Ethics in finance

In this article, Louis DETALLE (ESSEC Business School, Grande Ecole Program – Master in Management, 2020-2023) talks about ethics in finance.

With huge sums of money at our fingertips, the temptation to manipulate a few euros in order to put them in our pockets is great. Thus, the question of ethics in finance takes on its full meaning insofar as the human mind and its faculty of discernment are put to a severe test.

Definitions of ethics

Ethics comes from the Greek “ethikos” which means moral. Ethics is a branch of Philosophy that reflects on the aims and values of existence, on the conditions for a happy life, on the notion of “good” or on questions of morality.

Ethics can also be defined as a reflection on the behaviour to be adopted in order to make the world humanly habitable. In this sense, ethics is a search for the ideal of society and the conduct of life.

Difference between ethics and law

Ethics is a human science concerned with the behaviour of individuals in society. Law refers to the regulation of behaviour by written law, whereas ethics refers more broadly to the moral distinction between right and wrong, to what we should do independently of our purely legal obligations.

As a result, corporate ethics has developed

Indeed, given the stakes of which companies are the actors, and given that the diversity of profiles that constitute these companies is colossal, it seems clear that the question of corporate ethics arises. Let’s take shareholders for example, a shareholder holds part of a company through his share portfolio and therefore has an interest in seeing the companies of his portfolio succeed. This goes even further: in the event of bankruptcy, for example, the shareholder is only reimbursed after the creditors, if there are any funds left… The shareholder therefore has a strong incentive to do everything possible to ensure that the company in which he or she holds shares is successful in the long term.

Control and regulation mechanisms have been put in place so that the temptation to behave unethically is increasingly reduced, given the difficulties of circumventing the procedures. The banking sector, for example, has undergone an explosion of regulations over the last 20 years. Banks for example, have been struck by a wave of KYC “Know your customer” which consists in long questionnaires aiming at analyzing who are the people behind every financial actor. By doing that, banks prevent the financial actors such as companies from financing terrorism or companies sanctioned by international authorities. Other measures that lower the risks exist such as the ALM measures (“Anti-Laundering Money measures”) that identify precisely the source of capitals in order to make sure that the funds are not illegal.

New challenges for a new form of ethics

However, new challenges are emerging for our societies and financial actors seem to be key players in meeting them. Questions of government stability, leadership, social and ecological issues have gained importance in the public debate in recent decades. And financial players, because of their almost unlimited power to act, want to be the driving force behind the major changes in contemporary society. ESG criteria, for example, have been introduced as new instruments for evaluating companies, which can no longer be satisfied with good economic results but must also fulfil a certain number of ethical obligations. Without these ethical obligations, their financing, promotion and activity would be simply made impossible.

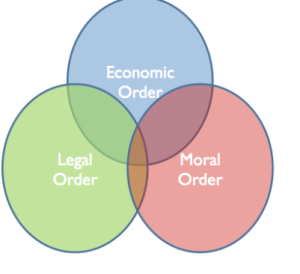

The three circles : economic performance, law and ethics.

Source: Harvard Global Collection.

Why should I be interested in this post?

If you are a business school or university undergraduate or graduate student, you may have heard about the ever-increasing ethical topics in finance. As such, one may not ignore these issues that will surely keep on gaining space in the field. Ethics is now a dimension in the way business is or should be conducted as evidenced by the ESG criteria that we mention in the article. In addition, the CFA emphasizes the ethical aspects in its series exams as a large part of the questions tackle these aspects.

Related posts on the SimTrade blog

▶ William LONGIN Netflix ‘Billions’ Analysis of characters through CFA Code and Standards

About the author

The article was written in February 2022 by Louis DETALLE (ESSEC Business School, Grande Ecole Program – Master in Management, 2020-2023).

1 thought on “Ethics in finance”

Comments are closed.