Hedge funds

This article written by Akshit Gupta (ESSEC Business School, Master in Management, 2019-2022) presents the role and functioning of a Hedge fund.

Introduction

Hedge funds are actively managed alternative investment vehicles that pools in money from several investors and invest in different asset classes. Only accredited investors have the access to invest in hedge funds. Accredited investors refer to high-net worth individuals, financial institutions, retail banks, and large corporations who satisfy certain conditions to obtain a special status to invest in these high-risk funds.

The first hedge fund was started in 1949 by Alfred Winslow Jones, coined as the father of the modern hedge fund industry. He tried to eliminate the systematic risk in his portfolio by buying stocks and short selling equal amounts of stocks at the same time. So, his portfolio returns were dependent on the choice of stocks he bought and sold rather than the direction in which the market moved.

Hedge funds use complex investment techniques to generate absolute market returns that are generally higher than the market benchmarks. These funds are less rigorously regulated (by the SEC in the US or the AMF in France) as compared to mutual funds by asset management firms or insurance companies which empowers them with greater flexibility.

The types of strategies used by hedge funds are risky and can lead to huge losses (like Long Term Capital Management in 1998 or Archegos Capital Management in 2021). In terms of performance, hedge funds try to achieve a positive performance regardless the direction of the market (up or down).

Benefits of a hedge funds

Hedge funds provide their clients (investors) with tools and mechanisms that enable them to handle their investments in an efficient manner and optimize their portfolios with high returns and well managed risk. The hedge funds invest in a variety of assets, thus diversifying the clients’ portfolios and dispersing their absolute returns. So, asset management firms are often acknowledged as the alternative funds in the industry.

Fee structure

Hedge funds usually follow the 2 and 20 fees structure practice. Under this practice, the hedge funds usually charge 2% management fees on the total assets under management (AUM) for the investor and 20% incentive fees on the total profits generated on the investments over the hurdle rate. The hurdle rate is generally the minimum returns that investors expects on their investments. The minimum return is set by the hedge fund while making investment decisions.

For example, a hedge fund has AUM worth $100 million and by the end of the year the total portfolio size is $140 million. The management fee is 2% and the incentive charges are 20% for a hurdle rate of 10%.

So, the hedge fund will receive total fees equivalent to:

The total fees is the sum of the management fee and the Incentive charges

Thus, total fees is equal to $8 million

(Calculation for the management fee: $100 million (Initial investment) x 2% which is $2 million

Calculation for the incentive charge: $100 million x max.(40% – 10%; 0) x 20% which is $6 million

Here, 40% is the portfolio return and 10% is the hurdle rate)

Types of strategies used by hedge funds

Hedge funds follow several strategies to try to get returns higher than the market returns. Some of the actively employed strategies are:

Long/Short equities

Long/short Equity strategy involves taking a long position and a short position on underlying stocks. The aim of this strategy is to find stocks that are undervalued and overvalued by the market and take long and short positions in them respectively. The positions can be taken by trading in the underlying shares or by trading in derivatives that have the same underlying.

The funds maintain a net equity exposure which can be positive or negative depending on the size of the long and short positions.

Event driven strategy

Under this strategy, the hedge funds invest their money on assets in which the investment returns, and risks are associated with specific events. The events can include corporate restructuring, mergers and acquisitions, spin-offs, bankruptcies, consolidations, etc. The hedge fund managers try to capitalize on the price inconsistencies that exist due to such events and use their expertise to generate good returns.

Relative value strategy

Hedge funds use relative value arbitrage to benefit from the discrepancies that exist in the prices of related assets (can be related in terms of historical price correlation, company size, industry, volume traded or several other factors). One of the strategies used under relative value arbitrage is called pairing strategy where hedge funds take positions in assets that are highly correlated (like on-the-run and off-the-run Treasury bonds). Relative value arbitrage strategy can be used on different asset classes including, bonds, equities, indices, commodities, currencies or derivatives.

The hedge fund manager takes a long position in the asset that is underpriced and simultaneously takes a short position in the relative asset that is overpriced. The long positions are highly leveraged which helps the manager to generate absolute returns. But this strategy can also lead to losses if the prices move in the opposite direction.

Distressed securities

Under this strategy, the hedge funds invest in companies that are experiencing distress due to any reason including operational inefficiencies, changes in senior management, or bankruptcy proceedings. The securities of these companies are often available at deep discounts and the hedge funds may see a high probability of reversal. When the reversal kicks-in, the hedge funds exit their positions with high returns.

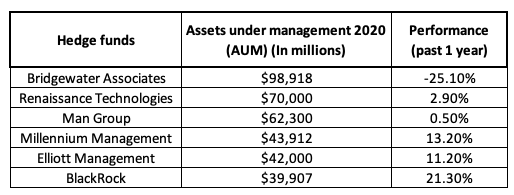

Major hedge funds in the world

Hedge funds are usually ranked according to their asset under management (AUM). Well-known hedge funds are:

Source: https://www.pionline.com/interactive/largest-hedge-fund-managers-2020

Risks associated with hedge funds

Although the investments in hedge funds can generate absolute performance, they also come with high risk which can lead to huge losses to the investors. Some of the commonly associated risks with hedge fund investments are:

- High risk exposure – the hedge funds invest in several asset classes with highly leveraged positions which can multiply the number of losses by several times. This characteristic of hedge funds makes it a risky investment vehicle.

- Illiquidity – Some hedge funds require a lock-in period of 2 to 3 years on the investments made by the accredited investors. This characteristic makes hedge funds illiquid to investors who plan to redeem their investments early.

- High fees and incentive charges – Most of the hedge funds follow a 2 and 20 fees structure. This means 2% fees on the total assets under management (AUM) for an investor and a 20% incentive charge on the returns generated by the hedge funds over the initially invested amount.

- Restricted access – The investments in hedge funds are highly restricted to investors who qualify certain conditions to be deemed as accredited investors. This characteristic of a hedge fund makes it less accessible to investors who are willing to take high risks and invest in these funds.

Useful resources

Lasse Heje Pedersen (2015) Efficiently inefficient – How smart money invests & market prices are determined. Princeton University Press.

Related posts

▶ Youssef LOURAOUI Introduction to Hedge Funds

▶ Shruti CHAND Financial leverage

▶ Akshit GUPTA Initial and maintenance margins in stocks

About the author

Article written by Akshit Gupta (ESSEC Business School, Master in Management, 2019-2022).