Inflation Rate

In this article, Bijal GANDHI (ESSEC Business School, Master in Management, 2019-2022) explains in detail about the inflation Rate.

This read will help you understand the causes for inflation, the pros and cons of inflation and finally how to control inflation.

What is inflation?

Inflation in simple terms means an increase in the cost of living. It is basically an economic term which means that an individual must spend more money now than before to buy the same goods or services. The percentage increase in the prices over a specified period can be termed as the inflation rate. As the prices increase, the purchasing power of each unit of the currency decreases. The change in the price level of a well-diversified basket of goods and services can help estimate the decline in the purchasing power. This basket should include commodities, services, utilities, and everything else that humans need to lead a comfortable life. Therefore, the calculation of inflation is a complex process. It is measured in several ways depending upon the goods and services included in the calculation.

Deflation is the opposite of inflation and it indicates a general decrease in the prices of goods and services. It occurs when the inflation rate is lesser than 0%.

Types of inflation

Inflation rates can be divided into the following categories depending upon their characteristics,

- Creeping inflation means that the prices have increased by 3% or less during a year.

- Walking inflation refers to an increase in prices between 3-10% a year. It is destructive in nature and is harmful for the economy.

- Galloping inflation causes an absolute havoc in the economy as the prices rise by 10% or more.

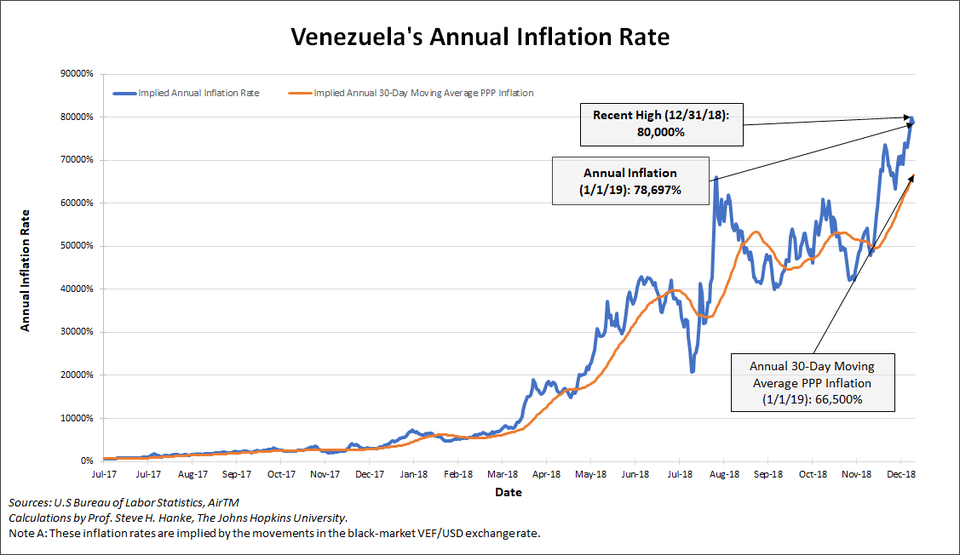

- Hyperinflation is a rare phenomenon which occurs when the prices rise by 50% or more.

What are the three causes of inflation?

The rise in prices is most associated with the rise in demand. But there are several other mechanisms that result in an increase in the money supply of an economy. These mechanisms can be classified into the following three types,

Demand-pull effect

The demand-pull effect refers to the situation in which the demand exceeds the supply for goods and services. This may occur due to an increase in the money supply and credit, stimulating the overall demand. The consumers are willing and able to pay higher prices for a product thereby leading to a price rise.

Cost-Push Effect

A cost-push effect occurs when the supply is restricted while the demand is not. The supply could be restricted due to several factors like the scarcity of raw materials, the increase in the prices of production inputs, pandemics, etc. These additional costs may result in a higher cost for the finished product or reduce supply. In any case, the prices would rise resulting in inflation.

Built-in Inflation

The built-in inflation is a result of the cause-effect relationship. It is based on the people’s expectations of inflation in the coming years. The laborers and workers will demand a higher wage if they expect that the prices of goods and services will rise. Thereby increasing the cost of production. This will further result in an increase of the prices of goods and services again.

Measure of inflation

The Consumer Price Index (CPI) evaluates the change in the average price of a selected basket of goods and services over time. This predetermined basket mainly includes necessities like food, medical care, and transportation. The change in price of each component is calculated over a period and averaged to its relative weight in the basket. It is a widely used measure for both the inflation and effectiveness of the government’s policy. In the US, the CPI reports are published on a monthly and yearly basis by the U.S. Bureau of Labor Statistics. The value of inflation can be calculated over a period between two dates using the following methodology:

If you wish to know the purchasing power of a certain sum of money from one period to another, you can input data in this Inflation Calculator by the U.S. Bureau of Labor Statistics and see the results. This calculator uses the same methodology and CPI data as mentioned above.

Is inflation good or bad?

Inflation can be either good or bad depending upon the situation of individuals. For example, individuals holding cash or bonds would not like inflation as the purchasing power of their holdings would decrease. Individuals with investments in assets like real estate, commodities, etc. would appreciate inflation as the real value of their holdings will increase.

Central banks often struggle in maintaining an optimal level of inflation. Spending is encouraged over saving as increased spending will help boost economic activities. This is because it would be profitable for individuals to spend now instead of later if the purchasing power of money is expected to fall. For example, in the U.S., the Federal Reserve aims for a target rate of inflation of 2% YoY. A very high inflation rate can have catastrophic consequences. For example, Venezuela, which was suffering from hyperinflation (1087%) in 2017, collapsed into a situation of extreme poverty and uncertainty. Individuals who depend upon savings or fixed income are affected the most. This is because the interest rates in their savings accounts in the banks are lesser than the inflation rate, thereby making them poorer. Similarly, lower-income families are highly affected if the rise in their wages does not keep up with the rise in the prices. A high inflation also pressurizes governments to take actions to financially support the citizens as the cost-of-living increases.

Similarly, a deflation situation is not healthy as well. Consumers may put off spending as they may expect a fall in the prices. The reduced demand for goods and services will result in slow economic growth. This could further result in a recession-like situation with increased unemployment and poverty.

How to control inflation?

As discussed in the Interest rates post, the financial regulators of a country shoulder the responsibility of maintaining a stable and steady inflation rate. In the US, the Federal Reserve communicates inflation targets well in advance to keep a steady long-term inflation rate. This is because price stability helps businesses plan well ahead in future and know what to expect. The central banks through the monetary policy actions controls the money supply. For example, they adopt methods like quantitative easing to either counter deflation or to maintain the targeted inflation rate.

One powerful way for individuals would be to increase their earnings either through demanding a higher pay or promotions to keep up with inflation. Other options include investing in the stock market. Stocks are a good way to hedge against inflation. This is because a rise in the stock price will be inclusive of the effects of inflation. Another alternative would be to invest in instruments indexed to the inflation. Treasury Inflation Protected Securities (TIPS) and Series I Bonds are examples of such instruments.

Useful resources

U.S. Bureau of Labor Statistics

Investopedia Inflation Rate

The Balance How to measure Inflation

Related posts on the SimTrade blog

▶ Bijal GANDHI Economic Indicators

▶ Bijal GANDHI Leading and Lagging Indicators

▶ Bijal GANDHI GDP

▶ Bijal GANDHI Interest Rates

About the author

Article written in April 2021 by Bijal GANDHI (ESSEC Business School, Master in Management, 2019-2022). Bijal has two years of experience in the financial markets and is currently working as a financial analyst at Mega Biopharma.