Money never sleeps

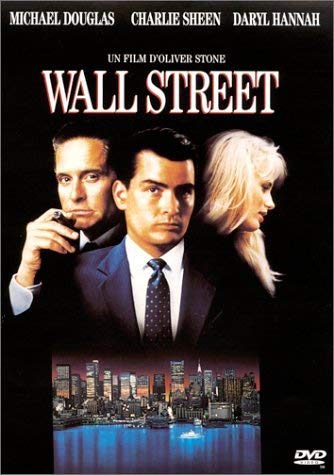

In this article, Federico MARTINETTO (ESSEC Business School, Exchange Global BBA, 2021) comments on a quote from Gordon Gekko in the famous Wall Street film.

Quote: Money never sleeps

The quote “Money never sleeps” is a famous line from the 1987 film “Wall Street” and has become a popular saying in popular culture. The phrase “money never sleeps” is commonly used in the context of financial markets and reflects the idea that financial activity never truly ceases, even outside of traditional business hours. This reflects the fast-paced nature of the global financial system, where transactions can occur at any time and from any location around the world. This concept is particularly relevant in the field of finance and investment, where the value of stocks, bonds, and other securities can fluctuate rapidly based on changes in market conditions or geopolitical events. As such, traders and investors must remain vigilant and stay informed about market developments, as opportunities and risks can arise at any time.

The idea that “money never sleeps” also highlights the interconnectedness of the global financial system, where events in one part of the world can have significant impacts on financial markets and economic activity in other regions. As a result, the ability to respond quickly and effectively to market changes is critical for success in the world of finance and investment.

Overall, the phrase “money never sleeps” reflects the dynamic and constantly evolving nature of the global economy, where financial activity never truly stops, and opportunities and risks can arise at any time.

Analysis of the quote

The quote “money never sleeps” can be analyzed as a reflection of the constantly changing and dynamic nature of financial markets. The phrase suggests that financial activity is always occurring, even outside of traditional business hours, and that investors and traders must be vigilant and responsive to changes in order to succeed.

One of the key factors that drives the ongoing nature of financial activity is the 24-hour nature of global financial markets. Financial exchanges around the world operate in different time zones, meaning that trading activity can occur at any time. This means that traders and investors must be prepared to respond quickly to market changes, even if they occur outside of normal working hours.

In addition to the 24-hour nature of financial markets, the phrase “money never sleeps” also reflects the rapid pace of financial activity. Financial markets are characterized by their fast-paced nature, with changes in market conditions or geopolitical events leading to rapid fluctuations in the value of securities. This creates both opportunities and risks for traders and investors, who must remain alert and responsive to these changes in order to make informed investment decisions. Furthermore, the interconnectedness of global financial systems is a third factor that contributes to the ongoing nature of financial activity. Events in one part of the world can have significant impacts on financial markets and economic activity in other regions. This means that traders and investors must be aware of global market trends and be prepared to adapt to changing circumstances in order to succeed.

From an academic perspective, the quote “money never sleeps” highlights the importance of remaining vigilant and responsive to changes in financial markets. By doing so, investors and traders can position themselves to take advantage of opportunities and manage risks in order to achieve their investment objectives. Additionally, the ongoing nature of financial activity underscores the importance of financial literacy and education, as individuals must be prepared to make informed decisions in an ever-changing financial landscape.

About the author

Gordon Gekko is a fictional character who appears as the villain in the popular 1987 Oliver Stone movie “Wall Street” and its 2010 sequel “Wall Street: Money Never Sleeps.” The character, a ruthless and wildly wealthy investor and corporate raider, has become a cultural symbol for greed, as epitomized by the famous “Wall Street” quote “Greed is good.”

In “Wall Street,” the protagonist, a young stockbroker named Bud Fox, is desperate to work with Gordon Gekko, who is a legend in the world of finance. Predatory, amoral Gekko is only impressed when Fox is willing to compromise his ethics and provide Gekko with inside information about his father’s company. Gekko makes Fox wealthy, but eventually, Fox regrets what he has done and turns state’s evidence against Gekko, who is sent to prison for securities fraud and insider trading.

For his portrayal of Gordon Gekko in the original film, Michael Douglas won an Academy Award.

Financial concepts related to the quote

The quote “money never sleeps” can be said to refer to three key financial concepts: the 24-hour nature of global financial markets, the rapid pace of financial activity, and the interconnectedness of global financial systems.

The 24-hour nature of global financial markets

One of the key reasons why “money never sleeps” is a relevant concept in finance is the 24-hour nature of global financial markets. Financial exchanges around the world operate in different time zones, meaning that trading activity can occur at any time. For example, the New York Stock Exchange is open from 9:30am to 4:00pm Eastern Time, while the Tokyo Stock Exchange operates from 9:00am to 3:00pm Japan Standard Time. This means that financial transactions can occur at any time, even outside of traditional business hours.

The rapid pace of financial activity

Another reason why “money never sleeps” is an important concept in finance is the rapid pace of financial activity. Financial markets are characterized by their fast-paced nature, with changes in market conditions or geopolitical events leading to rapid fluctuations in the value of securities. This can create both opportunities and risks for traders and investors, who must remain alert and responsive to these changes in order to make informed investment decisions.

The interconnectedness of global financial systems

The interconnectedness of global financial systems is a third reason why “money never sleeps” is a relevant concept in finance. Events in one part of the world can have significant impacts on financial markets and economic activity in other regions. For example, a change in monetary policy by the US Federal Reserve can impact the value of the US dollar and influence economic activity in other countries that trade with the US. This means that financial activity never truly stops, as the effects of market changes and economic events can continue to reverberate around the world.

Overall, the phrase “money never sleeps” reflects the dynamic and constantly evolving nature of the global economy, where financial activity never truly ceases, and opportunities and risks can arise at any time. As a result, traders and investors must remain alert and responsive to changes in financial markets and be prepared to adapt to changing circumstances in order to achieve their investment objectives.

My opinion about this quote

I like so much this quote because it means there are opportunities to make money at any time of the day. One reason why I find the quote appealing is because it suggests a sense of excitement and energy. The phrase implies that financial markets are always active, and that there is always something happening that can impact the value of securities or other financial instruments. For some people, this sense of constant motion and activity can be invigorating and attractive.

Additionally, the quote can be seen as a reminder of the importance of remaining engaged and aware in the pursuit of financial success. By suggesting that “money never sleeps”, the quote underscores the idea that financial markets are always evolving and changing, and that individuals who are not actively engaged in managing their investments may miss out on opportunities or be exposed to unnecessary risks.

Moreover, the quote can also be interpreted as reflective of the importance of hard work and dedication in the pursuit of financial success. The phrase “money never sleeps” suggests that financial success is not achieved through passive investment strategies, but rather through active engagement and a willingness to put in the time and effort required to stay informed and make informed decisions.

For individuals who are interested in finance and investing, the quote can be seen as a motivational reminder of the importance of remaining engaged and committed to achieving one’s financial goals. It encourages individuals to remain vigilant, respond quickly to changes in financial markets, and continually seek out opportunities to maximize their returns.

In conclusion, the quote “money never sleeps” can be appealing for a variety of reasons, including its suggestion of excitement and energy, its reminder of the importance of remaining engaged and aware in the pursuit of financial success, and its emphasis on the importance of hard work and dedication.

Why should I be interested in this post?

The quote “Money never sleeps” relates to the SimTrade certificate in different ways.

Concerning the practice by launching the Efficient market simulation, you will practice how information is incorporated into market prices through the trading of market participants and grasp the concept of market efficiency. By launching the Sending an order simulation, you will practice how financial markets really work and how to act in the market by sending orders.

Regarding the theory for example by taking the Market information course, you will understand how information is incorporated into market prices and the associated concept of market efficiency. By taking the Trade orders course, you will know more about the different type of orders that you can use to buy and sell assets in financial markets.

Related posts on the SimTrade blog

▶ Akshit GUPTA Analysis of the movie Wall Street: Money Never Sleeps

▶ Kunal SAREEN Analysis of the Wall Street movie

Useful resources

SimTrade course Trade orders

SimTrade course Market information

SimTrade course Leverage

SimTrade simulations Efficient market

About the author

The article was written in April 2023 by Federico MARTINETTO (ESSEC Business School, Exchange Global BBA, 2021).

1 thought on “Money never sleeps”

Comments are closed.