Currency swaps

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) introduces the currency swaps used in financial markets.

Introduction

In financial markets, currency swaps are a derivative contract in which two counterparties exchange a stream of interest payments and principal amount in one currency with a stream of interest payments and principal amount in another currency. The life of the swap is for a pre-defined number of years. The interest payments are based on a pre-determined principal amount and can include the exchange of:

- A fixed interest rate for a fixed interest rate

- A fixed interest rate for a floating interest rate

- A floating interest rate for a floating interest rate

Another way of understanding currency swaps can be that a counterparty A borrows funds from another counterparty B in a currency different from its domestic currency and lends funds in their domestic currency to the counterparty B. The principal amount is specified in each of the two currencies and is exchanged at the beginning and the maturity of the swap contract. Currency swaps differ from interest rate swaps as the principal amount is exchanged between the counterparties for currency swaps. The principal amounts set in the beginning of the exchange are usually equivalent to the exchange rate at that given time (the spot rate).

However, the exchange rate for the principal amounts at the end of the swap are decided between the counterparties at the time of entering the contract. Usually, it is equivalent to the initial exchange rate of the agreement.

Cross currency swaps can be used by different counterparties to reduce their exposure to exchange rate fluctuations and to benefit from lower interest rates to finance transactions in a foreign currency. These swaps also provide arbitrage opportunities between interest rates in different markets to the counterparties.

Types of currency swap contracts

Currency swap contracts can be classified into three types based on the interest rates that are to be exchanged on the contract.

Fixed for fixed currency swaps

In a fixed for fixed currency swap, the interest rates are exchanged between the counterparties based on a pre-determined fixed interest rates in both currencies.

For example, two counterparties, say Apple & LVMH, decides to enter a fixed for fixed currency swap. Apple wants to expand its operations in Europe and needs to borrow €87 million whereas LVMH wants to fund an acquisition it did in the US and requires $100 million. The companies resort to debt financing to fund their operations and takes a loan in their domestic currencies (due to cheaper borrowing rates in their respective countries). Apple takes a loan in USD for a fixed interest rate of 2% per annum, and LVMH takes a domestic loan in EUR for a fixed interest rate of 1.6% per annum.

Both the parties enter into a currency swap wherein Apple decides to pay $100 million to LVMH in exchange for €87 million ($1 = €0.87). On the principal amounts, Apple pays 1.6% in euros in interest rate to LVMH, and LVMH pays 2% in dollars to Apple. This is an illustration of a fixed for fixed currency swap.

Fixed for floating currency swaps

In a fixed for floating currency swap, a counterparty receives the interest payment based a fixed interest rate and pays the interest rates based on a floating interest rate. The rates are pre-determined at the time of entering the agreement.

If we take the case for fixed for floating currency swaps in the above example, LVMH pays at a fixed interest rate of 2% per annum and receives at a floating interest rate which is indexed to the 6-month Euribor.

Floating for floating currency swaps

In a floating for floating currency swap, a counterparty receives and pays the interest payment based floating interest rates that are pre-determined at the time of entering the agreement. The floating interest rates are usually indexed to the LIBOR rates.

If we take the case of floating for floating currency swaps in the above example, LVMH pays a floating interest rate indexed to the 6-month USD Libor and receives a rate based on the 6-month Euribor.

Interest rates on a currency swap

Currency swaps can be used in different market situations based on the needs of different counterparties. The floating for floating currency swap is considered as a basic swap and is most commonly used in financial markets. The interest rates for a floating for floating swaps are usually determined based on the LIBOR rates +/- spreads. The spreads are based on the dynamics of demand and supply for a currency swap. Higher spreads can imply higher demand for a particular currency swap.

The spreads also include the credit risk of a counterparty. The credit risk implies the possibility of a default on payments by a counterparty specified in the currency swap agreement.

Example – Fixed for fixed currency swap

For example, two counterparties, say Apple and LVMH, decides to enter a fixed for fixed currency swap. Apple wants to expand their operations in Europe and needs to borrow €87 million whereas LVMH wants to fund an acquisition they did in USA and requires $100 million. The companies resort to debt financing to fund their operations and takes a loan in their domestic currencies (due to cheaper borrowing rates in their respective countries).

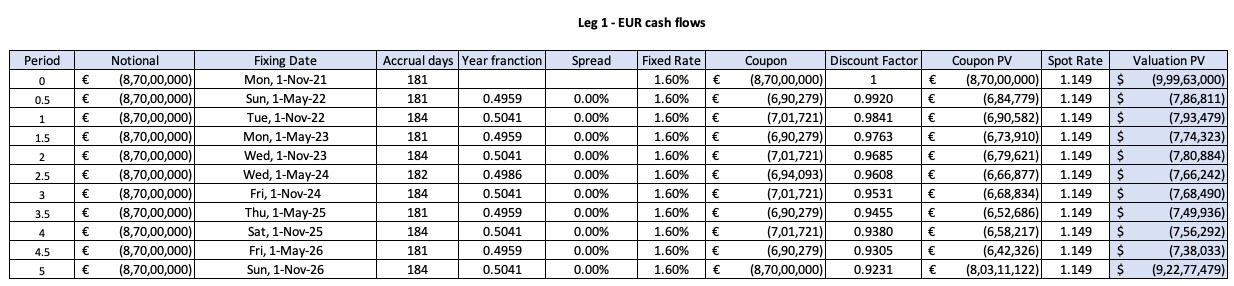

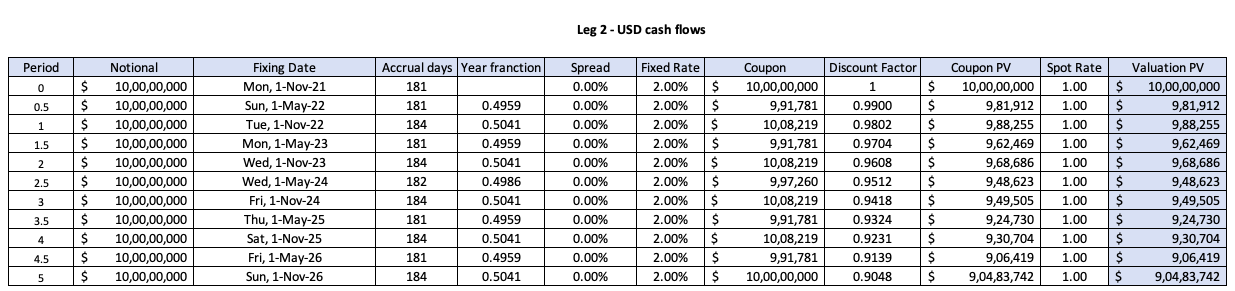

Apple takes a loan in USD for a fixed interest rate of 2% and LVMH takes a domestic loan in EUR for a fixed interest rate of 1.6%. Both the parties enter into a 5-year currency swap on 1st November 2021 wherein Apple decides to pay $1 million to LVMH in exchange for €0.87 million ($1 = €0.87). As interest payments, Apple pays 1.6% per annum fixed rate to LVMH and received 2% per annum fixed rate semi-annually. The table below shows the pricing of currency swap.

Figure 1. Pricing of currency swap

.

.

Source: computation by the author.

Related posts

▶ Alexandre VERLET Understanding financial derivatives: swaps

▶ Alexandre VERLET Understanding financial derivatives: forwards

▶ Alexandre VERLET Understanding financial derivatives: options

▶ Akshit GUPTA Options

Useful Resources

Hull J.C. (2015) Options, Futures, and Other Derivatives, Tenth Edition, Chapter 7 – Swaps, 180-211.

About the author

Article written in December 2021 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).