Use of AI in investment banking

In this article, Daksh GARG (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2020-2021) explains how the use of AI is transforming the investment banking industry.

What is artificial intelligence?

Artificial intelligence (AI) generally refers to the ability of machines to exhibit human-like intelligence and a degree of autonomous learning. An example could be training machines to recognize patterns and solve complex problems by analyzing those patterns.

Recently there has been a push to work with AI in the investment industry. The conditions to do so are optimal now, or at least more so than in the past. There have great leaps in computer processing abilities, allowing the cost of quality processing tech to decrease. There has also been a sharp increase in the availability of accessible data, which AI can use as needed. This has led to AI being cost effective enough to be used in carrying out investment guidance and analysis.

When can AI add value?

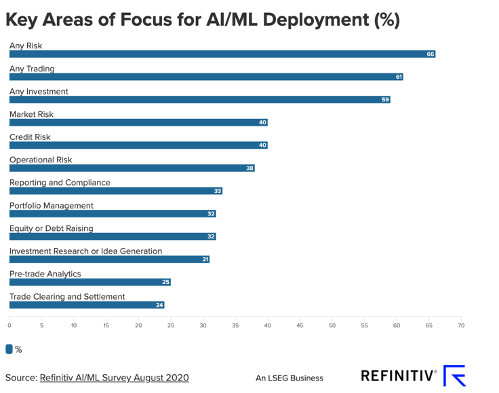

There have been several implementations of AI across the broad spectrum of investment banking , and the rapid pace of adoption paves the way for greater efficiencies in almost all departments and functions. AI has the potential to completely transform the competitive dynamics given its indispensability in investment banking. Much like a chain reaction, investment banks will adopt AI if even one of their peers adopts it, and they already have. This will keep going until all of them rely on the accuracy and effectiveness of AI in their daily trade and investment making decisions. By its very nature, investment banking is a highly competitive industry, and intelligent tools can augment every facet from trade processing to defining structured products and projecting returns on capital, simulating market conditions to support accurate and fast decision making, to even improving the customer experience. AI will also enhance back-office functions, ensuring quicker and easier settlements with minimal human error.

Some current use cases

There are several use cases already being adopted for use of AI and ML in the financial services industry. Some of the prominent examples of companies using AI are:

ING

ING leverages the power of AI to empower bond traders make faster and more accurate pricing decisions, with Katana, an AI tool that uses predictive analytics to ensure traders are quoting the right price when buying and selling bonds for their clients, based entirely on historic and real-time streaming data.

Barclays

The UK investment bank takes its AI initiatives very seriously, with the whole subsidiary dedicated to making the investment bank’s vision of becoming “the most AI savvy workforce in the UK” come true. Payments and trade decisions for their short term structured products are handled by their in-house AI.

UBS

UBS uses machine learning and neural networks for facilitating accurate decision making of its traders on the floor, including the allocation of funds and analyzing real time data to enhance the performance of its high performing traders.

JP Morgan Chase

The American investment banking giant is using AI to interpret loan agreements. As a part of its AI agenda, its now famous Contract Intelligence AI system saved 360,000 hours of mundane work, interpreting and recording contract clauses, freeing up support staff to focus on high value delivery.

The challenges towards wide-spread adoption of AI in investment baking

We cannot assume that AI will replace analysts anytime soon. There are a lot of nuanced human interactions and decisions for the machines to acquire at their current development phase. At this stage in the AI managing processes, leading analysis, and making judgment calls can be very dangerous. Like humans, the machines have to follow training for some time before performing as they are designed. Human supervision on these systems will be essential. After the collapse of many banks in 2008 there has been a wide spread adoption of AI. We are talking about more effective gathering data, from hours to mere seconds. Artificial Intelligence enables investment bankers to focus more on the transactions rather than the immense piles of hard work. There are certain costs towards adoption and a potential job loss also. In 2000, Goldman Sachs’ cash equities trading desk was holding 600 traders. Today, only two traders are left on the desk with machines doing the heavy lifting of the work.

Conclusion

Banks are automating their processes day by day. Despite the increasing and better application of AI in banking and financial industry contributing towards innovation, its adoption in the industry is still at the stage of infancy. Low level of maturity, infrastructure, reluctant industry adoption, increased technical complexity and high costs are the major reasons preventing financial services firms for large scale adoption. But this would change in future.

Why should I be interested in this post?

Artificial Intelligence is emerging in the digital era that we know now, expected to be the next big thing. This article shows the benefits and challenges of AI in the investment banking industry.

Useful resources

McKinsey (19/09/2020) AI-bank of the future: Can banks meet the AI challenge? Accessed November 2, 2021.

Forbes (31/10/2020) The State Of AI Adoption In Financial Services Accessed November 2, 2021.

Related posts on the SimTrade blog

▶ Shruti CHAND Algorithmic Trading

▶ Jayati WALIA Programming Languages for Quants

About the author

The article was written in November 2021 by Daksh GARG (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2020-2021).