The investment ecosystem

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023) explains the investment ecosystem in financial markets.

Introduction

In the investment ecosystem, there are several blocks to understand: market participants, market products, and market organization.

Market participants

Market participants are individuals, companies, financial institutions, and governments. Some of these participants may issue assets like companies (stocks, commercial paper, and bonds) and governments (bonds). Some of these participants may invest in these assets like individuals or pension funds.

Based on the amount they invest, market participants are segregated as big players and small players. Big players are mostly institutional investors which collect the funds and then invest them. Few examples of institutional investors are mutual funds, pension funds, hedge funds, trusts, charities etc. Big players may also be wealthy individuals (high net worth individuals or HNWI) or family offices. Small players are other individual investors.

Corporates run businesses, including manufacturing, service, and technology firms, and they need capital to expand and maintain their operations. On the other side, we have institutions that consist of fund managers that could be institutional investors but also retail investors as well. These are the people that have capital so the capital flows from the institutions or investment managers who have the money to the corporations that need that money to grow and run their business. The cycle between the two parties is completed when the firms issue back to the investor’s bonds, which are classified as debt, or shares, which are classified as equity.

In the middle of these two groups sit the investment banks they are often referred to as the sell side and they have contacts on both sides of these players. They have corporate clients, and they have institutional investor clients, their job is to match up the institutional investors with the corporates based on risk and return assessments and expectations and investment style to get the deal done. In addition, we have public accounting firms which are the fourth player in the market.

Market Products

Assets

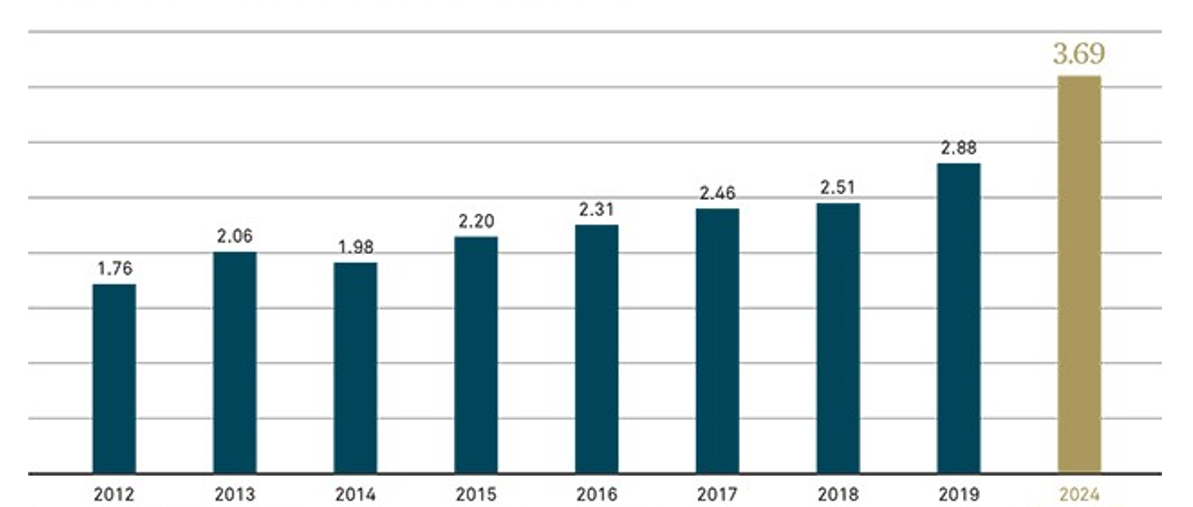

What are assets? In financial language, an asset is that which has some economic value. And assuming that its value increases in the future market participants buy them and that is how it is a part of the investment ecosystem. Few examples for assets are fixed deposit, land, gold, stock, etc.

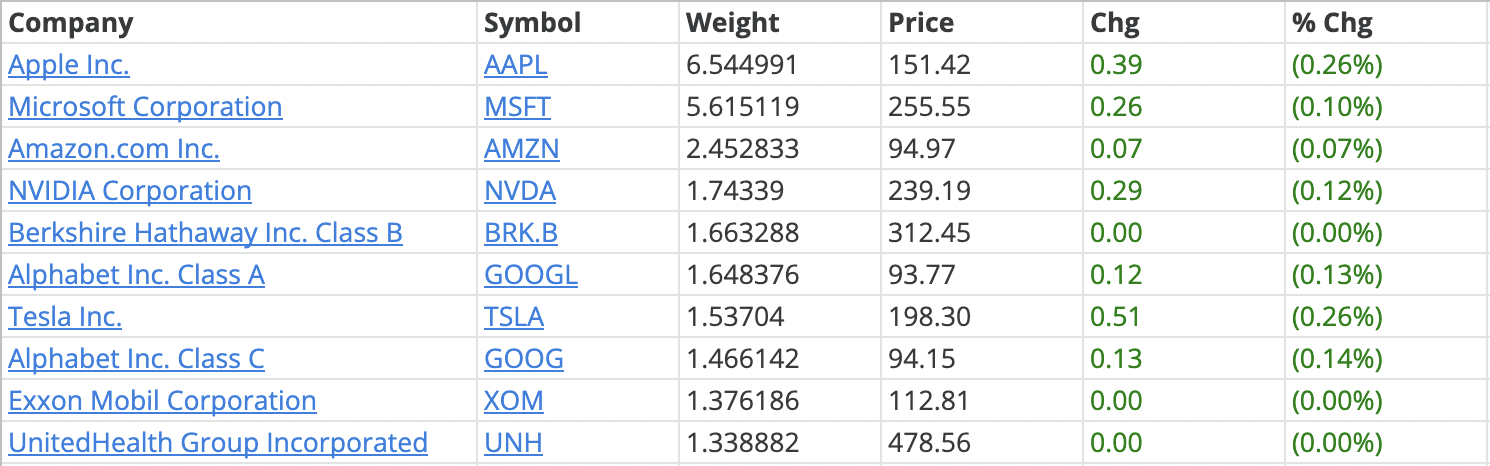

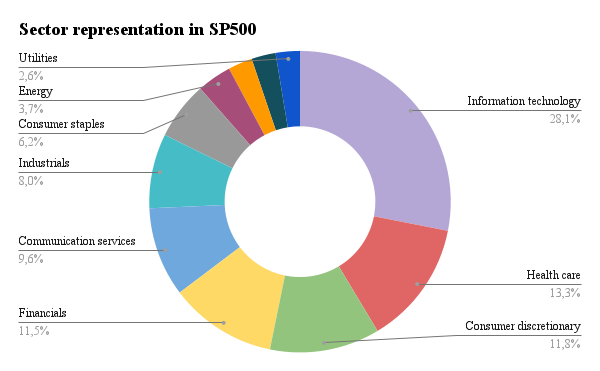

Asset classes are made up of those investments or securities whose characteristics are the same. Few major asset classes are equity, bonds (fixed income), commodities, and real estate.

Instruments

What are Instruments? Instruments are the ways through which we can invest in different asset classes.

Some of the major instruments we see in markets are direct investing, mutual funds, and exchange-traded funds (ETFs).

- Direct investing is nothing but investing cash physically in different asset classes or we can digitally buy assets through our accounts

- Mutual funds are the funds collected by multiple investors and then those are invested in different asset classes. To manage these mutual funds, we have fund managers who will invest on behalf of investors.

- ETFs are nothing but a basket of securities just like mutual funds, but the only difference is they are traded on stock exchanges.

Market organization

Primary and secondary markets

The primary markets: the initial issuance of assets

The primary market is where new securities, including stocks, bonds, and other financial assets, are first issued by governments or corporations. The primary market is also referred to as the market for new issues.

Companies and governments raise money in the primary market by offering their securities to retail or institutional investors. The securities may be sold through a private placement or an initial public offering (IPO).

There are four main players in the primary market mainly for issuance of securities.

1) Corporates

2) Investors: institutional investors and individual investors

3) Corporate banks

4) Public accounting firms

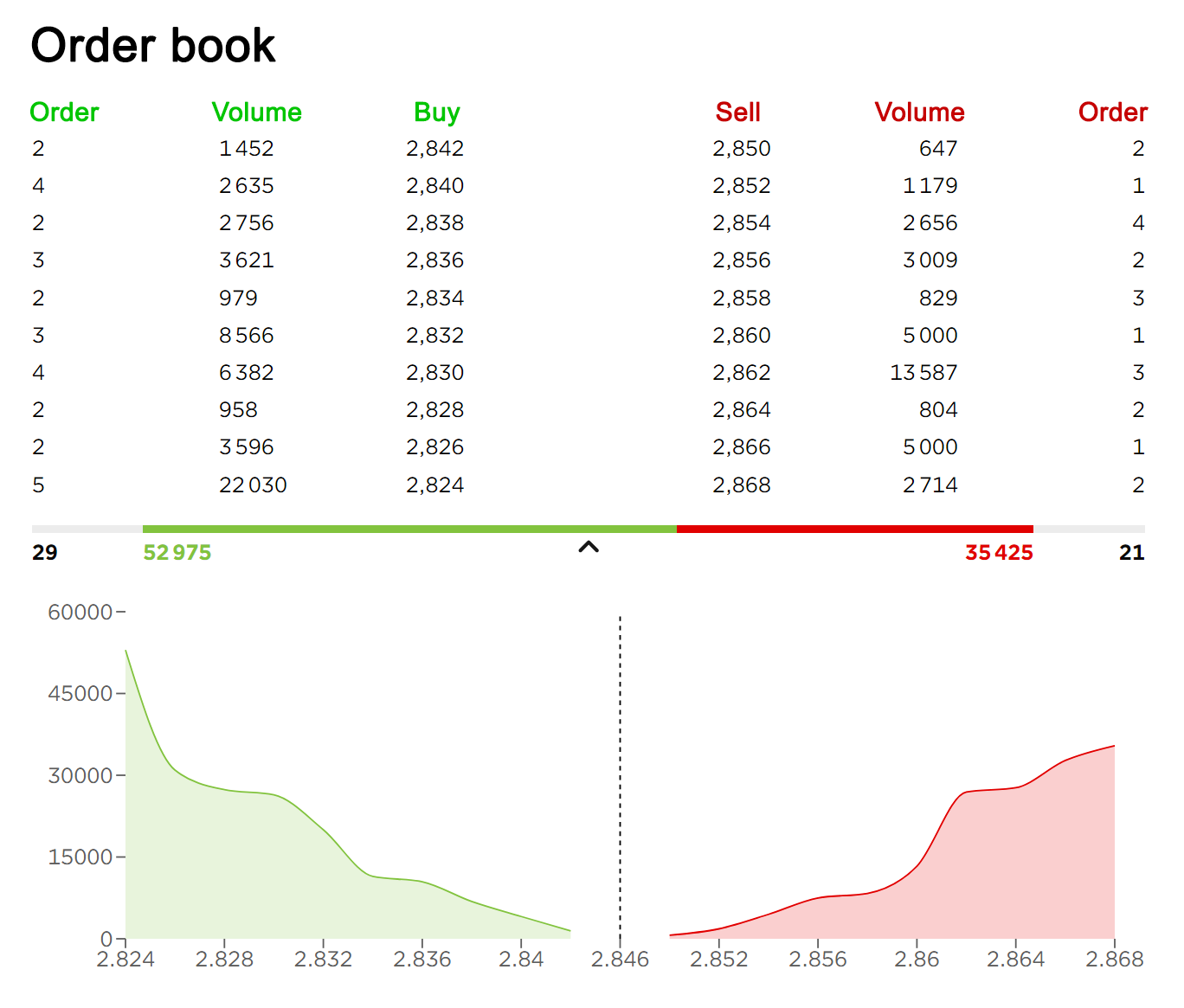

The secondary markets: the exchange of assets

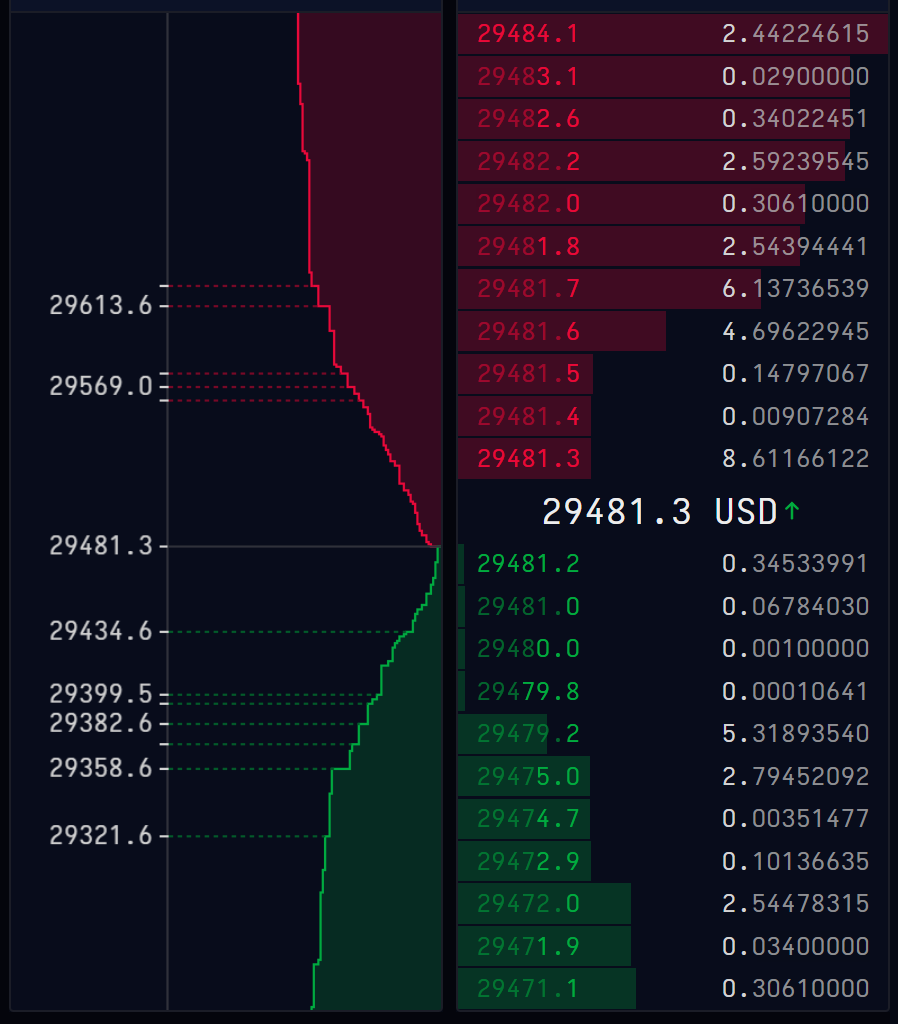

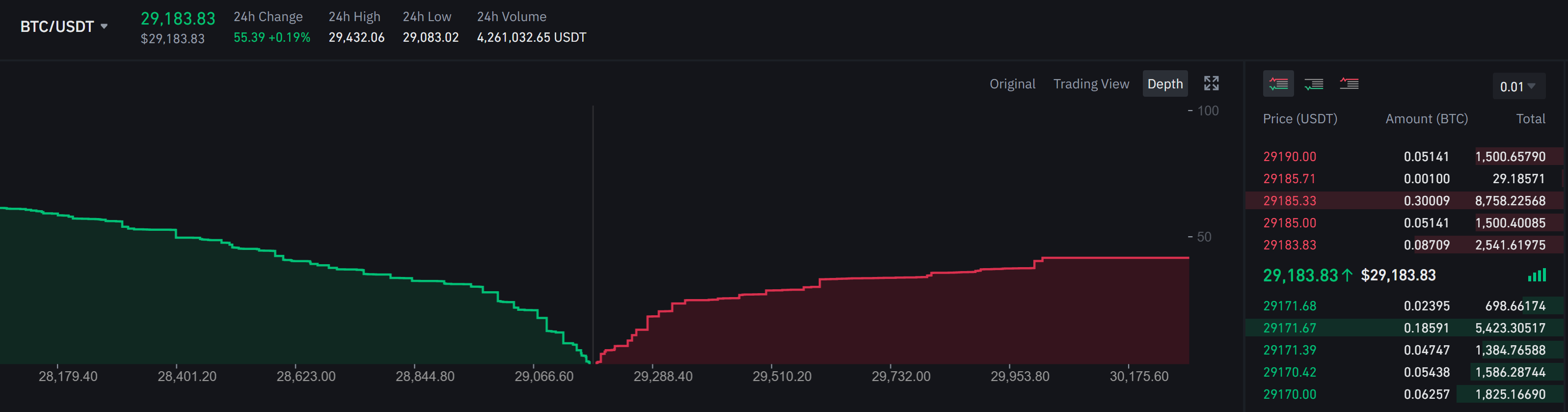

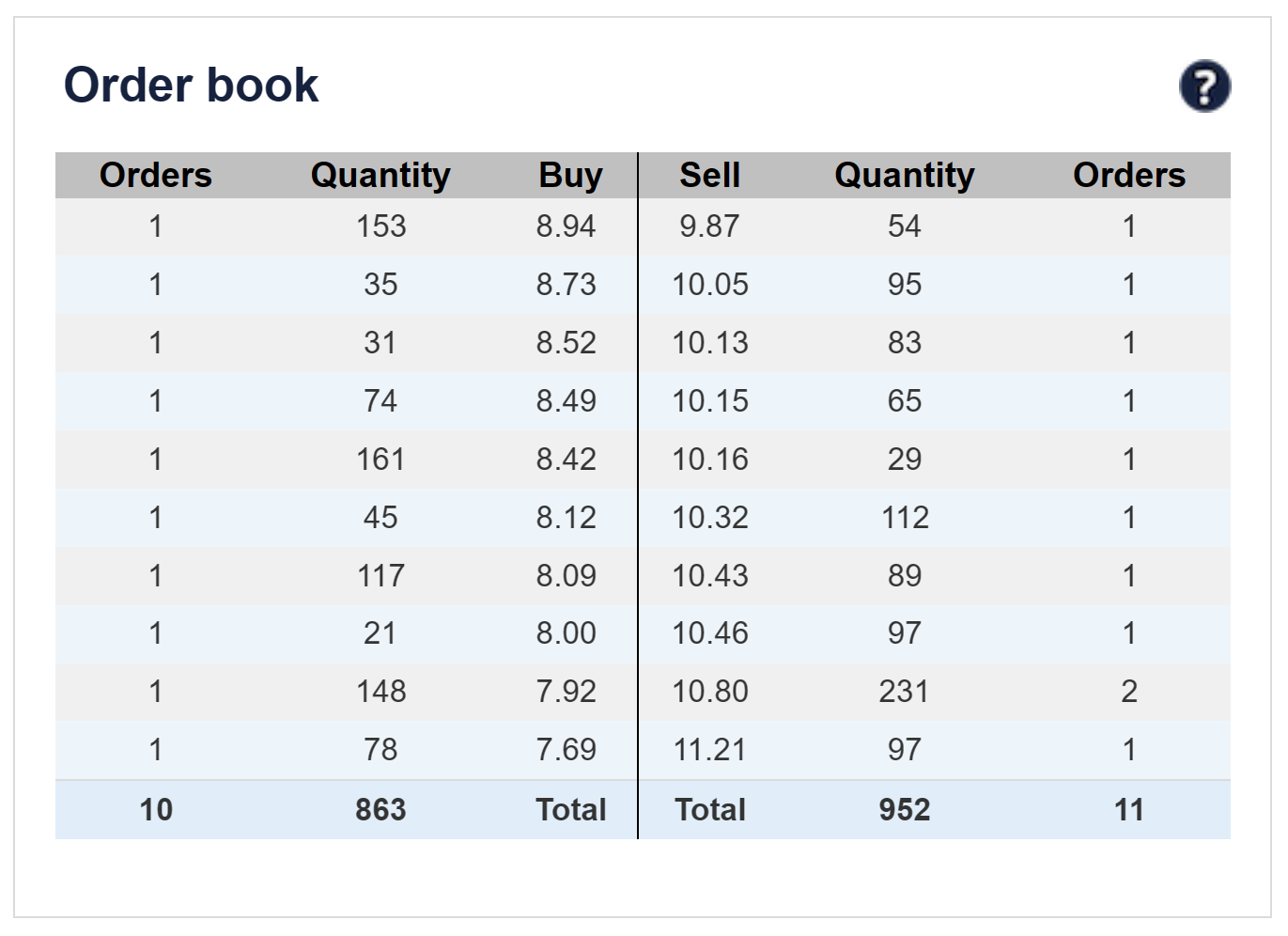

In the secondary market, fund managers and banks collaborate to trade securities between investors after they have already been issued. On one side, a fund manager may want to purchase securities of a public company, while on the other, a different fund manager may wish to sell those same securities. Investment bankers come between these clients to help facilitate these trades, and this trade is facilitated over the stock exchange. They provide equity research coverage to help fund managers make decisions about buying and selling those securities. And this secondary market trading makes markets liquid. This is what allows you to get in and out of security very easily.

Market infrastructure

Infrastructure providers are the companies which enable the transactions and functioning of different instruments. It means all the digital and physical infrastructure required for the investor is provided by the infrastructure provider. The few common examples of an infrastructure provider are the stock exchange, depositories, and registrar and transfer of agents.

- Stock exchange: It is the platform where you can sell and buy securities. Here, with the help of a broker and the stock exchange two investors can buy and sell stocks without knowing each other. For example, The TSE is the largest stock exchange in Asia by market capitalization. It is located in Tokyo, Japan and has over 3,500 listed companies.

- Depositories: These are the companies that store the stocks we buy in electronic form. We can store these stocks through our demat accounts. Depositories help you transfer stock and various other functions like checking the statements, portfolio holdings and transaction information etc. Generally investors directly do not interact with depositories but they approach through a broker who would invest on their behalf. For example: The DTC is one of the largest depositories in the world. It is located in New York City and holds over 3.5 million securities worth trillions of dollars.

- Registrar and Transfer of Agents (RTA): just like depositories in case of stocks, RTA’s in case of mutual funds. All trades of mutual funds like subscription, redemption, and transfer, are recorded by an RTA. An RTA also helps mutual fund investors in providing their portfolio and statements to them.

Why should I be interested in this post?

As a student and prospective business management graduate, I think it is important to know the investment ecosystem. Firstly, investments play a vital role in the growth and success of companies. Companies need investments to fund their operations, expand their businesses, and create value for their shareholders. Therefore, understanding the investment ecosystem will enable management students to make informed decisions regarding investments that can help drive the growth of the companies they work for or manage in the future.

Related posts on the SimTrade blog

▶ All posts about financial techniques

▶ Marie POFF Film analysis: The Wolf of Wall Street

Useful resources

McKinsey (2017) Capital Markets Infrastructure: An Industry Reinventing Itself

Black rock The Investment Stewardship Ecosystem

About the author

The article was written in March 2023 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023).