Structured Debt in Private Equity: Rated Feeder Funds and Collateral Fund Obligations

In this article, Dante MARRAMIERO (ESSEC Business School, Master in Strategy and Management of International Business (SMIB), 2022-2023) explains structured debt in Private Equity: Rated Feeder Funds and Collateral Fund Obligations. Such debt products open the market for insurance companies.

Structured Financing for Investment

In the intricate world of finance, innovative structures continually emerge to meet investor demands under the current regulatory framework. Among these structures are Rated Feeder Funds (RNFs) and Collateralized Fund Obligations (CFOs), which facilitate investments for investors with specific investment criteria. This happens particularly with insurance companies and asset managers, to access private equity or alternative strategy funds such as growth funds or private credit funds through rated debt instruments. However, structures like RNFs and CFOs are not without their complexities and regulatory scrutiny, especially in light of historical parallels to Collateralized Debt Obligations (CDOs) and the financial crisis of 2008. CFOs and CDOs have exactly the same structure but have different underlying assets: CDOs are based on debt, specifically mortgages while CFOs are based on Private Equity funds.

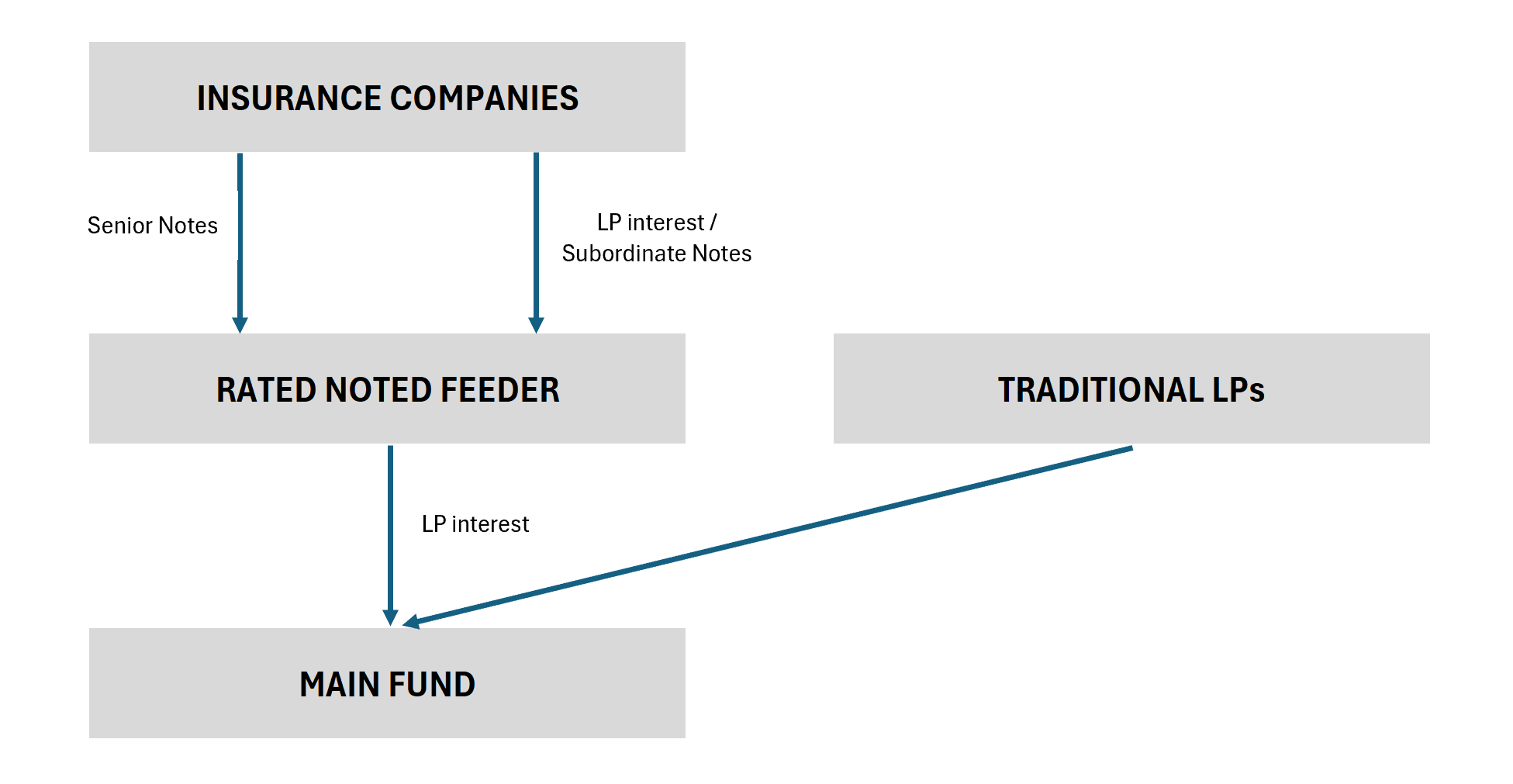

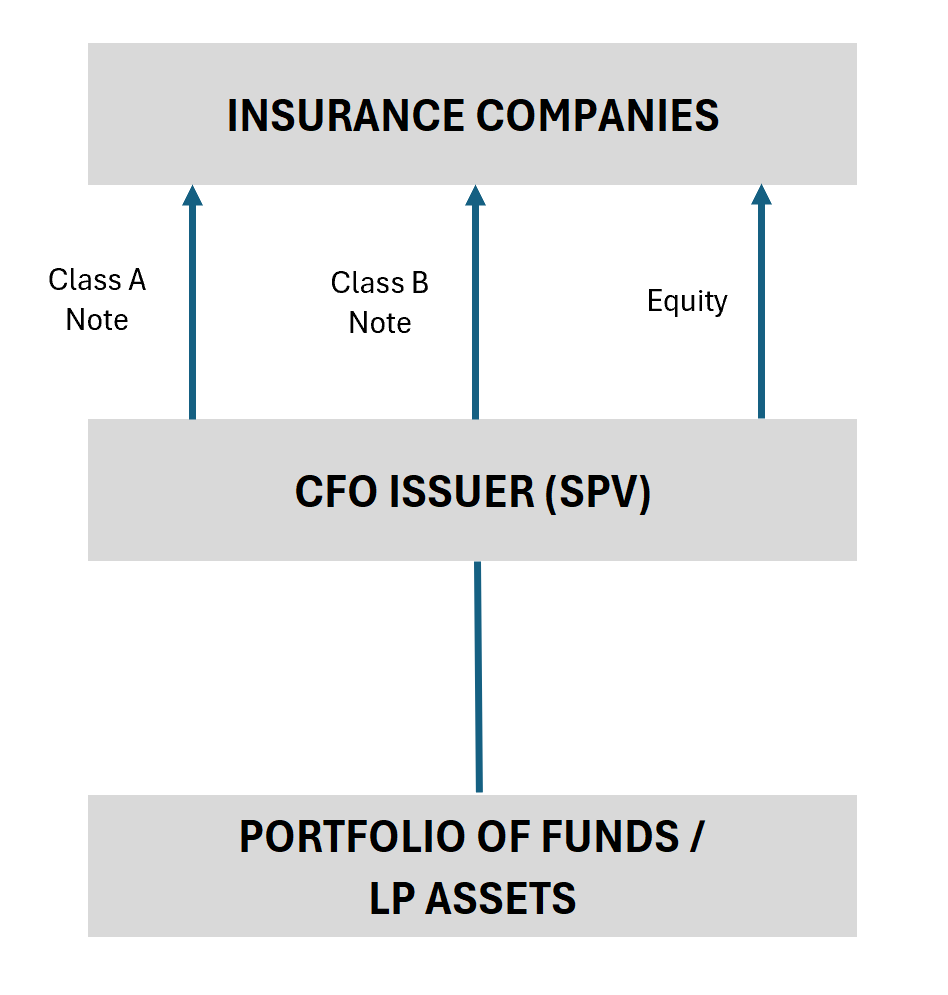

The two figures below represent the financial structure of RNFs and CFOs.

Figure 1. Financial structure of an RNF.

Source: the author.

Figure 2. Financial structure of a CFO.

Source: the author.

Rated Feeder Funds (RNFs) and Collateral Fund Obligations (CFOs) thus represent innovative approaches to structured financing, aiming to bridge the gap between investors and private equity or alternative strategy funds.

Why are CFOs and RNFs attracting insurance companies?

CFOs and RNFs are both characterized by a blend of debt and equity components. These vehicles raise capital by issuing debt securities, which are then used to invest in a diversified portfolio of assets across multiple funds. The presence of both debt and equity elements not only provides investors with exposure to various underlying assets (in which the various funds have invested) but also introduces a diversification effect that can attract capital seeking lower risk profiles. The debt issued by CFOs typically undergoes scrutiny by rating agencies to determine their creditworthiness, thereby providing assurance to investors regarding the quality of the investment.

On the other hand, RNFs operate through a structure where investors’ capital is channeled through a special purpose vehicle (SPV) or feeder fund. This feeder fund then invests in a master fund managed by the sponsor. This setup allows investors to gain exposure to the underlying assets of the master fund without directly participating in its operations. RNFs, similar to CFOs, offer rated debt instruments to investors, providing them with a regulated and transparent avenue to access private fund investments.

Regulatory Considerations and Risk Mitigation

One of the key attractions of RNFs and CFOs is the regulatory capital treatment they offer to institutional investors. By investing through rated debt instruments, regulated institutions such as insurance companies can benefit from reduced capital requirements compared to direct equity investments in underlying funds.

However, regulatory scrutiny is a critical aspect of these structures, particularly in jurisdictions like the United States and Europe. In the US, concerns have been raised regarding the applicability of risk retention rules, especially in CFO transactions where repayment primarily depends on limited partnership interests. Similarly, European regulations such as the UK and EU Securitization Regulations impose stringent requirements.

In the US, currently, the NAIC – National Association of Insurance Commissioners has blocked investments from insurance companies in CFOs but is working on possible ways to regulate the market and open the investment again in the future.

Conclusion: Balancing Innovation with Regulatory Compliance

Rated Feeder Funds (RNFs) and Collateral Fund Obligations (CFOs) represent innovative solutions for investors seeking exposure to private funds while optimizing regulatory capital requirements. However, their structural complexities and regulatory scrutiny, particularly in the aftermath of the 2008 financial crisis, underscore the importance of due diligence and compliance.

As financial markets evolve, the challenge lies in striking a balance between innovation and regulatory compliance. While RNFs and CFOs offer opportunities for capital efficiency and investment diversification, they must navigate a complex regulatory landscape to ensure stability and mitigate systemic risks. Only through careful consideration of lessons from history and adherence to regulatory guidelines can these structured financing solutions fulfill their promise in the modern financial ecosystem.

Example of precedent transaction: Tikehau raise a $300 million CFO

Tikehau Capital has raised $300 million collateralized fund obligation backed by cashflows from commitments to its direct lending and private debt secondary strategies. The CFO’s assets consisted of interests in Tikehau’s own debt funds as well as third-party managed private debt funds originated by the firm’s private debt secondaries strategy, according to a statement from Jefferies, which advised on the transaction.

Specifically, the CFO assets were largely Tikehau-managed funds: the direct lending and private debt secondaries which were held on the firm’s balance sheet. This transaction allowed Tikehau to raise capital from the big American insurance companies that otherwise would have considered investing in Tikehau’s funds as out of scope.

Why should I be interested in this post?

This post could be particularly intriguing for business students because it highlights diverse methods of fundraising within the private equity sector. This knowledge could benefit students aiming for careers in finance and those seeking to secure funding for their own ventures. Moreover, it provides valuable insights into the pivotal role that debt plays in financing strategies. Furthermore, it could be a good competitive advantage during Private Equity interviews to know about structured finance as it is an emerging topic in the Private Equity industry and not everyone is up to date with it!

Related posts on the SimTrade blog

▶ Colombe BOITEUX Le métier de structureur

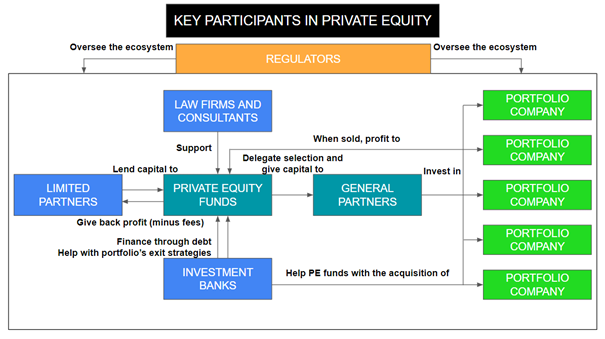

▶ Matisse FOY Key participants in the Private Equity ecosystem

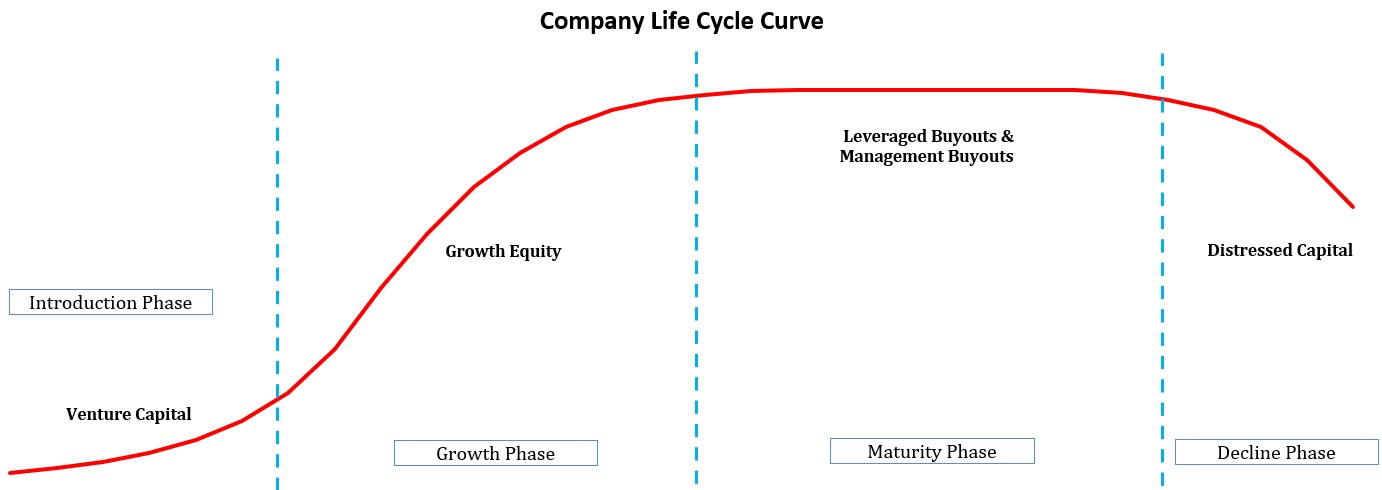

▶ Lilian BALLOIS Discovering Private Equity: Behind the Scenes of Fund Strategies

▶ Alessandro MARRAS Top 5 Private Equity firms

Useful resources

Hanson R. (08/11/2023) Collateralised fund obligations and rated note feeders: options for structuring investment into private funds Morgan Lewis

Cadwalader Brief Primer on CFOs and Rated Feeder Funds

About the author

The article was written in May 2024 by Dante MARRAMIERO (ESSEC Business School, Master in Strategy and Management of International Business (SMIB), 2022-2023).