Real-Time Risk Management in the Trading Arena

In this article, Vardaan CHAWLA (ESSEC Business School, Master in Strategy and Management of International Business (SMIB), 2020-2023) shares a case study on real-time risk management in the trading arena.

As an individual investor venturing into the dynamic world of financial markets, it’s crucial to understand and implement effective risk management strategies. The following article, explores the key principles and techniques to safeguard your investments and navigate the potential risks.

Financial markets are very dynamic, interesting, and filled with opportunities and risks. Learning to manage risks in the always-changing world of financial markets is crucial. In the following article I discuss the effective methods to manage, navigate, and avoid risk while dealing in financial markets to help you make informed decisions and safeguard your money.

Understanding Your Risk Tolerance

The first principle of effective risk management is self-awareness. Before diving into financial markets one must assess one’s own risk tolerance meaning the amount of losses you are able to manage comfortably.

Ask yourself critical questions:

- How much capital can I realistically afford to lose?

- How would a significant loss impact my financial well-being?

- Am I prone to emotional decision-making during market fluctuations?

After answering these questions you can start making your trading and risk management strategies and techniques. A very aggressive investor will be open to taking a high amount of risk with more potential results while a conservative investor will be the opposite, low risk with less potential returns. One must invest based on their own loss tolerance.

Core Risk Management Strategies

Once you understand your risk tolerance, equip yourself with these key risk management strategies:

- Position Sizing: This describes how much capital is devoted to a specific deal. Starting small is a vital notion, particularly for novices. A typical place to start is with 1% to 2% of your entire portfolio for each deal. With a diversified portfolio, you can progressively raise position size as your experience and risk tolerance permits.

- Stop-Loss: Stop orders are vital instruments for safeguarding your investment. To limit potential losses if the market swings against your position, a stop-loss order automatically sells an asset when the price hits a predefined level (lower than the current market price). It’s critical to create stop-loss levels that balance possible asset recovery with risk minimization.

- Take Profit: Limit orders work similarly to stop-loss orders in that they automatically lock in profits by selling an asset when the price hits a predefined level (higher than the current market price). This lessens the chance of losing gains if the market turns south. To safeguard your earnings and resist the need to cling to a winning position for too long, use take-profit orders wisely.

- Diversification: Avoid putting all of your money in one place. Distribute your investments throughout several industries, sectors, and asset classes. This lessens the effect that a fall in one asset will have on the value of your entire portfolio. Diversification makes your portfolio more stable and less vulnerable to changes in the market.

- Risk-Reward Ratio: This measure contrasts the possible gain with the possible loss on a certain transaction. Seek for transactions where the possible profit margin outweighs the potential loss margin. A better risk profile is indicated by a greater ratio. Prior to making a trade, evaluating the risk-reward ratio will help you make well-informed judgments regarding potential gain vs downside.

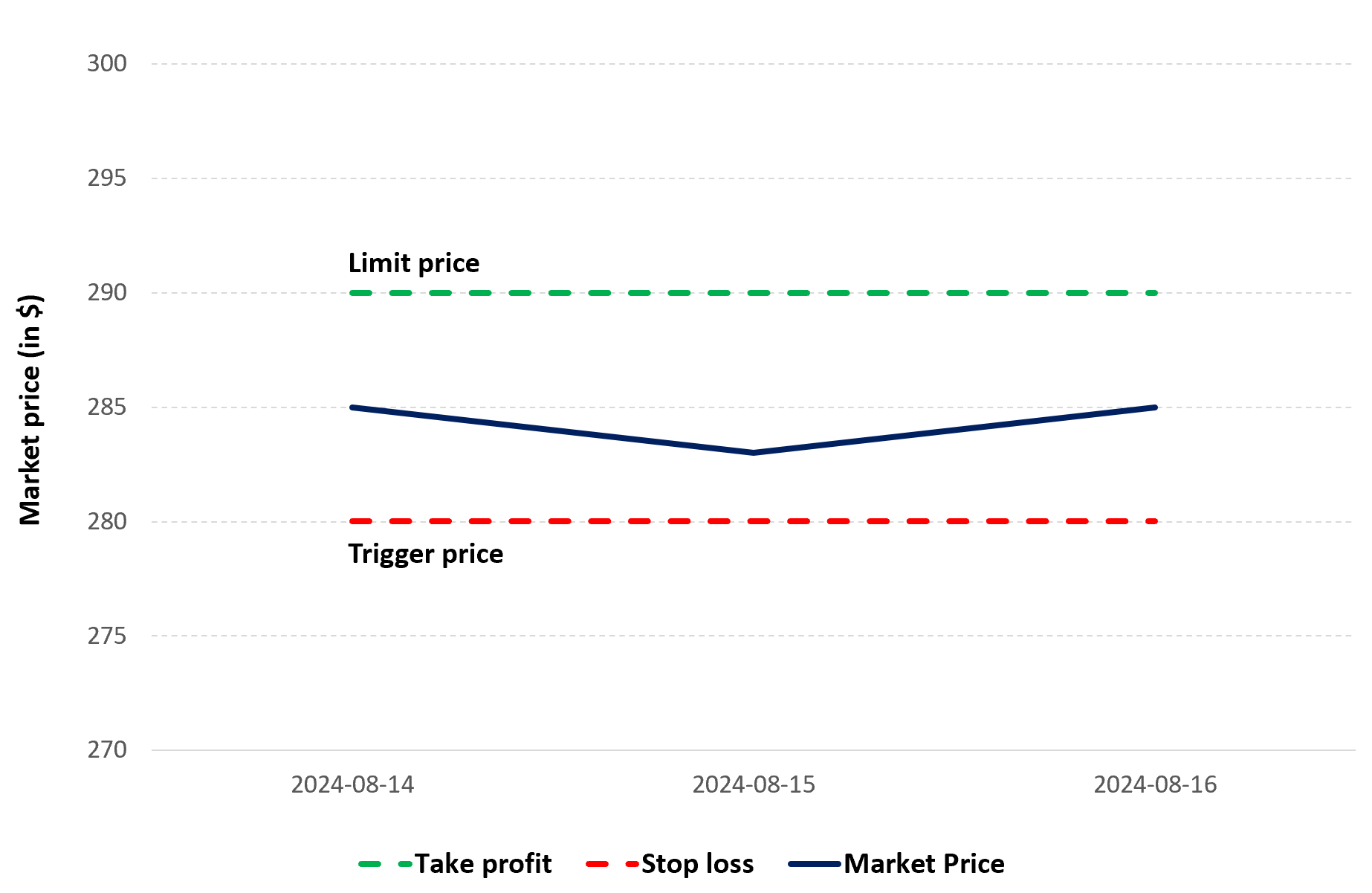

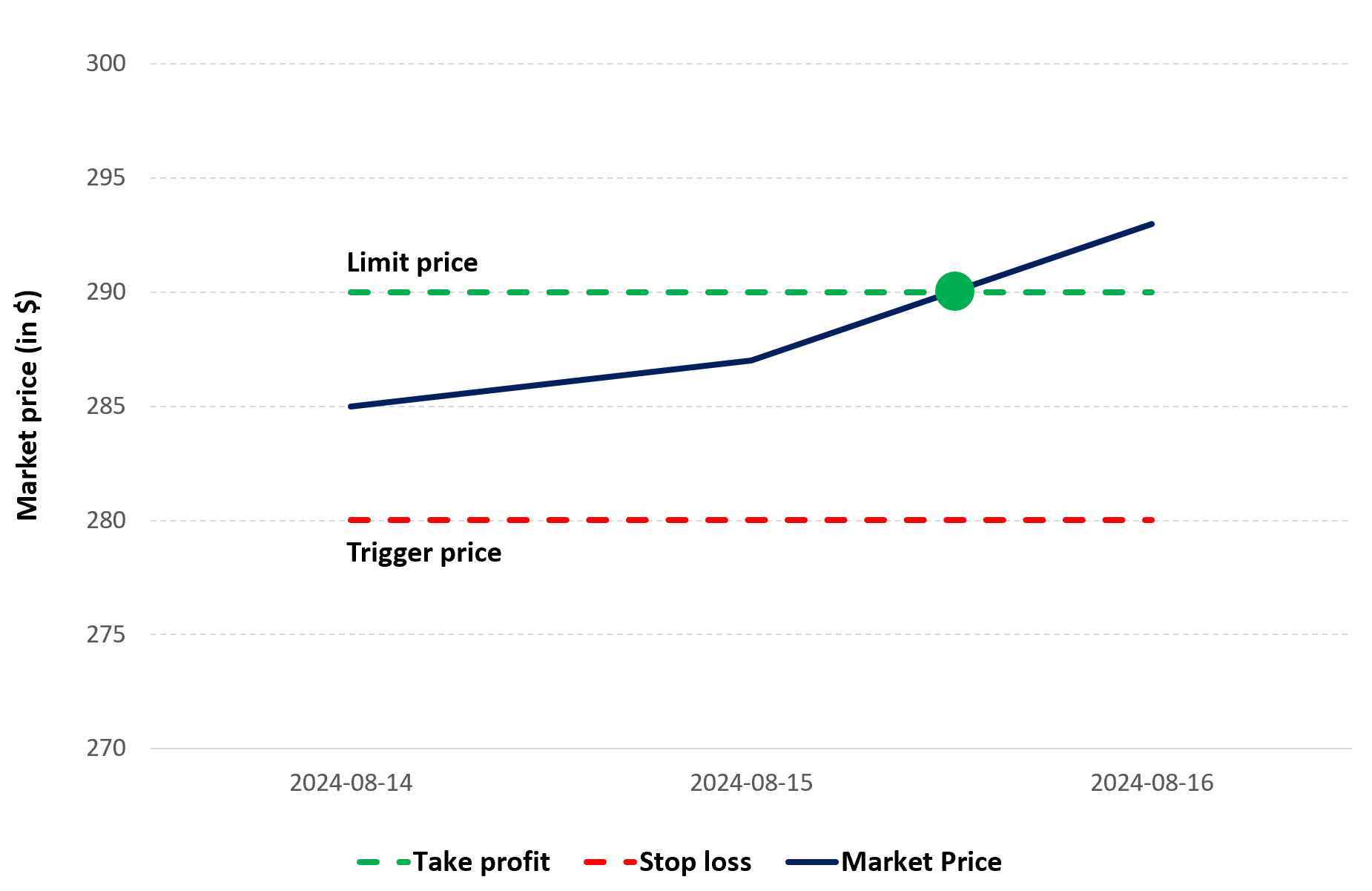

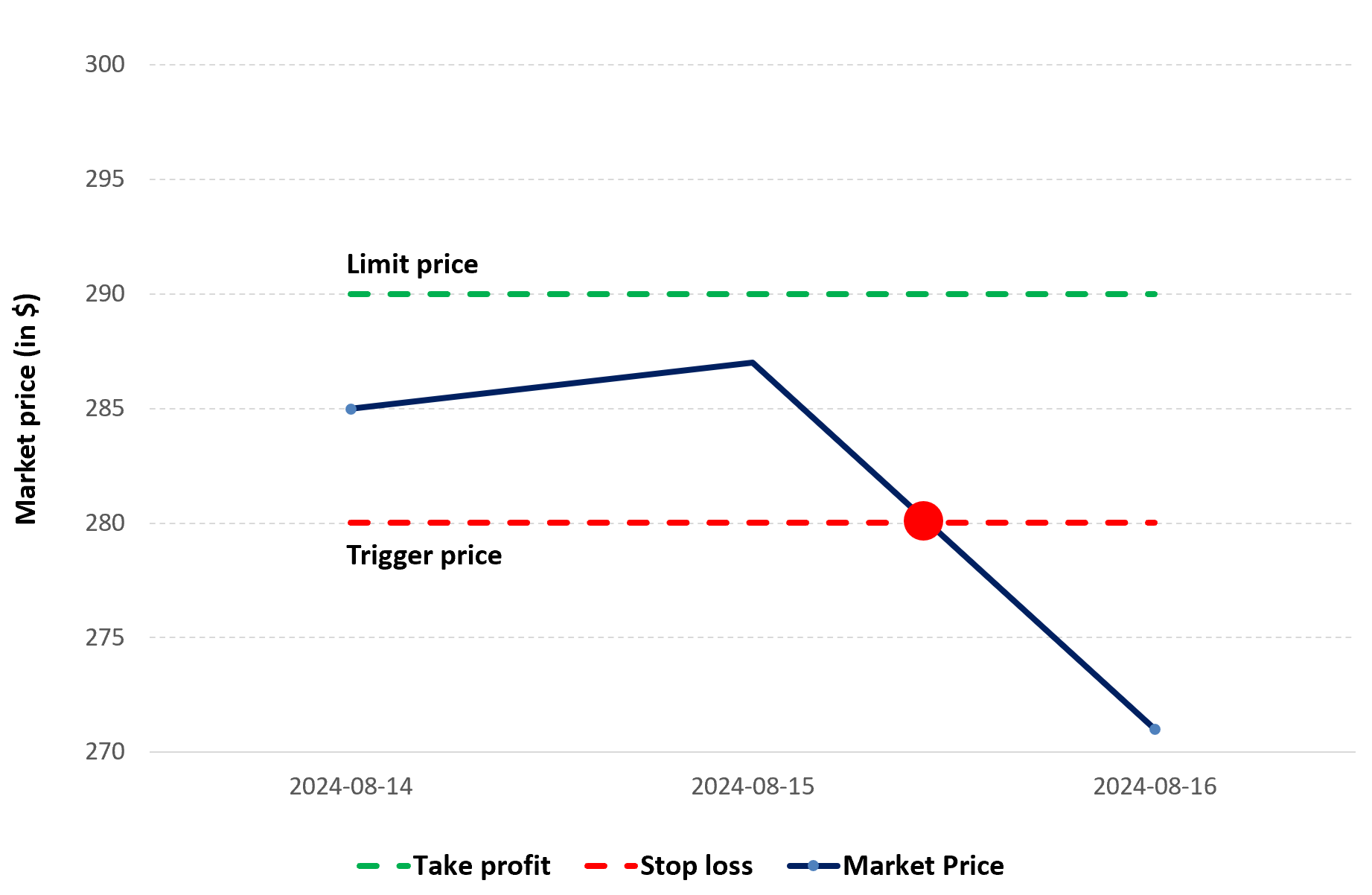

The figures below illustrate how take-profit and stop-loss can be implemented for a given stock (Meta around August 15,2024). Two orders are sent to the market (at the same time): a sell limit order with a limit price of $290 and a stop order with a trigger price of $280. Note that it is not always possible to place both a limit order an stop order at the same time (it depends on the brokers or trading platforms).

In Figure 1, the stock price stays below the limit price and above the trigger price.

Figure 1. No order execution.

Source: computation by the author.

In Figure 2, the sell limit order is executed as the market price reaches the limit price of the order; the transaction price is $290.

Figure 2. Take profit: execution of the limit order.

Source: computation by the author.

In Figure 3, the sell stop order is executed as the market price reaches the trigger price of the order; the transaction price is $280 (or lower if the market is not very liquid).

Figure 3. Stop loss: execution of the stop order.

Source: computation by the author.

Advanced Risk Management Techniques

As you gain experience, consider incorporating these advanced techniques:

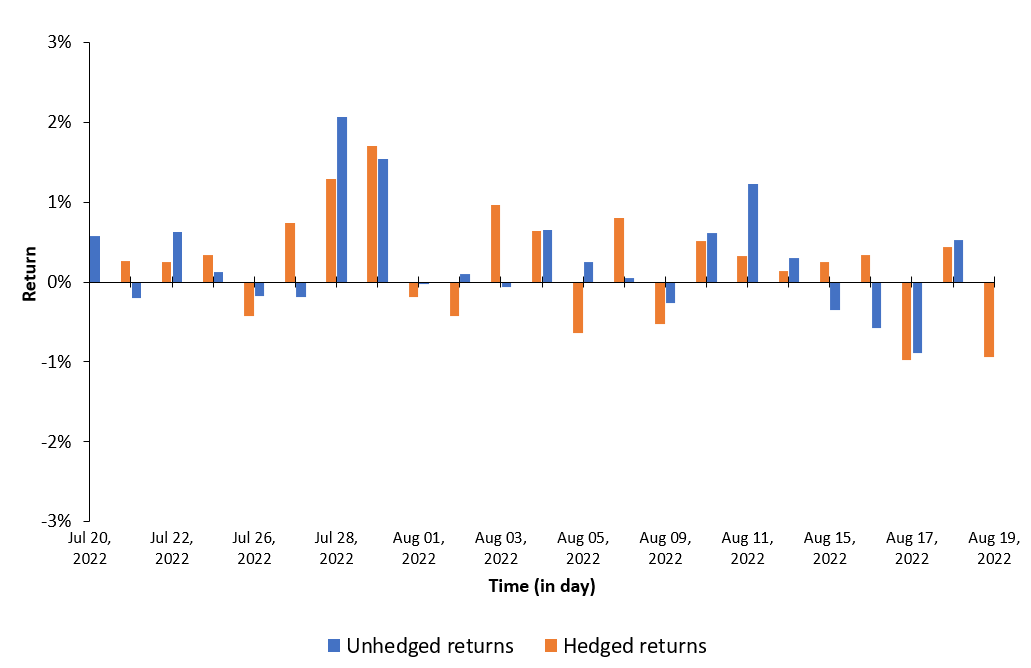

- Hedging: This is the process of offsetting possible losses in your underlying holdings by employing derivative instruments, such as option contracts. Before putting hedging methods into practice, careful thought and comprehension are necessary because they can be complicated.

- Volatility Targeting: This strategy modifies the overall risk exposure of your portfolio in response to fluctuations in the market. You may lower the sizes of your positions or devote more capital to less volatile assets during times of high volatility. On the other hand, you may decide to take on larger positions or invest in riskier assets during times of low volatility.

Disciplined Execution: The Key to Success

Risk management is not just about having the right tools; it’s about disciplined execution. Here are some essential practices to cultivate:

- Trading Plan: One must work meticulously in developing a comprehensive trading plan that clearly defines your entry, exit, risk management strategies, and what you aim to achieve from trading and avoid emotional and impulsive decision-making.

- Monitoring and Adjustment: You must also regularly monitor your portfolio and be updated on financial news in order to prepare for potential future losses or opportunities. To maximize your gains utilize Stop loss orders and take profit orders and adjust your trades and position as and when needed.

- Emotional Control: When we receive surprise losses or surprise gains we are inclined to make emotional and impulsive decisions that can lead to further future losses. The trader must always make decisions with a calm composed mind to make sound decisions.

By adopting these risk management principles and maintaining disciplined execution, you can navigate the real-time financial markets with greater confidence and minimize the possibility of significant losses. Remember, risk management is an ongoing process that requires constant evaluation and adaptation.

Related posts on the SimTrade blog

▶ Federico DE ROSSI Understanding the Order Book: How It Impacts Trading

▶ Jayati WALIA Quantitative risk management

▶ Ziqian ZONG My experience as a Quantitative Investment Intern in Fortune Sg Fund Management

▶ Michel VERHASSELT Risk comes from not knowing what you are doing

Useful resources

SimTrade course Trade orders

Justin Kuepper (June 12, 2023) Risk Management Techniques for Active Traders

Amir Samimi & Alireza Bozorgian (2022) An Analysis of Risk Management in Financial Markets and Its Effects, Jounrnal of Engineering in Industrial Research, 3(1): 1-7

About the author

The article was written in December 2024 by Vardaan CHAWLA (ESSEC Business School, Master in Strategy and Management of International Business (SMIB), 2020-2023).

Source : computation by the author.

Source : computation by the author.