Creating a portfolio of Conviction

In this article, Chloé ANIFRANI (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2019-2024) explains what it means to create a portfolio of conviction.

Conviction as a filter for your investment universe

In their article on Asset Allocation, Akshit GUPTA, an ESSEC student, defines the basics criteria considered by investors when building a portfolio. He defines them as the profile of the investor (risk profile, objective, time horizon), characteristics of the chosen assets (expected returns, risk, correlation), and chosen strategy of investing (strategic or tactical allocation).

Although those characteristics are what any good investor should consider in the first place, some other criteria might come into account. This is the case for portfolio used in thematic and conviction funds, which use particular quality filters to reduce their investment universe before taking a closer look at other characteristics in the highlighted assets.

In this article, we will only talk about equity assets (no bonds, structured products…).

For example, these filters might be geographic (global, European, American…), by capitalization (small, mid and large caps) or sector (technology, luxury, energy…).

Another type of filter seen in stock picking might be a conviction: after analyzing a company, the investor strongly believes that it shows a particular quality that makes it eligible for their portfolio.

The filter we will talk about today is one of those: Pricing Power.

Pricing Power is defined as the ability of a company to raise their prices without affecting the demand for their products, mostly thanks to specific technological invocation or patent, brand image and/or high barriers to entry for competitors.

This quality is often observed in sectors like luxury (LVMH, Hermès, Ferrari, Mercedes-Benz…), health (Cooper, Zoetis, medication for rare disease…) or aeronautics (Airbus Dassault…), for example. On the contrary, it is harder to find in sectors like energy, insurance or telecom, where many actors offer the same type of products and services.

Pricing Power in asset allocation: how can an analyst recognize Pricing Power in companies

Although Pricing Power is greatly influenced by sectors, as explained above, it also is company specific. Firms might possess technologies and innovations that allow them to showcase Pricing Power in a sector that isn’t known for it, while others may not be able to utilize their sector’s strength in a way that would lead to gaining Pricing Power.

Therefore, here are some characteristics that help recognize Pricing Power in companies (Louis Vuitton, Ferrari, Hermès, Atoss Software, Capgemini, Airbus, ASML, Safran, EssilorLuxottica, Disney, Netflix, L’oréal):

Brand strength

Companies with strong and well-established brands often have better Pricing Power. Consumers may be willing to pay a premium for products associated with a trusted and recognized brand.

Examples: Louis Vuitton, Ferrari, Hermès

Unique products or services, technological innovation

If a company offers unique or differentiated products or services that are not easily replicated by competitors, it may have greater control over pricing. This uniqueness can create a competitive advantage.

Examples: Atoss Software, Capgemini

High barriers to entry

If a company is established in a sector with high barriers to entry, like high cost of development or strict regulatory environment, it may showcase Pricing Power, as switching from this company to competitors might be difficult for customers in case of price increase.

Examples: Airbus, ASML, Safran

Market position

A leading market position or a dominant market share can provide Pricing Power. Market leaders often have more control over pricing, since customers may view their products as industry standards.

Examples: LVMH, EssilorLuxottica

Customer loyalty

High customer loyalty can enable a company to maintain Pricing Power. However, since customer loyalty derives from a feeling of trust between the client and brand, it shouldn’t be considered as a primary element to examine for investors, as too many raises in prices might negatively impact the relationship.

Examples: Disney, Netflix

Track record of price increases

Examining a company’s historical ability to implement price increases successfully can provide insights into its Pricing Power. Consistent or periodic price increases without significant negative effects on sales would be a positive indicator.

Examples: L’oréal, Louis Vuitton, Hermès

It is important to note that elements like cost advantages (economies of scale, economies of scope, relationship with manufacturers…) do not lead to pricing power, but to margin control, which would be another type of filter.

The case of luxury: intangibles in Pricing Power

To better understand how Pricing Power evolves for brands, let’s talk about the case of luxury today.

In 2022 and 2023, the market has been shaken by the new hawkish monetary policy declared by central banks, with interest rates raising at a rapid pace and to a level that had not been seen for many years.

This new reality led to difficulties for firms which relied heavily on debt to finance their activities.

In the case of the luxury sector, our new situation of “Higher for longer” rates lead to a strengthening of the already existing barriers to entries. Firms that have been major actors in this field for decades (LVMH, Kering, Hemes, Richemont…) should see fewer young brands emerging to their levels for the years to come.

It is interesting to note that those actors’ Pricing Power comes primarily from their brand image. This component helps them to sustain an “asset light” growth, which doesn’t require much investment in new technologies or patents on their parts.

However, an investor might worry that the current inflation and reduction of houses’ purchasing power might affect demand on luxury products, that are often not primary necessities.

Indeed, if 2022 was a particularly good year for the sector (9-11% annual growth), its trajectory has slowed down in 2023, coming back to average historical levels (7-8%). The major actors, who raised their prices significantly in 2022 and 2023, already plan more moderate raises for the years to come.

Those elements should be considered by an investor interested in Pricing Power. However, they do not invalidate it for the sector. We notice two elements that are in its favor for the upcoming years: the consumption of luxury goods is becoming more and more concentrated on the most “iconic” brands (Hermès, Chanel, Louis Vuitton…) and the number of clients is increasing steadily every year. In 2023, there were 400 million of luxury consumers. 50 million of them where millionaires, which is interesting to note, knowing how polarized this sector consumption is: 1% of the customers equals 20% of the total sales. This means that the main luxury consumers are the least affected by the current drop in purchasing power.

With this information and the previously stated higher barriers to entry, we can consider that the current state of the market might actually be beneficial to the luxury sector’s main actors’ Pricing Power.

Funds and ETFs with Pricing Power at their core

To conclude this article, we will cite some funds that have been basing their investment strategies around Pricing Power.

We selected three of these funds, all primarily invested in Eurozone. The funds are Delubac Pricing Power I (FR0011304229), Pictet Premium brands I (LU0217138485, also invested in the US) and Amplegest Pricing Power (FR0010889857).

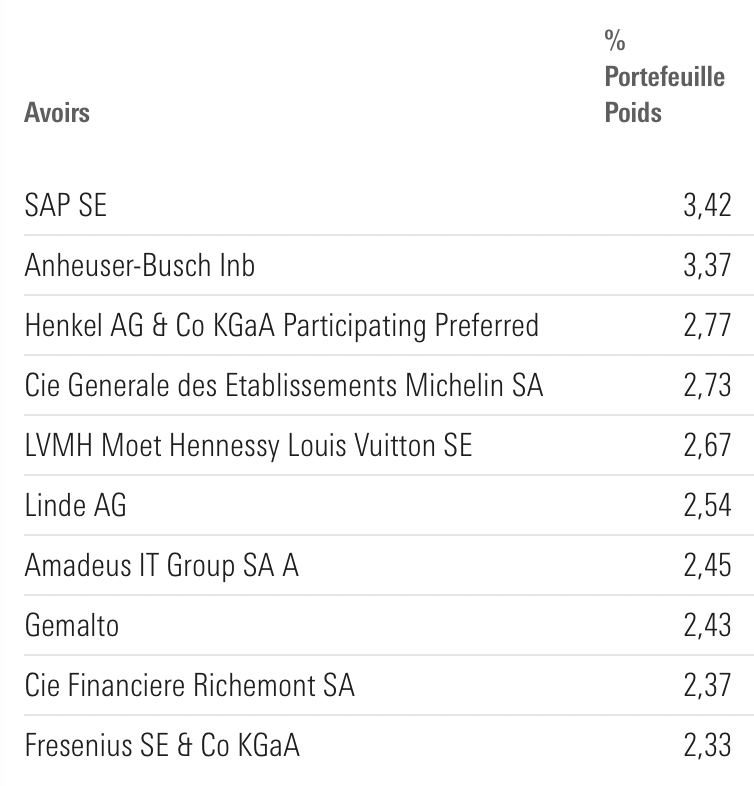

Top 10 Delubac Pricing Power.

Source: Morningstar.

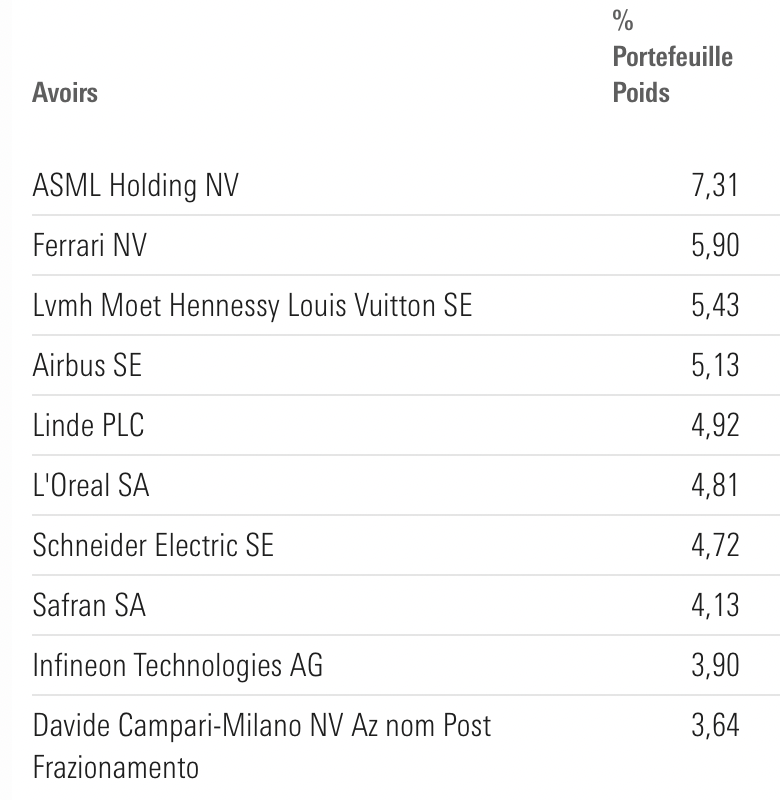

Top 10 Pictet Premium Brands.

Source: Morningstar.

Top 10 Amplegest Pricing Power.

Source: Morningstar.

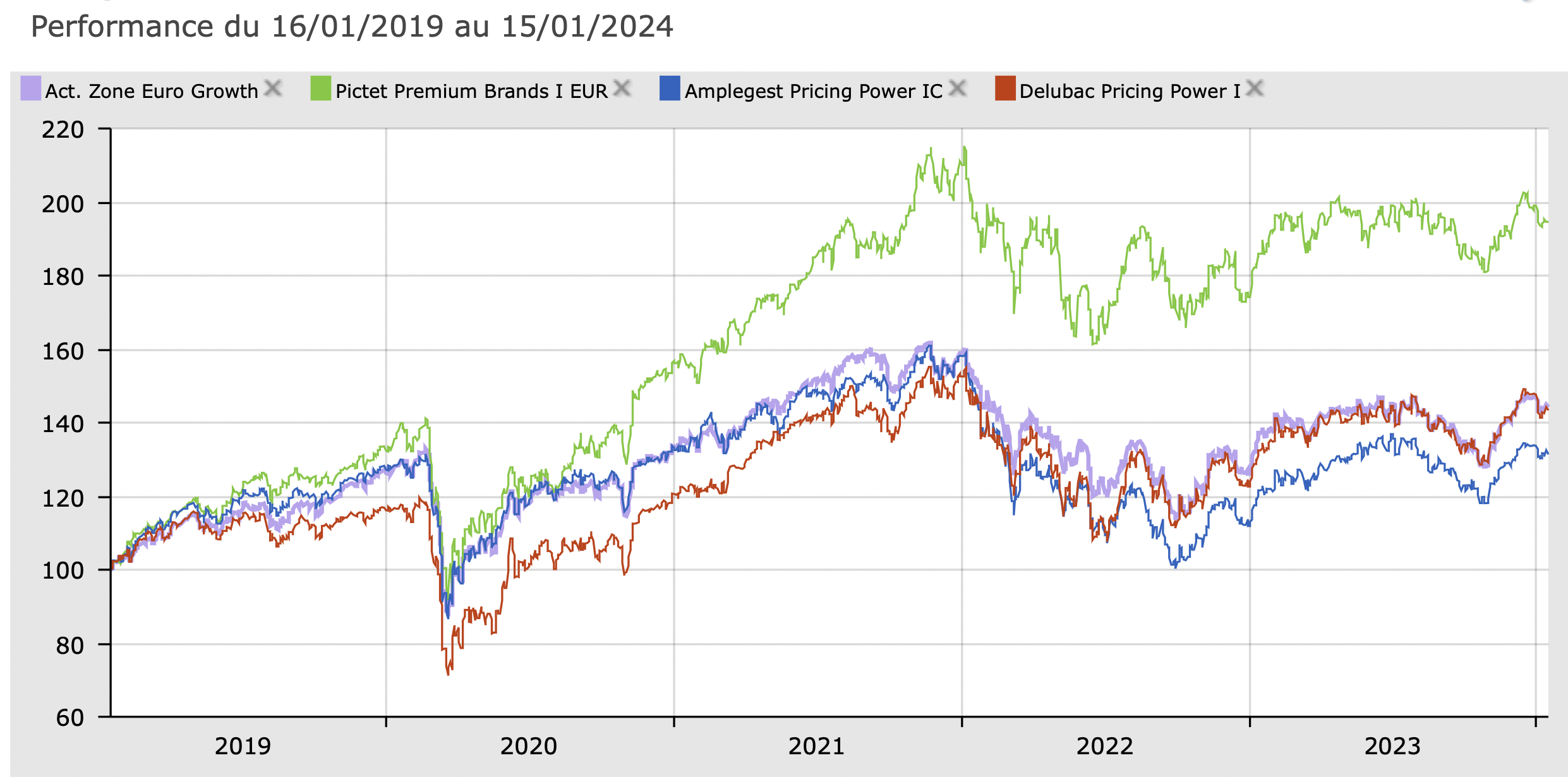

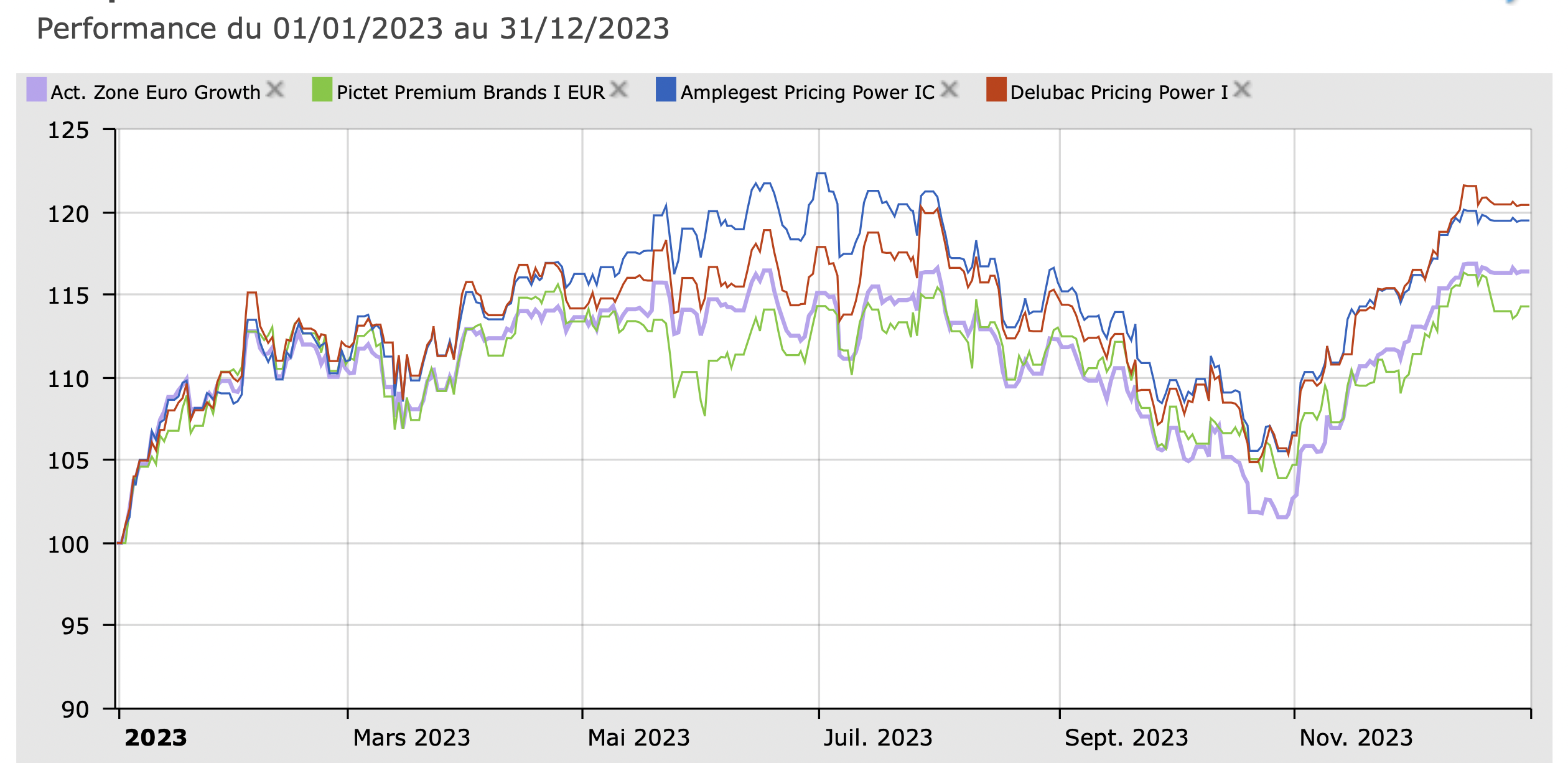

While examining their top 10 stocks, it is interesting to note that some brands, well-established as having Pricing Power, can be found in all three allocations (LVMH, L’Oréal, Linde).

For your information, here are the funds’ performances over the last five years, compared to their zone of investment’s.

Performances over 5 years

Source: Quantalys.

Performances in 2023

Source: Quantalys.

Annual Performances from 2017

Source: Quantalys.

And yes, investing with conviction can be rewarding and a great way to differentiate your product, but it doesn’t always beat the market!

Why should I be interested in this post?

If you wish to work in Asset Management, as an analyst or funds manager, or as a customer, this post will help you understand what kind of criteria might be used to do so. Asset Managers sell a product, not just a track record, and it is important to know how to build a portfolio around a concept in order to differentiate yourself on a very saturated market!

Related posts on the SimTrade blog

▶ Youssef LOURAOUI Asset Allocation Techniques

▶ Louis DETALLE A quick interview with an Asset Manager at Vontobel

▶ Akshit GUPTA Asset Allocation

Useful resources

Pricing Power is the magic ingredient for equity investors

JP Moorgan Combating inflation with pricing power

Morgan Stanley Combating inflation with pricing power

About the author

The article was written in February 2024 by Chloé ANIFRANI (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2019-2024).