The selling process of funds

In this article, David-Alexandre BLUM (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2019-2023) explains about the selling process of funds.

The process of selling a fund involves several key steps and stakeholders. The fund is built by management teams that develop the strategy, allocation, and follow the macroeconomic scenario of economists. Let’s take the example of Lazard Frères Gestion.

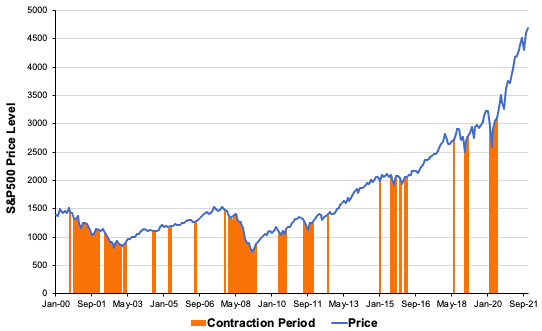

Lazard Frères Gestion is characterized by active management based on fundamental analysis. Financial analysis and knowledge of companies are at the heart of the management process. All institutional management relies on the same macroeconomic scenario. Financial assets are the major source of financing for the real economy. The economy is cyclical. Financial assets are also cyclical. Volatility or bubble effects can cause the market price of an asset to diverge from its fair economic price in the short term, but not in the long term. Over time, it is the ability to capture the different phases of the cycle that creates outperformance.

Lazard Frères Gestion’s investment philosophy is based on both reading the economic cycle and evaluating companies. When products are launched and marketable, the distribution team prospects new clients (through seminars, contacts, or research), responds to tenders, or meets specific client requests.

The client meeting

Once the initial contact has been made, the sales team must prepare a specialized presentation for clients, gathering necessary documents (such as reports, management points, comparative studies, etc.). The preparation of such a presentation is crucial and should not be overlooked. It is important to choose the right arguments to highlight, taking into account the current economic environment and supporting the scenario put forward by the management team.

Selling a fund requires a thorough understanding of the management process, portfolio values, managers’ philosophy, as well as the benchmark performance and various risk and performance indicators of the presented fund.

Once the speech is prepared and the materials finalized, it is up to the seller to showcase the fund’s qualities. If the meeting goes well and negotiations are successful, the transaction can follow quickly or the client may request an entirely different service, such as a dedicated fund (customized fund), if it meets the criteria for accessing the service.

The team then needs to manage the contractual and administrative aspects to finalize the operation. The potential buyer conducts thorough due diligence on the fund, examining financial documents, contracts, internal procedures, and regulatory compliance to ensure there are no hidden issues or unforeseen risks.

Once due diligence is completed and the terms of the transaction are finalized, the parties draft and sign the sales contracts. In addition, they obtain the necessary approvals from the relevant regulatory authorities to transfer the fund’s management to the buyer.

After obtaining regulatory approvals, the client transfers the fund’s assets and liabilities to the buyer. This may include transferring securities, contracts with custodians and fund administrators, as well as communicating with the concerned investors.

Once the transfer is completed, the buyer integrates the fund into their own management structure and takes over the daily management of the fund, ensuring that investment objectives and applicable regulations are met.

Managing the relationship and the customer service

The team’s work does not stop at mere sales. Its role is much more important. It must ensure the proper receipt of financial and legal documents sent to clients periodically. It must also respond to all information requests about the subscribed products and ensure that the services subscribed by the client are performed. It is their duty to do everything possible to justify any underperformance and to nourish the relationship with information and explanations. To do this, they attend various committees and internal meetings to keep abreast of different movements and tactical bets. The sales team can encourage its client to invest more in its product and propose new products that seem to meet the client’s demand. In the event that the client chooses to withdraw from the fund, the relationship does not end there, and it is up to the sales team to work to potentially bring their client back.

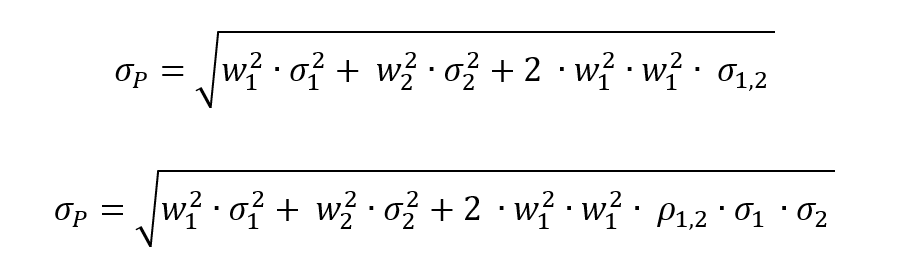

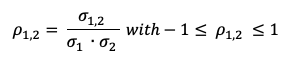

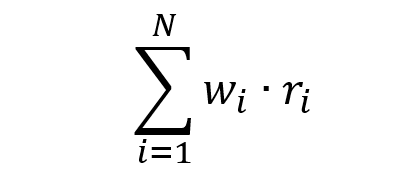

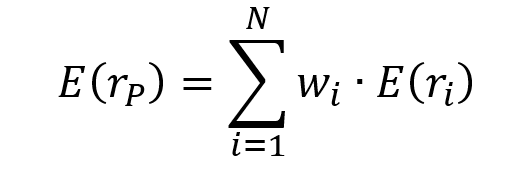

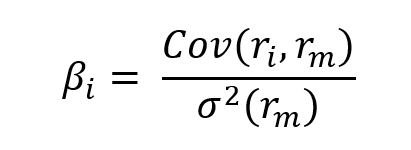

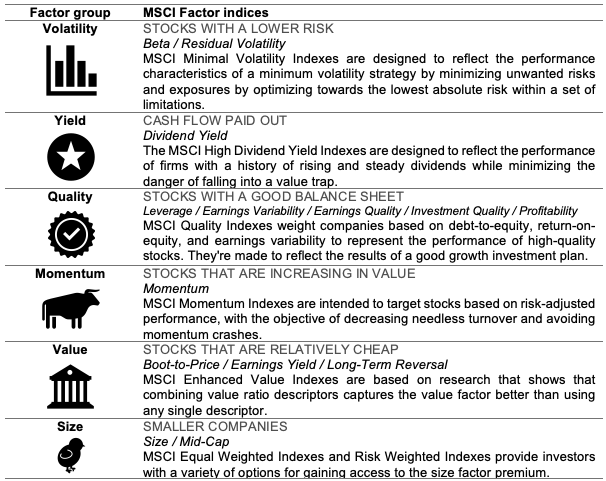

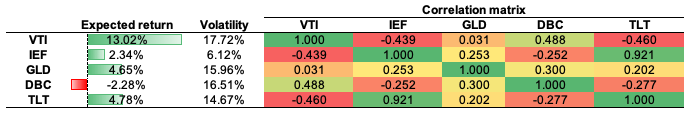

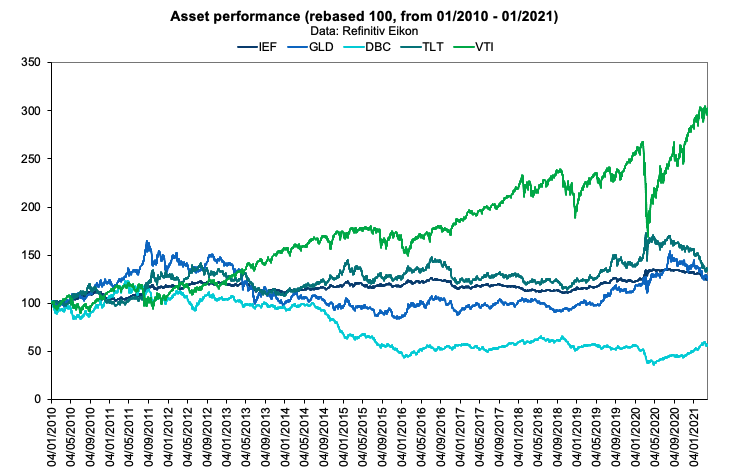

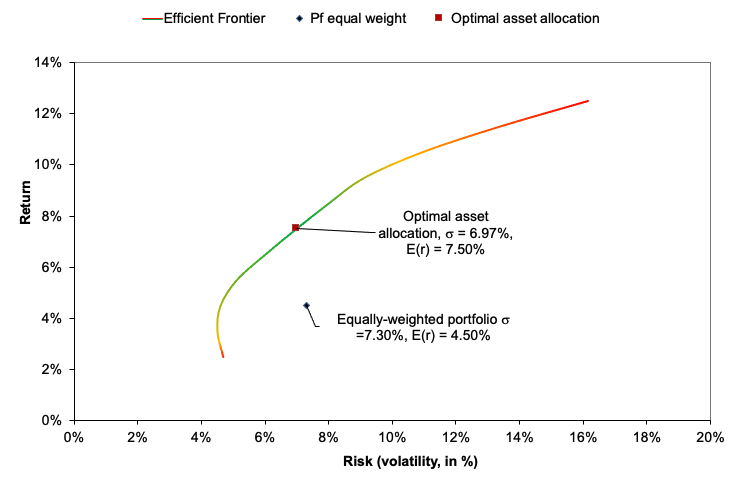

From a technical standpoint, the sales team must master the knowledge of its products. The sales team must deeply understand the characteristics of the fund, including investment strategy, objectives, underlying assets, sectoral and geographical allocation, as well as fees and associated costs.

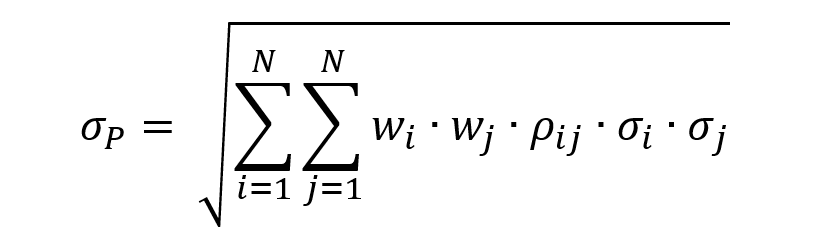

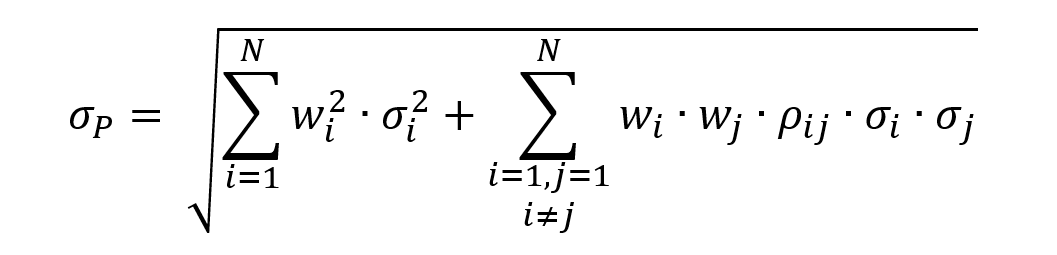

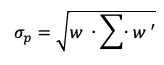

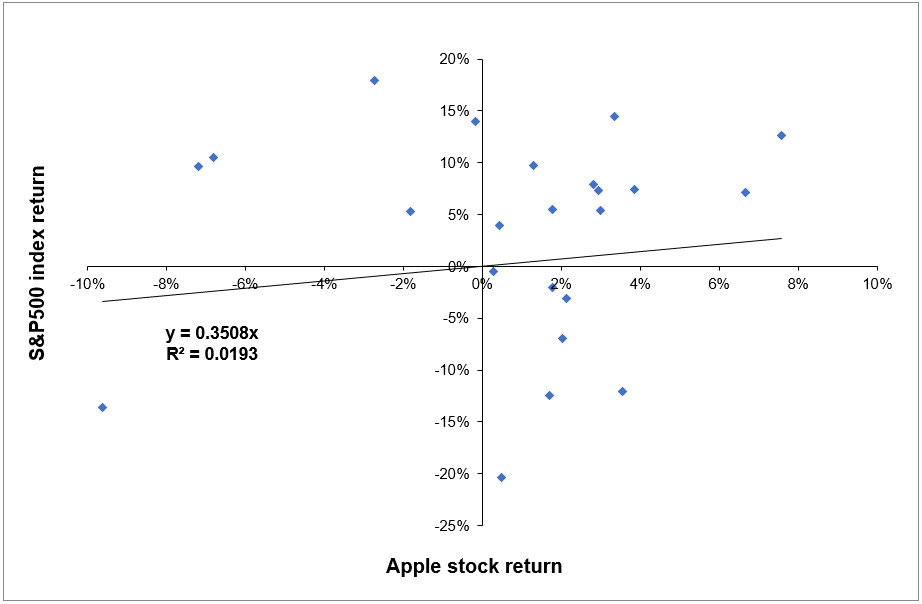

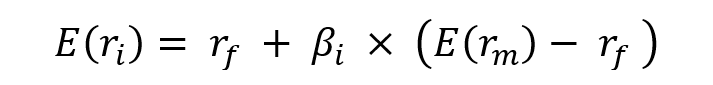

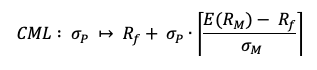

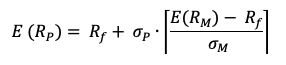

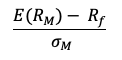

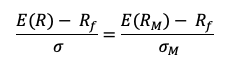

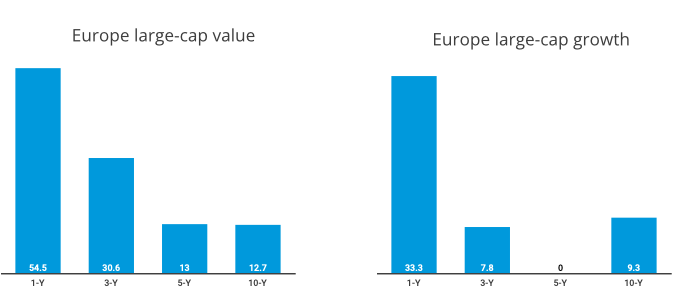

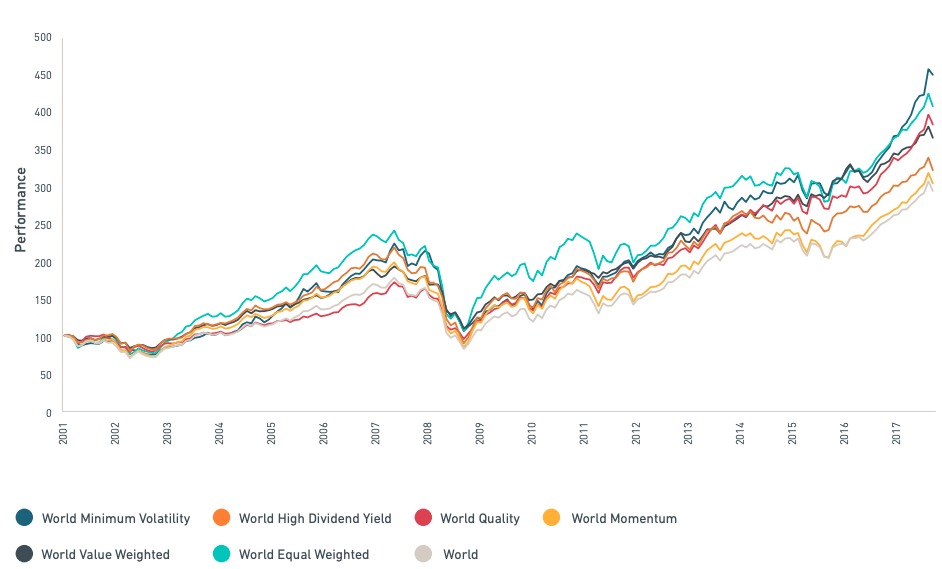

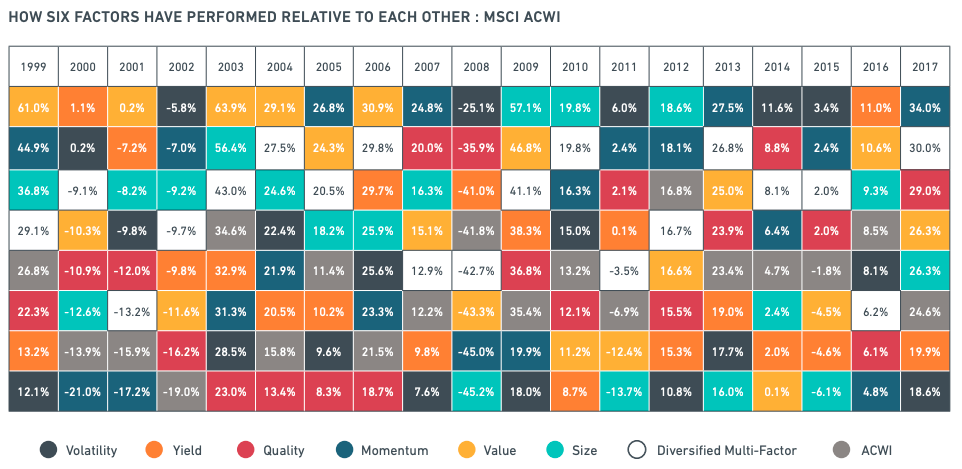

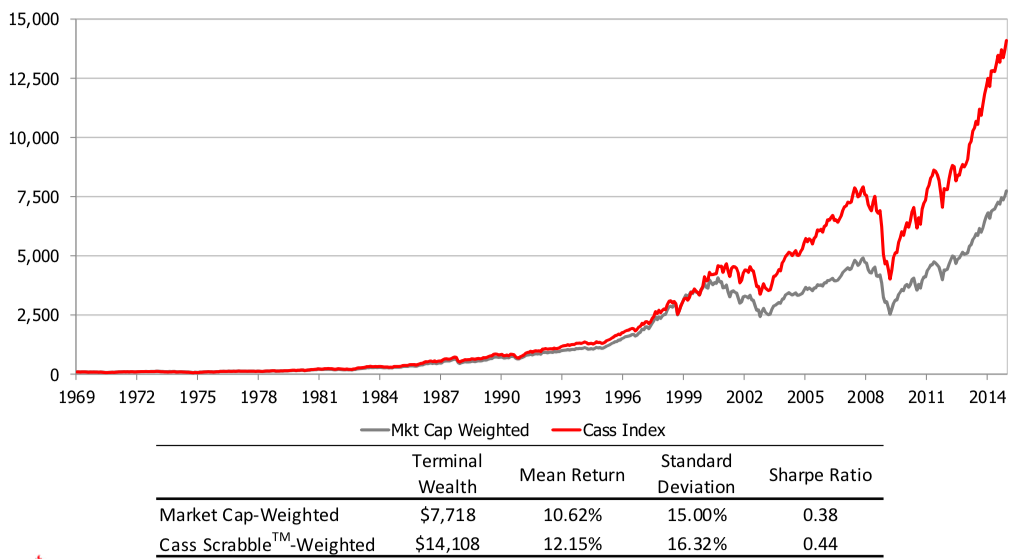

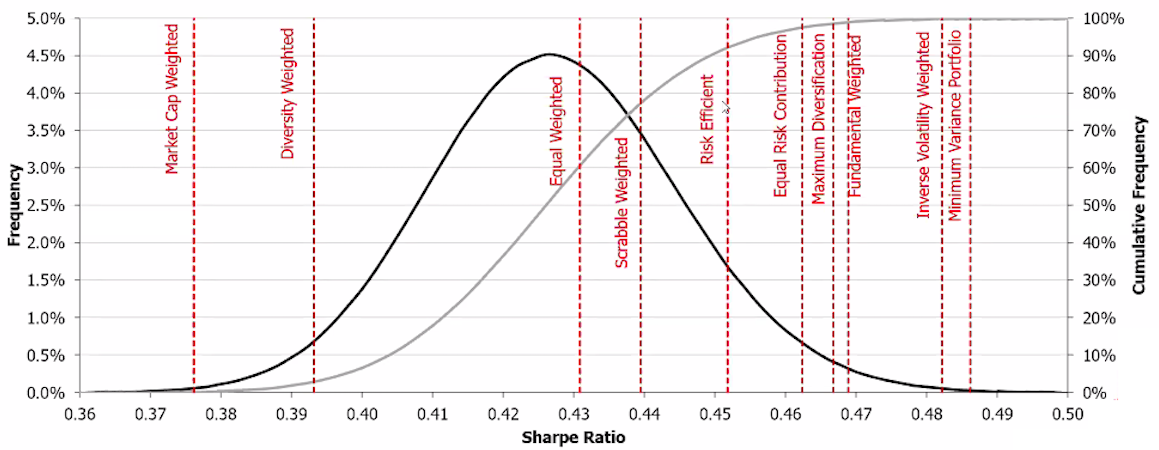

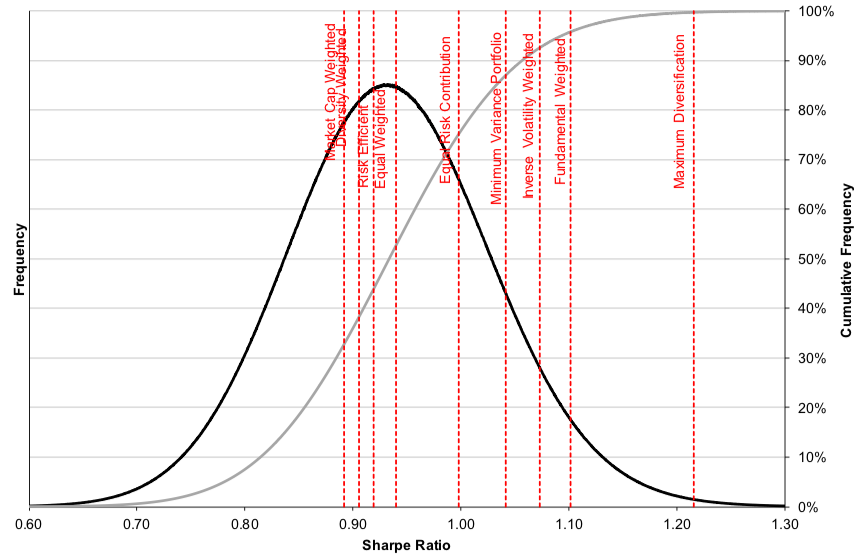

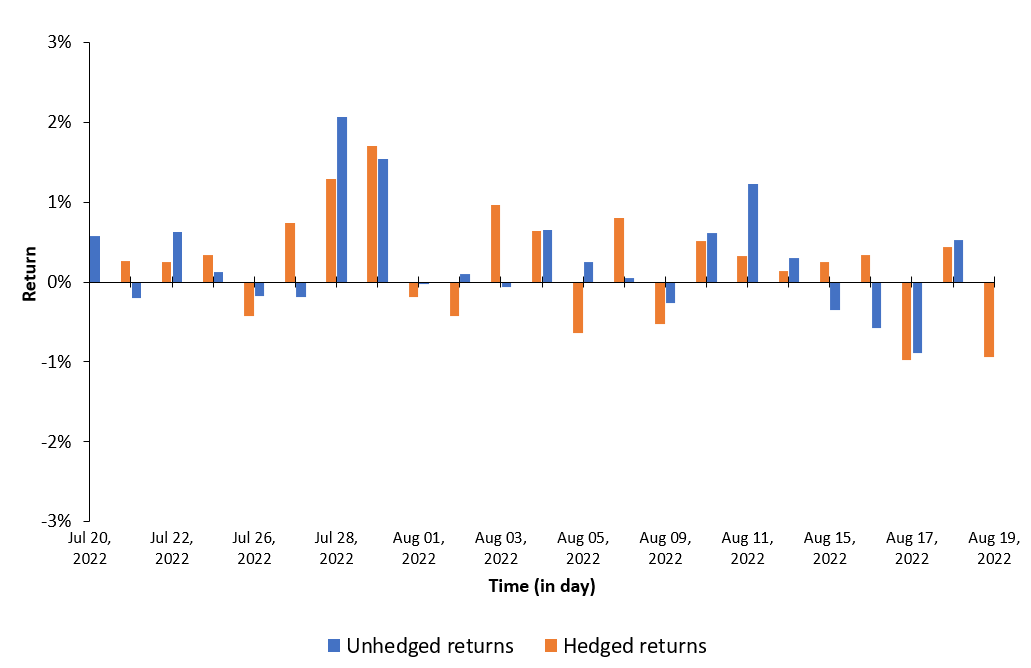

It is essential to know the historical performance of the fund, risk-adjusted returns (such as the Sharpe ratio), and comparisons with benchmark indices or similar funds. The sales team must be able to explain the main risks associated with the fund, such as market, credit, liquidity, and currency risks, as well as the measures taken by the fund manager to mitigate these risks.

Knowledge of regulations applicable to investment funds, such as UCITS or AIFMD directives in Europe, and disclosure and reporting requirements, is crucial to ensure compliance and client trust.

The sales team must be able to identify target investors for the fund, taking into account their risk profile, investment objectives, and liquidity needs.

Team members must master the procedures for subscribing and redeeming fund shares, including deadlines, fees, and specific conditions.

Communication and presentation: Communication and presentation skills are essential for clearly and convincingly explaining the benefits of the fund and addressing potential clients’ questions.

By mastering these technical aspects, the sales team will be able to effectively present the investment fund to potential clients, address their concerns, and assist them in making informed investment decisions.

Why should I be interested in this post?

The sales process of a fund helps to better understand the functioning of the investment fund market and the dynamics between asset management companies, investors, and financial intermediaries.

Investors who understand the sales process of a fund are better equipped to evaluate fund offerings and make informed investment decisions based on their objectives and risk tolerance. Professionals working or considering working in the financial industry, particularly in the areas of asset management, sales, and investment advisory, will benefit from a deep understanding of the fund sales process to enhance their skills and professional performance.

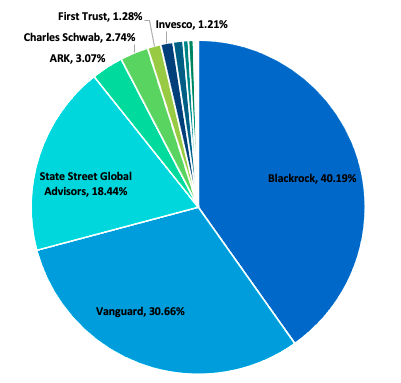

Furthermore, understanding the sales process of a fund can assist investors and financial advisors in comparing different investment products, such as mutual funds, exchange-traded funds (ETFs), and alternative investment funds, to determine the best solution for their specific needs and objectives.

Related posts on the SimTrade blog

▶ Louis DETALLE A quick presentation of the Asset Management field…

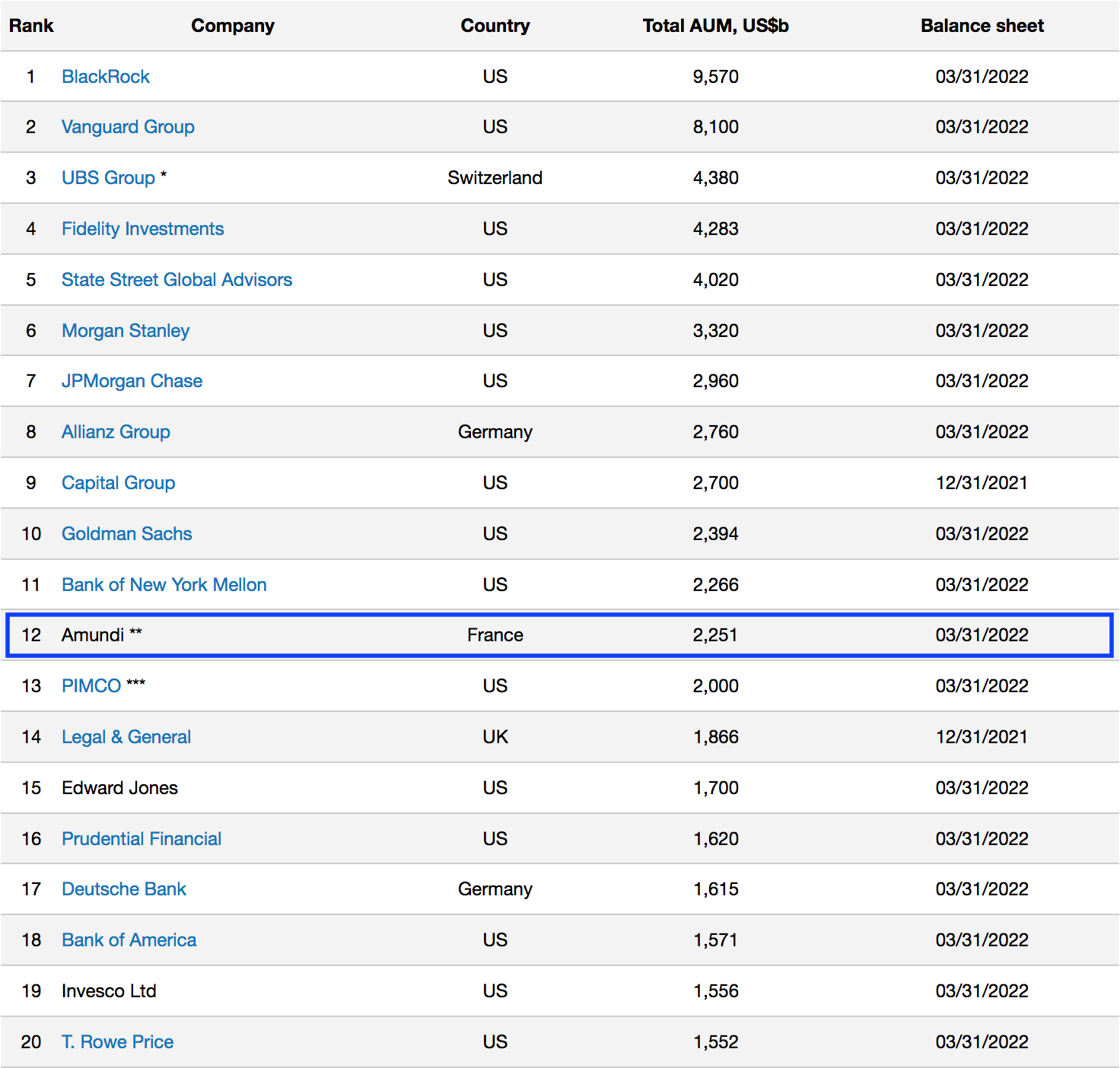

▶ Tanguy TONEL My experience as an Investment Specialist at Amundi Asset Management

Useful resources

Lazard Frères Gestion Les métiers de la gestion d’actifs (webinaire)

Lazard Frères Gestion Qu’est-ce que la gestion d’actifs ?

Lazard Frères Gestion Quelle allocation d’actifs pour un portefeuille diversifié ?

Hull J., P. Roger (2017) Options futures et autres actifs dérivés Pearson Education.

About the author

The article was written in May 2024 by David-Alexandre BLUM (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2019-2023).

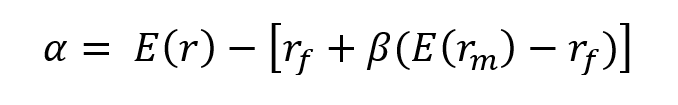

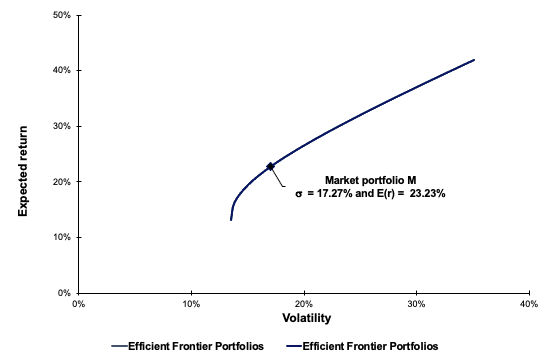

Source : computation by the author.

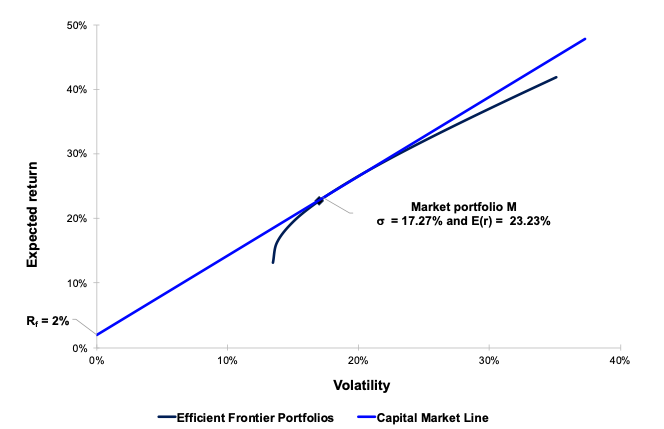

Source : computation by the author. Source: www.advratings.com

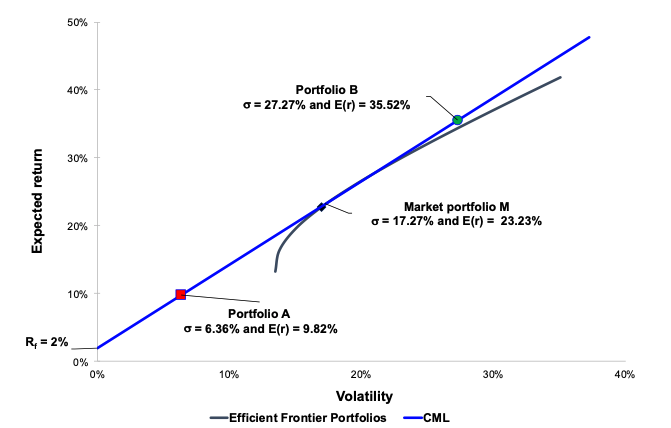

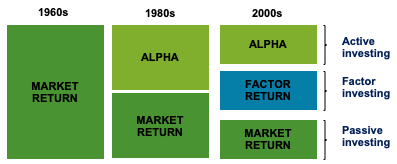

Source: www.advratings.com Source: Amundi

Source: Amundi