The Great Stock Market Crash of October 1987

This article written by Akshit Gupta (ESSEC Business School, Master in Management, 2022) analyzes the Great Stock Market Crash of October 1987.

Introduction

A stock market crash refers to an abrupt drop in the prices of a major stock index, triggered by a drop in underlying stock prices, resulting from speculations, investor panic, or an economic crisis. 6 major stock market crashes have been recorded in the United States till date where the indexes have tumbled more than 10% in a single market day. Known as the Black Monday, the stock market crash of 19th October 1987 has been regarded as the most significant or largest single-day fall in the history of US markets. The day was dominated by aggressive selling and situation of great investor panic across the country.

The stock market collapse of October 1987

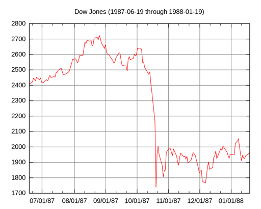

Late 1985 onward, the US markets started to gain momentum after prolonged years of slow growth and economic recession. The financial systems also saw a heightened level of M&A activity with leverage buyouts becoming the new norm. The use of leverage started to be extensive in all areas of the system. In August 1987 the markets peaked with DJIA standing at 2,722 points, up 44% from the same time during the last year. Some investors became concerned about an existing stock bubble or a near term market correction. A new investment strategy named portfolio insurance started gaining traction from many big institutional investors, as a way to hedge their bets in case the market tumbles.

This strategy used algorithm-based trading and relied on the use of options and futures to safeguard an investor’s money. Also, the presence of risk arbitrage or merger arbitrage, who were making profits from announced M&A deals, was on a rise.

On 13th October 1987, an anti-takeover bill was introduced in the US by the House Ways and Means Committee, placing restrictions on takeovers and corporate restructuring resulting in lower investor sentiments and a break on the then-active M&A environment as a result of higher interest rates due to a larger trade deficit. The leveraged risk arbitrage traders started unwinding their positions owing to fears of failing M&A deals. The selling continued till 16th October 1987, when investors started selling their positions to avoid further margin calls. Due to the newly introduced globalization and intertwining of global exchanges, when markets opened on Monday, sharp selling in the US market resulted in a chain effect affecting all the major stock exchanges across the world.

On the day of 19th October 1987, also known as ‘Black Monday’, the indexes across all the major stock markets across the world took a big hit and the U.S. Dow Jones Industrial Average lost 23% of its value in a single market day. The crash was exuberated by the presence of algorithm-based trading, as the sell orders spiked when a target price was breached. As a result, mutual funds started unwinding their positions triggered by increased mutual fund redemptions. The fall in the spot market was followed by a fall of the futures and options markets as a result of excessive short selling by portfolio insurances to hedge the decline in stocks. The intensity of the total trading volume can be gauged by the fact that computerized systems like SuperDot at NYSE failed and were shut down for a prolonged period of time.

The event was a result of high selling pressure continuing for the past several days before the crash day. Although the exact reason for such a crash is difficult to comprehend, it is believed that high-interest rates, the introduction of an anti-takeover bill, algorithm-based trading, and intervention of portfolio insurances are the reasons that led to this forced selling and the biggest crash recorded in the history. The crash brought fears of prolonged economic instability and recession across the world.

After effects of the stock market crash

The significant losses incurred on Black Monday weren’t followed by times of economic recessions. The markets regained their momentum by 1989 and recovered most of the lost value. After the crash of 1987, strict measures were adopted by all the major stock exchanges around the world, to prevent such events from happening again. A new mechanism known as ‘circuit breakers’ was introduced to curb any such sudden declines in the market. Under this new system, exchanges halt the trading for a short duration of time, if the markets experience any such large decline in the prices. To bring liquidity to the market, Open Market Operations were carried out by the Fed to increase the supply of money. Also, other preventive measures were adopted to rectify the market irregularities that led to investor confusion and delay in information processing.

Potential impact of market crashes

The occurrence of such a catastrophic event decreases investor confidence and the after-affects stay for the following many years. As per the wealth effect, consumer spending decreases following such crashes as an individual becomes more hesitant to spend money. The crash of 1987 had a negative impact on the wealth of many individuals, eroding lifetime savings many investors.

Also, as pension funds invest significantly in the stock market, a prolonged decline in the stock prices reduces the value of these funds, thereby effecting the payout capabilities. If the fall in the prices is long-term, the pension income for many households decreases, thus reducing the overall spending power in the economy.

Article written by Akshit GUPTA (ESSEC Business School, Master in Management, 2022).