In this article, Snehasish CHINARA (ESSEC Business School, Grande Ecole Program – Master in Management, 2022-2024) explains cryptocurrency Litecoin, shedding light on its impact and value propositions for digital finance.

Historical context and background

Litecoin, often referred to as the “silver to Bitcoin’s gold,” emerged in 2011 as one of the earliest altcoins, or alternative cryptocurrencies, following the launch of Bitcoin in 2009. It was created by Charlie Lee, a former Google engineer and Coinbase employee. Lee designed Litecoin with the intention of addressing some of the perceived limitations of Bitcoin, such as transaction speed and scalability.

One of the key innovations of Litecoin was its adoption of the Scrypt hashing algorithm instead of Bitcoin’s SHA-256 algorithm. This choice made Litecoin more accessible to individual miners using consumer-grade hardware, as it reduced the advantage of specialized mining equipment known as ASICs (Application-Specific Integrated Circuits). As a result, Litecoin initially gained popularity among miners and enthusiasts who sought a more democratic and decentralized mining ecosystem.

Litecoin also introduced a faster block generation time compared to Bitcoin, with new blocks being created approximately every 2.5 minutes instead of every 10 minutes. This faster block time enabled quicker transaction confirmations, making Litecoin more suitable for everyday transactions.

Over the years, Litecoin has established itself as one of the most prominent cryptocurrencies in the market, often considered a reliable and stable digital asset. Its longevity and consistent development have contributed to its reputation as a credible alternative to Bitcoin.

Litecoin’s journey has been marked by various milestones, including network upgrades, partnerships, and integrations into payment systems and exchanges. Despite facing competition from other cryptocurrencies and undergoing market fluctuations, Litecoin has maintained a strong community of supporters and continues to be actively traded and utilized for various purposes, including payments, remittances, and investment.

Litecoin Logo

Source: Litecoin

Figure 1. Key Dates in Litecoin History

Source: Yahoo! Finance.

Key features

Scrypt Algorithm

Unlike Bitcoin’s SHA-256 algorithm, Litecoin utilizes the Scrypt hashing algorithm for its proof-of-work consensus mechanism. This algorithm was chosen to enable faster block generation and to promote more decentralized mining by reducing the advantage of specialized mining hardware (Application-Specific Integrated Circuits (ASIC) versus consumer-grade hardware like standard PCs).

Faster Block Time

Litecoin has a target block time of approximately 2.5 minutes, compared to Bitcoin’s 10 minutes. This faster block time allows for quicker transaction confirmations, making Litecoin more suitable for everyday transactions.

Higher Maximum Coin Supply

Litecoin has a maximum coin supply limit of 84 million coins, four times the maximum supply of Bitcoin. This larger supply aims to facilitate more widespread adoption and usage while still maintaining scarcity.

Segregated Witness (SegWit) Activation

Litecoin was one of the first major cryptocurrencies to activate Segregated Witness (SegWit), a protocol upgrade aimed at improving transaction throughput and scalability. SegWit also paved the way for the implementation of the Lightning Network on Litecoin, enabling off-chain transactions for faster and cheaper payments.

Atomic Swaps

Litecoin has been at the forefront of implementing Atomic Swaps, a technology that allows for the trustless exchange of cryptocurrencies across different blockchains without the need for intermediaries like crypto platforms. This feature enhances interoperability and decentralization within the cryptocurrency ecosystem.

Litecoin Improvement Proposals (LIPs)

Similar to Bitcoin Improvement Proposals (BIPs), Litecoin has its own proposal system called Litecoin Improvement Proposals (LIPs). These proposals allow community members to suggest changes or improvements to the Litecoin protocol, fostering a transparent and collaborative development process.

Use cases

Peer-to-Peer Payments

Litecoin’s fast transaction confirmations and low fees make it suitable for peer-to-peer transactions. Users can quickly send and receive funds across the globe without relying on traditional banking systems, making Litecoin an efficient option for remittances and international payments.

Online Purchases

As of 2023, over 2,000 online merchants and service providers accept Litecoin as a form of payment globally. Litecoin’s transaction volume has steadily increased, with an average of over 100,000 transactions per day. In 2022, Litecoin processed over 35 million transactions, highlighting its growing use for everyday payments. Many online merchants and service providers accept Litecoin as a form of payment. There are over 5,000 cryptocurrency ATMs worldwide that support Litecoin, allowing users to buy and sell LTC with cash. Users can use Litecoin to purchase a wide range of goods and services, including electronics, clothing, digital products, and more.

Micropayments

Litecoin’s low transaction fees and fast processing times make it well-suited for micropayments, enabling users to make small transactions economically. This use case is particularly relevant for content creators, online tipping, and pay-per-view services.

Cross-Border Transactions

Litecoin’s borderless nature makes it an attractive option for cross-border transactions, as users can avoid the high fees and long processing times associated with traditional remittance services and bank transfers.

Privacy Transactions

While not as focused on privacy as some other cryptocurrencies like Monero or Zcash, Litecoin offers a degree of privacy through features like confidential transactions and the option to use privacy-enhancing wallets. This makes Litecoin appealing for users who prioritize privacy in their transactions.

Technology and underlying blockchain

Litecoin operates on a blockchain-based decentralized network, sharing many similarities with Bitcoin while incorporating several key technical differences. At its core, Litecoin’s blockchain serves as a distributed ledger that records all transactions made with its native cryptocurrency, LTC. One of the distinguishing features of Litecoin is its utilization of the Scrypt proof-of-work algorithm, which differs from Bitcoin’s SHA-256 algorithm. This algorithm was chosen to promote a more equitable mining process, allowing individuals to mine LTC using consumer-grade hardware and reducing the dominance of specialized mining equipment.

The Litecoin blockchain maintains a target block time of approximately 2.5 minutes, significantly faster than Bitcoin’s 10-minute block time. This faster block generation rate enables quicker transaction confirmations, making Litecoin well-suited for use in everyday transactions and enhancing its scalability. Additionally, Litecoin implemented Segregated Witness (SegWit) in 2017, a protocol upgrade aimed at improving transaction throughput and reducing network congestion by separating transaction signatures from transaction data.

Furthermore, Litecoin has experimented with technologies like the Lightning Network, a layer-2 scaling solution designed to facilitate instant and low-cost transactions by leveraging payment channels. This technology enables off-chain transactions that can be settled on the Litecoin blockchain, further enhancing its transaction speed and efficiency.

Supply of coins

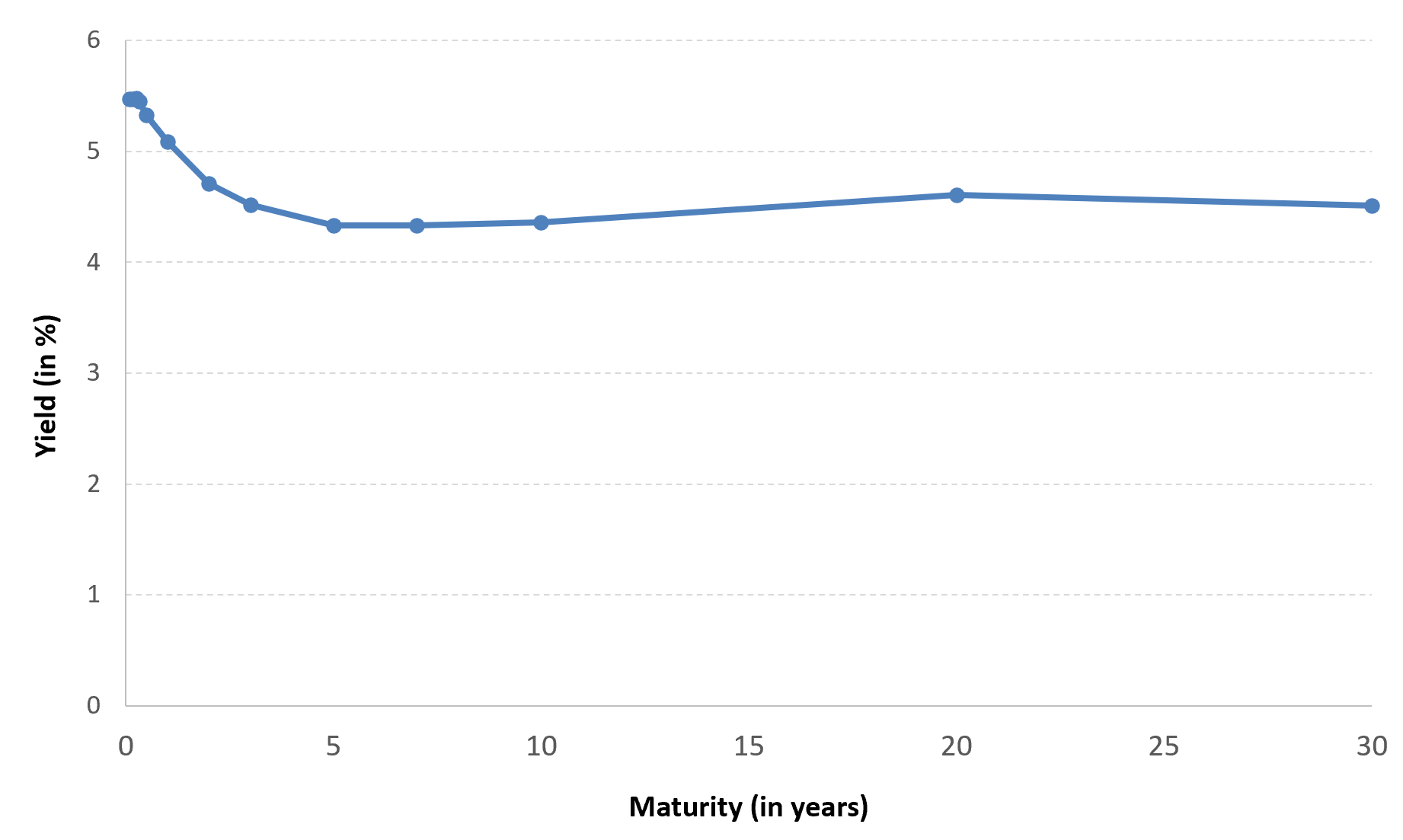

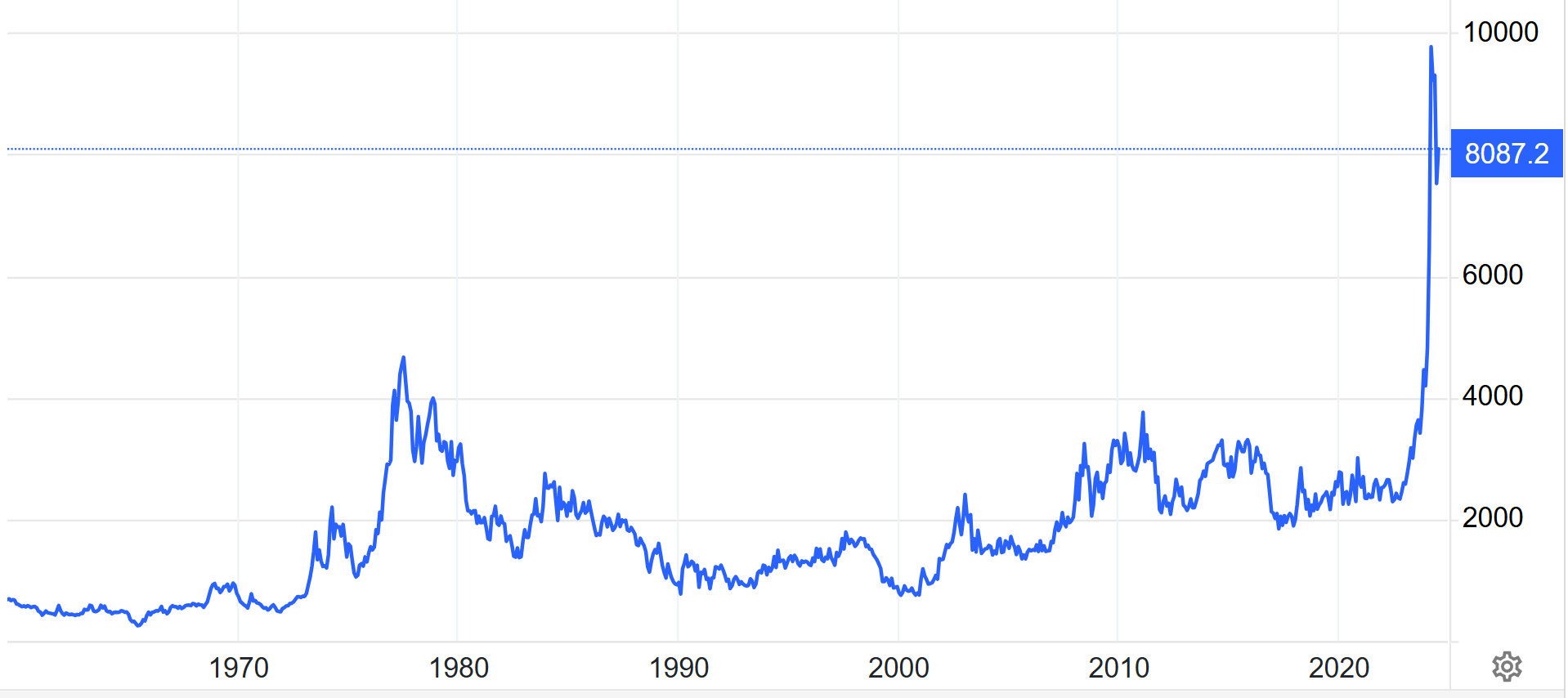

Figure Figure 2. Litecoin Supply

Source: Yahoo! Finance.

Litecoin’s coin supply is governed by its protocol, which dictates the issuance rate and maximum supply limit. Unlike traditional fiat currencies that are subject to centralized control by governments and central banks, Litecoin operates on a decentralized network secured by blockchain technology. The issuance of new Litecoin coins occurs through a process called mining, where miners use computational power to validate transactions and add new blocks to the blockchain.

Litecoin employs a deflationary monetary policy, with a fixed issuance schedule that halves the block reward approximately every four years. Initially, the block reward was set at 50 Litecoins per block, but it reduces by half every 840,000 blocks. This process, known as “halving,” aims to curb inflation over time and maintain scarcity, similar to Bitcoin’s issuance schedule. As of now, the block reward stands at 12.5 Litecoins per block, and this rate will continue to halve periodically until the maximum supply of 84 million Litecoins is reached.

The predictable issuance schedule and maximum supply cap of Litecoin contribute to its scarcity and value proposition, aligning with principles of sound money and monetary decentralization. This transparent and algorithmic approach to coin issuance fosters confidence among users and investors, as it prevents arbitrary inflation and ensures the integrity of Litecoin’s monetary policy over the long term.

Historical data for Litecoin

How to get the data?

The Litecoin is popular cryptocurrency on the market, and historical data for the Litecoin such as prices and volume traded can be easily downloaded from the internet sources such as Yahoo! Finance, Blockchain.com & CoinMarketCap. For example, you can download data for Litecoin on Yahoo! Finance (the Yahoo! code for Litecoin is LTC-USD).

Figure Figure 3. Litecoin data

Source: Yahoo! Finance.

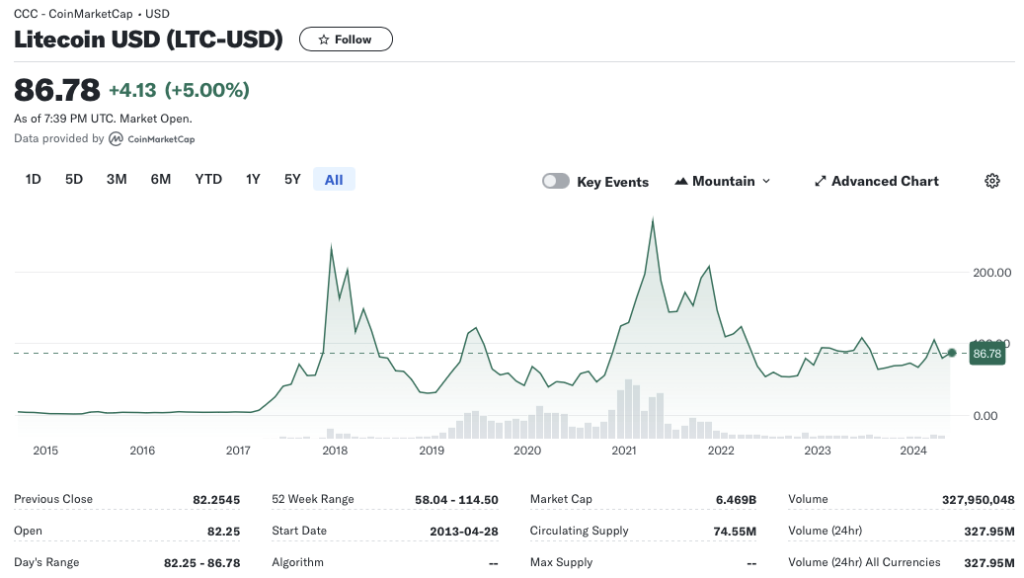

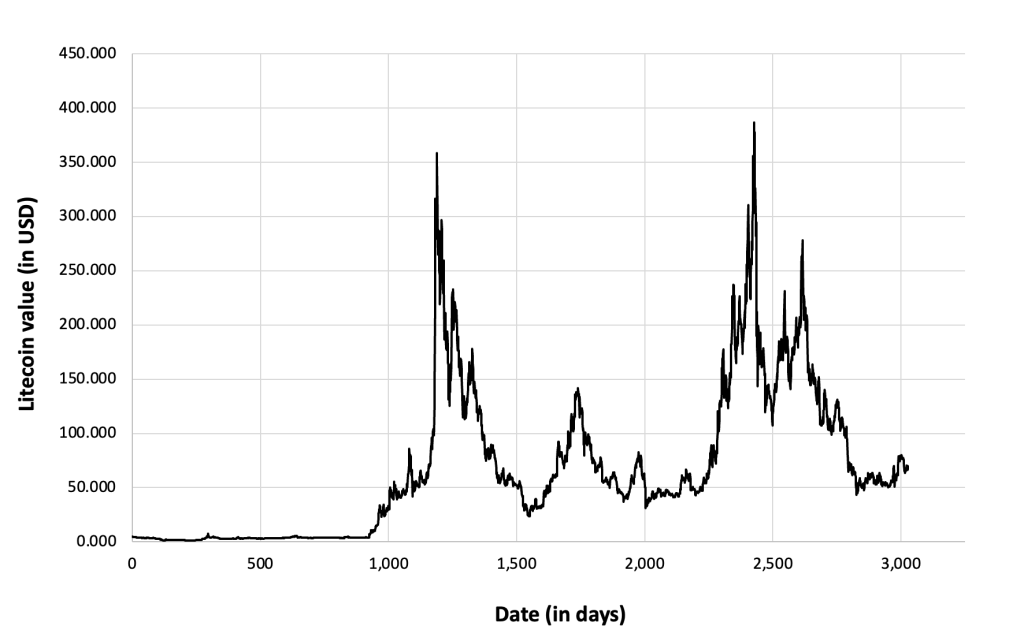

Historical data for the Litecoin market prices

Since its inception in 2011, Litecoin has undergone multiple bull and bear cycles, with its price witnessing remarkable volatility. In its early years, Litecoin’s market price remained relatively low, often trading at a fraction of Bitcoin’s value. However, as the cryptocurrency market gained traction and Litecoin’s utility as a fast and affordable payment method became recognized, its price began to appreciate steadily. The price of Litecoin experienced its first major surge in late 2013, reaching an all-time high above $50 USD. This rally was fueled by increased adoption, media attention, and speculation within the cryptocurrency community.

Following the 2013 peak, Litecoin underwent a prolonged bear market, with its price declining significantly over the subsequent years. However, Litecoin’s resilience and active development continued to attract interest, leading to periodic price rallies and subsequent corrections. The cryptocurrency market’s overall volatility, regulatory uncertainty, and competition from other digital assets also influenced Litecoin’s price movements during this period.

One of the most significant price rallies in Litecoin’s history occurred during the cryptocurrency bull market of 2017-2018. During this period, Litecoin’s price surged to unprecedented levels, reaching an all-time high of over $300 USD in December 2017. This rally was fueled by factors such as increased mainstream adoption, the integration of Segregated Witness (SegWit) and the Lightning Network, and speculative buying spurred by the broader cryptocurrency market rally.

Since the 2017-2018 bull market, Litecoin has experienced periods of both consolidation and volatility. While its price has not reached the same highs as during the peak of the bull market, Litecoin has maintained a relatively stable position within the cryptocurrency market, often regarded as one of the top digital assets by market capitalization. The ongoing development of Litecoin’s protocol, partnerships, and adoption efforts continue to shape its market prices, as investors and enthusiasts closely monitor its evolution in the broader cryptocurrency landscape.

Figure 4 below represents the evolution of the price of Litecoin in US dollar over the period September 2014 – May 2024. The price corresponds to the “closing” price (observed at 10:00 PM CET at the end of the month).

Figure 4. Evolution of Litecoin price

Source: Yahoo! Finance.

R program

The R program below written by Shengyu ZHENG allows you to download the data from Yahoo! Finance website and to compute summary statistics and risk measures about the Litecoin.

Data file

The R program that you can download above allows you to download the data for the Litecoin from the Yahoo! Finance website. The database starts on September 2014.

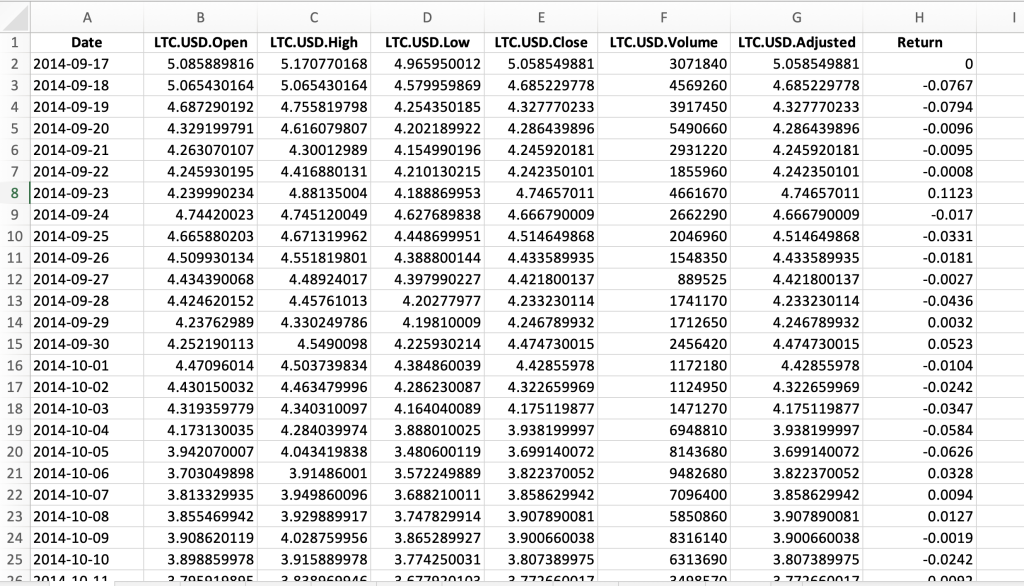

Table 1 below represents the top of the data file for the Litecoin downloaded from the Yahoo! Finance website with the R program.

Table 1. Top of the data file for the Litecoin

Source: computation by the author (data: Yahoo! Finance website).

Python code

You can download the Python code used to download the data from Yahoo! Finance.

Python script to download Litecoin historical data and save it to an Excel sheet:

import yfinance as yf

import pandas as pd

# Define the ticker symbol for Cardano “ADA-USD”

Litecoin_ticker = “LTC-USD”

# Define the date range for historical data

start_date = “2014-09-01”

end_date = “2024-04-30”

# Download historical data using yfinance

CLitecoin_data = yf.download(Litecoin_ticker, start=start_date, end=end_date)

# Create a Pandas DataFrame from the downloaded data

Litecoin_df = pd.DataFrame(Litecoin_data)

# Define the Excel file path

excel_file_path = ” Litecoin_historical_data.xlsx”

# Save the data to an Excel sheet

Litecoin_df.to_excel(excel_file_path, sheet_name=”Litecoin Historical Data”)

print(f”Data saved to {excel_file_path}”)

# Make sure you have the required libraries installed and adjust the “start_date” and “end_date” variables to the desired date range for the historical data you want to download.

Evolution of the Litecoin

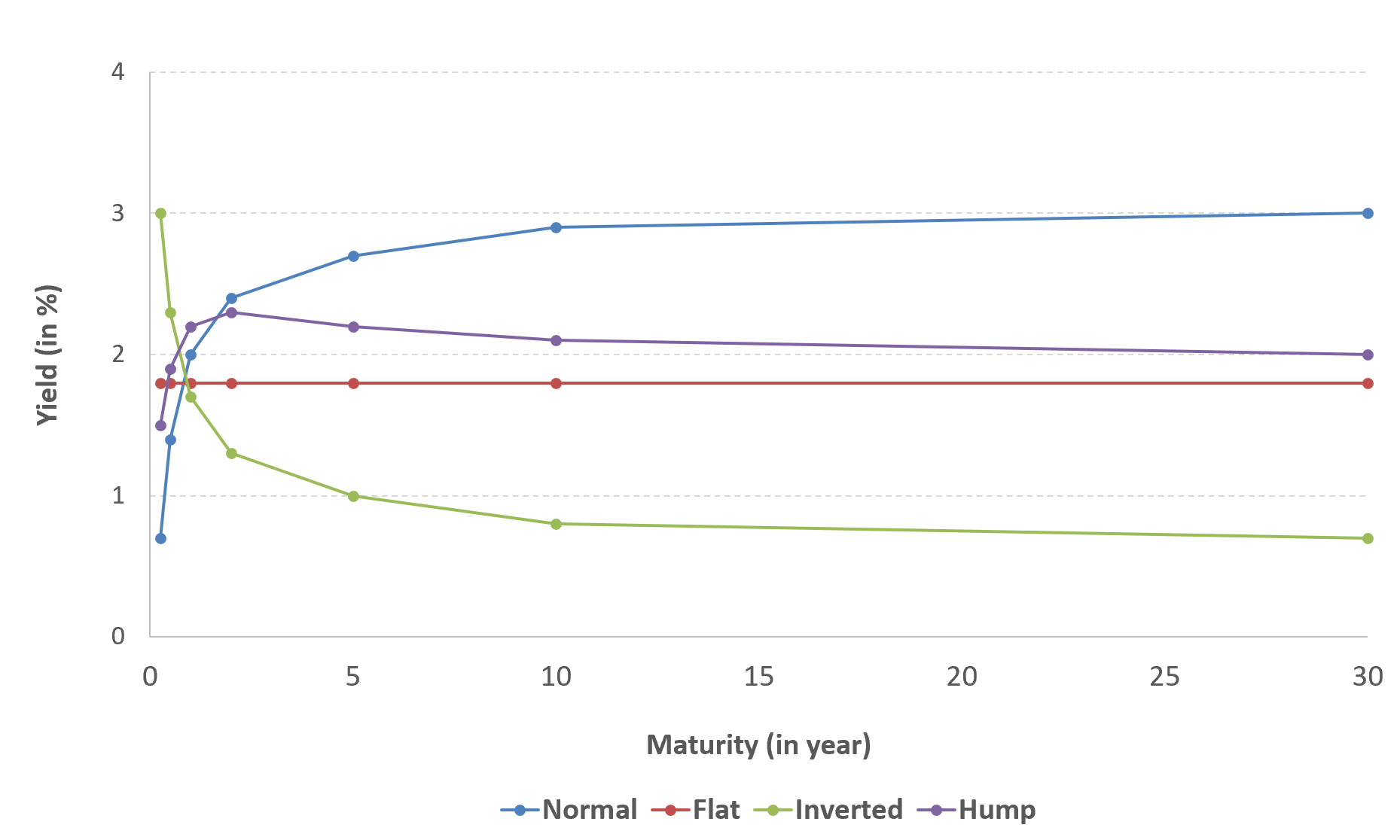

Figure 5 below gives the evolution of the Litecoin on a daily basis.

Figure 5. Evolution of the Litecoin

Source: computation by the author (data: Yahoo! Finance website).

Figure 6 below gives the evolution of the Litecoin returns from September 2014 to May 2024 on a daily basis.

Figure 6. Evolution of the Litecoin returns.

Source: computation by the author (data: Yahoo! Finance website).

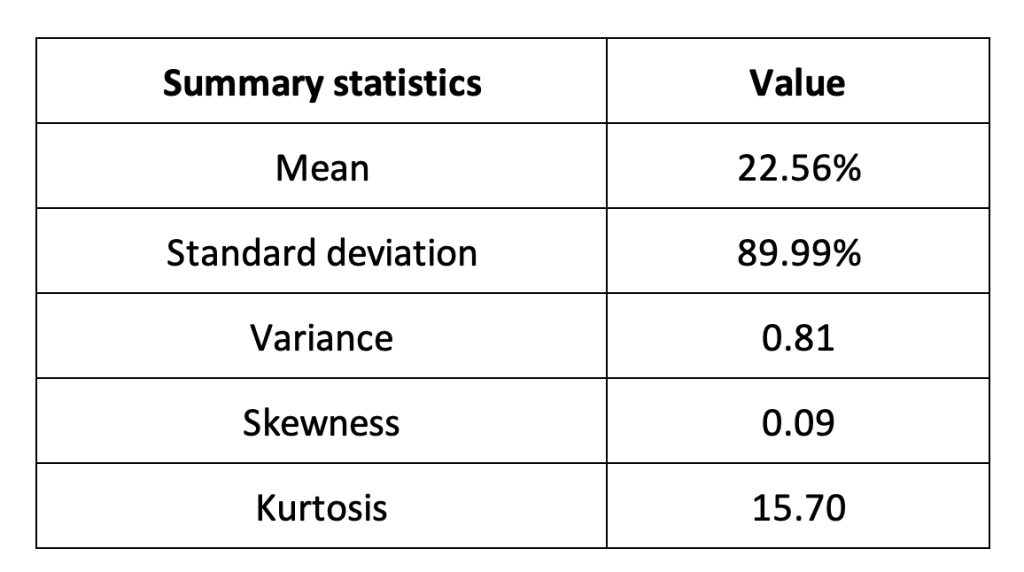

The R program that you can download above also allows you to compute summary statistics about the returns of the Litecoin.

Table 2 below presents the following summary statistics estimated for the Litecoin:

- The mean

- The standard deviation (the squared root of the variance)

- The skewness

- The kurtosis.

The mean, the standard deviation / variance, the skewness, and the kurtosis refer to the first, second, third and fourth moments of statistical distribution of returns respectively.

Table 2. Summary statistics for Litecoin

Source: computation by the author (data: Yahoo! Finance website).

Statistical distribution of the Litecoin returns

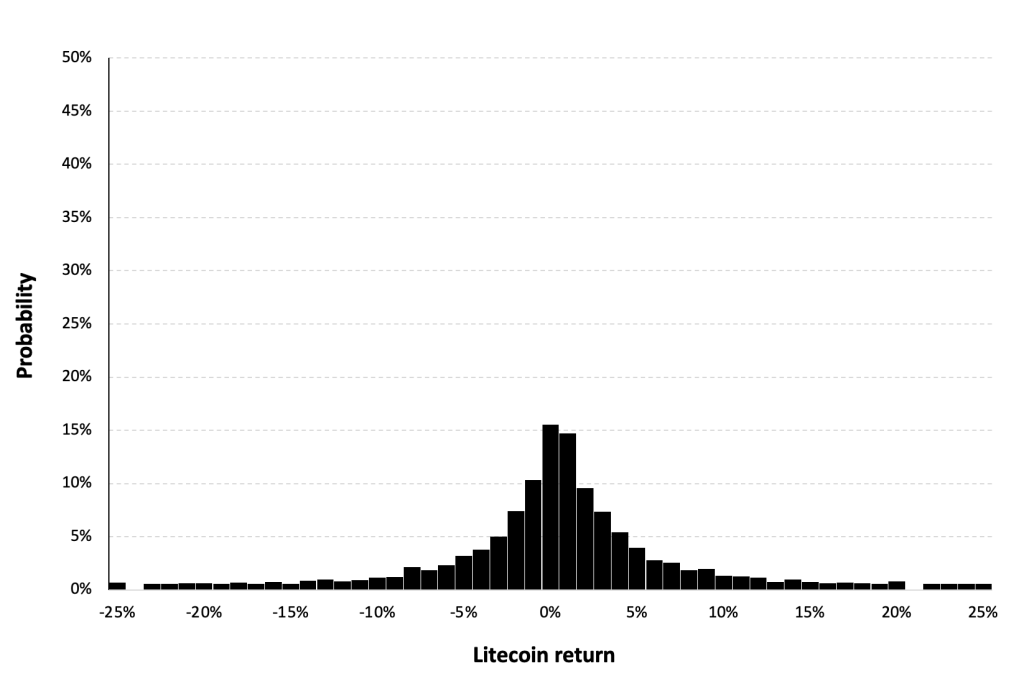

Historical distribution

Figure 7 represents the historical distribution of the Litecoin daily returns for the period from September 2014 to May 2024.

Figure 7. Historical distribution of Litecoin returns.

Source: computation by the author (data: Yahoo! Finance website).

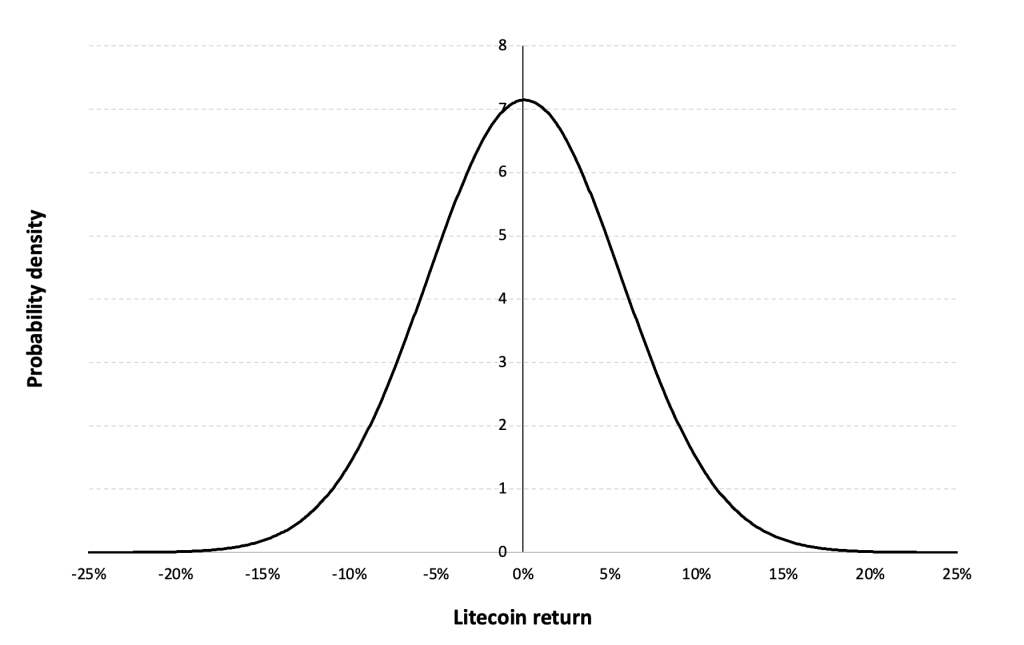

Gaussian distribution

The Gaussian distribution (also called the normal distribution) is a parametric distribution with two parameters: the mean and the standard deviation of returns. We estimated these two parameters over the period from September 2014 to May 2024.

Figure 9 below represents the Gaussian distribution of the Litecoin daily returns with parameters estimated over the period from September 2014 to May 2024.

Figure 8. Gaussian distribution of the Litecoin returns.

Source: computation by the author (data: Yahoo! Finance website).

Risk measures of the Litecoin returns

The R program that you can download above also allows you to compute risk measures about the returns of the Litecoin.

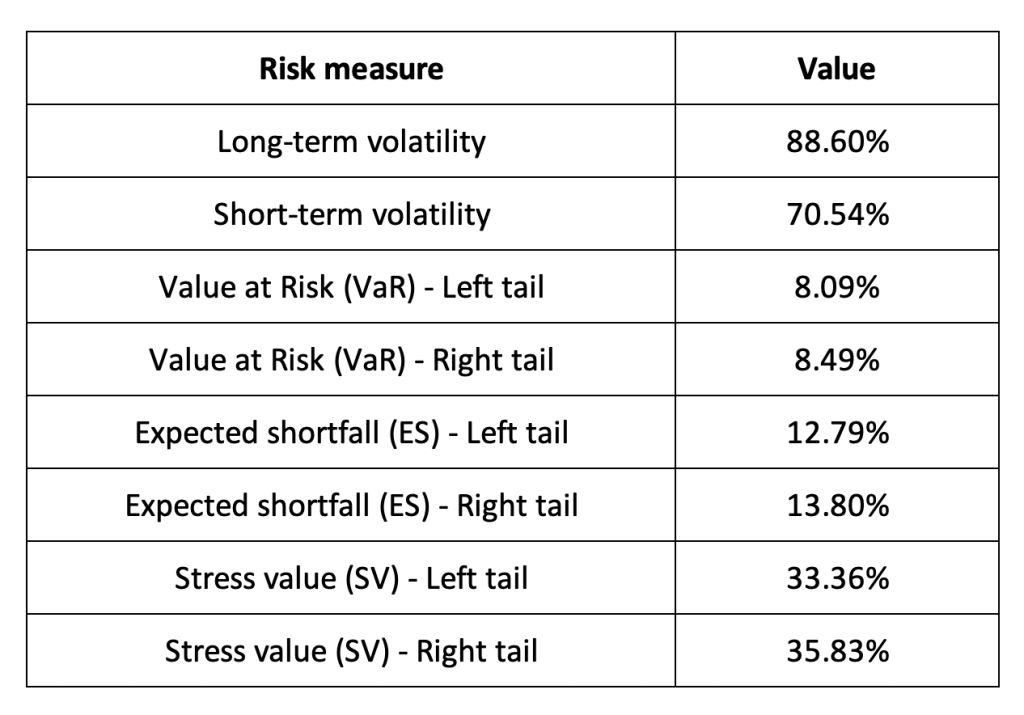

Table 3 below presents the following risk measures estimated for the Litecoin:

- The long-term volatility (the unconditional standard deviation estimated over the entire period)

- The short-term volatility (the standard deviation estimated over the last three months)

- The Value at Risk (VaR) for the left tail (the 5% quantile of the historical distribution)

- The Value at Risk (VaR) for the right tail (the 95% quantile of the historical distribution)

- The Expected Shortfall (ES) for the left tail (the average loss over the 5% quantile of the historical distribution)

- The Expected Shortfall (ES) for the right tail (the average loss over the 95% quantile of the historical distribution)

- The Stress Value (SV) for the left tail (the 1% quantile of the tail distribution estimated with a Generalized Pareto distribution)

- The Stress Value (SV) for the right tail (the 99% quantile of the tail distribution estimated with a Generalized Pareto distribution)

Table 3. Risk measures for the Litecoin

Source: computation by the author (data: Yahoo! Finance website).

The volatility is a global measure of risk as it considers all the returns. The Value at Risk (VaR), Expected Shortfall (ES) and Stress Value (SV) are local measures of risk as they focus on the tails of the distribution. The study of the left tail is relevant for an investor holding a long position in the Litecoin while the study of the right tail is relevant for an investor holding a short position in the Litecoin.

Why should I be interested in this post?

This blog offers an intriguing journey into the world of Litecoin, tailored for both newcomers and seasoned cryptocurrency enthusiasts alike. It unveils the innovative features and unique characteristics that set Litecoin apart in the digital currency landscape. From its inception to its current standing, we explore Litecoin’s historical journey, shedding light on its pivotal moments and market dynamics. Whether you’re intrigued by its faster block time or its active development community, this post provides a comprehensive understanding of Litecoin’s significance and potential. Whether you’re a curious observer or an investor seeking new opportunities, join us as we delve into the fascinating world of Litecoin and uncover its role in shaping the future of decentralized finance.

Related posts on the SimTrade blog

About cryptocurrencies

▶ Snehasish CHINARA Bitcoin: the mother of all cryptocurrencies

▶ Snehasish CHINARA How to get crypto data

▶ Alexandre VERLET Cryptocurrencies

About statistics

▶ Shengyu ZHENG Moments de la distribution

▶ Shengyu ZHENG Mesures de risques

▶ Jayati WALIA Returns

Useful resources

Academic research about risk

Longin F. (2000) From VaR to stress testing: the extreme value approach Journal of Banking and Finance, N°24, pp 1097-1130.

Longin F. (2016) Extreme events in finance: a handbook of extreme value theory and its applications Wiley Editions.

Data

Yahoo! Finance Historical data for Litecoin

CoinMarketCap Historical data for Litecoin

About the author

The article was written in July 2024 by Snehasish CHINARA (ESSEC Business School, Grande Ecole Program – Master in Management, 2022-2024).