Futures

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) introduces Futures contracts.

Introduction

The last few decades have witnessed an incredible increase in international trade volume and business due to the globalization wave that has spread across the world causing unforeseeable and rapid fluctuations in financial assets’ prices, interest and exchange rates, and has made the corporate world vulnerable to rampant financial risk more than ever before. Thus, risk management is extremely essential for investors and firms to hedge against uncertainties in financial markets. Derivatives are efficient risk management tools and future contracts are one such derivative that have become an integral part of the modern financial system.

A futures contract is an agreement between a buyer and a seller wherein the seller agrees to deliver a specified quantity of any particular financial asset or commodity at a predetermined time in future, at a mutually agreed upon price. The parties involved in the contract are obligated to fulfil their respective terms specified in the contract. Future contracts are standardized by an exchange i.e., they can be only traded through designated markets under stringent financial safeguards. This provides them transparency, liquidity and also eliminates potential counterparty risks due to the guarantee provided by the clearing houses. In general, the underlying asset of futures can either be commodities like food grains, metals, vegetables, etc. or financial instruments like equity shares, market indices, bonds, etc.

Another essential feature of futures is that they are settled daily and not just at the maturity of the contract. That is, traders have an option to either close or extend their open positions without holding the contract to expiration. One of the defining features of the futures markets is daily. The final daily settlement price for futures is the same for everyone which is the mark-to-market (MTM) prices on all contracts established by the exchange. While different contracts may have different closing and daily settlement calculations, the methodology is entirely disclosed in the contract specifications and the exchange rulebook, hence the transparency.

Terminology used for a futures contract

Underlying asset

A futures contract is a type of a derivative contract. It includes an underlying asset which can be an equity, index, commodity or bond.

Spot price

A spot price is the current market price of the underlying asset when the contract is entered into.

Future price

A future price is the agreed upon future price of the underlying asset at the time of entering the agreement.

Maturity/Expiration date

The maturity date is the date on which the counterparties can settle the terms of the contract and the contract essentially expires.

Payoff

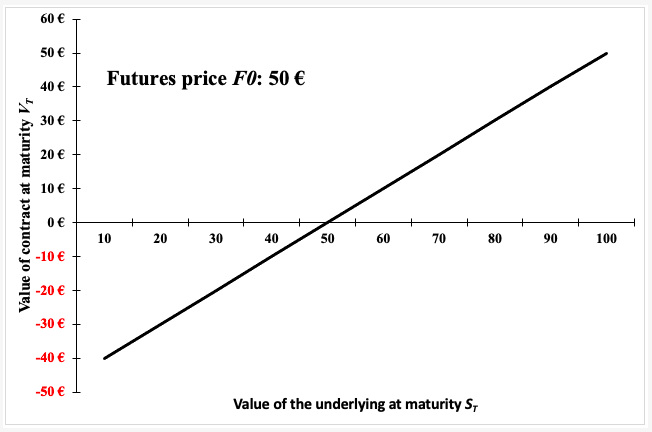

Formally the payoff function for a long position in a futures contract is given by:

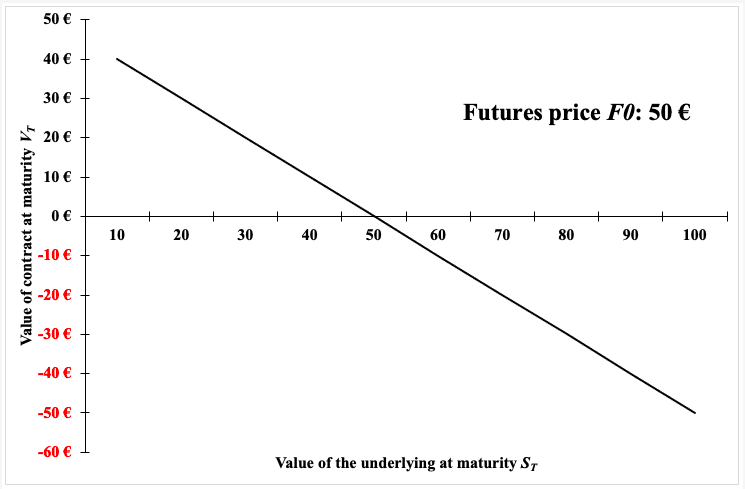

And, the payoff function for a short position in a futures contract is given by:

With the following notations:

N: Quantity of the underlying assets

FT = Futures price at maturity T

F0 = Futures price at time 0

Note: the futures price at maturity T is equal or close to the price of the underlying asset (if there is no arbitrage).

Payoff of a long position in a futures contract

Payoff of a short position in a futures contract

Example

Consider a future contract on an Apple stock with a futures price of $50 and a maturity of one month.

If at the maturity date, the price of Apple stock is $60, the investor with a long position will gain $10 from the futures contract by buying Apple stock for $50 with a market price of $60. The investor with a short position will lose $10 from the forward contract by selling the apple stock at $50 while the market price of $60.

Underlying of futures contracts

There are different types of futures contracts based on the type of the underlying asset, a few main ones explored more below:

Commodity futures

They enable hedging against price fluctuations in various commodities including agricultural products, gold, silver, copper, crude and natural oil, petroleum etc. Speculators may also use them to bet on price movements. Commodity markets are highly volatile, and participants are generally large institutional firms, including private companies and governments. The initial margins are low in commodities and the upside potential is enormous, but the risks tend to be high as well.

Interest rate futures

These are futures based on interest rates i.e., the underlying assets are interest paying bonds like the US treasuries or T-bills (generally government bonds) and these contracts enable investors to hedge against changes in interest rates. Purchasing an interest rate futures contract thus allows the buyer to lock in the price of a debt security bearing an interest rate. The buyer can speculate or hedge against interest rate.

Currency futures

Also known as exchange rate or FX futures, these enable hedging against fluctuations in exchange rates of various currency pairs and thus limit risk exposure. The underlying asset is essentially currencies that can be traded at a predetermined exchange rate at a specific time in future.

Physical settlement and cash settlement

Physically settled futures contracts are known as ‘physical delivery’. Physical settlement means that at the expiration of the futures contract, the actual underlying asset will be exchanged between the counterparties at the pre-determined futures price. So, at the expiry of the futures contract, the short position holder will deliver the underlying asset to the long position holder. Most commodity futures, including commodity Futures, are physically settled while most non-physical asset futures such as index futures are cash settled.

Cash settlement means that at the end of a futures contract’s life, only the profit and loss are settled in cash between the long and the short with no exchange of the physical asset. In case of cash settlement (in case the contract has expired), there is no need for physical delivery of the contract. Instead, the contract can be cash-settled. When the contract expires, the trader’s margin account will be marked-to market for P&L on the final day of the contract. Cash settlement is a preferred option for most traders because of the savings in transaction costs.

Use of futures contracts

Futures contracts can be used as a means of hedging or speculation.

Hedging

Futures are very commonly used for hedging in equities, commodities and foreign exchange. In a futures currency contract, the buyer hopes the asset to appreciate, while the seller expects the asset to depreciate in the future. The futures are an efficient instrument to protect the buyer/seller of the contract from the risk involved in the severe price movement of the underlying asset.

Speculation

Futures contracts can also be used for speculative purposes. It is more common than a forward contract as the futures contracts are available for trading on centralized exchanges. If a speculator believes that the future spot price of an asset will be greater than the futures price today, she/he may enter into a long futures position and thus if the viewpoint is correct and the future spot price is greater than the agreed-upon contract price, she/he will gain profits.

Clearing houses

A clearing house is an agency or a separate corporation of a futures exchange that is responsible for settling trading accounts, clearing trades, collecting and maintaining margin amounts, regulating delivery and reporting trading data. Clearing houses act as third parties to futures contracts and its purpose is to reduce the settlement risks like counterparty default risk by collecting collateral deposits (also called “margin deposits”) that can be used to cover losses, providing valuation of trades and collateral, monitoring the credit worthiness of the contract and ensuring that delivery of the underlying asset is consistent in terms of quality, quantity, size etc. thus providing a robust risk management framework for future contracts. The New York Stock Exchange (NYSE) and the NASDAQ are two renowned clearing houses in the United States. Options Clearing Corporation (OCC) is another specializing in equity derivatives clearing.

Mark-to-market

Mark to market mechanism is used to mark the value of an asset to its current market price. This essentially means that the price fluctuations in a forward contract are settled to record the absolute gains or losses happening at the end of every period which is pre-decided.

This is done to ensure that adequate margin is maintained by each counterparty on a rolling basis. This also reduces the probability of credit defaults by each counterparty.

Useful resources

Hull J.C. (2015) Options, Futures, and Other Derivatives, Ninth Edition, Chapter 1 – Introduction, 23-43.

Hull J.C. (2015) Options, Futures, and Other Derivatives, Ninth Edition, Chapter 5 – Determination of forwards and futures prices, 126-152.

Corporate Finance Institute: Futures contracts

Related posts

▶ Gupta A. Forwards contracts

About the author

Article written in June 2021 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).