Price fixing

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) presents the concept of Price Fixing.

Definition

Price fixing refers to an agreement between two or more participants operating in a market to collude and set the prices of an asset to serve their interest. In financial markets, price fixing refers to a form of market manipulation where the manipulators rig asset prices by inflating or deflating them to benefit from such practices. The main markets where price fixing takes place are for the following assets: interest rates, currencies and commodities.

The price fixing practice works in contradiction to the free and fair financial market forces and hampers public confidence in the markets. The asset prices should be decided by the natural market forces of supply and demand. Price fixing is banned and deemed illegal across global financial markets and stringent regulations.

In the United States of America, several laws have been implemented including the Sherman Act of 1890, which prohibits any form of price fixing or collusion among financial institutions to fix asset prices. The market manipulation tactic of price fixing comes with severe civil and criminal liabilities along with heavy penalties (see the example of the Libor scandal below).

Mechanisms

Price fixing can take different forms: collusion among market participants and window dressing.

Collusion among market participants

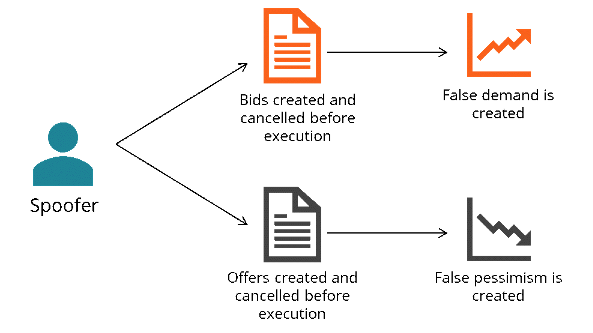

In such a form of price fixing, the market participants operating on the same side of a market often collude to set the buying or selling prices of an asset to manipulate the asset prices and serve their personal interest.

Window dressing

It is often carried out to give an artificial appearance to assets offered by certain companies, done by window dressing their creditworthiness and inflating the demand for the financial products offered.

Examples of price fixing

The Libor Scandal

Price fixing came to light when the Libor scandal was uncovered in 2012.

What is Libor?

Libor (London Inter-Bank Offered Rate) is a benchmark interest rate that is decided on the basis of the average inter-bank unsecured borrowing rates over a short-term period ranging from 1 day to 1 year. It is computed on a daily basis by the ICE Benchmark Committee working under Intercontinental Exchange, which is the overseeing body for Libor. Every day, at 11:00 AM, major banks from all across the world submit their borrowing interest to the ICE Benchmark Committee.

The Libor rate is used worldwide by major financial institutions to determine interest rates for different loans (for corporations to finance their investments and operational activities, for individuals to finance their consumption and the acquisition of their home, students to finance their studies, etc.) and the flows of financial derivatives.

How the Libor is calculated on a daily basis?

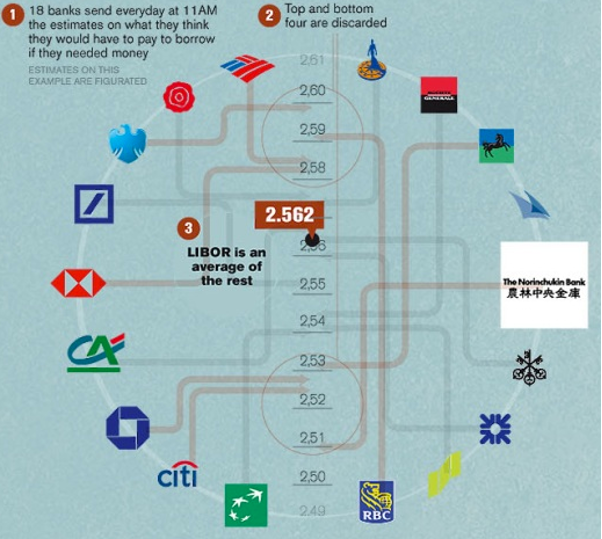

As seen in the picture, 18 major banks from all across the world sends their estimated unsecured borrowing rates on a daily basis at 11 AM to the ICE Benchmark Committee.

The committee then ranks the rates in a top to down order and eliminates the top and bottom 25% of the outliers from the list. The remaining rates are then averaged out and a five decimal Libor figure is issued at 11:55 AM on a daily basis. The committee issues the Libor in 5 currencies and with 7 different maturities, thus issuing a total of 35 different rates. The three-month US Libor is generally termed as the current Libor rate.

What happened?

A pool of banks colluded to artificially inflate or deflate the Libor rate over a couple of decades. The traders working at these banks submitted higher or lower rates to the ICE Benchmark Committee than they actually paid for unsecured short-term borrowings to manipulate the Libor on a daily basis. The price fixing was carried out to benefit traders and banks who traded financial derivatives to make profits by artificially inflating or deflating the Libor, which was the reference rate for such instruments.

The Libor scandal was unearthed in 2012 when a series of international investigation uncovered the price-fixing activities that were carried out by banks that formed a major part of the group of banks submitting their borrowing rates.

The Libor is used worldwide and the price fixing impacted millions of honest people around the globe, who took loans on inflated fixed Libor, and companies, which held derivative contracts.

The investigation led to fines amounting to $9 billion for the major banks that were involved in the scandal including Citi Bank, Barclays, JP Morgan Chase, Deutsche Bank and Royal Bank of Scotland. Many individual brokers and traders working for these banks were also sued by the regulatory bodies and charged with severe punishments and fines.

Related posts on the SimTrade blog

▶ Akshit GUPTA Securities and Exchange Commission

▶ Akshit GUPTA Price fixing

▶ Akshit GUPTA Corner

To know more about price fixing

The links mentioned below provides a comprehensive picture of how price fixing works in the financial markets and also provides a deeper view of the different scandals that happened using price fixing manipulation and shook the world.

About the Libor scandal

Wikipedia Libor Scandal

About the author

Article written in December 2020 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).