s exposure to risk, company’s stakeholders look at the Debt / Equity ratio, which is a measure of the extent of financial leverage.

Total Debt = Current liabilities + Long-term liabilities

Total Equity = Shareholders’ equity + Retained Earnings

Analysis: The higher the debt-equity ratio, the weaker the financial position of the enterprise. Hence, lesser the ratio, lesser the chances of bankruptcy and insolvency.

Other ratios that can be used to measure financial leverage: Debt to Capital Ratio, Interest Coverage Ratio, and Debt to Ebitda Ratio.

Example of financial leverage in action

A company with $1 million shareholder equity, borrows $4 million and has $5 million to invest in assets and operations. This will allow this company to set up new factories, take up growth opportunities and expand.

Let’s assume the cost of debt is $0.5 million for a year and at the end of the first year, the company makes $1 million in profits (20% for the return on assets), the realised profit for the business becomes $1 million (profits) – $0.5 million (debt cost) = $0.5 million (50% for the return on equity for shareholders).

Now on the other hand, if the company makes $1 million in losses (-20% for the return on assets), then the realised loss for the business is $1 million + $0.5 million= $1.5 million. (-150% for the return on equity for shareholders).

You can see how in adverse situation that the effect of leverage can be really detrimental.

Now let’s consider a scenario with no leverage, the business utilizes only the $ 1 million that it already has. Considering the profit and loss percentage in the previous scenario, the business will end up making or losing $200,000 in profitable and loss making scenario respectively (20% for the return on equity for shareholders for the positive scenario and -20% for the negative scenario).

Any business needs to support its activity with borrowed money to acquire assets and hence it can be seen that manufacturing companies such as automakers have a higher debt equity ratio than service industry companies.

Advantages of financial leverage

Among the main benefits of financial leverage is the opportunities to invest in larger projects. There are also tax advantages (linked to the deductibility of interests in the income statement).

Disadvantages of financial leverage

As attractive as financial leverage might sound for a business to grow, leverage can sometimes in fact be really complex. As much as it magnifies gains, it can also magnify losses. With interest expenses and credit risk exposure, a company can often destroy shareholder value to a greater extent if it would have grown its business without Leverage.

All in all, leverage can increase burden on the company, high risk of losses, may lead to bankruptcy and other reputational losses.

Conclusion

It is really important for a company to be wise with its financial leverage position. While giving out too much ownership is not good for the shareholders, in the same way taking too much debt can also be hazardous for the company. Hence, even though the debt equity ratio differs for different industries, it is of a consensus that ideally it shouldn’t be more than 2.

Related posts on the SimTrade blog

▶ Shruti CHAND Balance Sheet

▶ Louis DETALLE What are LBOs and how do they work?

▶ Akshit GUPTA Initial and maintenance margins in stocks

▶ Youssef LOURAOUI Introduction to Hedge Funds

Relevance to the SimTrade certificate

This post deals with financial leverage for firms. Similarly, financial leverage can be used investors in financial markets. This can be learnt in the SimTrade Certificate:

About theory

- By taking the Financial leverage course (Period 3 of the certificate), you will know more about how investors can use financial leverage to buy and sell assets in financial markets.

About practice

- By launching the series of Market maker simulations, you will practice how investors can use financial leverage to buy and sell assets in financial markets.

Useful resources

SimTrade course Financial leverage

About the author

Article written in March 2021 by Shruti CHAND (ESSEC Business School, Grande Ecole Program – Master in Management, 2020-2022).

4 thoughts on “Financial leverage”

Comments are closed.