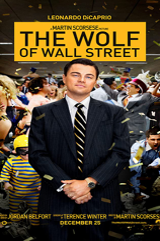

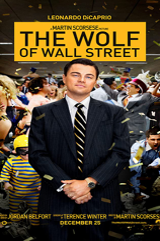

Analysis of The Wolf of Wall Street movie

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) analyzes The Wolf of Wall Street movie.

The Wolf of the Wall Street (2013) is an American drama movie based on true events showcasing the life of an infamous stockbroker and trader, Jordan Belfort. The movie shows how Stratton Oakmont, the firm founded by Jordan and his friends, was involved in a series of large scale corruption and scams that managed to dupe people into investing their hard-earned money in penny stocks. On the marketing side, the use of high-pressure telephonic tactics and scripted talks has been shown as an effective measure to lure people into these scams.

Key characters in the Movie

- Jordan Belfort: Founder of Stratton Oakmont

- Donnie Azoff: Co-founder of Stratton Oakmont

- Naomi Lapaglia: Wife of Jordan Belfort

- Aunt Emma: Aunt of Naomi residing in England

- Patrick Denham: FBI agent

- Jean-Jacques Saurel: Swiss Banker

Summary of the movie

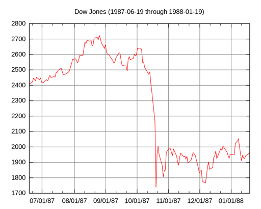

The movie starts by introducing Jordan Belfort, a 22-year-old stockbroker, who has joined an investment bank named L.F. Rothschild, based out in Wall Street. He learns the art of generating high commissions, through his aggressive stock pitching, very quickly while working under Mark Hanna, a senior stockbroker at the firm. The unfortunate Black Monday of October 19, 1987 occurs, resulting in termination of Jordan’s job at the bank.

To move forward with his career, Jordan joins a Boiler Room stock brokerage firm in the Long Island, named Investors Center. The firm deals in unlisted penny stocks and pink sheets while engaging in illicit businesses with high commissions up to 50% of the traded value. In his initial task, Jordan is made to pitch the stock of a company named Aerotyne, a pink sheet stock of a company based out in a small garage. Jordan is lured by the amount of potential this business carries. Using his impressive sale tactics, he makes a good fortune while working at the firm.

While eating at a restaurant, Jordan meets Donnie Azoff, his neighbor, and both of them become friends instantly. They decide to open up a brokerage firm, named Stratton Oakmont, and recruit Jordan’s friends as the senior brokers at the company. Their business model relies on luring the top 1% population of America and gaining their confidence by pitching blue-chip stocks initially. As the investors becomes loyal to the firm, Jordan and his friends would sell them unlisted penny stocks, on which the company would earn high commissions. The simple pump and dump deal made Jordan a millionaire within a short span of time. As the company grew, the founders started living a lavish life spending on drugs and other illegal needs and also recruited more employees to expand their operations. The company became a big name on the Wall Street with the Forbes magazine publishing an article about them. The excessive limelight brought the firm under the radar of the FBI and SEC starting to investigate the operations of the firm. Jordan brings in his father to oversee the bank accounts for his firm. To remain safe from any issues, Jordan also hires a legal advisor to keep a check on the legal formalities.

After finding out about his extramarital affair with Naomi Lapaglia, Jordan’s wife divorces him and soon he marries Naomi in a fancy wedding. To gain more popularity, the company decides to launch the IPO of then-famous brand Steve Madden. Jordan and Donnie together hold around 50% of the listed stocks of Steve Maddens and when the stock becomes a success they make profits of more than $20 million within a day. The IPO makes the FBI more suspicious about the firm and they start their investigation on the same.

To keep his illicit money safe from all the authorities, Jordan decides to store it in offshore accounts in Switzerland and takes a trip for the same. Together with his friends, Jordan meets a group of bankers led by Jean-Jacques Saurel and decides to open up an account in the name of Naomi’s aunt, Emma, who is a European passport holder. The smuggling of cash takes place over the next few weeks and is deposited in the offshore accounts.

Jordan’s private investigator informs him about his phone being tapped by FBI agents to gather proof against him. Cautious about his moves, Jordan initially decides to step down from his company but later changes his mind, when requested by his colleagues.

Jordan takes a trip to Italy with his wife and Donnie’s family and operates his business from there. But soon, the news of Aunt Emma’s demise arrives and Jordan decides to go to Switzerland via Monaco, on a yacht to safeguard his money. The yacht is knocked over by a sea storm and the group barely escapes the incident.

Taking it as a signal of God, Jordan decides to sober up his life and changes his lifestyle. Two years after the incident, Jean Jacques Saurel is arrested in Switzerland in some cases unrelated to Jordan but he confesses about Jordan’s illicit business and accounts. As fate had its own plans, Jordan is arrested with overwhelming proofs. Jordan’s lawyer tries to cut a deal with the FBI and in return, Jordan is asked to turn upon his other friends involved in the scam. He agrees and his prison sentence is reduced to 36 months, completing which he turns into a public speaker and talks about his effective sales tactics.

Relevance to the SimTrade course

The lessons taught in the movie perfectly blends with the concepts that are taught on the SimTrade course. The movie depicts the effective use of concepts such as “Demand & Supply” and ‘Market Manipulation’ to generate high profits. The technique used by Jordan involves creating a need for a product in the market and building trust with his clients to sell that product. The high-pressure sale tactics were at the core of this fraud which involved duping thousands of investors and creating an urgent demand for products that had the so-called potential to earn fortunes.

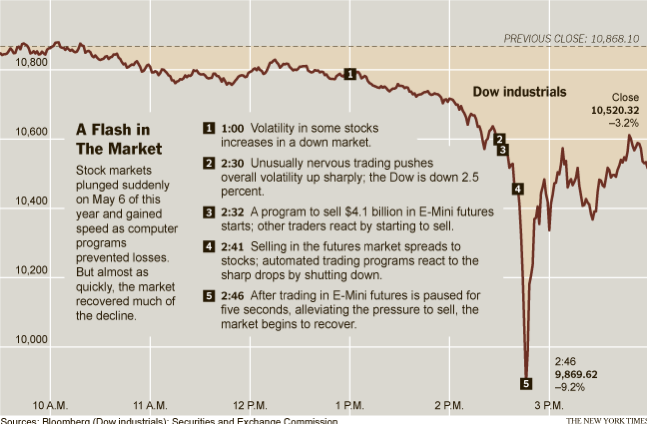

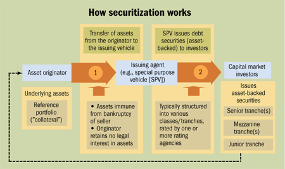

The financial frauds shown in the movie include “pump and dump” schemes which were very prevalent in the financial markets until a few years back. The scheme involves inflating the prices of penny stocks or pink sheet stocks to high levels and then selling them at those prices to crash the market and make huge profits. The brokers were involved in creating artificial demand for the stocks, that were otherwise worthless, and hampering the free and fair operations of the market, thereby manipulating it. The alertness and effectiveness of market regulators and agencies are what helped stop such schemes to operate openly in the markets and safeguard investor’s interest. Instead of working towards generating high commissions and fulfilling their ambitions, stockbrokers should engage themselves in building trust with their clients by keeping their interests in mind.

Most famous quotes from the movie

Please find below some quotes from the movie that may help you to progress in your professional career:

“The only thing standing between you and your goal is the bullshit story you keep telling yourself as to why you can’t achieve it.” – Jordan Belfort

“97% of the people who quit too soon are employed by the 3% who didn’t.” – Jordan Belfort

Trailer of the movie

Related posts on the SimTrade blog

▶ All posts about Movies and documentaries

▶ Kunal SAREEN Analysis of the Wall Street movie

▶ Marie POFF Film analysis: The Wolf of Wall Street

About the author

Article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).