In this article, Louis DETALLE (ESSEC Business School, Programme Grande Ecole – Master in Management, 2020-2023) presents three major corporate frauds of the 21st century.

Enron (2001)

Enron was a leader in the raw material and energy sector in 2000. Kenneth Lay and Jeffrey Skilling were the two leaders of the group who have disguised the accounts of the company for years. As an example, Enron’s Directors hid never-ending debts in subsidiaries so as to display a healthy Head company whose liabilities were very limited because hidden in the subsidiaries’ accounts. In 2001, when hiding the truth was not possible anymore, Enron collapsed and dragged down the auditing firm Arthur Andersen as well as the pension funds designed for the retirement of its employees that were all made redundant at the same time.

The stock price and logo of Enron

Parmalat (2003)

Parmalat was an Italian company that was rocked in 2003 by a financial scandal that forced it to declare bankruptcy. During 1990s, Parmalat had been losing over $300 million per year, and decided to wipe this debt off the company’s financial records by using 3 shell companies situated in the Caribbean. However, a €14 billion euro hole was discovered in the Parmalat books. Calisto Tanzi and the financial director, Fausto Tonna had set up six shell companies in Luxemburg and falsified banking documents stating the company had accounts with millions of dollars at Bank of America…

Logo of Parlamat

Logo of Parlamat

Volkswagen and the DieselGate (2015)

In fact, Volkswagen had launched in 2006 a project that aimed at manufacturing engines adapted to the American emission norms that were tougher than Europe’s. As they couldn’t implement their solution, the employees and engineers developed a software that enabled cars to bypass the control. In fact, the car’s software was able to detect when it was being measured and it curbed the car’s emissions accordingly. In 2014, an American study measured the emission levels of Volkswagen that reached nearly 40 times the authorized levels. The DieselGate exploded in 2015 when the US Environmental Protection Agency accused Volkswagen of having bypassed the anti-pollution regulation with a software able to bypass the control.

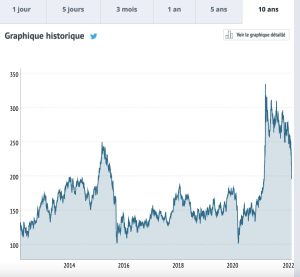

Events accelerate and Volkswagen admits to having equipped 11 million of its vehicles worldwide with fraudulent software. Volkswagen’s CEO, Martin Winterkorn, is pushed out and resigns and the German justice system opens a criminal investigation against the Group. As a result of this scandal, Volkswagen’s share price falls by 50% (see chart below), the Group records its first annual loss for 20 years and commits to paying a fine of 1 billion euros, the largest ever paid by a company in Germany.

Conclusion

As a conclusion, one can identify 2 different types of mechanism at stake: for Enron & the Parlamat, the fraud occurred because the leaders falsified accounting documents & financial statements. For Volkswagen, it’s a bypass of the US authorities that ended up having the German Group sanctioned. Board of Directors are often tempted to manipulate the financial statements or their knowledge of the sector to have the better of the regulators and the markets, however, as evidenced by the stock charts of the 3 companies, when the fraud is unveiled, the firms lose a lot as investors’ confidence plummet.

Related posts on the SimTrade blog

▶ Louis DETALLE Quick review on the most famous trading frauds ever…

▶ Louis DETALLE Quick review of the most famous investments frauds ever…

▶ Louis DETALLE The incredible story of Nick Leeson & the Barings Bank

▶ Louis DETALLE What happened between Iksil & JP Morgan

▶ Akshit GUPTA Market manipulation

Useful resources

AM Today (30/09/2019) Origine et conséquences : ce qu’il faut savoir sur le dieselgate

Le Monde Diplomatique (February 2004) Le scandale Parmalat

About the author

The article was written in March 2022 by Louis DETALLE (ESSEC Business School, Programme Grande Ecole – Master in Management, 2020-2023).