Inflation & deflation

In this article, Raphaël ROERO DE CORTANZE (ESSEC Business School, Master in Management, 2018-2022) describes the main mechanisms at the origin of inflation and deflation episodes, providing historical examples.

Inflation

Definition

Inflation is a movement of increase in the general price level (all products and not a few products) in an economy. It is a self-sustaining movement over several years. Measuring inflation is complex. Historically, inflation has been calculated by monitoring the evolution of a fixed basket of day-to-day products (such as milk, bread, etc.).

If your local supermarket suddenly increases its prices, it is not inflation: it is a microeconomic and located event that is the consequence of a human decision. In the same way, a sudden price increase following a tax increase is not considered as inflation.

Maintaining a level of inflation is one of the objectives of the Central Banks, which manipulate interest rates to reach their inflation target (2% for the European Central Bank). Indeed, low inflation is often beneficial for the economy, as it guarantees monetary and economic stability, and in particular helps to avoid deflationary spirals.

The origin of inflation

Firstly, inflation can be the result of imbalances between supply and demand:

- Demand increases faster than supply (Keynesian approach): inflation occurs when the use of the means of production is at a maximum (it is not possible to produce more) and imports are unable to compensate the lack of domestic supply. The excess aggregate demand pushes up the prices as supply cannot follow.

- A sudden fall in supply: in Germany in 1922, bad crops and a 30% drop in the industrial production in 1923 created a wave of hyperinflation as the supply couldn’t cope with the demand.

Secondly, inflation can be the result of evolution of productive constraints and price movements:

- Wages increase more rapidly than the productivity of labor: companies increase their prices to maintain their margins, which creates inflation. William Baumol (American economist – the Baumol law) explained in 1966 that wage increases in less productive sectors rise in parallel with wage increases in more productive sectors. These increases, which are not justified by productivity arguments, result in inflation.

- An increase in the production price per unit (for instance in the case of a sharp increase in the price of commodities) can result in inflation if companies can increase their prices to maintain their margins.

Finally, the expectations of economic agents can amplify the effect of inflation. If they expect a high inflation, the number and amount of transactions will increase, as they try to get rid of cash rapidly (in case of hyperinflation, the currency can lose its value very quickly), which will amplify inflation. It is the mechanism of “flight from money”.

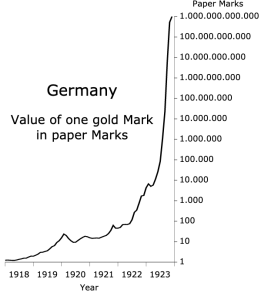

The post WW1 German hyperinflation

The stage of hyperinflation is reached when the rise in prices exceeds 50% per month. After WW1, the Treaty of Versailles imposed reparations on Germany. Quickly after, the fear that Germany would not be able to pay its reparations and debts spread. As a consequence, the value of the mark decreased in comparison to other European currencies. At the same time, the German government artificially injected money while Germany experienced a sharp decrease. These three phenomena translated into inflation, which was accelerated by the mechanism of “flight from money”. The average monthly rise in prices went beyond 300%. Germany managed to get out of this inflationary episode thanks to drastic measures: the introduction of a new currency, the capping of governmental money injection in the economy, austerity measures and debt rescheduling.

Deflation

Definition

Deflation is not to be confused with disinflation: disinflation is characterized by a decrease in the rate of inflation, whereas deflation happens when the prices decrease. Deflation is downward trend in the general price level over several years and similar to inflation, it is cumulative and self-sustaining. Deflationary episodes are much less common than inflationist periods.

The origins of deflation

Deflation mainly comes from imbalances between demand and supply:

- Demand collapses compared to supply: Keynes explains that a collapse in private investment and savings can lead to a decrease in prices and salaries, as firms will try to sell their unsold products and maintain their margin. Due to wage decreases, consumption is depressed, which reduce the demand and pushes companies to further lower prices.

- Supply increases suddenly: a sudden decrease in the price of commodities, labor cost or an acceleration of productivity gains can lead to disinflation, and eventually to deflation as firms will be able to decrease their prices. In this case, it is possible for deflation and growth to coexist, especially if productivity gains are high enough.

The Japanese deflation

In this two-decades deflationary episode, structural factors combined with macroeconomic events. In terms of structural factors, the increase in relocations to China, the sharing of added value to the detriment of employees and the aging of the population created a situation of weak and sluggish demand. In 1984, the Oba-Sprinkle agreements (which imposed a deregulation) lead to a continuous appreciation of the yen, which translated into an increased profitability of financial investments and therefore an influx of foreign capital. Fearing a speculative bubble, the Bank of Japan raised its key interest rate abruptly in 1992. The bubble burst, causing an economic slump. Households and banks became very cautious, leading the country into a dynamic of price decreases for over 20 years. Japan gradually emerged from this deflationary episode thanks to the reflationary policy conducted by Shinzo Abe since 2012.

Key concepts

Reflation policy

Reflation policy is the act of stimulating the economy by increasing the money supply or reducing taxes, seeking to return the economy to its long-term trend. This is the opposite of disinflation, which aims to bring inflation back to its long-term trend.

Useful resources

Solow and Samuelson (1960), Analytical aspects of anti-inflation policy, The American Economic Review.

Kaldor (1985) The scourge of monetarism.

Baumol (1966) Performing Art: The Economic Dilemma.

JM Keynes (1936), The General Theory of Employment, Interest and Money.

About the author

Article written in June 2021 by Raphaël ROERO DE CORTANZE (ESSEC Business School, Master in Management, 2019-2022).