My experience as a credit analyst at Amundi Asset Management

In this article, Jayati WALIA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) shares her apprenticeship experience as an assistant credit analyst in Amundi which is a leading European asset management firm.

About Amundi

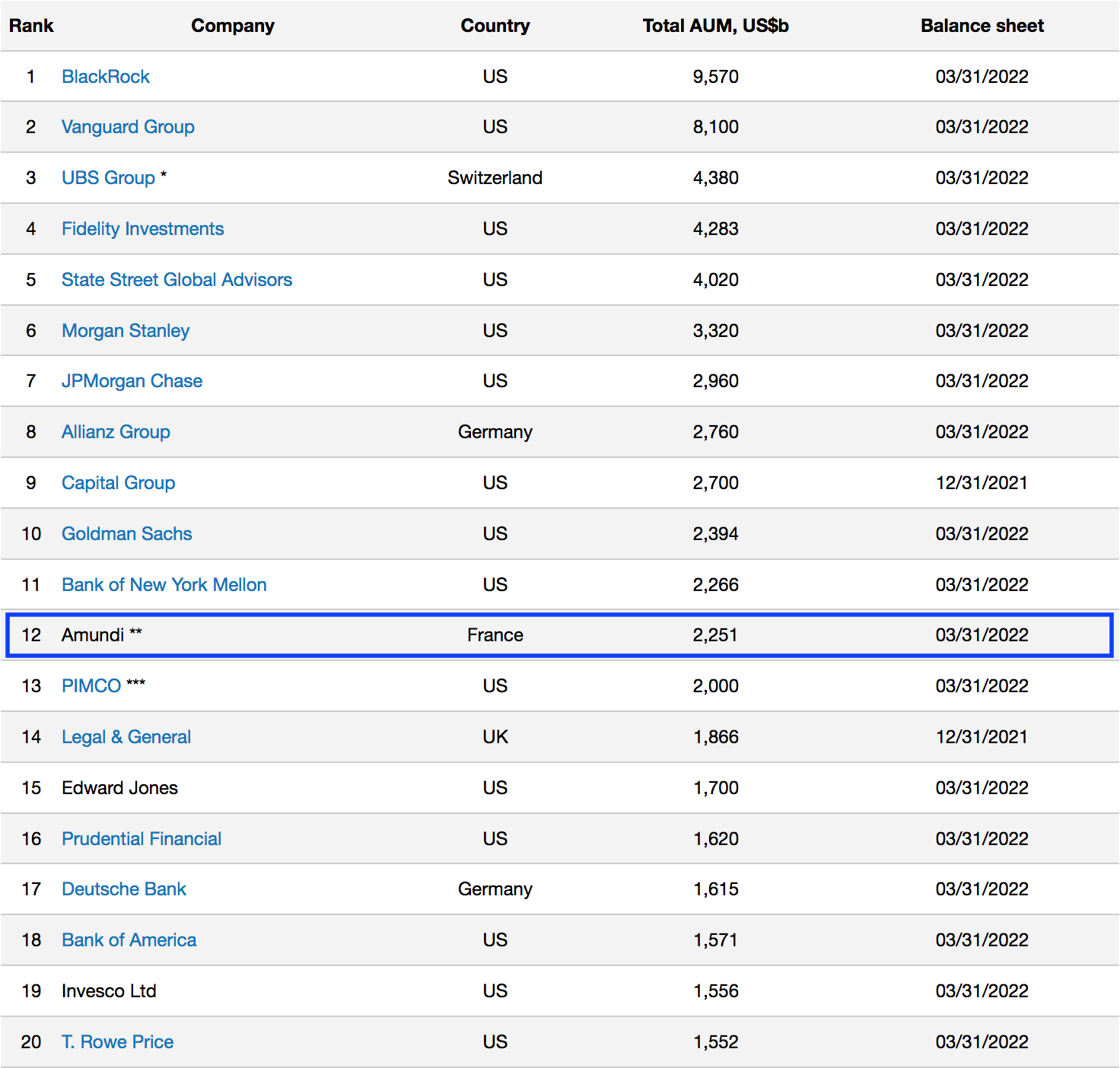

Amundi is a French asset management firm with currently over €2 trillion asset under management (AUM). It ranks among the top 15 asset managers in the world (see Table 1 below). Amundi is a public company quoted on Euronext with the highest market capitalization in Europe among asset management firms (€10.92 billion as of May 20, 2022). Amundi was founded in 2010 following a merger between Crédit Agricole Asset management and Société Générale Asset management.

Table 1. Rank of asset management firms by asset under management (AUM).

Source: www.advratings.com

Source: www.advratings.com

Amundi has over 100 million clients (retail, institutional and corporate) and it offers a range of savings and investment solutions, services, advice, and technology in active and passive management, in both traditional and real assets.

Source: Amundi

Source: Amundi

My apprenticeship

My team at Amundi, Fixed Income Solutions, works in coordination with all the teams of the firm’s global bond management platform. The team’s work revolves majorly around product development on Amundi’s Fixed Income offerings including technological work, generating new investment ideas, and bringing them to clients both institutional and distributors. My position in the team is Assistant Credit Analyst.

Missions

My work primarily involves setting up tools and procedures linked to various investment solutions and portfolios handled by team. The tools are developed through algorithms in programming languages (mainly Python) and their functionalities range from analysis of market signals for investment, pricing of securities, risk monitoring and reporting. I worked on fixed-income portfolio construction and optimization algorithms implementing modern portfolio theory.

My daily responsibilities include report production related to daily fund activity such as monitoring fund balance and calculation of regulatory financial ratios to check for alignment against specific risk constraints. Additionally, I also participate in market research for new investment ideas through analysis of various fixed-income securities and derivatives.

Required skills and knowledge

The work and missions involved in my role require technical knowledge especially programming skills in Python, quantitative modelling and an understanding of financial markets, products and concepts of valuation, various types of risks and financial data analysis. Other behavioral skills such as project management, autonomy and interpersonal communication are also essential.

Three key financial concepts

The following are three key concepts that are used regularly in my work at Amundi:

Credit ratings

Credit ratings are extensively used in fixed income. They reflect the creditworthiness of a borrower entity such as a company or a government, which has issued financial debt instruments like loans and bonds.

Credit risk assessment for companies and governments is generally performed by rating agencies (such as S&P, Moody’s and Fitch) which analyze the internal and external, qualitative and quantitative attributes that drive the economic future of the entity.

Bonds can be grouped into the following categories based on their credit rating:

- Investment grade bonds: These bonds are rated Baa3 (by Moody’s) or BBB- (by S&P and Fitch) or higher and have a low rate of default.

- Speculative grade bonds: These bonds are rated Ba1 (by Moody’s) or BB+ (by S&P and Fitch) or lower and have a higher rate of default. They are thus riskier than investment grade bonds and issued at a higher yield. Speculative grade bonds are also referred to “high yield” and “junk bonds”.

Often, some bonds are designated “NR” (“not rated”) or “WR” (“withdrawn rating”) if no rating is available for them due to various reasons, such as lack of credible information.

Credit spreads

Credit spread essentially refers to the difference between the yields of a debt instrument (such as corporate bonds) and a benchmark (government or sovereign bond) with similar maturities but contrasting credit ratings. It is measured in basis points and is indictive of the premium of a risky investment over a risk-free one.

Credit spreads can tighten or widen over time depending on economic and market conditions. For instance, times of financial stress cause an increase in credit risk which leads to spread widening. Similarly, when markets rally, and credit risk is low, spreads tighten. Thus, credit spreads are an indicator of current macro-economic and market conditions.

Credit spreads are used by market participants for investment analysis and bond valuations.

Duration and convexity

Bond prices and interest rates share an inverse relationship, i.e., if interest rates go up, bond prices move down and similarly if interest rates go down, bond prices move up. Duration measures this price sensitivity of bonds with respect to interest rates and helps analyze interest-rate risk for bonds. Bonds with higher duration are more sensitive to interest rate changes and hence more volatile. Duration for a zero-coupon bond is equal to its time to maturity.

While duration is linear measure of bond price-interest rates relationship, in real life, the curve of bond prices against interest rates is convex i.e., the duration of the bonds also changes with change in interest-rates. Convexity measures this duration sensitivity of bonds with respect to interest rates.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Alexandre VERLET Classic brain teasers from real-life interviews

▶ Louis DETALLE My professional experience as a Credit Analyst at Société Générale.

▶ Jayati WALIA Credit risk

▶ Jayati WALIA Fixed-income products

Useful resources

About the author

The article was written in August 2022 by Jayati WALIA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).

1 thought on “My experience as a credit analyst at Amundi Asset Management”

Comments are closed.