Yield Factor

In this article, Youssef LOURAOUI (ESSEC Business School, Global Bachelor of Business Administration, 2017-2021) presents the yield factor, which is based on a risk factor that aims to get exposure to companies that are regarded to be inexpensive and have a history of consistent and rising dividends.

This article is structured as follows: we begin by defining the yield factor and reviewing academic studies. The MSCI Yield Factor Index, which is well used as a benchmark in the asset management industry, is next presented in terms of performance and risk-return trade-off. We showcase the ETF market for investors looking to profit from the yield factor.

Definition

In the world of investing, a factor is any aspect that helps explain an asset’s long-term risk and return performance. In the late 1970s, the portfolio management industry’s objective was to capture the market return on a portfolio. As a result of Markowitz and Tobin’s earlier research, William Sharpe, John Lintner, and Jan Mossin independently developed the Capital Asset Pricing Model (CAPM). Because it enabled investors to properly value assets in terms of systematic risk, the CAPM was a significant evolutionary step forward in the theory of capital market equilibrium (Mangram, 2013).

Eugene Fama and Kenneth French, following the CAPM’s original work, developed the Fama-French Three-Factor model in 1993 to solve the CAPM’s inadequacies. It claims that, in addition to the market risk component of the CAPM, two other factors have an effect on the returns on securities and portfolios: market capitalization (called the “size” factor) and the book-to-market ratio (referred to as the “value” factor). Other factor characteristics were developed to capture some additional performance as financial research advanced and significant contributions were made.

The yield factor is based on a risk factor that aims to get exposure to companies that are regarded to be inexpensive and have a history of consistent and rising dividends (Arnott and Asness, 2003).

Academic research

Since 1995, and until a recent increase in response to plummeting earnings, market wide dividend-payout ratios in the United States had been in the lowest historical decile, reaching record lows between late 1999 and mid-2001. In other words, earnings retention rates have lately reached or above all-time highs (Arnott and Asness, 2003). Meanwhile, despite the dramatic decline in stock prices since early 2000, price-to-earnings and price-to-dividend ratios remain high by historical standards. With recent valuation ratios so high and dividend payouts so low, the only way future long-term stock returns can approach historical norms is if profits growth accelerates significantly. Certain market analysts, including several prominent Wall Street strategists, do predict extraordinary long-term growth. They attribute this confidence to a variety of factors, including previous policies of low dividend payment ratios. According to the financial literature (Arnott and Asness, 2003), the attractiveness for the yield factor could be explained by the following reasons:

- Corporate executives are averse to dividend cuts. Perhaps a high payout ratio reflects managerial confidence in the future stability and increase of earnings, whilst a low payout ratio reflects the reverse. This confidence (or lack thereof) may be founded on public as well as private data

- Another explanation compatible with the link we discovered experimentally is that businesses occasionally retain an excessive amount of revenue because of managers’ ambition to construct empires (Jensen, 1986). This conduct does not have to be malicious: A seemingly innocuous coincidence policy of profit retention may end up fostering empire development by accumulating an enticing cash hoard. On the other hand, while funding via share issue and paying significant dividends may be less tax effective, it may subject management to greater scrutiny, eliminate conflicts of interest, and so limit empire building

The article concluded that the empirical evidence supports a world in which managers possess private information that motivates them to pay out a large share of earnings when they are optimistic that dividend cuts will not be necessary and a small share when they are pessimistic, possibly to ensure that dividend payouts are maintained (Arnott and Asness, 2003). Alternatively, the findings match a scenario in which low payment ratios result in inefficient empire building and the backing of less-than-ideal initiatives and investments, resulting in subpar later growth, whereas high payout ratios result in more carefully selected enterprises (Arnott and Asness, 2003). Additionally, the tale of empire-building matches the first macroeconomic facts well. At the moment, these explanations are speculative; further work on distinguishing between conflicting narratives is necessary.

MSCI Yield Factor Index

MSCI Factor Indexes are rules-based, transparent indexes that target equities with favorable factor qualities, as determined by academic discoveries and empirical outcomes, and are designed for easy implementation, replicability, and usage in both standard indexed and active portfolios.

The MSCI Yield Factor Index concentrate on firms that pay a high dividend yield, but exclude those that lack dividend sustainability, consistency, and quality. It considers securities that fulfill these screening criteria (MSCI Factor research, 2021). Only those having a dividend yield more than 30% of the parent market capitalization index are included.

The yield factor is classified as a “defensive” component, which means that it has historically benefited from economic contraction. For several reasons, investors may be interested in the stock dividend income connected with the yield component. The method has been adopted by institutional investors seeking income outside of the fixed income industry. For example, an insurance business that requires a consistent revenue stream to cover claims may lean its portfolio toward the yield component to accomplish this goal. Additionally, historically, high dividends have accounted for a sizable share of long-term overall portfolio performance (MSCI Factor research, 2021).

Dividend investment is as ancient as stocks, having played a critical part in the growth of firms throughout history. Benjamin Graham and David Dodd, pioneering economists, memorably described dividend distributions as “the primary function of a corporate organisation… A successful business is one that can pay dividends on a consistent basis and, presumably, improve the rate over time” (MSCI Factor research, 2021).

Numerous ideas attempt to explain why high-dividend equities perform so well. One observes that yield investors have favored current dividend payouts above uncertain future capital returns. Additionally, they have viewed dividend increases as a predictor of future success (MSCI Factor research, 2021). Dividend yields have historically been good predictors of profit growth, according to several studies (MSCI Factor research, 2021). A naive high-yielding equity strategy may fall victim to a variety of “yield traps,” including those caused by momentarily high earnings, big dividends, or decreasing stock prices (MSCI Factor research, 2021).

Performance of the MSCI Yield Factor Index

Figure 1 compares the MSCI Yield Factor Index’s performance to those of other factors from May 1999 to May 2020. All indices are rebalanced on a 100-point scale to ensure consistency in performance and to facilitate factor comparisons.

Figure 1. Performance of the MSCI Yield Factor Index from 1999-2020.

Source: MSCI Factor research (2021).

Since 1999, the MSCI Yield Factor Index has consistently earned excess gains of 0.15 percent per year above the MSCI World Index analysed (MSCI Factor research, 2021).

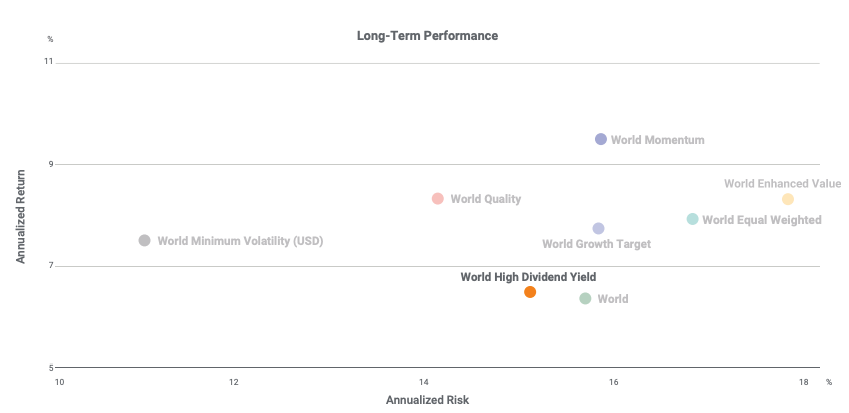

Risk-return profile of MSCI Yield Factor Index

Figure 2 shows the MSCI Yield Factor Index compared to other factors over the period May 1999 – May 2020 in terms of risk/reward. The risk-return trade-off states that the potential return rises with an increase in risk. Individuals connect low levels of uncertainty about future returns with low potential returns, while high levels of uncertainty or risk are associated with large potential returns. According to the risk-return trade-off, an investor’s money can generate higher returns only if the investor is willing to endure a higher risk of loss (Figure 2).

Figure 2. Risk-return profile of MSCI Yield Factor Index compared to a peer group.

Source: MSCI Factor research (2021).

High-yield equity factor investing entails screening for dividends that are sustainable over time. With equity market involvement, it has generated yield income. The MSCI High Dividend Yield Indexes are designed to track the performance of firms that have historically paid steady and rising dividends while avoiding value traps. Outside of fixed income, yield seekers have found the equity yield factor index to have several attractive characteristics, including defensive income, a long-term positive risk premium, and diversification against other factors.

ETFs to capture the Yield factor

Let us recall that an Exchange-Traded Fund (ETF) is an investment vehicle that seeks to mirror the performance of a benchmark like an equity index and is traded on a continuous basis during the day like stocks. By investing in ETFs, an investor gains access to a plethora of diversification options through several asset classes (equity, bonds, currency, commodity, real estate, etc.).

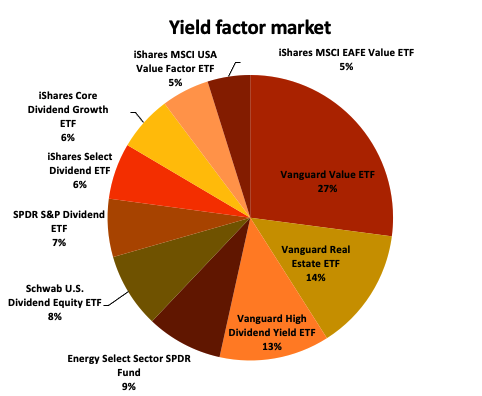

Figure 3 illustrates the overall ETF distribution of the major providers of yield factor ETFs in terms of percentage of asset under management. By examining the market overview for minimal volatility factor investments, we can observe Vanguard’s dominance in this factor investing market with 53.46%, representing nearly 164 billion in term of market value in the of the overall yield factor ETF market retained in this benchmark.

Figure 3. Yield factor ETF market.

Source: etf.com (2021).

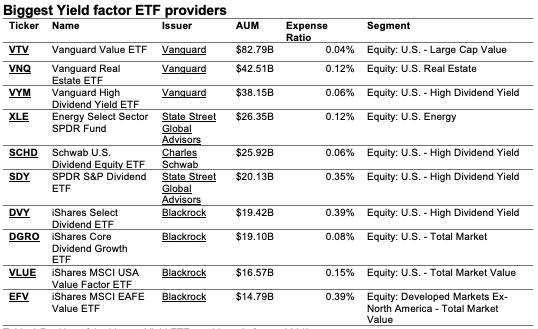

Table 1 gives more detailed information about the biggest yield factor ETF providers: the asset under management (AUM), expense ratio (ER) and the segment for the investments.

Table 1. Ranking of the biggest Yield ETF providers.

Source: etf.com (2021).

Why should I be interested in this post?

If you are an undergraduate or graduate student in a business school or at the university, you may have seen in your 101 finance course the CAPM related to the market factor. This post makes aware of the existence of another risk factor priced by the market.

If you are an investor, you may consider adding an exposure to yield factor to enhance the overall portfolio return.

Related posts on the SimTrade blog

▶ Youssef LOURAOUI Minimum Volatility

▶ Youssef LOURAOUI Value Factor

▶ Youssef LOURAOUI Size Factor

▶ Youssef LOURAOUI Momentum Factor

▶ Youssef LOURAOUI Quality Factor

▶ Youssef LOURAOUI Growth Factor

Useful resources

Academic research

Arnott, R. and Asness, C., 2003. Surprise! Higher Dividends = Higher Earnings Growth. Financial Analysts Journal, 59(1): 70-87.

Jensen, M., 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. The American Economic Review, 76(2): 323-329.

Hasaj, M., Sherer, B., 2021. Covid-19 and Smart-Beta: A Case Study on the Role of Sectors. EDHEC-Risk Institute Working Paper.

Mangram, M.E., 2013. A simplified perspective of the Markowitz Portfolio Theory.Global Journal of Business Research, 7(1): 59-70.

Pagano, M., Wagner, C., Zechner, J., 2020. Disaster Resilience and Asset Prices, Working paper.

Business analysis

etf.com, 2021. Biggest Yield ETF providers.

MSCI Investment Research, 2021. Factor Focus: Yield.

About the author

The article was written in September 2021 by Youssef LOURAOUI (ESSEC Business School, Global Bachelor of Business Administration, 2017-2021).

Pingback: Value Factor - SimTrade blogSimTrade blog

Pingback: Minimum Volatility Factor - SimTrade blogSimTrade blog

Pingback: Momentum Factor - SimTrade blogSimTrade blog

Pingback: Size Factor - SimTrade blogSimTrade blog

Pingback: Growth Factor - SimTrade blogSimTrade blog

Pingback: Quality Factor - SimTrade blogSimTrade blog

Pingback: Origin of factor investing - SimTrade blogSimTrade blog

Pingback: Factor Investing - SimTrade blogSimTrade blog

Pingback: VIX index - SimTrade blogSimTrade blog