In this article, William ARRATA (Lecturer in advanced portfolio management at ESSEC Business School Master in Finance and Master in Management since 2014) shares his professional experience as Fixed Income Portfolio Manager then Asset Liability Manager at Banque de France.

About the company

Founded in 1800 by Napoléon Bonaparte, Banque de France began as a private institution for managing state debts and issuing notes. The first Basic Statutes of the Bank were established in 1808, where the Bank’s notes in French Franc became legal tender. In 1936 the Bank was nationalized. In 1993, a reform granted the Bank independence, in order to ensure price stability, regardless of domestic politics. This reform cleared the path for the European monetary union. In 1998, the Bank became a founding member of the European System of Central Banks which groups together the European Central Bank and the National Central Banks of all countries that have adopted the Euro. On 1st January 1999, France adopted the euro. Nowadays Banque de France’s three main missions, as defined by its statuses, are to drive the French monetary strategy, ensure financial stability and provide services to households, small and medium businesses and the French state. In particular, it manages the accounts and the facilitation of payments for the Treasury and some public companies. The Bank is a sui generis public entity governed by the French Monetary and Financial Code. The conditions whereby it conducts its missions on national territory are set out in its Public Service Contract. François Villeroy de Galhau has served as Governor of the Banque de France since 1 November 2015.

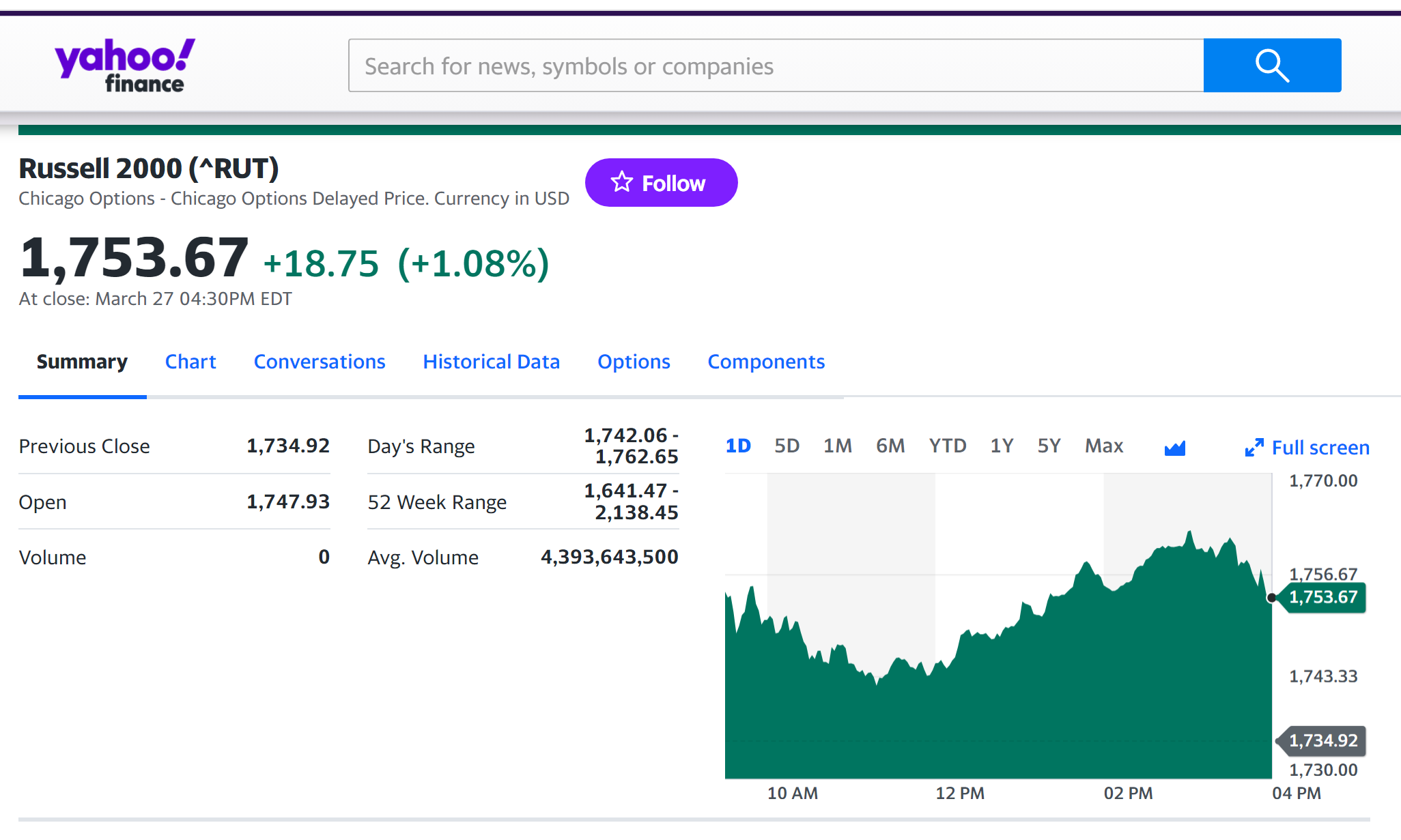

Logo of Banque de France.

Source: the company.

Since 2019, I work as Asset Liability Manager at the Financial Directorate of the General Secretariat of Banque de France, having previously worked from 2013 to 2019 as Fixed Income portfolio manager in the Markets Directorate of the Directorate General Financial Stability and Operations.

The Markets Directorate of Banque de France encompasses the management of foreign exchange reserves and gold, foreign exchange operations, and the provision of investment services to foreign central banks and international organizations. The Directorate is fully integrated from front office to back office and custody. It is split into five divisions and totals 120 persons, based in Paris, Poitiers, New York and Singapore.

The Financial Directorate of Banque de France encompasses the accounting of Eurosystem monetary policy operations as well as BdF’s investment operations, the costing and budgeting of expenses, management control, Asset Liability Management modeling of the Balance sheet, as well as the investment and management of BdF’s Capital and pension funds, on which the Socially Responsible Investment strategy of BdF is also enforced. It is split into five divisions and totals around 100 persons.

My jobs

From 2013 to 2019, I was Fixed Income Portfolio Manager in the Reserves Management Division of the Markets Directorate, in charge of managing foreign exchange reserves. In essence, the job consists of managing a fixed income portfolio, with the objective of consistently outperforming its benchmark through time.

Since 2019, I am an Asset Liability Manager (modeling mainly) in the Financial Management Division of the Financial Directorate. It consists of balance sheet modeling and projection through time. It is a quantitative position, which requires knowledge in stochastic calculus and programming languages. In addition, it is also a special job in the sense that the central bank balance sheet is unique in its kind such that asset and liability management (ALM) modeling at the central bank also requires understanding monetary policy operations.

My missions

My position as a Fixed Income portfolio manager in the Reserves Management Division of the Markets Directorate started in 2013. Foreign exchange reserves are held in various currencies, and each currency is actively managed against a benchmark into a specific portfolio, which is daily marked-to-market. I have been responsible for the management of one of those portfolios for 6 years. As for all portfolios, it is invested in money market instruments (reverse repos, repos, deposits, fully hedged swaps, STIR futures) on the one hand, and bonds from different types of issuers on the other hand. It also makes use of derivatives such as bond futures, rates futures, and Interest Rate Swaps. Each portfolio is managed in reference to a benchmark, around which risk limits are defined. Those risk limits give leeway to the portfolio manager to do tactical asset allocation, in order to “beat” the benchmark. Tactical allocation can take many forms.

First, the portfolio manager (p.m.) has the possibility do “time the market”, which is named after “duration position” in the Fixed-Income universe. This translates into an increase or a decrease of the differential duration (duration in excess of the benchmark) of his portfolio. A duration position is implemented when expectations from the p.m. on the interest rate path differ from what is priced in the forward curve (i.e. the p.m. expects indeed rates to “reprice” in the future according to his expectations, e.g., to move up or down). To benefit from this expected variation, the p.m. adjusts the differential duration of his portfolio. For instance, he increases the differential duration if he expects rates to go down. Such positions can also be combined. Combining a long duration position with a short duration position on two different segments of the yield curve can be a relevant investment strategy when the p.m. expects the yield curve to steepen or to flatten. This creates a spread position, referred to as “butterfly position”.

Market timing bets can be set using different techniques. This can stem from a regular central bank watching, which allows to understand the central bank “reaction function“ and to take positions in advance of other market participants. It can also be done using quantitative tools such as rates models.

The benchmark can also be beaten using security selection. This consists in substituting a bond whose price is seen as deviating from its fair value with another bond. The p.m. sells the “richer” bond and buys the “cheaper” bond. Such a strategy should not embed a duration mismatch with the benchmark, i.e., the duration of the bond sold (the bond in the benchmark) should equal the one of the bond bought. For instance, the p.m. can choose to sell a bond whose yield is deemed below its estimated fair yield (whose price is too high) and buy a bond whose yield is deemed either fairly priced or above its estimated fair yield, with identical durations for the two bonds. There are many ways to estimate bonds’ fair yield. One can employ a model such as the Nelson Siegel Svensson (NSS) model. This model proposes a parametric form for the zero coupon rate curve of a given issuer. Observed market yields can then be compared to theoretical yields, to identify “cheap” and “rich” bonds.

Such tactical positions can be held over varying horizons, usually not more than 6 months.

The p.m. can also implement some “arbitrage” strategies, for instance on the repo market, by lending “special” securities against least expensive (“General Collateral”) security (see infra). When the risk framework allows it, he can manage the short-term portion of his portfolio by taking advantage of the basis between money market rates between his currency and another currency (“cross currency basis”), when the interest rate parity is not enforced. He can then build a “synthetic” money market position made out in his portfolio’s currency, by using a FX derivative and a foreign currency money market instrument, to benefit from the higher rate of return provided by the synthetic money market rate versus the “natural” one. At last, he can also substitute the purchase of a bond on a given segment by investing in a risk-free instrument and a future on that bond, to take advantage of a deviation in the “cash and carry relationship” (see infra).

My second experience started in 2019 at the Financial Directorate, as an Asset Liability manager in charge of modeling the balance sheet of Banque de France and proposing strategies for the investment portfolios of Banque de France.

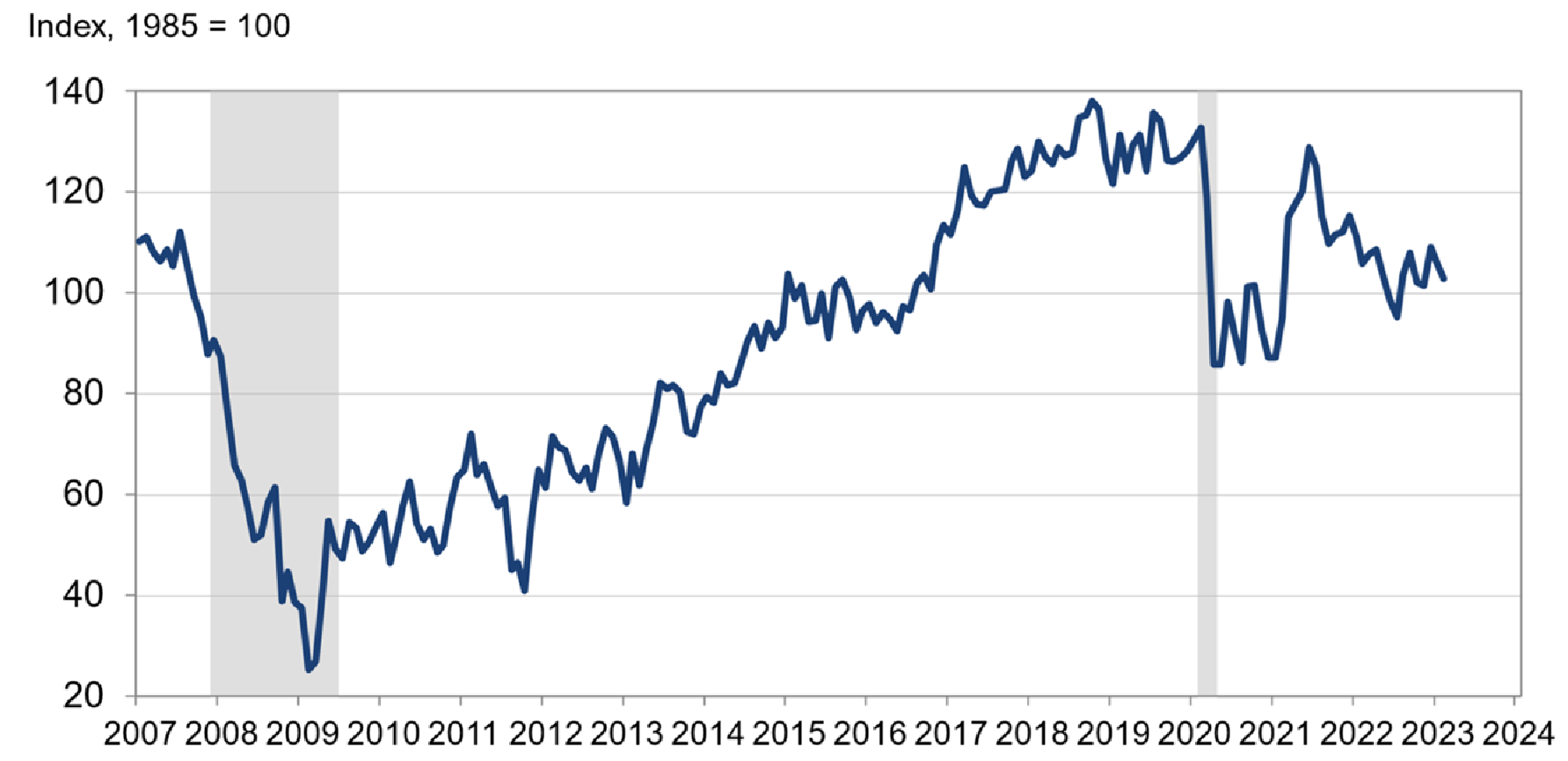

The job starts with the modeling of the different assets and liabilities of a central bank balance sheet. The central bank balance sheet is unique and requires an understanding of the dynamics of monetary policy operations, but also on the drivers of banknotes issuances, target 2 positions, accounts of non-banking clients, etc… In an unconventional monetary policy environment such as the one experienced by the Euro System since 2014, the dynamics of the balance sheet have somewhat become more complex. What is crucial in this step is to provide with a joint modeling of all elements concerned as they interact with each other in specific ways.

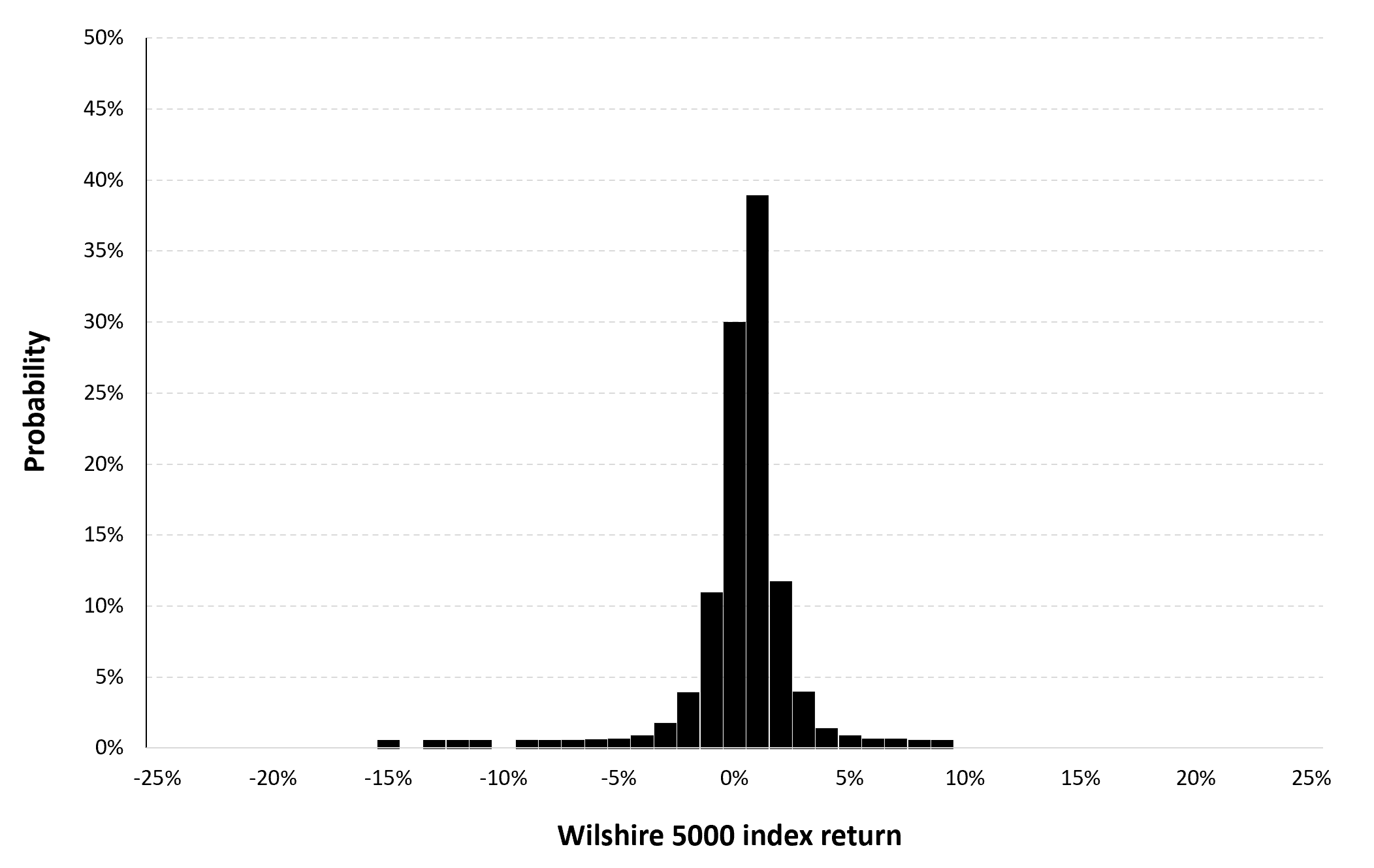

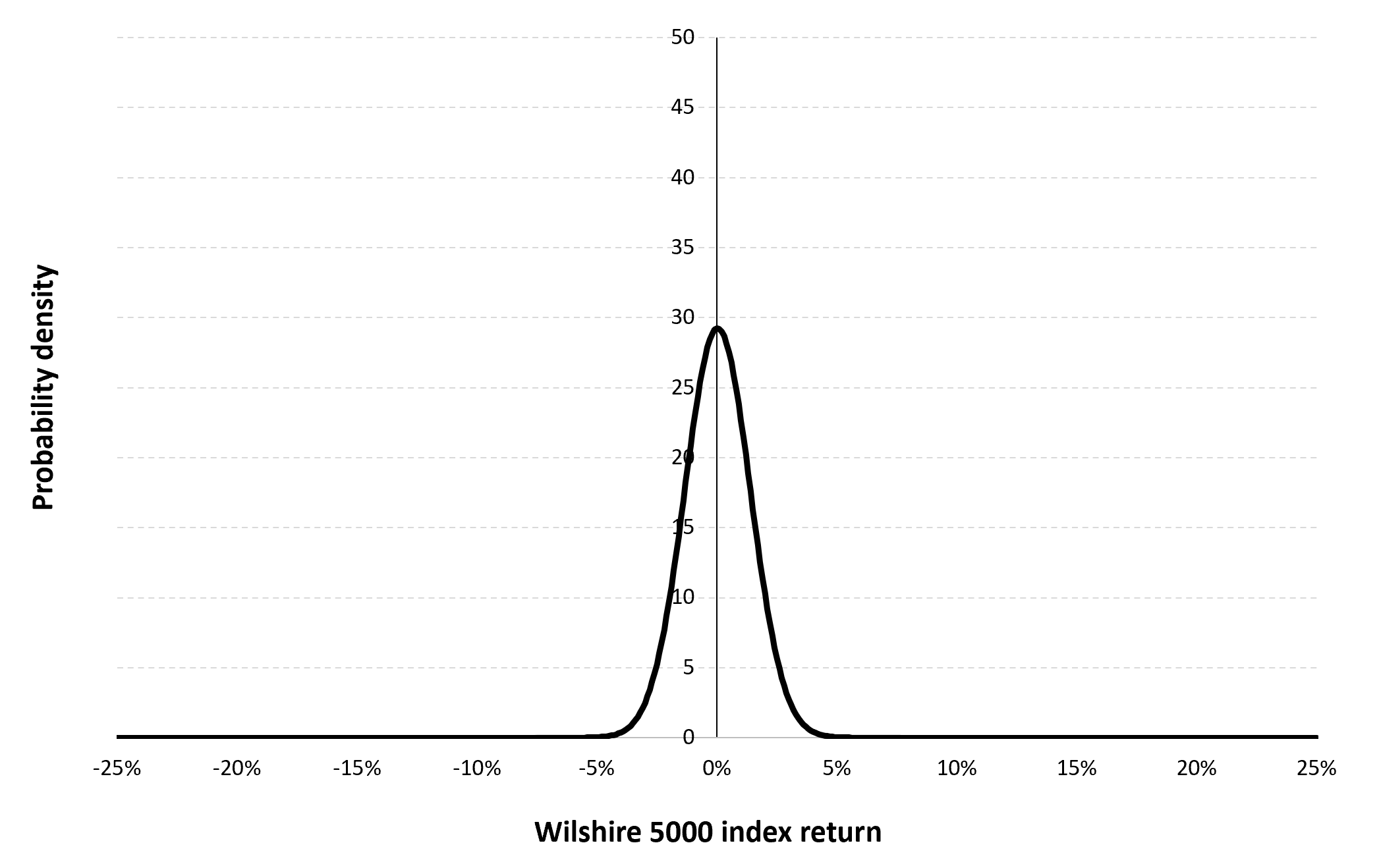

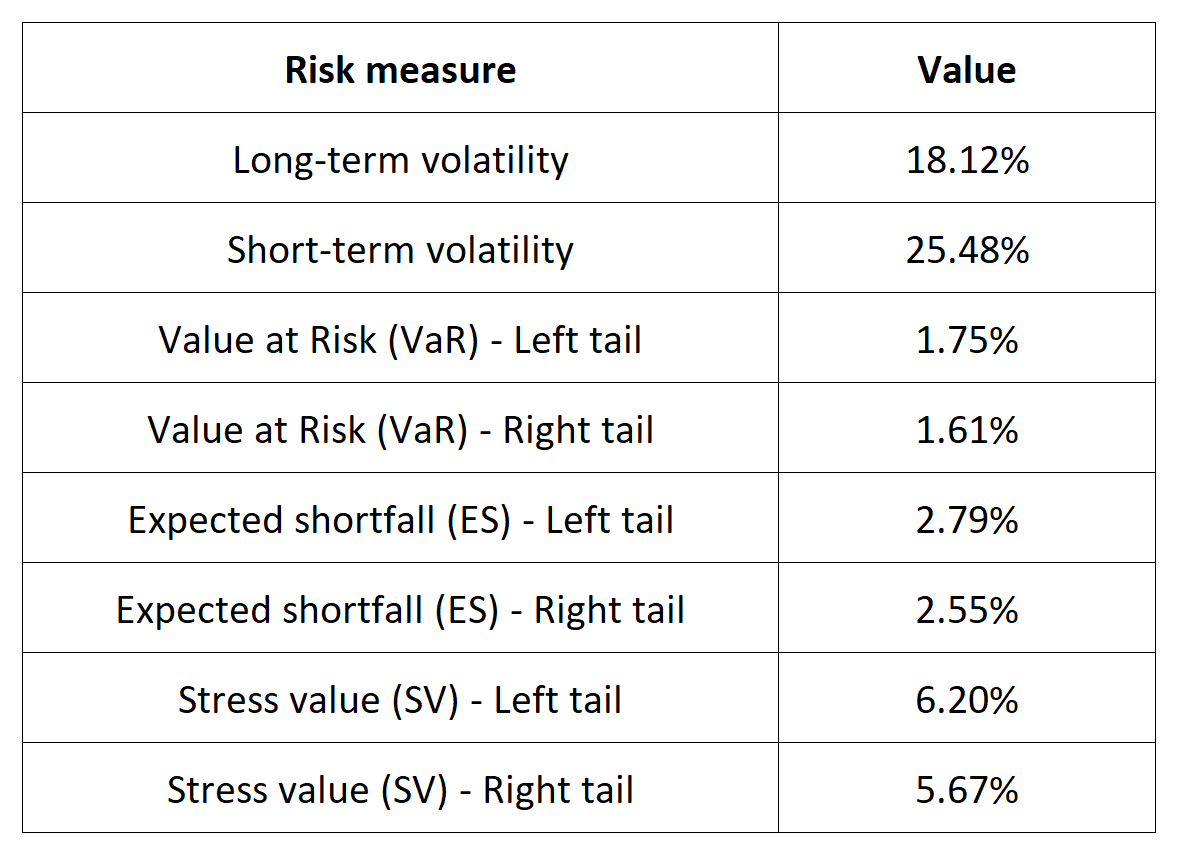

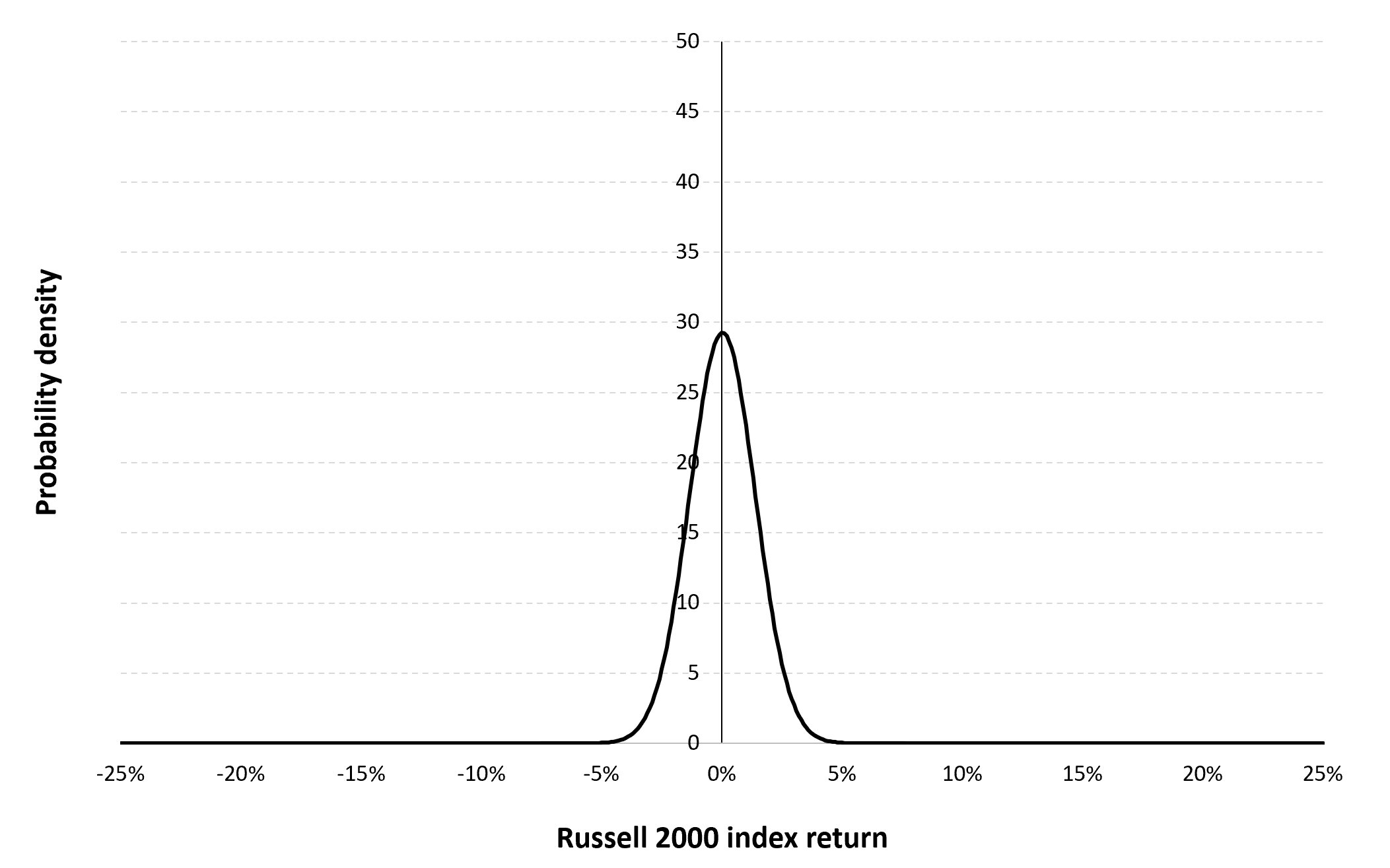

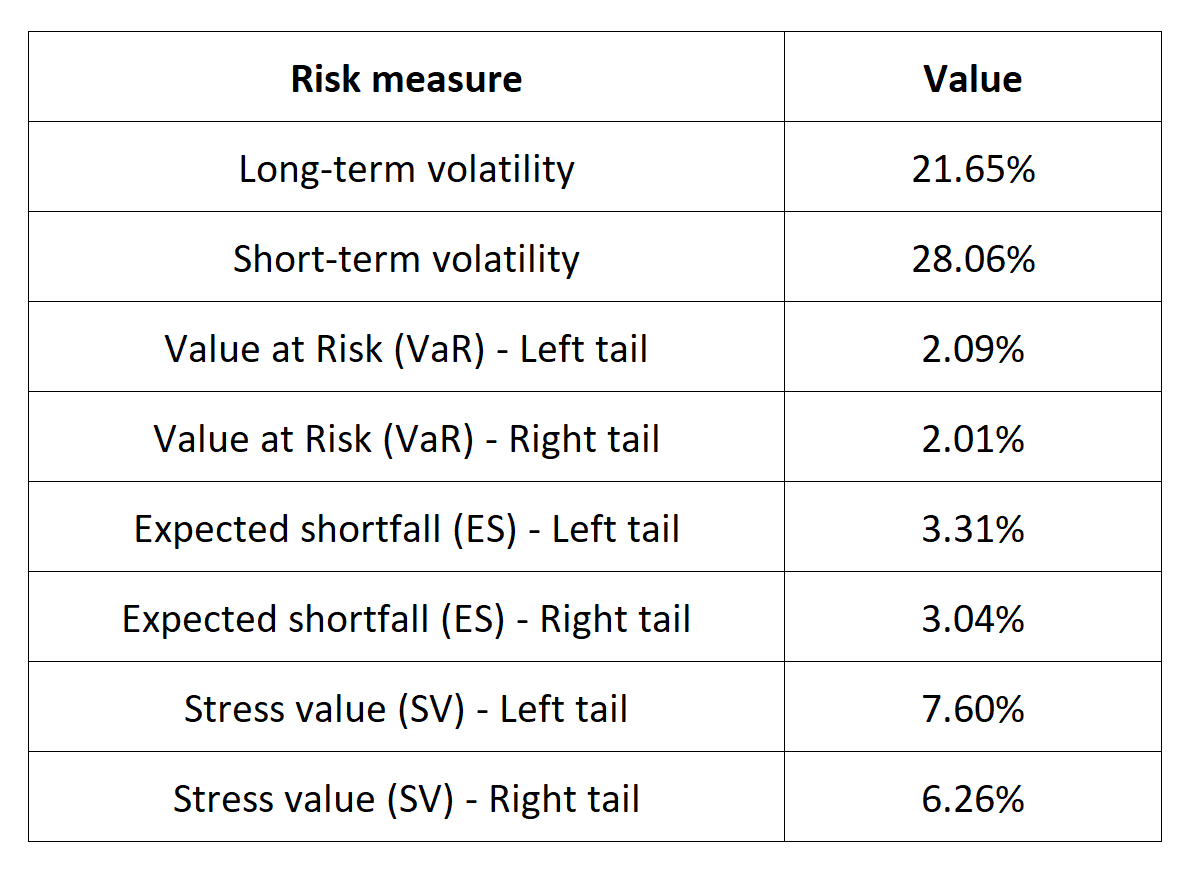

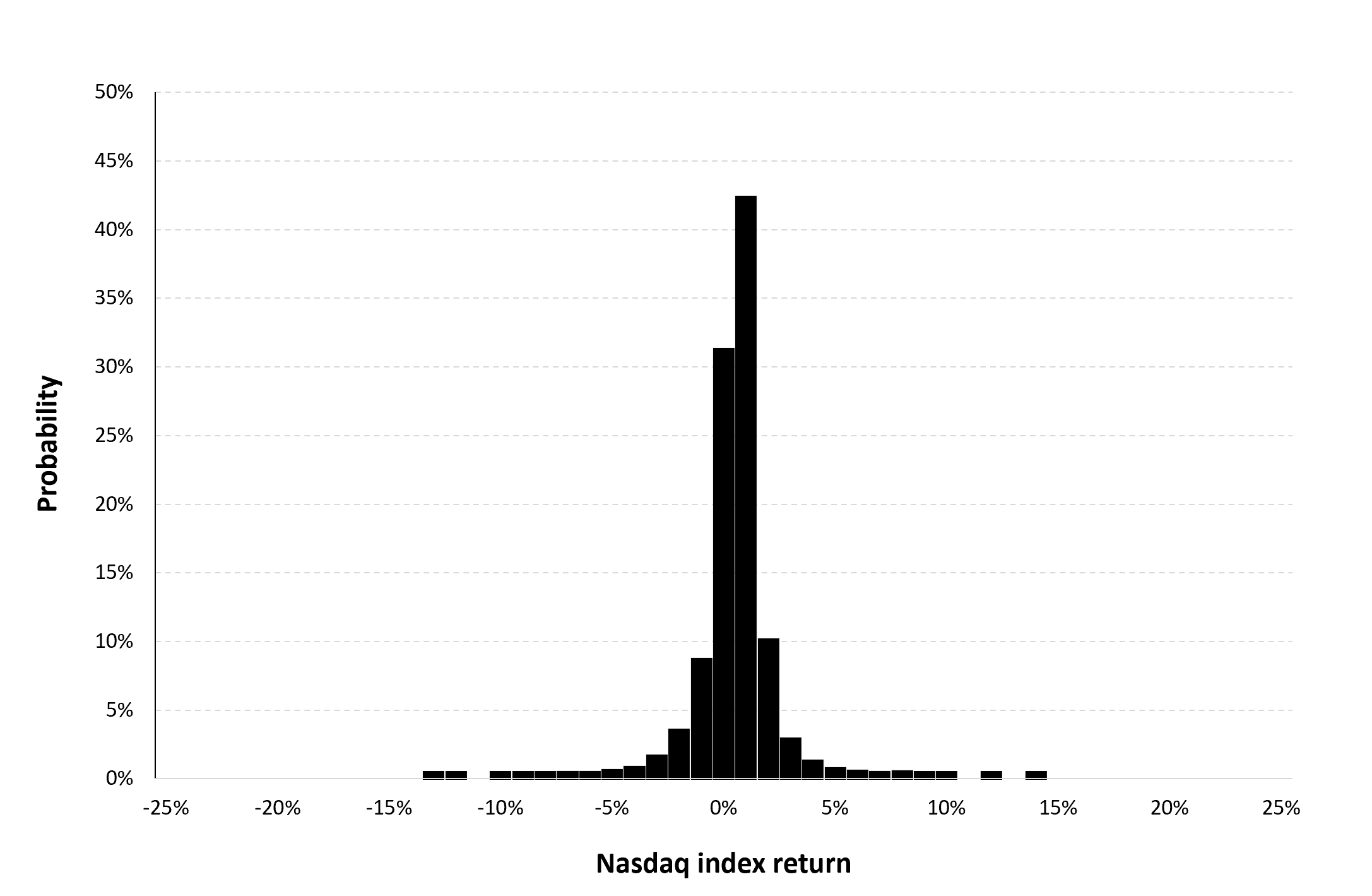

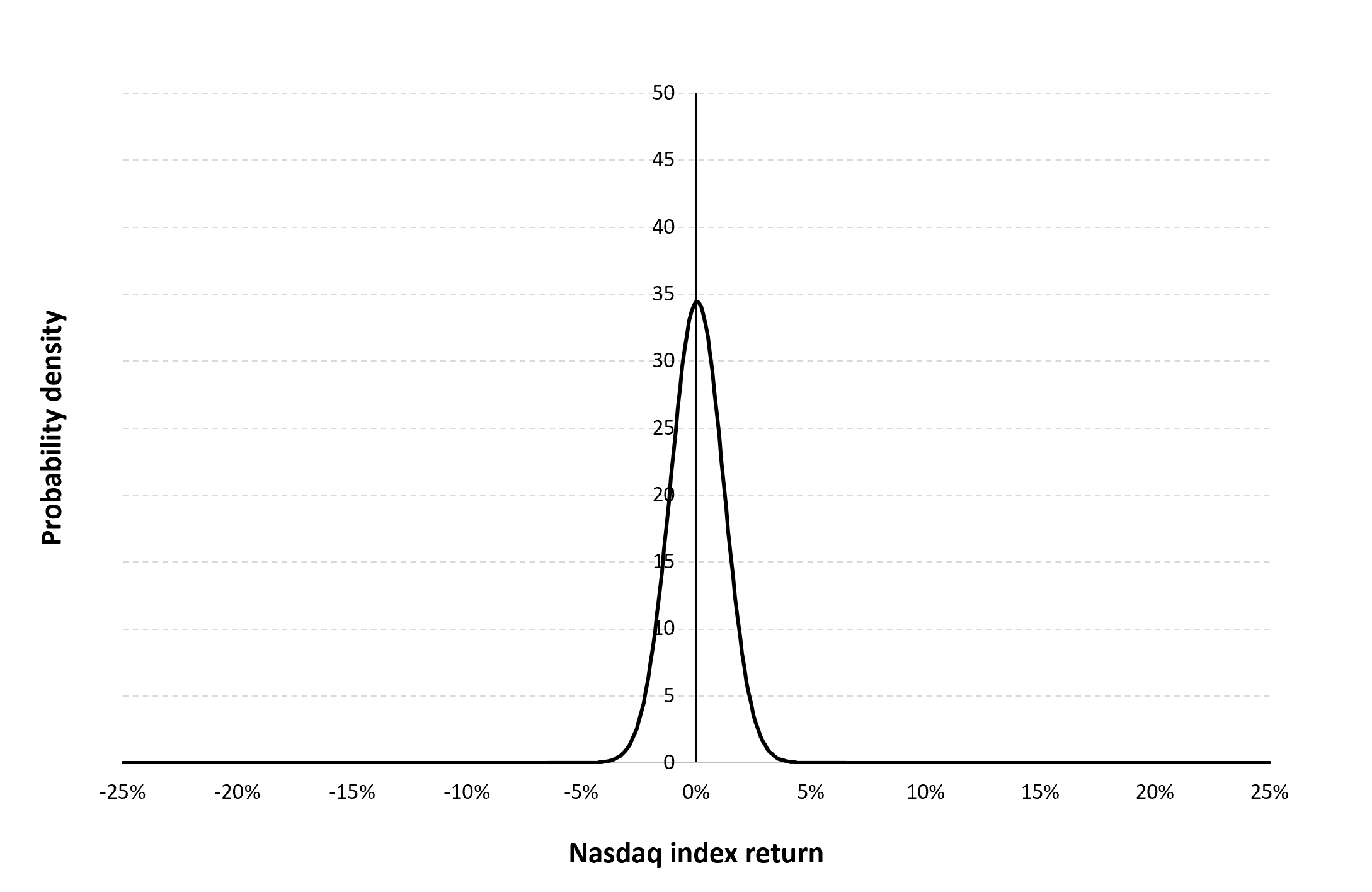

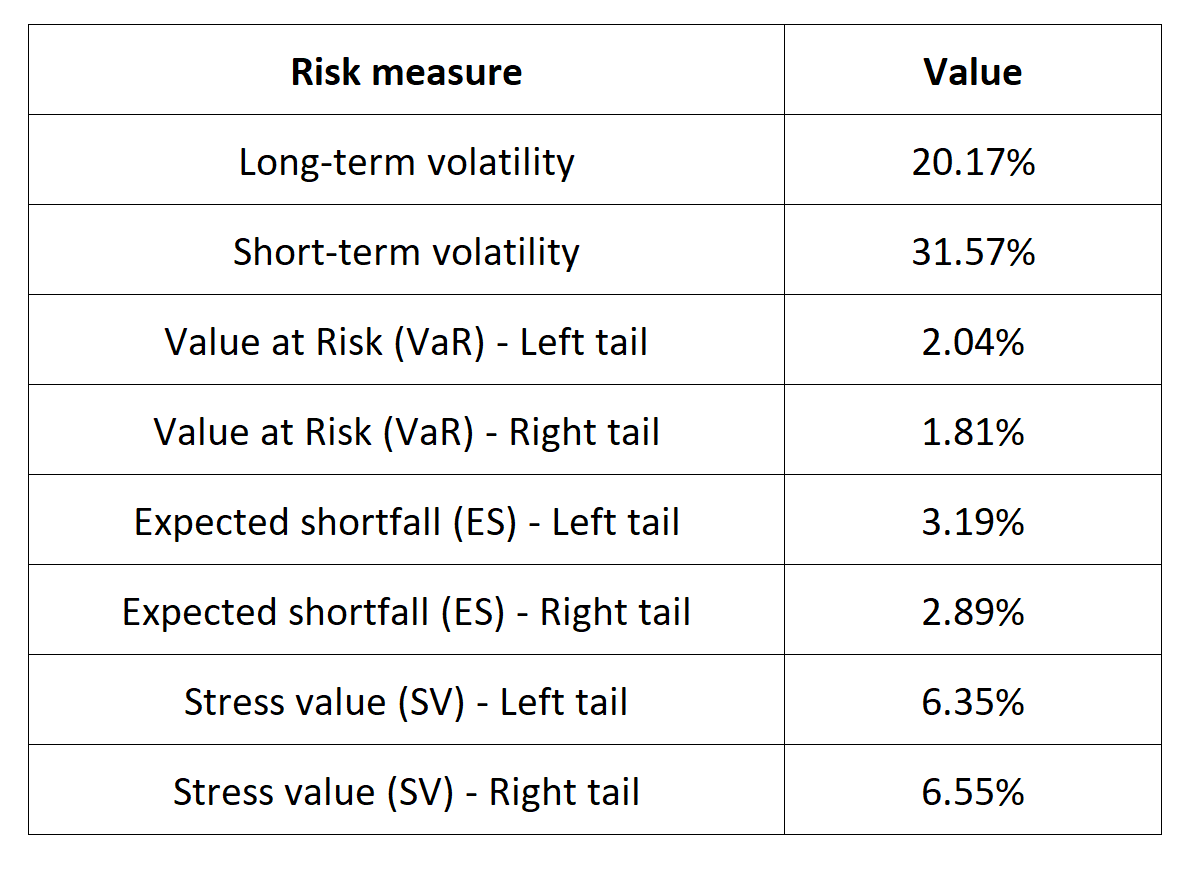

Another important task lies on the projection of economic and financial market through time. It relies on modeling over a long-term horizon (usually a 10-year horizon) the evolution of the financial and economic variables to which the central bank is exposed. This requires the usage of stochastic calculus and programming skills, as projections models are implemented with programming languages such as R, Python or Matlab. For instance, one can take advantage of the existence of listed options on assets such as Euribor futures, French sovereign bonds futures, fed funds futures or US Treasuries futures. By making some assumptions about the price process of those assets, it is possible to retrieve their implied distributions at given horizons (so called “risk neutral densities”). Those distributions can then be used to build a large number of scenarios (say 1000) which are applied to the modeled balance sheet, to propose a distribution of future revenues through time.

The fact that the BdF belongs to the Euro System also requires understanding the rules for sharing the monetary revenues of the 20 national central banks of the Euro System. Analytical balance sheets have to be modeled, to compute monetary revenues for each national central bank.

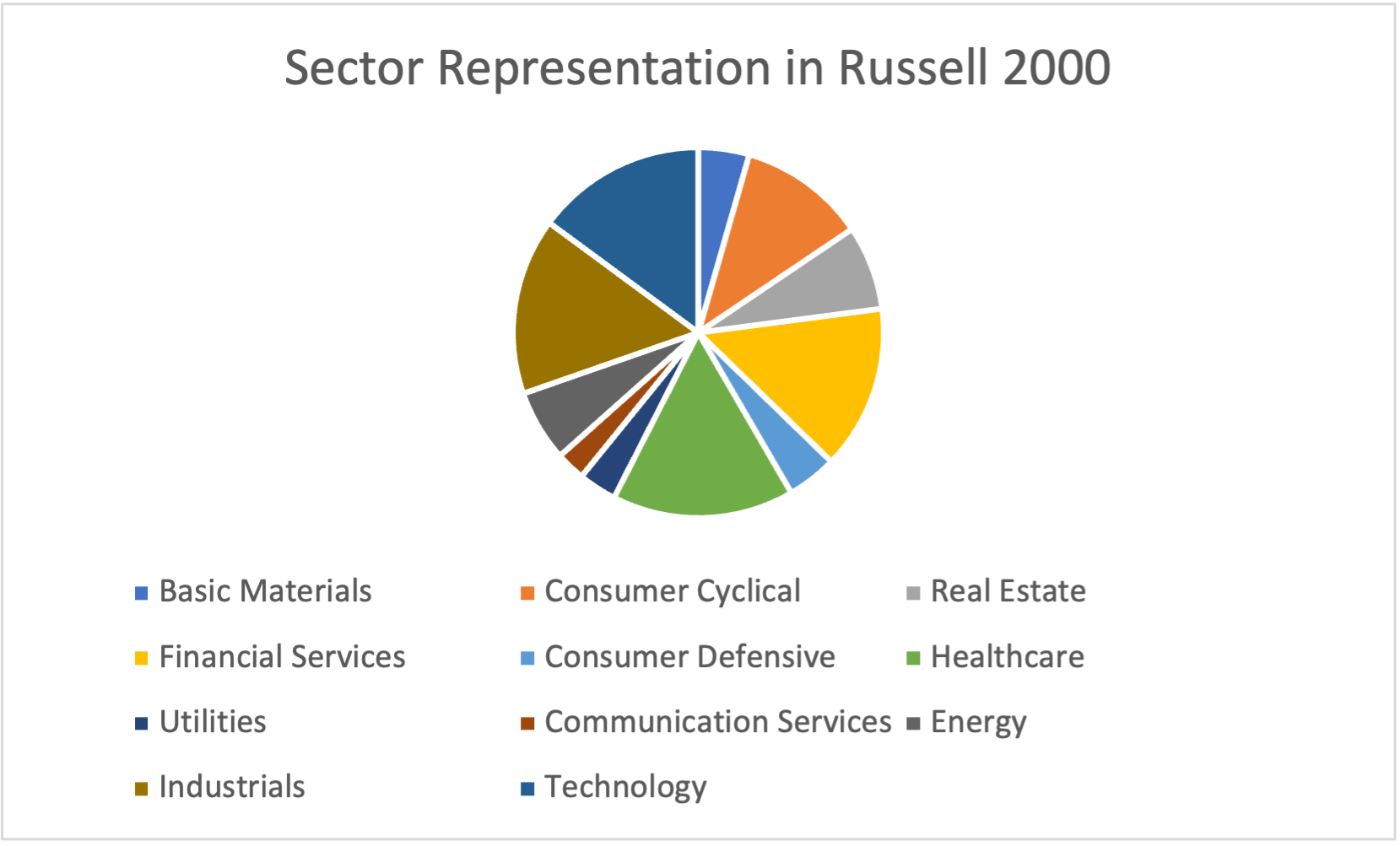

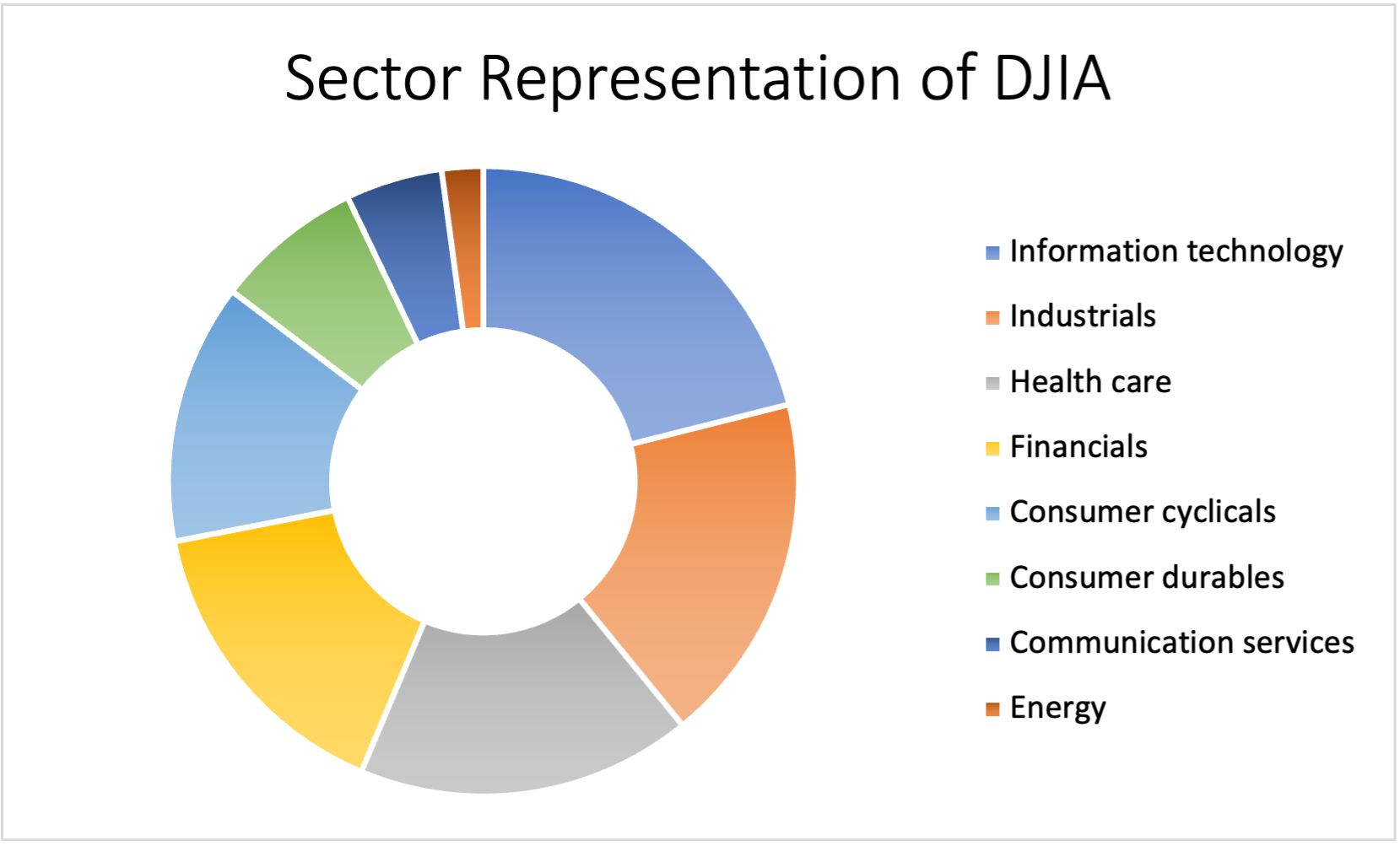

At last, this ALM exercise can also serve as the basis for devising optimal investment strategies for investment portfolios of Banque de France non-monetary balance sheet.

Required skills and knowledge

A fixed income portfolio manager should be skilled in money markets, fixed income securities and derivatives, portfolio management (in particular tactical allocation and performance attribution tools) and fully understand the impact of macroeconomics and monetary policy on rates markets.

An Asset Liability Manager should be skilled in fixed income securities, financial accounting, probabilities and statistics, stochastic calculus, rates models and option pricing, programming languages such as R, Python or Matlab, and monetary policy when it comes to modeling the balance sheet of a central bank.

An Asset Liability Management position in an ideal position after a Fixed Income portfolio management position. Having explored the many facets of Fixed Income and monetary policy are indeed very helpful to start an Asset Liability Management position. It is very satisfactory to develop analytical skills on the aggregate balance sheet after having worked on a specific portfolio.

What I learned

I learned a lot in all the fields I mentioned, but in particular about some topics that are not extensively covered in masters in finance’s curricula, such as money markets and monetary policy. I learned a lot about unconventional monetary policy, as it has been enriched from the recent experiences of the Fed, the ECB or the BoE, which we not in textbooks when I graduated 15 years ago. At last, as time went by I gained capacities in programming languages (especially related to quantitative finance), which is a prerequisite for ALM modeling, and a “nice to have” for fixed income portfolio management.

Financial concepts related my internship

I develop below three financial concepts related to my activities: implied repo and basis, par-par asset swap and specialness on the repo market.

Implied repo and basis

The implied repo rate is the rate of return earned by a market participant who sells a bond future contract and buys the Cheapest to Deliver (CtD) bond in the basket of bonds available for delivery at contract maturity. The implied repo rate should be compared to the effective repo rate of the CtD, and the difference between the two is referred to as the “net basis”. An arbitrage profit can be captured by combining a position on the bond future, the CtD and a reverse repo, depending on the sign of the net basis.

Par-par asset swap

It is a position that consists in purchasing a bond and entering into an interest rate swap such that the combined position is a floating rate bond valued at par. Forcing the value of the bundled position to equal par implicitly requires the fixed rate of the swap to equal the bond’s coupon rate, and as a result, the swap’s initial value will differ from zero. As the obtained synthetic floating rate bond is trading at par, its discount rate is a par rate. As such, it is not distorted anymore by the discrepancy between the bond coupon rate and its current market yield (which is at the origin of the discount/premium). Thus it is a pure measure of the ytm of the issuer on the considered maturity.

Specialness on the repo market

A reverse repurchase agreements (“reverse repo”) is a transaction whereby cash is lent on the market against collateral, usually a bond, to mitigate counterparty default risk. Such an operation falls into the many possible money market instruments available to p.m. to earn a return on the short-term portion of their portfolios.

Conversely, a repo transaction implies lending a bond against cash. The counterparty of a repo trader is a reverse repo trader.

When a reverse repo trade is initiated to lend cash, the cash lender will require from his counterparty that the collateral posted fills some characteristics (for instance, Investment Grade sovereign bonds with a residual maturity below 10 years), but he will not require a particular bond. The collateral posted by his counterparty is referred to as “General Collateral” (GC). This is why the rate of return earned on the trade is named after the GC repo rate.

But in some instances, some bonds in the market are particularly looked after (for instance, newly issued bonds in the days surrounding their auction, or the Cheapest-to-Deliver Bond of a future contract). They are usually in high demand when they have been sold short by market makers or primary dealers, and they must borrowed to be delivered to the bond buyers in due time. As those bonds have to be delivered, they cannot be substituted by another bond as would be the case for GC collateral (the repo transaction is said to be “security driven”). Thus the demand from short sellers on those bonds is inelastic to price, and they will be inclined to pay a lower rate than the GC rate to borrow them on the repo market, as they are at risk of failing to deliver otherwise. Such bonds are referred to as “special” (spec) collateral in the repo market, as opposed to the GC.

The rate on special collateral is lower than on the GC, which means that the cash leg will receive a lower remuneration when the borrowed bond is spec. Thus looking for a special bond entails a cost for the borrower. Specialness on a bond is often measured by computing the spread between the GC repo rate and the special repo rate on that bond.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Youssef LOURAOUI Yield curve calibration

▶ Youssef LOURAOUI Fixed Income arbitrage

▶ Youssef LOURAOUI Portfolio Management at the Central Bank of Morocco

Useful resources

About the author

The article was written in May 2023 by William ARRATA (Lecturer in Advanced Portfolio Management at ESSEC Business School’s MiF and MiM and Asset Liability Manager at Banque de France).