Netflix ‘Billions’ Analysis of characters through CFA Code of Ethics and Standards of Professional Conduct

In this article, William LONGIN (EDHEC Business School, Global BBA 2020-2024) analyzes the show “Billions” through the lens of the Code of Ethics and Standards of Professional Conduct developed by the CFA Institute. I wrote this post while I prepared for the Level 1 of the CFA exam.

Overview of ‘Billions’ and ethics

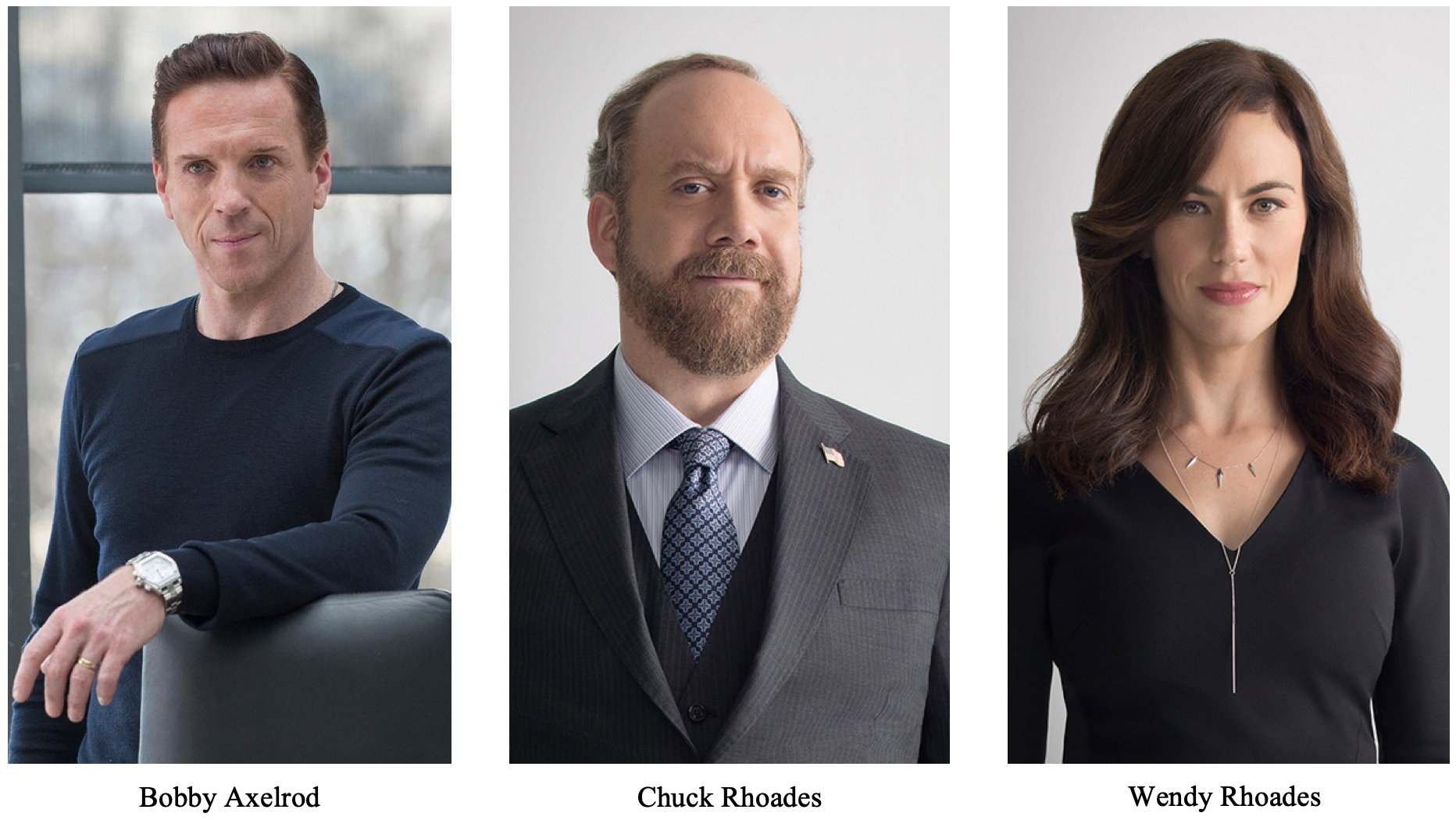

The Netflix show “Billions,” set in New York City, portrays the intense story between three individuals: Bobby Axelrod, CEO of hedge fund ‘Axe Capital’, Chuck Rhoades, a tenacious US Attorney, and Wendy Rhoades, the wife of Chuck Rhoades and a talented performance coach working at Axe Capital. Bobby Axelrod and Chuck Rhoades fight for their honor and survival throughout the series with sometimes questionnable actions. Wendy Rhoades often plays the role of a middle person to find compromise and communication between Bobby Axelrod and Chuck Rhoades. The main characters insatiable greed has led them to indulge in misconduct, disregarding the ethical rules that govern investment and legal professionals in the real world.

Source: Showtime / Netflix.

CFA Institute’s Code of Ethics and Standards of Professional Conduct

The CFA Institute’s Code of Ethics and Professional Standards defines a comprehensive canvas for ethical and professional behavior. It states that it is for “investment professionals globally, regardless of job function, cultural differences, or local laws and regulations.” The Code places a strong emphasis on honesty to ensure that investment professionals operate in clients’ best interests. In “Billions”, the characters’ choices and actions often cross paths with these moral guidelines. In this article we will explore the three main characters Bobby Axelrod, Chuck and Wendy Rhoades through the lens of the CFA Code of Ethics and Standards of Professional Conduct.

“Billions” main characters: Bobby Axelrod, Chuck and Wendy Rhoades

Source: Netflix.

Bobby Axelrod: the hedge fund manager

Bobby Axelrod is the main character of the series “Billions”. He is the CEO of the hedge fund Axe Capital. Bobby Axelrod possesses exceptional financial acumen (the ability to make good judgements and take quick decisions) but his actions often push the boundaries of ethical behavior. These actions are driven by the drive to always beat the market at whatever cost.

Insider trading

By definition, insider trading is the illegal practice of trading on the stock exchange to one’s own advantage using material non-public information (confidential information).

One important ethical concern surrounding Bobby is his open willingness to engage in insider trading for himself and his firm. Despite having a legal department at Axe Capital, insider trading has been normalized throughout the series and undetected in most cases by the Securities and Exchange Commission (SEC) – the US authority in charge of regulating the financial markets. Bobby Axelrod gets his information through his extensive professional network and from his spies. Insider trading is forbidden by CFA standards of professional conduct as it violates point II.A. of CFA standards of professional conduct.

| II.A. Material Nonpublic Information. Members and Candidates who possess material nonpublic information that could affect the value of an investment must not act or cause others to act on the information. |

Insider trading is also forbidden by law in the United States. According to Cornell Law School “Courts impose liability for insider trading with Rule 10b-5 under the classical theory of insider trading and, since U.S. v. O’Hagan, 521 U.S. 642 (1997), under the misappropriation theory of insider trading”.

An example of insider trading is in the Episode 1 Season 1: “Pilot”. Bobby Axelrod approves a short-sell on Superior Automotive based on insider information. In this scene, Bobby Axelrod listens to two points of view: a deduction based on public information from one of his employees and another point of view based on confidential information from the character Dollar-Bill. When Axe asks Dollar-Bill “his level of certainty” about the excess supply that wasn’t disclosed by the company, there is a cut scene that shows the bribing with cash & watches of an employee of Superior Automotive and Dollar-Bill directly looking at the physical inventories of the company. To which Dollar-Bills answers famously “I am not uncertain”. When in possession of insider information, professionals cannot share, or influence action based on that information according to CFA Code of Professional Standards. Although Dollar-Bill is the one that actively tried to act on insider information, Axelrod is also in fault because of his lack of due diligence and supervision of his employee.

Independence and Objectivity

Bobby Axelrod has been found to use financial incentives to influence other people’s decisions in his favor. For example, Axelrod tipped the policeman that was going to arrest his employee. This tip avoided legal charges for his employee and bad image for the firm. Axelrod is found to disregard point I.B of the CFA standards of professional conduct.

| I.B. Independence and Objectivity. (…) Members and Candidates must not offer, solicit, or accept any gift, benefit, compensation, or consideration that reasonably could be expected to compromise their own or another’s independence and objectivity. |

In season 1 episode 7 “The Punch”, Bobby Axelrod pays a police officer named Lonnie Watley to prevent the arrest of one of his employees, Donnie Caan. Donnie Caan is a key member of Axe Capital, and Bobby Axelrod takes measures to protect him from legal troubles related to an insider trading investigation. In a later episode this incident was discovered by Raul Gomez, New York City Police and Fire Department Pension Fund Manager that asks him to not “greed” his colleagues in the future.

Unethical behavior

Axelrod frequently engages in aggressive tactics to push his personal agenda. A major example of unethical behavior is the Ice Juice Scheme from Season 2. In this case Bobby Axelrod sabotaged the initial public offering (IPO) of a company called “Ice Juice.” He used insider information to short the stock and profit immensely when the stock price immediate crash due to his scheme. His plan was to have some people get instantly sick after drinking Ice Juice and profit from media coverage. His scheme tampered with the public opinion and destabilised the fair consideration of Ice Juice on its IPO day. This also impacted his colleagues in the investment profession and their clients. According to point 1 of the CFA Code of Ethics this behaviour is unethical.

| Act with integrity, competence, diligence, respect and in an ethical manner with the public, clients, prospective clients, employers, employees, colleagues in the investment profession, and other participants in the global capital markets. |

Chuck Rhoades: the US Attorney for Southern district of New York

Chuck Rhoades is the United States Attorney for the Southern district of New York. During the first season Chuck attempts to take down Bobby Axelrod to protect fair competition in the markets. Bobby and Chuck both used their network to try and destabilize the other but ended in a stalemate in the 1rst season. It is important to note that Chuck Rhoades is not an investment professional, but the Code and Standards promotes ethical guidelines that can be interpreted in various professions.

Fraud

Chuck’s methods and ethical choices also raise concern. Chuck often bends the rules, manipulates evidence, and employs coercion to secure convictions and survive in his industry. Manipulating evidence goes against point II.D of the Code of standards of professional conduct regarding misconduct.

| II.D. Misconduct. Members and Candidates must not engage in any professional conduct involving dishonesty, fraud, or deceit or commit any act that reflects adversely on their professional reputation, integrity, or competence. |

Conflicts of interests

Additionally, Chuck’s relationship with Wendy Rhoades, who works as a performance coach for Axe Capital, raises ethical concerns regarding conflicts of interest and the appropriate boundaries between personal and professional relationships. While Chuck initially recuses himself from the Axe Capital case, he continued to work on the case behind the scene. This goes against the interest of the American people because he is biased in his work. Point VI.A. of CFA standards of professional conduct on conflicts of interests states the following.

| VI.A. Disclosure of Conflicts. Members and Candidates must make full and fair disclosure of all matters that could reasonably be expected to impair their independence and objectivity or interfere with respective duties to their clients, prospective clients, and employer. Members and Candidates must ensure that such disclosures are prominent, are delivered in plain language, and communicate the relevant information effectively. |

Wendy Rhoades: the middle woman

Wendy Rhoades is a performance coach at Axe Capital. She plays a key role in the series and is a powerful woman that often plays a role in resolving the fights between Axe and Chuck. Wendy tries to balance her professional responsibilities at Axe Capital while managing her personal relationship with Chuck Rhoades. Since Wendy Rhoades works in the finance industry she is therefore directly concerned by the Code of Ethics and Standards.

Whistleblowing

Wendy Rhoades is entrusted with confidential information, serving as a confidante to many within the organization. This fiduciary (involving trust) duty requires her to prioritize the interests and welfare of these individuals, acting with integrity and avoiding any conflicts that could compromise their trust. Across Season 2 we see that the information that Wendy has on the company is compromising and therefore we may ask ourselves if under national law she would be required to play a role of whistleblower. Indeed, Wendy has had knowledge of criminal activity and refused to whistle blow mostly due to her friendship with Bobby. This goes against point I.A of CFA standards of professional conduct.

| I.A. Knowledge of the Law. Members and Candidates must understand and comply with all applicable laws, rules, and regulations (including the CFA Institute Code of Ethics and Standards of Professional Conduct) of any government, regulatory organization, licensing agency, or professional association governing their professional activities. (…) Members and Candidates must not knowingly participate or assist in and must dissociate from any violation of such laws, rules, or regulations. |

Wendy’s loyalty to Bobby Axelrod adds another layer of complexity. Bobby relies heavily on Wendy’s expertise and guidance, seeking her advice on critical business decisions and relying on her insight into the minds of Axe Capital employees.

Wendy’s dual loyalties place her in a delicate position, as her duty to uphold the best interests of Axe Capital and with her personal relationship with her husband Chuck Rhoades.

Importance of ethics in the investment industry and popular media’s influence

Ethics play an important role in the investment industry as it gives it reputation and trust. A Code of Ethics and Professional Standards as proposed by the CFA Institute helps to work towards a stable financial system while reducing the likelihood of wrongdoings.

The Netflix series “Billions” that started in 2016, almost 10 years after the financial crisis of 2007 portrays traders as greedy and unethical in many cases. “Billions” stays nonetheless a fictional representation of the financial industry. However, this portrayal could badly influence and create false impressions, especially for future analysts and viewers who aspire to these positions.

Television shows and movies have the power to shape public opinion. “Billions” contributes to the overall perception of the financial sector along with other films like the Wolf of Wall Street and The Big Short. The financial sector is often a sector that is unknown or known very little by the average person. The portrayal of ethical dilemmas in popular media could raise awareness and generate important discussions about the role of ethics in finance. It encourages critical thinking and prompts viewers to question the ethical boundaries they would be willing to cross in pursuit of success.

Related posts on the SimTrade blog

▶ All posts about Movies and documentaries

▶ Louis DETALLE Ethics in finance

▶ Akshit GUPTA Market manipulation

▶ Akshit GUPTA Securities and Exchange Commission

▶ Akshit GUPTA Short selling

▶ Akshit GUPTA Price fixing

▶ Akshit GUPTA Corner

Useful resources

U.S Securities Exchange Commission (SEC)

Cornell Law School Insider trading

CFA Code of Ethics and Professional Standards

About the author

Article written in July 2023 by William LONGIN (EDHEC Business School, Global BBA, 2020-2024).