In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024) gives an overview about Berkshire Hathaway, starting from its history to its investment strategies, financial analysis of the company and its future outlook.

Introduction

Berkshire Hathaway is one of the most iconic and highly regarded companies in the world. Led by Warren Buffett, often referred to as the “Oracle of Omaha,” it is synonymous with long-term investment success and financial acumen. This article delves into the origins, business model, and strategic philosophy of Berkshire Hathaway, providing a robust understanding tailored for finance students and professionals.

Logo of Berkshire Hathaway

Source: 1000 logos

History

Berkshire Hathaway traces its roots back to two textile companies, Berkshire Fine Spinning Associates and Hathaway Manufacturing, which merged in 1955. Originally a struggling textile firm, it caught the attention of Warren Buffett in 1962. Buffett initially invested in Berkshire for its undervalued stock price but soon pivoted the company’s focus toward investing in other businesses. Under his leadership, Berkshire Hathaway became a multinational conglomerate, abandoning textiles entirely by the mid-1980s. Charlie Munger is a renowned American investor, businessman, and philanthropist who served as the vice chairman of Berkshire Hathaway for decades. was also a close friend and business partner of Warren Buffett, and together they built Berkshire Hathaway into one of the most successful companies in the world.

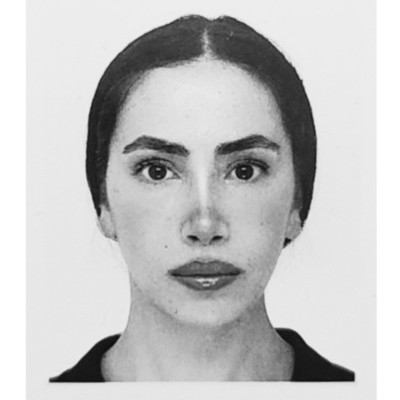

Warren Buffet and Charlie Munger

Source: Hindustan Times

Company Overview

Berkshire Hathaway is headquartered in Omaha, Nebraska, and is a holding company with diverse business interests. It owns a mix of wholly owned subsidiaries and significant minority stakes in publicly traded companies. As of recent years, Berkshire is one of the largest companies globally by market capitalization, with Class A shares trading at $745,303 per share, dated 24th February 2025, a testament to its consistent growth and profitability.

Berkshire hathaway class A share price

Source: Yahoo

Business Segments

Berkshire Hathaway operates across a wide range of industries, making it a textbook example of diversification. The major business segments include:

- Insurance: The cornerstone of Berkshire’s operations, this segment includes GEICO, Berkshire Hathaway Reinsurance, and General Re. These businesses provide a significant source of “float,” or upfront premium payments, that Berkshire uses for investments.

- Utilities and Energy: Berkshire Hathaway Energy manages electricity and natural gas utilities, renewable energy projects, and energy infrastructure across the United States and abroad.

- Manufacturing, Service, and Retail: Subsidiaries such as Precision Castparts, Duracell, and Brooks Sports fall under this category, showcasing Berkshire’s hands-on involvement in consumer and industrial goods.

- Railroad: BNSF Railway, one of the largest freight rail networks in North America, is a wholly owned subsidiary.

- Investments in Public Companies: Berkshire holds substantial equity stakes in companies like Apple, Coca-Cola, American Express, and Bank of America, demonstrating its preference for blue-chip stocks.

Investment Strategy and Philosophy

Berkshire Hathaway’s investment strategy is underpinned by value investing principles championed by Benjamin Graham, Buffett’s mentor. Key aspects include:

- Focus on Intrinsic Value: Berkshire seeks companies trading below their intrinsic value, as determined by rigorous analysis of cash flows and assets.

- Long-Term Horizon: Unlike traders aiming for short-term gains, Berkshire prioritizes investments that can yield substantial returns over decades.

- High-Quality Businesses: Buffett often invests in companies with strong competitive advantages (economic moats), robust management, and predictable cash flows.

- Conservative Use of Debt: The company’s cautious approach to leverage ensures financial stability, even during market downturns.

Financial Performance and Analysis

Berkshire Hathaway’s financial performance is closely scrutinized due to its unique structure and Buffett’s reputation. Some critical metrics include:

- Book Value Per Share: Historically, this measure has been used to gauge the company’s intrinsic worth.

- Operating Earnings: This highlights the profitability of Berkshire’s subsidiaries.

- Investment Portfolio Performance: The returns from its equity holdings and fixed-income securities significantly contribute to overall earnings.

Berkshire’s annual shareholder letters, penned by Buffett, are a treasure trove of insights, blending financial results with timeless investing wisdom.

Future Outlook and Challenges

While Berkshire Hathaway remains a formidable entity, it faces challenges:

- Succession Planning: As Warren Buffett and Vice Chairman Charlie Munger age, questions about leadership continuity loom large. Buffett has named Greg Abel, a senior executive, as his successor.

- Capital Deployment: Berkshire’s massive cash reserves, often exceeding $100 billion, can be both an asset and a liability. Finding suitable investment opportunities at scale remains challenging.

- Market Dynamics: As Berkshire grows, maintaining its historical rate of return becomes increasingly difficult due to the sheer size of its asset base.

Conclusion

Berkshire Hathaway stands as a masterclass in disciplined investing and business management. Its journey from a failing textile mill to a global conglomerate is a testament to the power of sound financial principles, patience, and vision.

Why should I be interested in this post?

For finance students and professionals, studying Berkshire Hathaway offers invaluable lessons in diversification, risk management, and the nuances of value investing.

Related posts on the SimTrade blog

▶ Federico De ROSSI The Power of Patience: Warren Buffett’s Advice on Investing in the Stock Market

▶ Rayan AKKAWI Warren Buffet and his basket of eggs

▶ Youssef EL QAMCAOUI The Warren Buffett Indicator

▶ Akshit GUPTA Warren Buffett – The oracle of Omaha

▶ Michel VERHASSELT “Risk comes from not knowing what you are doing”

▶ Fatimata KANE “Money is a terrible master but an excellent servant”

▶ Youssef LOURAOUI Passive Investing

▶ Youssef LOURAOUI Active Investing

Useful resources

Wikipedia Berkshire Hathaway

Yahoo! Finance Berkshire Hathaway Inc. (BRK-A)

About the author

The article was written in February 2025 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management (MiM), 2021-2024).