In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) provides an overview of the inverse relationship between gold price and interest rate, and how various factors affect the relation between them.

Introduction

Gold and interest rates often exhibit an inverse relationship, meaning that as interest rates rise, gold prices tend to fall, and vice versa. Unlike stocks or bonds, gold doesn’t generate income (like dividends or interest) and is often used as a hedge against inflation or economic uncertainty. For instance, during the early 1980s, the U.S. Federal Reserve raised interest rates sharply to combat high inflation, leading to a short-term drop in gold prices. In 2022, the Fed’s aggressive rate hikes led to a decrease in gold’s appeal, which resulted in a relatively stable but pressured gold market. However, this relationship is not always straightforward and can be influenced by various factors.

The Inverse Relationship

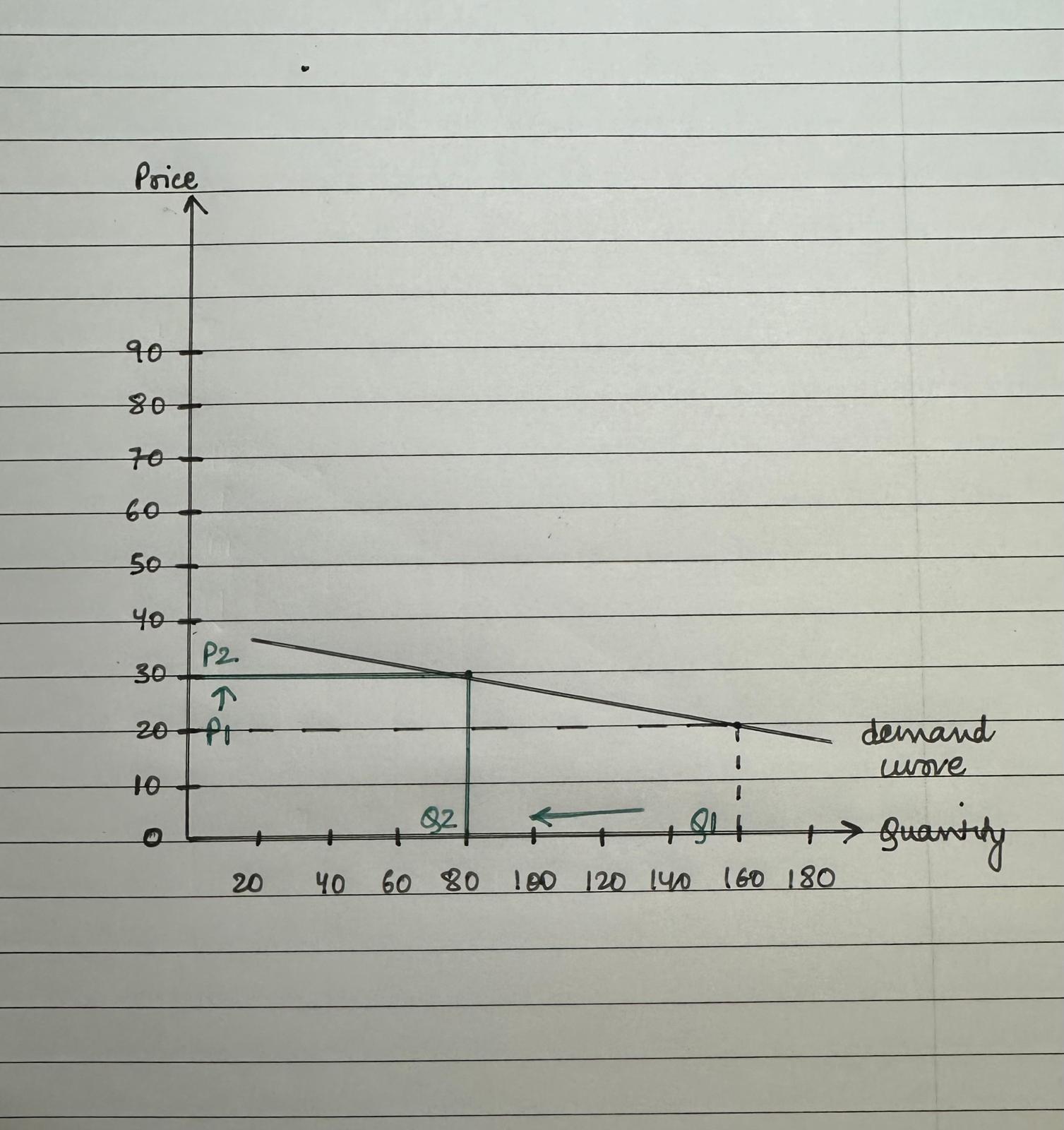

This refers to the mostly known two factors that cause the inverse relationship between gold price and interest rate, namely opportunity costs and currency exchange rates.

Opportunity Cost

One of the primary reasons for this inverse correlation is the opportunity cost of holding gold. When interest rates rise, traditional investments like bonds and fixed deposits become more attractive due to higher yields. As a result, investors may shift their funds from gold to these higher-yielding assets, reducing demand for gold and consequently its price.

Currency Exchange Rates

Another factor is the impact of interest rates on currency exchange rates. Rising interest rates can strengthen a country’s currency, particularly the US Dollar. A stronger dollar can make gold, which is priced in US dollars, more expensive for international buyers, leading to decreased demand and lower prices.

Or is it a complex relationship?

It is important to note that the relationship between gold and interest rates is not always straightforward. Other factors, such as geopolitical tensions, inflation expectations, and market sentiment, can also influence gold prices. For instance, during periods of economic uncertainty or geopolitical turmoil, investors may seek refuge in gold, even if interest rates are rising.

To navigate this complex relationship, investors should consider the following:

- Diversification: Gold can be a valuable addition to a diversified portfolio, providing a hedge against inflation and economic uncertainty.

- Long-Term Perspective: A long-term investment horizon can help mitigate short-term price fluctuations and focus on the underlying value of gold as a store of value.

- Market Timing: While it’s challenging to accurately predict interest rate movements and their impact on gold prices, investors can consider adjusting their gold holdings based on economic indicators and market sentiment.

The Historical Perspective

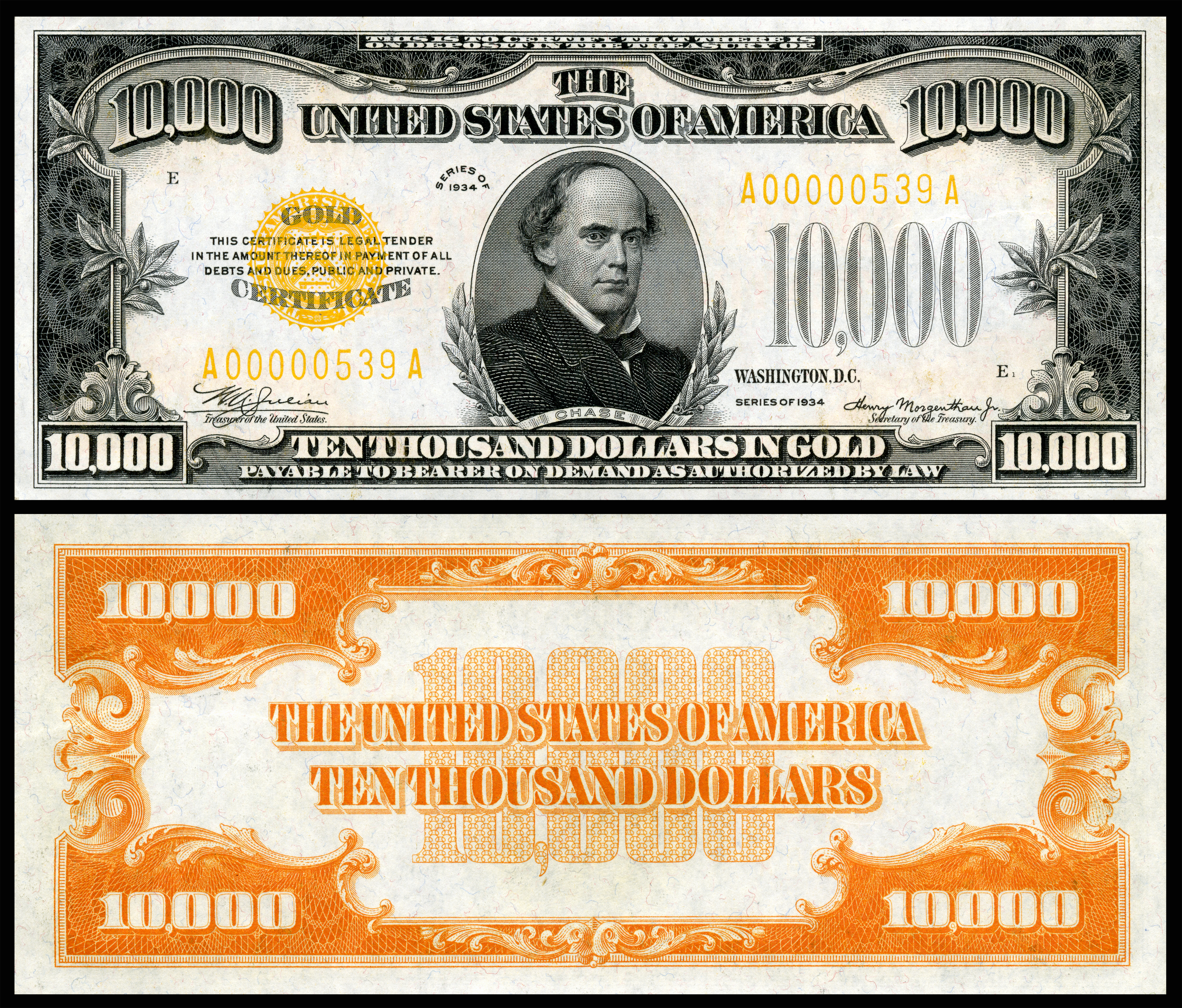

Historically, gold has been seen as a hedge against inflation. When inflation rises, the purchasing power of fiat currencies declines, making gold an attractive investment. However, rising interest rates can sometimes counteract this inflationary pressure.

The 1970s

A period of high inflation and economic uncertainty led to a surge in gold prices. However, as central banks tightened monetary policy and interest rates rose, gold prices began to decline.

The 2000s

The global financial crisis of 2008 and subsequent quantitative easing measures by central banks led to a significant increase in gold prices. However, as central banks began to normalize monetary policy in the late 2010s, gold prices declined.

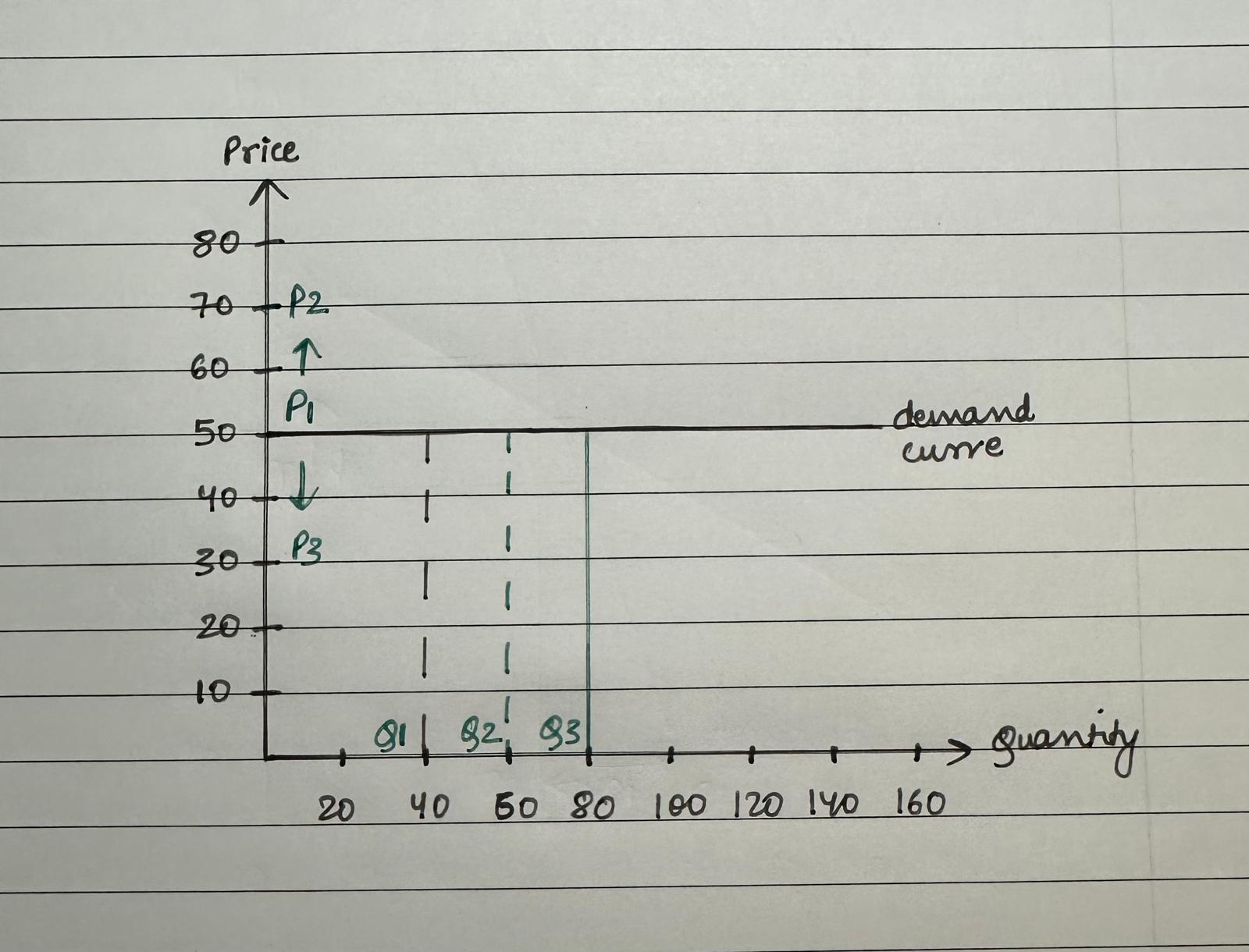

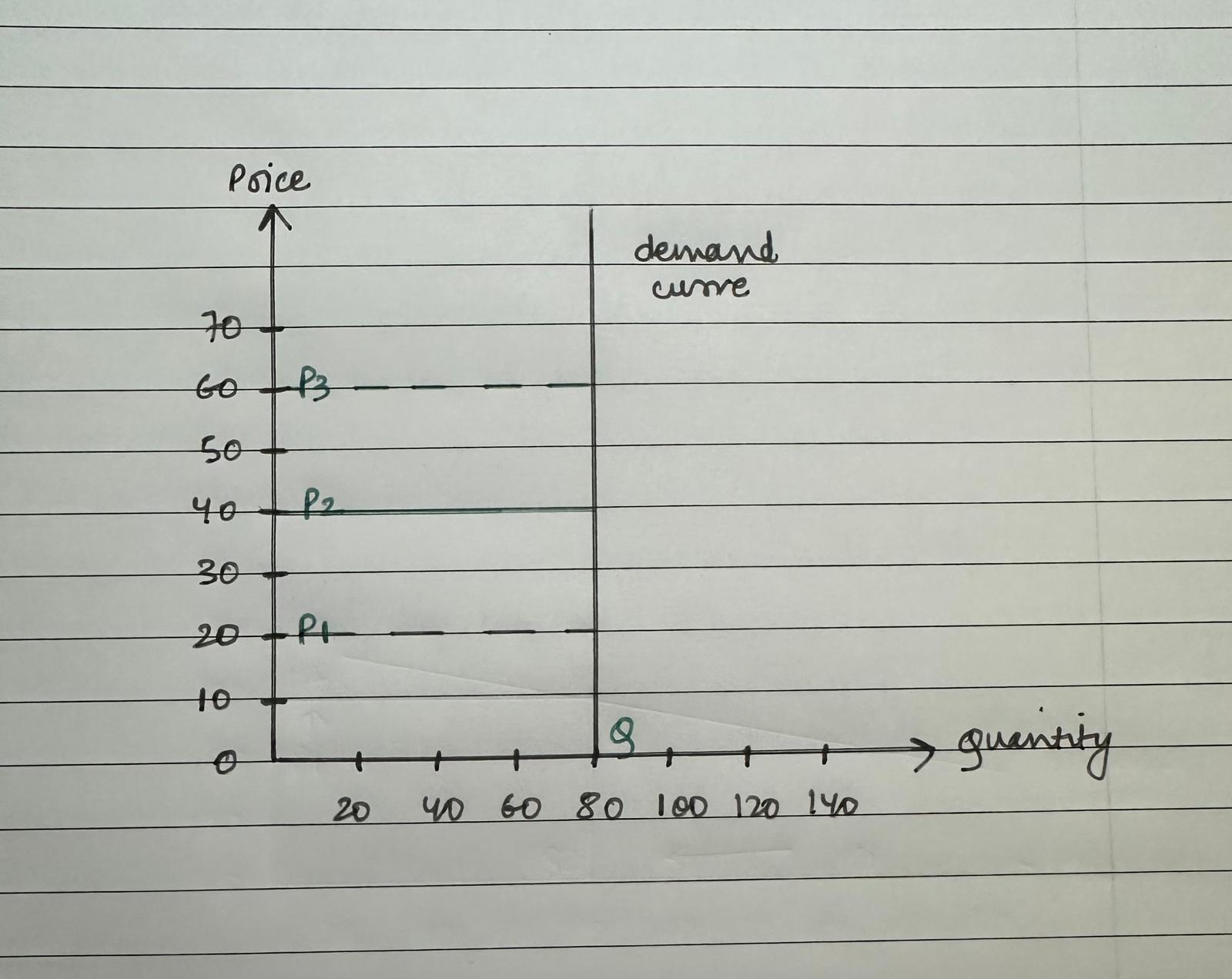

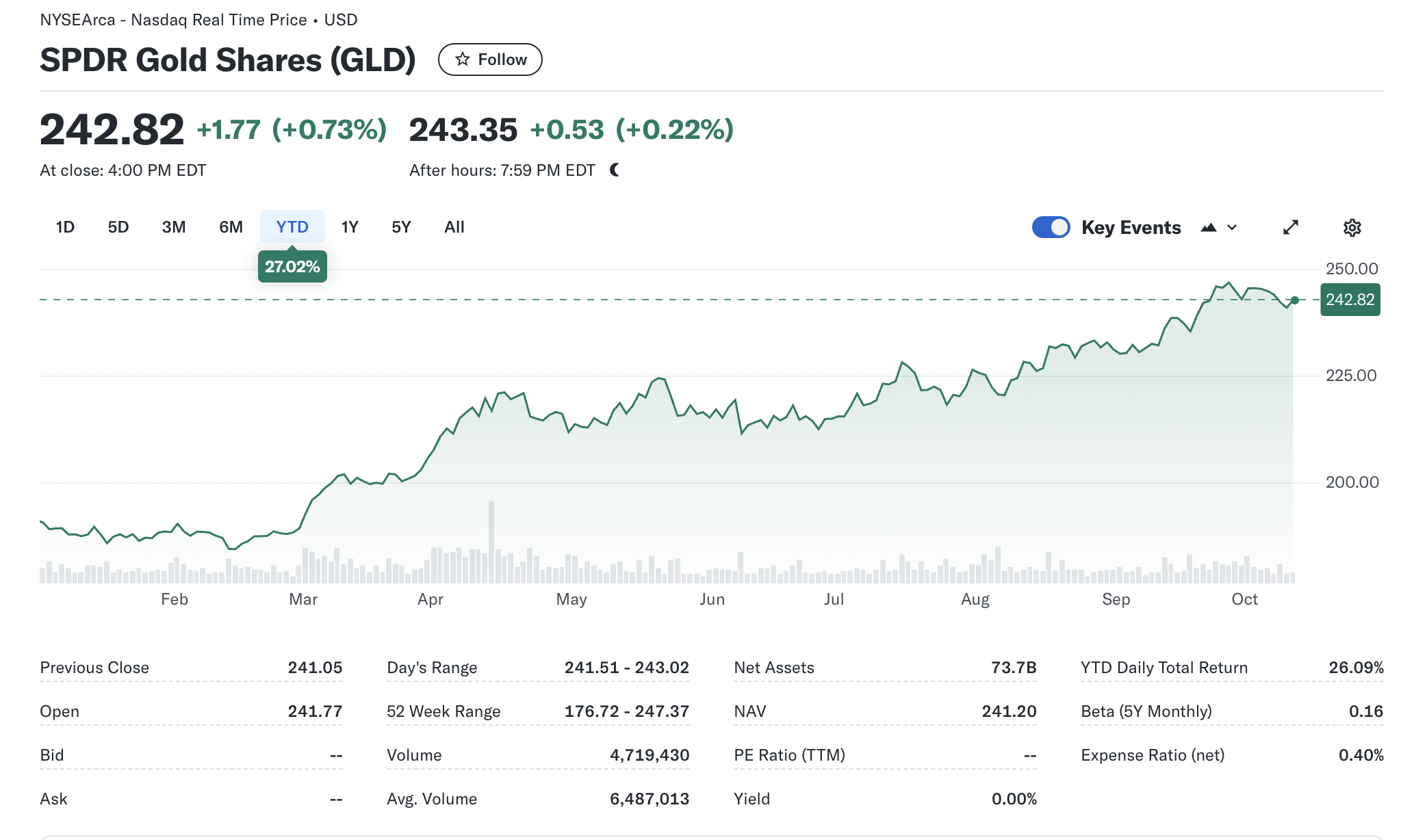

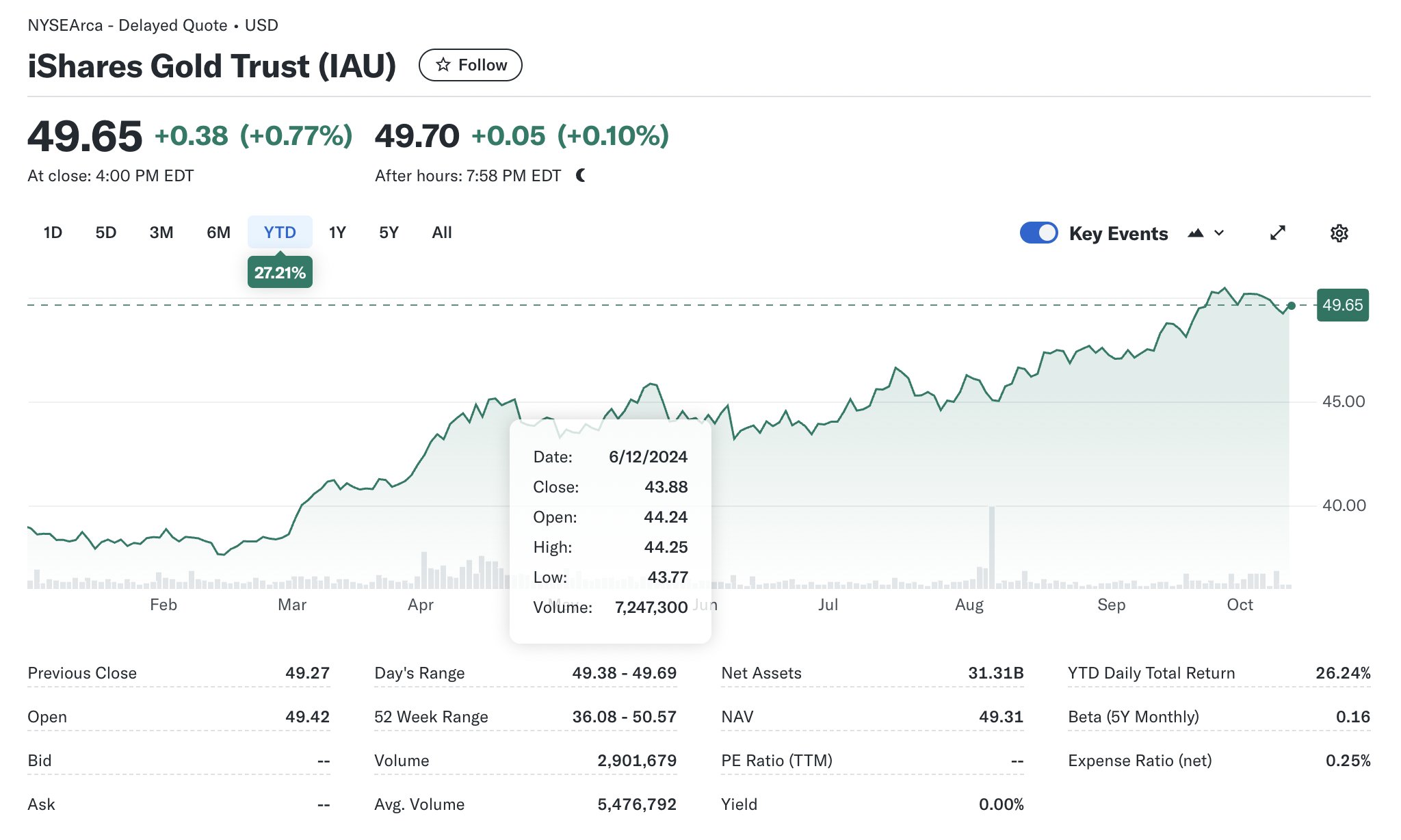

Many people believe that the price of gold is inversely related to interest rates. However, it is only partially true. In fact, gold prices are driven not by nominal rates (which are not adjusted for inflation), but by real rates (which are nominal rates adjusted for inflation). Investors should remember that what really matters for gold are real interest rates, not the federal funds rate or nominal yields.

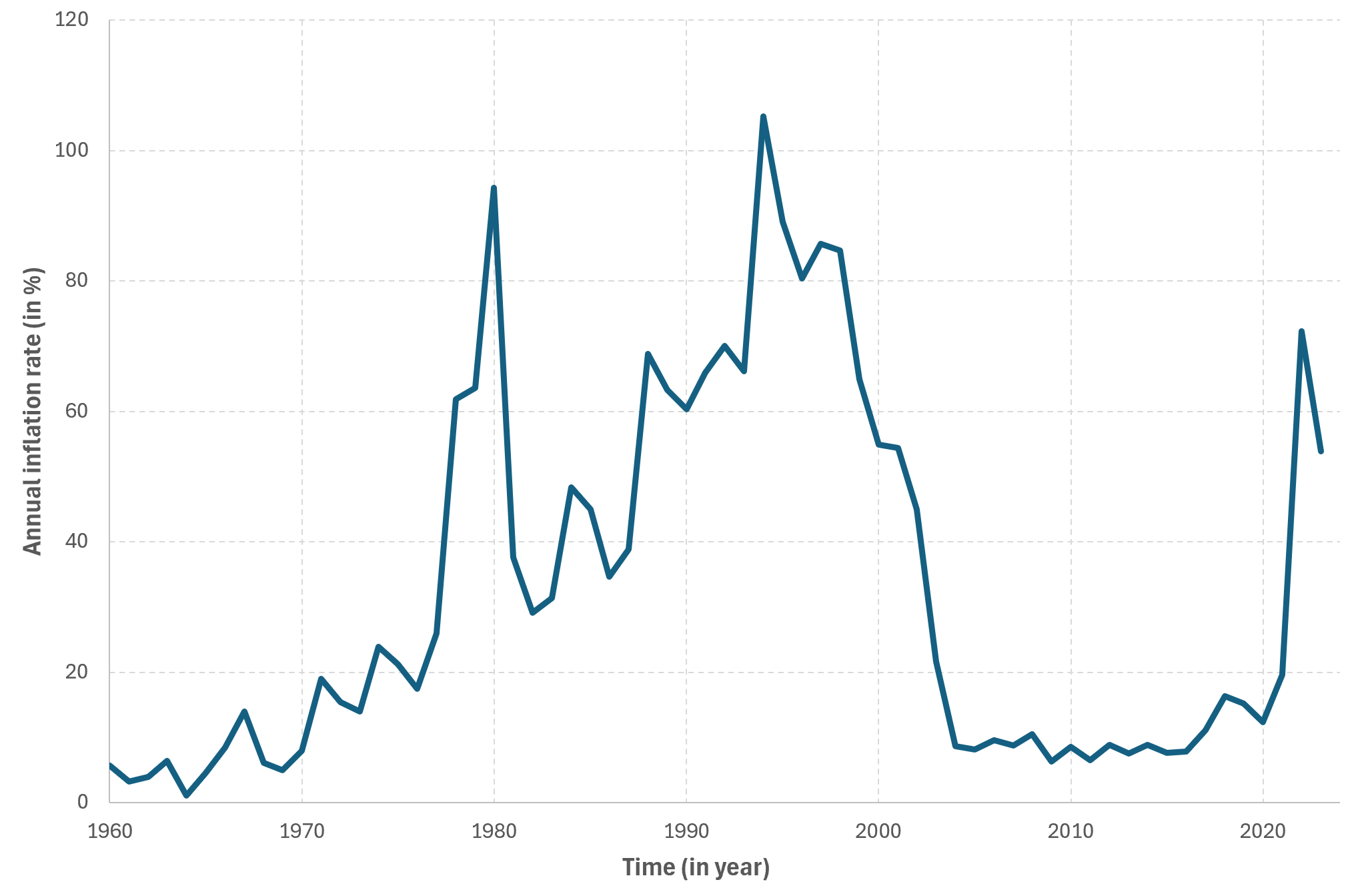

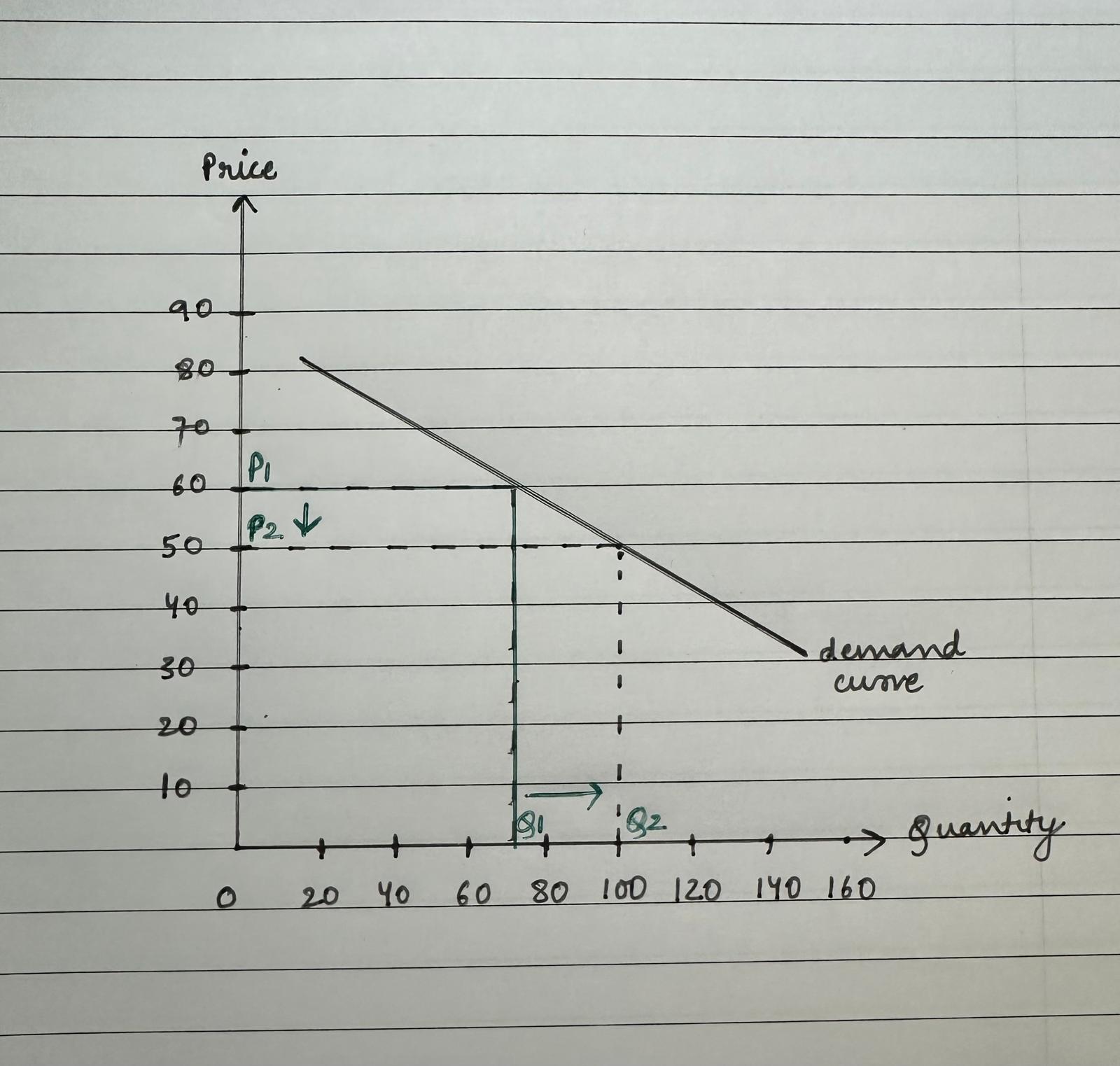

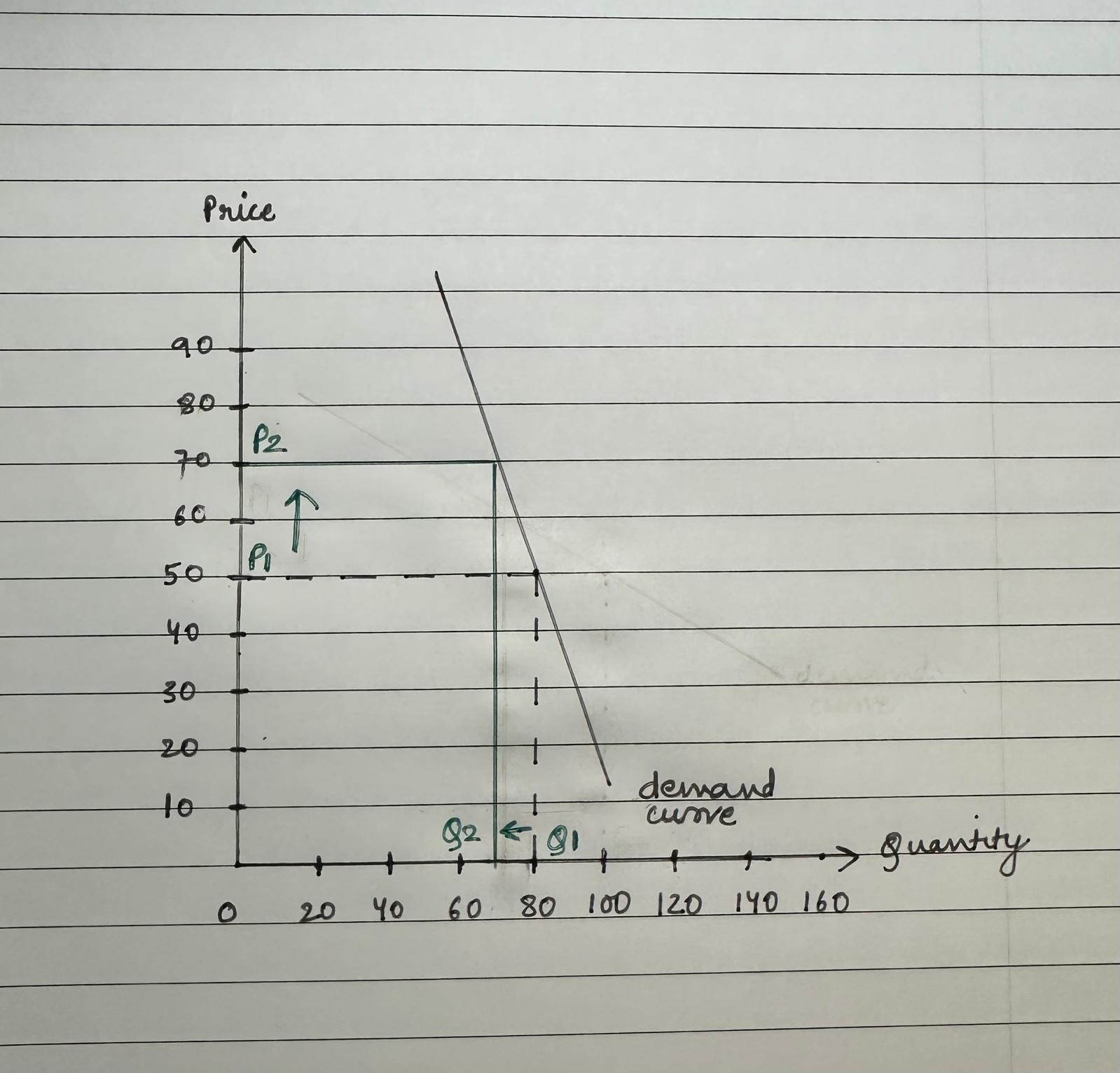

The chart below represents the relation between real interest rates (the 10-year inflation indexed Treasury rate is a proxy for long-term U.S. real interest rates) and the price of gold for the period 2003-2016. It shows significant negative correlation between real interest rates and the price of gold.

Relation between interest rates and gold price

Source: Gold price forecast

The Role of Central Bank Policies

Central banks play a crucial role in influencing interest rates and, consequently, gold prices. When central banks implement expansionary monetary policies, such as quantitative easing, they inject liquidity into the economy, which can lead to higher inflation and increased demand for gold. Conversely, when central banks tighten monetary policy by raising interest rates, they can reduce inflationary pressures and dampen gold demand.

The Impact of Geopolitical Risks

Geopolitical tensions, such as wars, political instability, and trade disputes, can also impact the relationship between gold and interest rates. During periods of heightened geopolitical risk, investors may flock to gold as a safe-haven asset, even if interest rates are rising.

Conclusion

In conclusion, understanding the relationship between gold and interest rates is crucial for investors seeking to optimize their portfolios. By considering the various factors that influence this relationship and adopting a long-term investment perspective, investors can effectively navigate the complexities of the gold market.

Why should I be interested in this post?

Gold has been a key financial asset for centuries, acting as a store of value, a hedge against inflation, and a safe-haven asset during economic crises. Understanding its investment options helps students grasp fundamental market dynamics and investor behavior, especially during periods of economic uncertainty.

Related posts on the SimTrade blog

▶ Nithisha CHALLA History of Gold

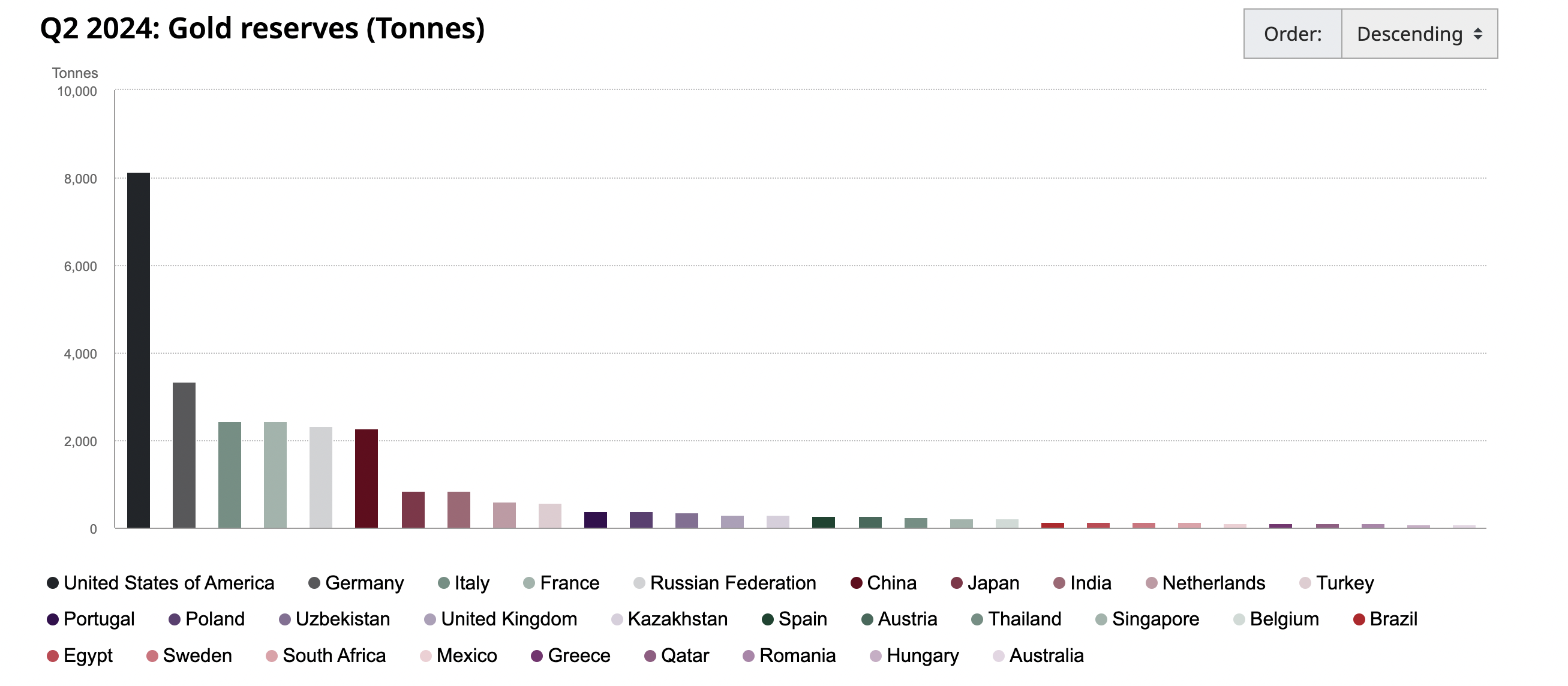

▶ Nithisha CHALLA Gold resources in the world

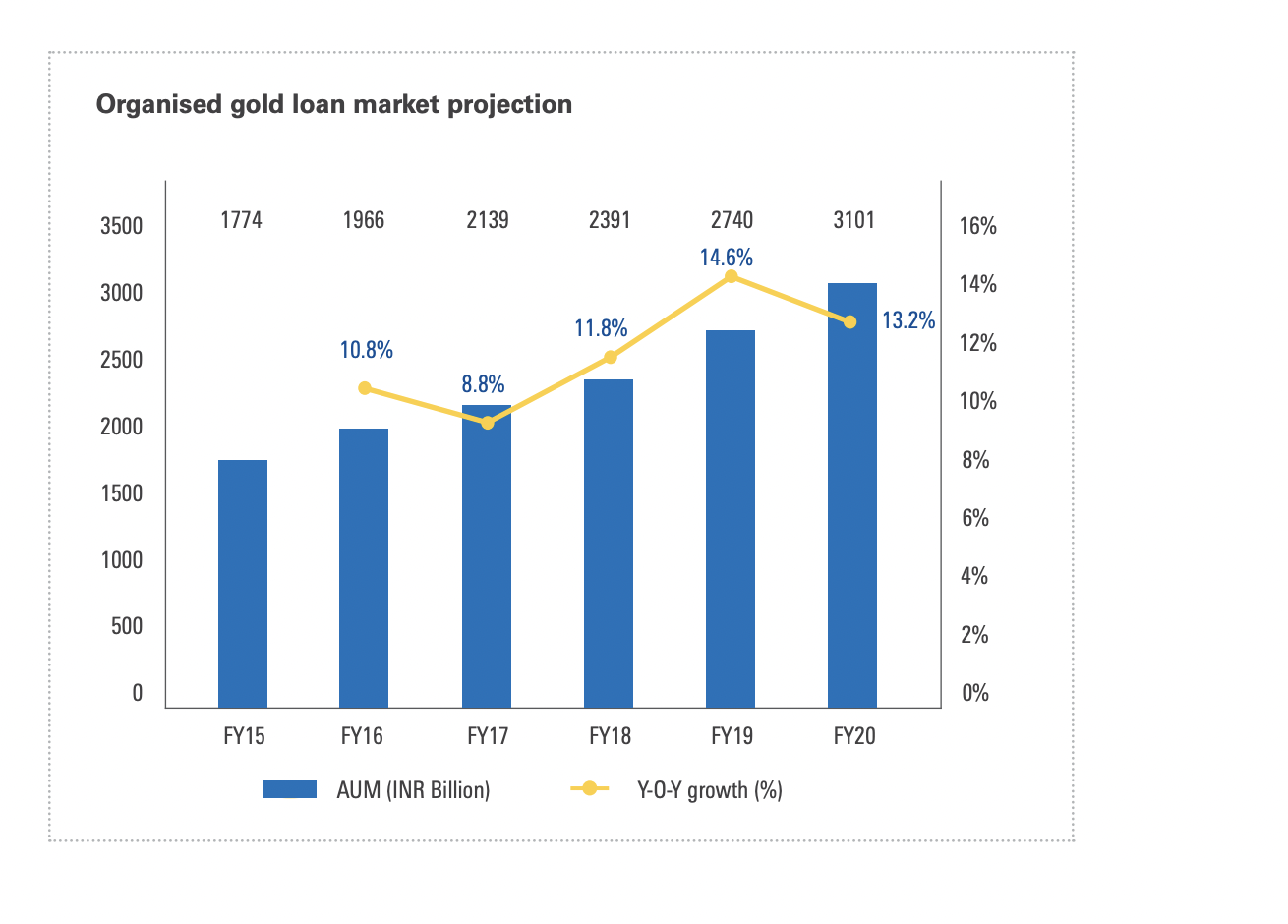

▶ Nithisha CHALLA How to invest in Gold

Useful resources

World Gold Council Gold is moving with rates

Bullion by post Gold price and interest rate relationship

CBS news Here’s how interest rates impact gold prices

APMEX When Do Central Banks Buy Gold & How Do They Affect Prices?

Other

Wikipedia Gold

About the author

The article was written in November 2024 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024).