Initial and maintenance margins in stocks

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) explains the mechanisms of initial and maintenance margin used in stocks.

Introduction

In financial markets, margin requirements are present in leveraged positions in stock trading. They refer to a percentage of assets that an investor must put aside with his or her own cash or assets (collateral) as a means of protection against the risk exposure to its potential default for the other counterpart.

Margin requirements serve as a guarantee that the investor providing the margins will fulfill its trade obligations. Many exchanges across the world provide leverage facilities to investors for trading in different assets. For example, an investor can use leverage facilities for trading in equities, bonds, exchange rates, commodities, etc. It usually takes the form of derivatives contracts like futures and options. Whenever an investor buys or sells stocks using leverage, it is called buying or selling on margin.

Margin requirements can be categorized as initial and maintenance margin requirements.

Initial margin

Initial margin (or IM) refers to the initial deposit required when an investor opens a position in an underlying asset and amounts to a percentage of the nominal contract value. The amount for the initial margin requirement is calculated in accordance with approved margin models that are based on the market’s regulatory rules. The determination of the initial margin requirement is essentially based on the volatility of the asset being covered. The more volatile the asset, the higher the initial margin requirement.

You can download below the file to learn about the different initial margin requirements at Euronext Clearing used in stock trading (PDF document).

Maintenance margin

When an investor holds an underlying asset on margin, she is required to maintain a minimum margin amount of that asset position in her portfolio to keep her position open and this is known as the maintenance margin. Maintenance margin requirements aim to protect against excess losses and ensure the broker has enough capital to cover any losses the investor may incur. In case the investor is unable to fulfill the maintenance margin requirements, she receives a margin call initiated from the broker to deposit a further amount in order to keep her position open. If she fails to provide adequate maintenance margins, the broker has the power to close her position.

Mechanism of initial and maintenance margins

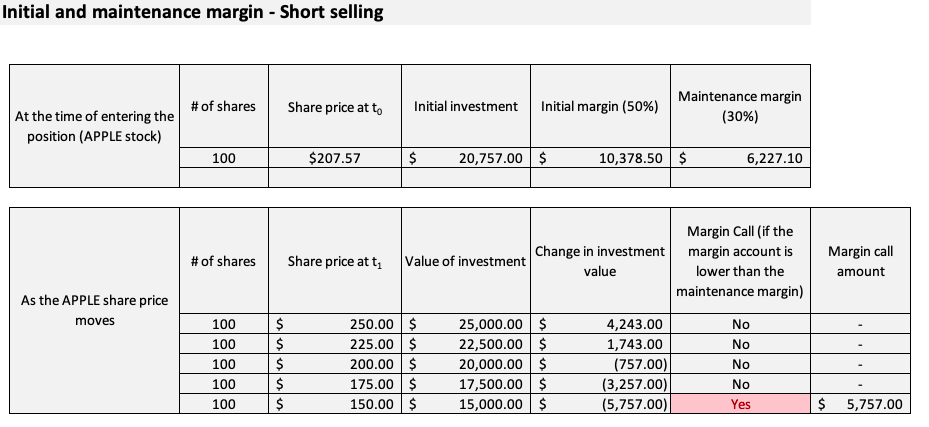

Now, we will see how initial and maintenance margins work in the financial markets with the concept of short selling used in equity trading. Since the short sell involves borrowing stock, the investor is required by its broker to post an initial margin at the time the trade is initiated. For instance, this initial margin is set to 50% of the value of the short sale. This money is essentially the collateral on the short sale to protect the lender of the stocks in the future against the default of the borrower (the investor).

Followed by this, a maintenance margin is required at any point of time after the trade is initiated. The maintenance is taken as 30% of the total value of the position. The short seller has to ensure that any time the position falls below this maintenance margin requirement, he will get a margin call and has to increase funds into the margin account.

Example

Here is an example of a typical case of short selling and its margin mechanism:

You can download below the Excel file for the computation of the Intial and Maintenance Margins for the stocks.

Useful resources

Financial Industry Regulatory Authority (FINRA)

Related posts

▶Akshit GUPTA Initial and Maintenance margin in futures contracts

▶ Youssef LOURAOUI Introduction to Hedge Funds

▶ Akshit GUPTA Analysis of the Big Short movie

▶ Akshit GUPTA Analysis of the Margin call movie

▶ Akshit GUPTA Analysis of the Trading places movie

About the author

Article written in August 2022 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).