Top 5 Asset Management firms in Europe

In this article, Chloé ANIFRANI (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2019-2024) discusses the top 5 Asset Management firms in Europe.

Methodology

To define the top 5 Asset Management firms in Europe, we built a methodology based on a selection of criteria. However, as the initial pool of firms would have been too extensive to analyze, we first looked for rankings online, led by independent research institutes, to reduce the area of research.

We then took the companies that appeared in their top 5 the most often, and obtained this first ranking:

- Amundi Asset Management

- BlackRock

- Allianz Group

- UBS Group

- Legal & General Investment Management (LGIM).

However, this ranking will not be final.

While we will use it to know which companies to analyze, we will reorganize our list thanks to the following elements, which seem like the most relevant and the most useful for an objective comparison. We also think these elements will be the most interesting to a student trying to learn more about the Asset Management field for their future career. The following criteria will each bring insights on the companies’ businesses and sizes, on their catalogs (interesting for customers), and on their social policies (interesting for employees) :

- Global Asset under Management (AuM)

- 2023 net inflows

- Diversity of product offer

- Employee well-being.

Considering the AuM, we would have rather used European numbers, instead of global, but we couldn’t access this data.

Therefore, our final ranking will be a top 5 of Asset Management firms in Europe in 2023, based on these criteria. The criterion of reputation was already considered by the original rankings, which is why we won’t use it.

For each criterion, we will rank each firm according to the other’s results, 1 being the highest rank and 5 the lowest. Then, we will compute the average score of each company and rank them accordingly.

Asset under Management and 2023 net inflows will be found on the firms’ websites or in press releases.

To grade firms’ offers’ diversity, we will see how many funds each company sells (source: Quantalys), but also what type of products they offer (stocks funds, fixed income, diversified, ETFs, structured products…).

To grade their employee’s well-being, we will use their average scores on Glassdoor, a website where employees can grade their firms. Each criterion weights the same.

Amundi Asset Management

Asset under Management 2023: 1973bn€

Net inflows 2023: 69bn€

Diversity of product offer: 673 funds (stocks, structured products, diversified, fixed income, monetary, real estate)

Employees’ well-being: 3,9/5 (841 reviews)

BlackRock

Asset under Management 2023: +10000bn$

Net inflows 2023: 289bn$

Diversity of product offer: 876 funds (stocks, fixed income, diversified, monetary)

Employees’ well-being: 3,9/5 (5812 reviews)

Allianz Group

Asset under Management 2023: 2162bn€

Net inflows 2023: 2,2bn€

Diversity of product offer: 290 funds (stocks, fixed income, diversified, monetary, structured products)

Employees’ well-being: 4/5 (8509 reviews)

UBS Group

Asset under Management 2023: 146,9bn$

Net inflows 2023: 11,5bn$

Diversity of product offer: 542 funds (stocks, fixed income, diversified, monetary)

Employees’ well-being: 3,9/5 (14212 reviews)

Legal & General Investment Management (LGIM)

Asset under Management 2023: 1471bn$

Net inflows 2023: 271bn€

Diversity of product offer: 48 funds (stocks, fixed income)

Employees’ well-being: 3,7/5 (219 reviews)

Conclusion

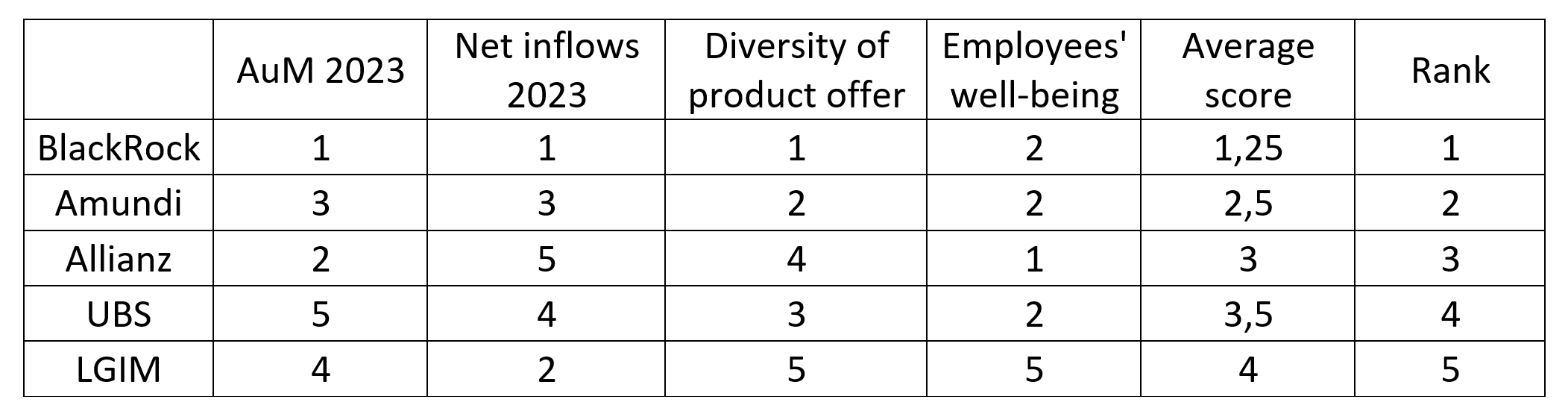

Once we consider all these elements, here are the ranks we obtain for each criterion and their average for each firm:

Ranking of asset management firms.

Source: The author.

Therefore, our new ranking for the top 5 Asset Management firms in Europe in 2023 is :

- BlackRock

- Amundi

- Allianz

- UBS

- LGIM

Why should I be interested in this post?

As an ESSEC student in the SimTrade course, you might be interested in Asset Management, and wanting to know more about its key players. This post will be a good way for you to know more about them and their characteristics. Maybe your future employer is one of them!

Related posts on the SimTrade blog

▶ Louis DETALLE A quick presentation of the Asset Management field…

▶ Akshit GUPTA Asset management firms

▶ Youssef LOURAOUI ETFs in a changing asset management industry

Useful resources

Mordor Intelligence Asset management markets in Europe size & share analysis – growth trends & forecast

MarkWide research Europe Asset Management Market Analysis-Industry Size, Share, Research Report, Insights, Covid-19 Impact, Statistics, Trends, Growth and Forecast 2024-2032

About the author

The article was written in February 2024 by Chloé ANIFRANI (ESSEC Business School, Global Bachelor in Business Administration (GBBA), 2019-2024).