The Islamic financial system as a solution to tackle social issues

In this article, Evan CHAISSON (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2022-2023) comments on a quote by Wolfgang Schafuble about Islamic finance.

Quote

Islamic finance is growing in importance for the global economy. It is therefore important consider questions related to integrating Islamic finance into global finance.

Analysis of the quote

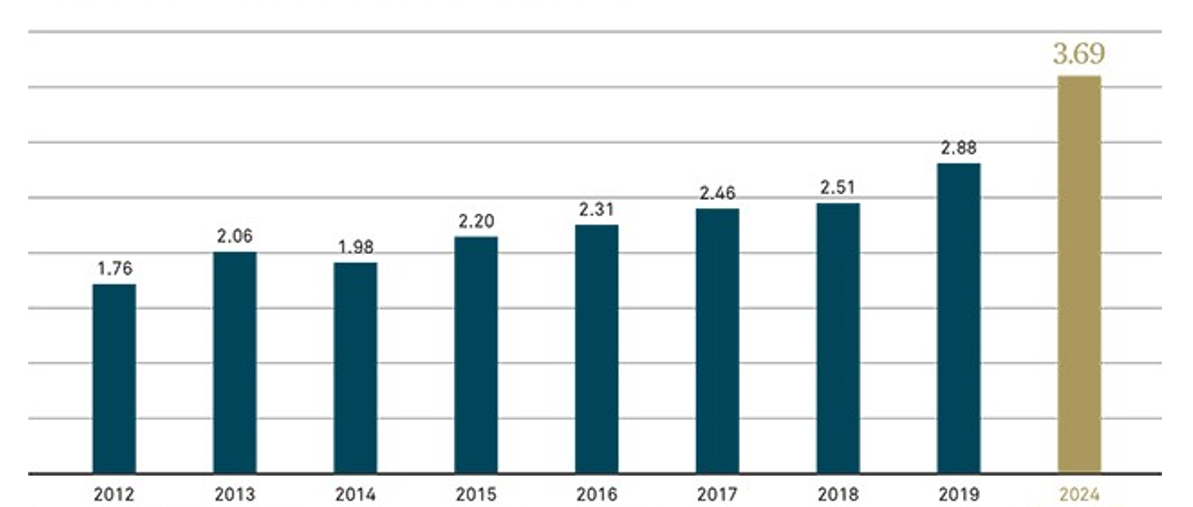

This quote, by Wolfgang Schauble, highlights the growing importance of Islamic finance in the global economy. Islamic finance is a rapidly growing sector, with an estimated value of over $2 trillion in assets worldwide. Figure 1 below gives the Global Islamic Finance Assets Growth (in US$ Trillions). As you can see from the figure, the sector is projected to more than double in value in 2024 based on its 2012 value.

Figure 1. Global Islamic Finance Assets Growth.

Source: ICD – Refinitiv Islamic Finance Development Report (December 2020).

As such, it is becoming increasingly important for the global financial system to consider questions related to integrating Islamic finance into global finance.

Additionally, this quote presents Islamic finance as a financial system that is different from the classical “Western” system that is commonplace today. As such, it may be able to offer solutions to global issues that the current system is unable to solve.

About the author

Wolfgang Schauble is a German politician who has played a prominent role in German and European politics for several decades. He served as Germany’s Minister of Finance from 2009 to 2017, during which time he played a key role in managing the global financial crisis and the European debt crisis.

Prior to serving as Minister of Finance, Schauble served as Minister of the Interior, where he was responsible for domestic security and law enforcement. He is widely regarded as a conservative politician and has been a member of the Christian Democratic Union (CDU) since 1974.

Financial concepts related to the quote

Although much separates Islamic law from the Western system, there are three main aspects that stand out: prohibition of interest, asset-based financing, and ethical and social considerations.

Prohibition of interest

The prohibition of interest, or riba, is one of the foundational principles of Islamic finance. This principle is based on the Islamic belief that money should not be used as a commodity to generate profit. The concept of riba is not limited to charging interest on loans, but also includes any type of fixed, predetermined, or guaranteed return on investment. Instead of interest-based lending, Islamic finance relies on profit-and-loss sharing (PLS) arrangements, where both the lender and the borrower share the risks and rewards of a particular investment.

PLS contracts take several forms, including mudarabah, musharakah, and ijara. In mudarabah, one party provides the capital, and the other party provides the expertise to invest the capital. Profits are shared according to a pre-agreed ratio, but losses are borne solely by the provider of capital. In musharakah, both parties provide capital and expertise, and profits and losses are shared according to a pre-agreed ratio. In ijara, the financier purchases an asset and leases it to the borrower for a fixed period of time, with the option to purchase the asset at the end of the lease term.

Asset-based financing

In Islamic finance, financial investments are tied to physical assets, such as property or commodities, rather than financial instruments such as stocks, bonds, or, say mutual funds. This is known as asset-based financing, and it is designed to promote stability in the financial system. By tying financial investments to tangible, physical assets, Islamic finance encourages investment in the real economy and discourages speculation.

The use of asset-based financing also has implications for risk management. Since investments are tied to real assets, the risks associated with those investments are more tangible and can be more easily managed. This also encourages all parties involved to share the risk of the venture. In turn, this will help build trust between partners, and, as more time goes by, investment risk will steadily decrease.

Ethical and social considerations

Islamic finance places a strong emphasis on ethical and social considerations in investment decisions. This includes avoiding investments in industries such as alcohol, tobacco, and gambling, which are considered harmful to society. Additionally, Islamic finance institutions often have social welfare programs that aim to promote social justice and alleviate poverty.

One example of a social welfare program in Islamic finance is zakat, which is a form of mandatory charitable giving. Muslims are required to give a portion of their wealth to those in need, and Islamic finance institutions often collect and distribute zakat on behalf of their clients. Islamic finance institutions may also engage in other forms of social welfare, such as providing interest-free loans to small businesses or supporting community development projects.

My opinion about this quote

Having stumbled on this quote by chance, I chose it because it made me curious about a financial system which I previously was not familiar with. This then led me to learn about a financial system which operates in a way that is decidedly different from what Westerners are used to. As a young adult growing up in an increasingly uncertain world with more than its fair share of issues, I am always searching for a solution. Thanks to this quote, I have discovered a financial system that, perhaps, can shape a path towards a better future.

Why should I be interested in this post?

Any student of business and finance, regardless of its origins, has much to gain from simply learning about the Islamic financial system.

This system should be studied, first and foremost, simply because Islamic finance is an increasingly important and influential component of the global financial system. According to the Islamic Financial Services Board, the global Islamic finance industry had assets worth $2.88 trillion in 2019. As the industry continues to grow, there will be a growing demand for professionals who understand the principles and practices of Islamic finance.

Another more ethical reason is because, as mentioned earlier, Islamic finance places a strong emphasis on ethical and social considerations in investment decisions. This includes avoiding investments in industries such as alcohol, tobacco, and gambling, which are considered harmful to society. For students who are interested in pursuing careers in finance with a social and ethical focus, Islamic finance may be of particular interest.

Related posts on the SimTrade blog

▶ Paul Antoine BOHOUN Bourse Régionale des Valeurs Mobilières

Useful resources

Islamic Finance: Principles, Performance and Prospects

About the author

The article was written in March 2023 by Evan CHAISSON (ESSEC Business School, Grande Ecole – Master in Strategy & Management of International Business, 2022-2023).

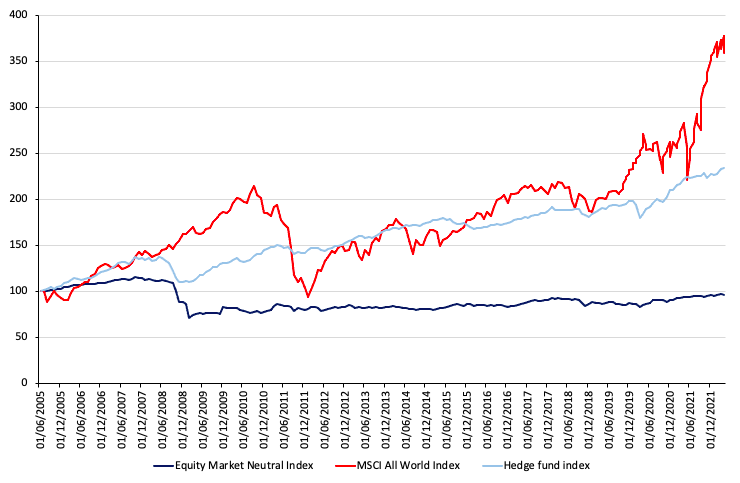

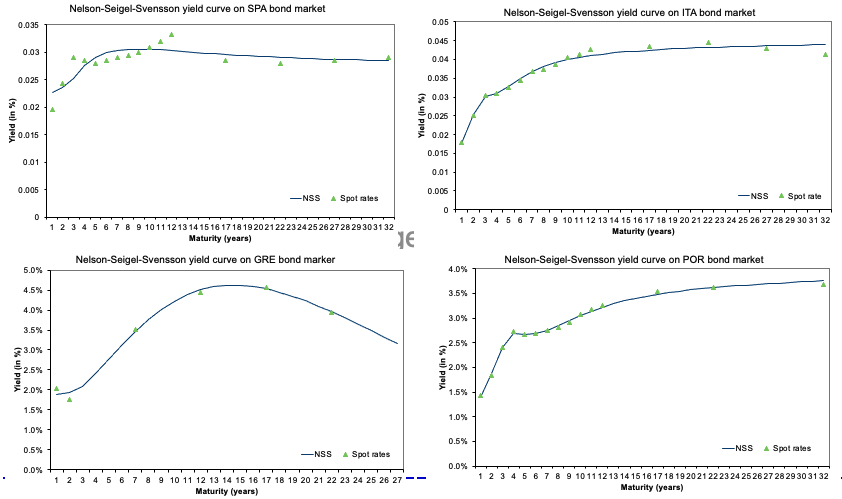

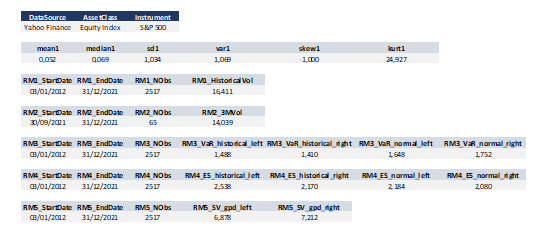

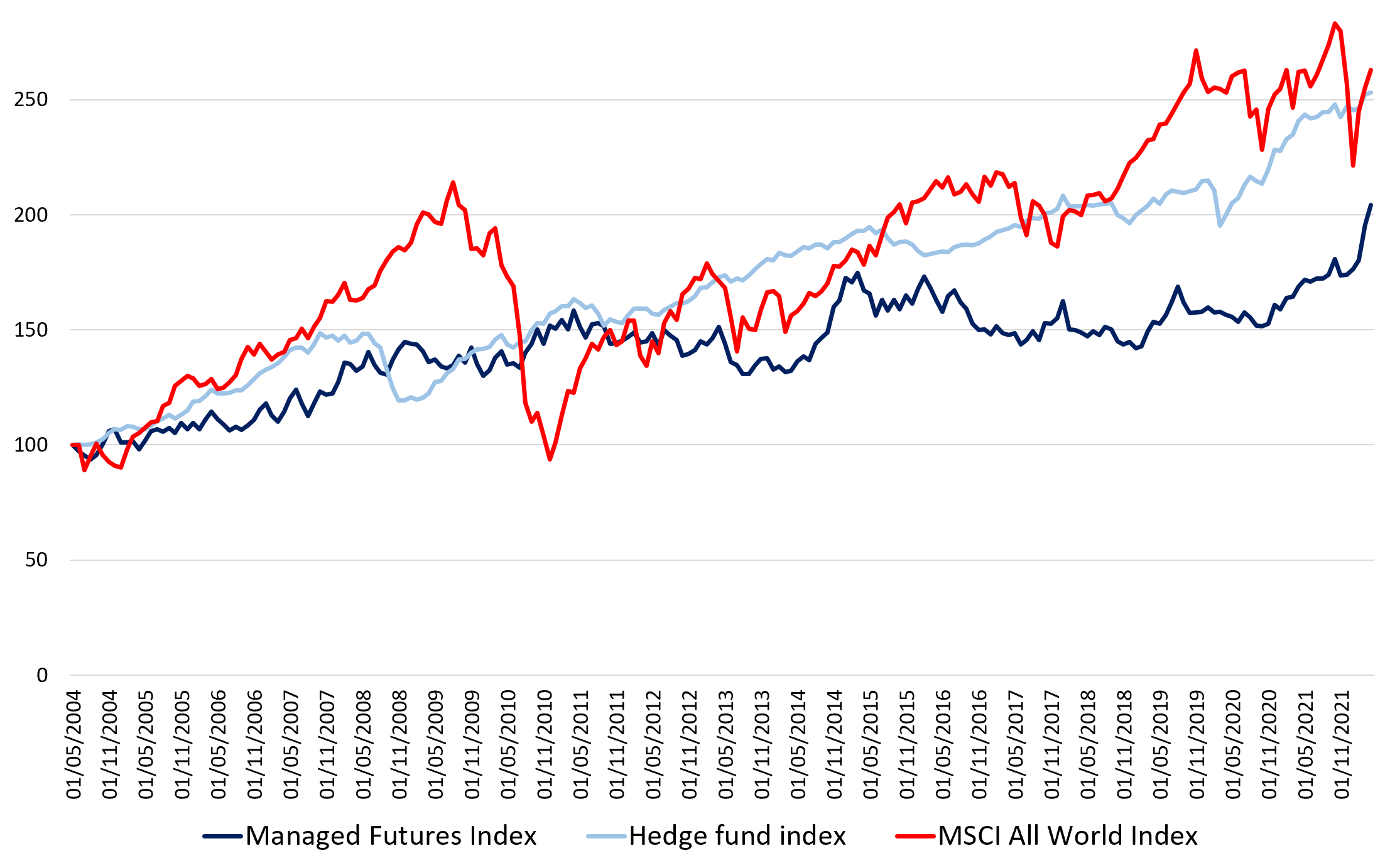

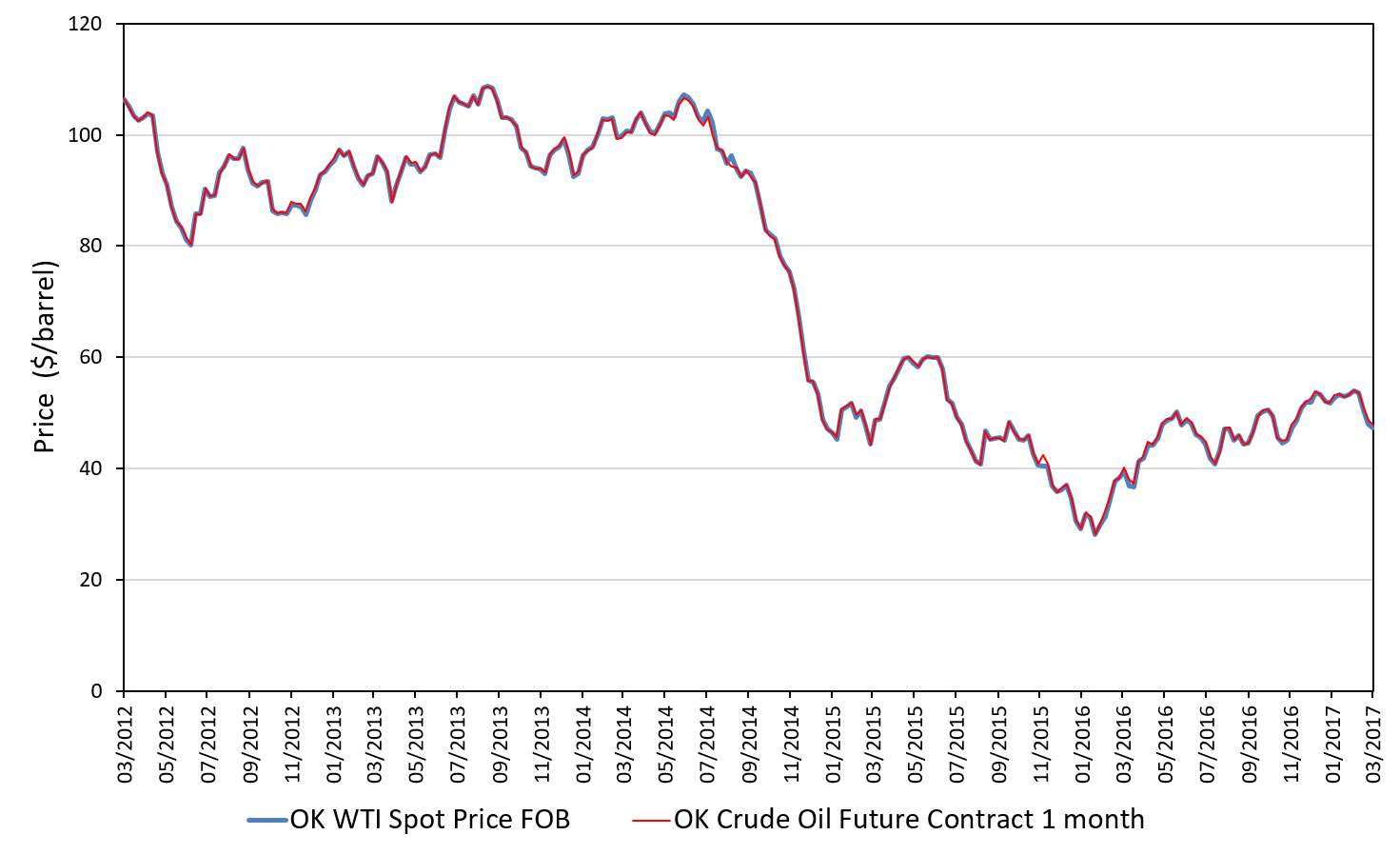

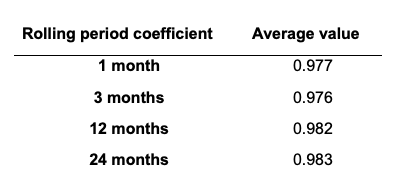

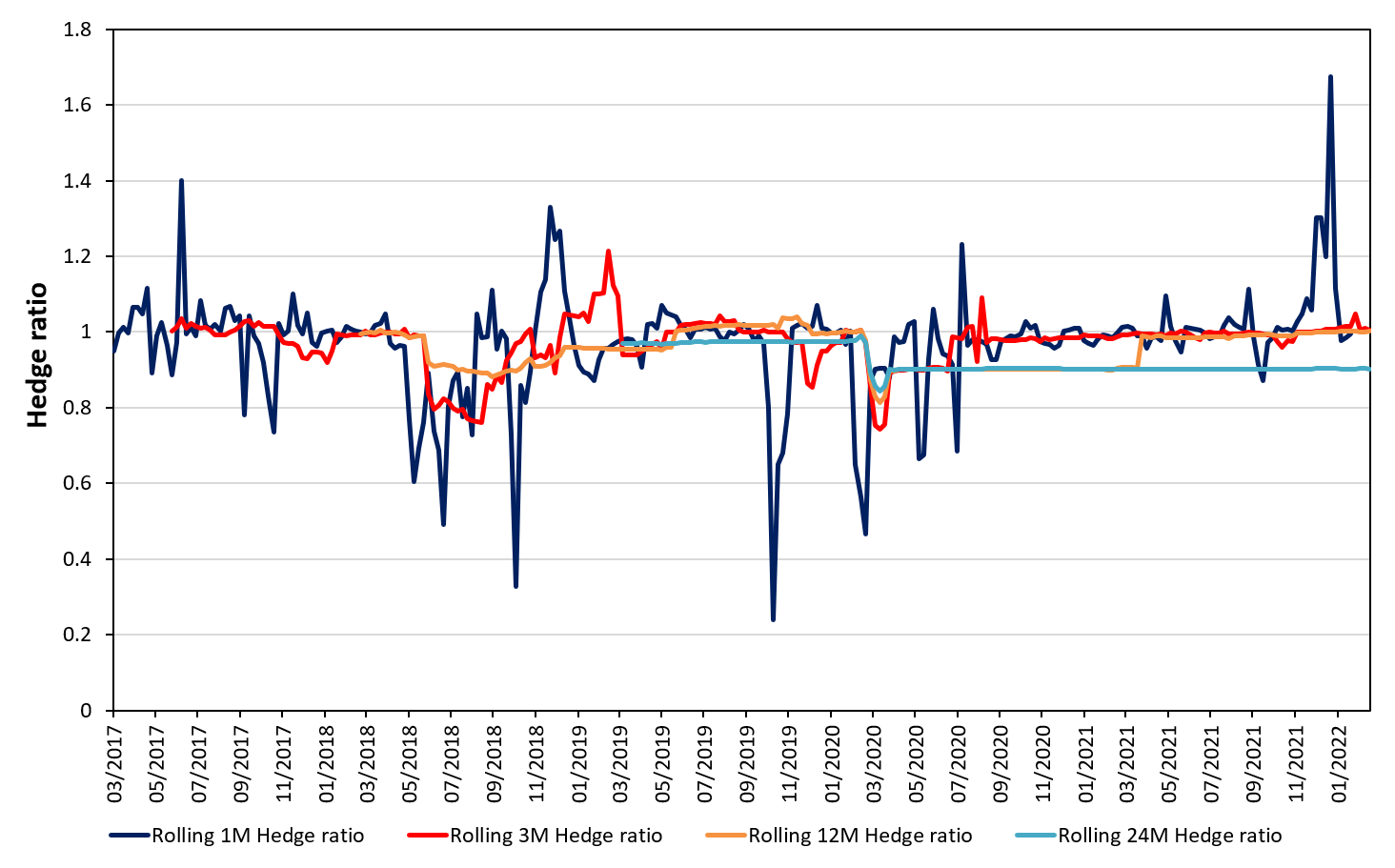

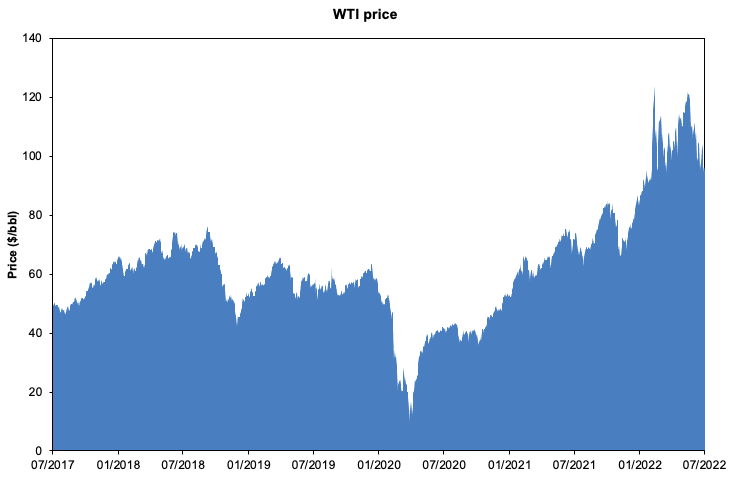

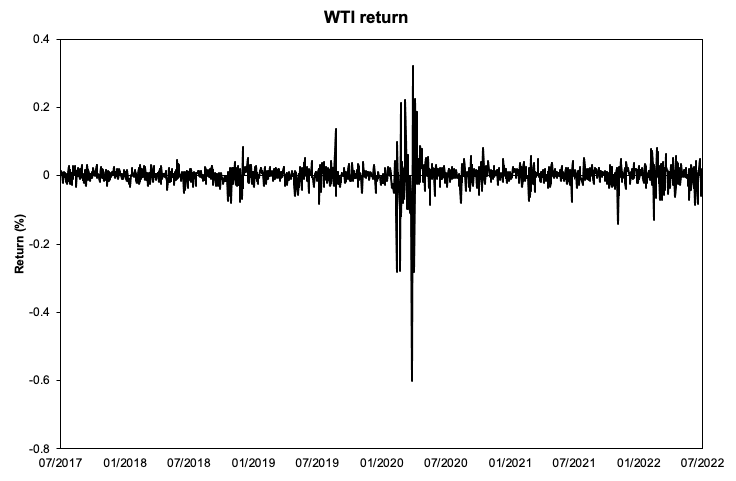

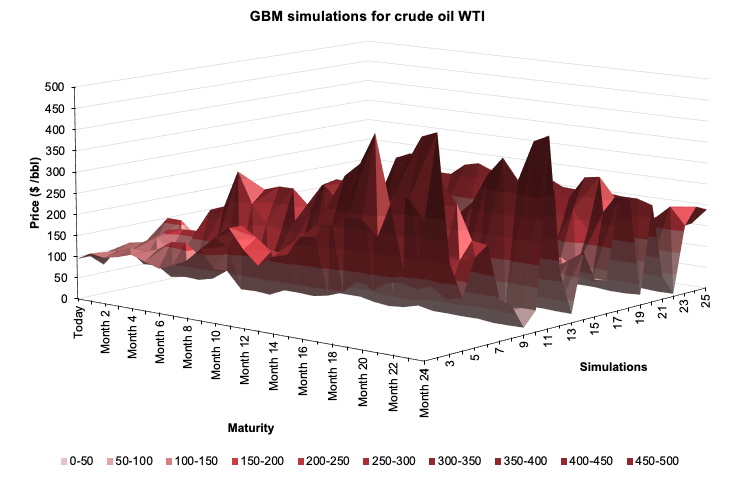

Source: computation by the author (data: Refinitiv Eikon).

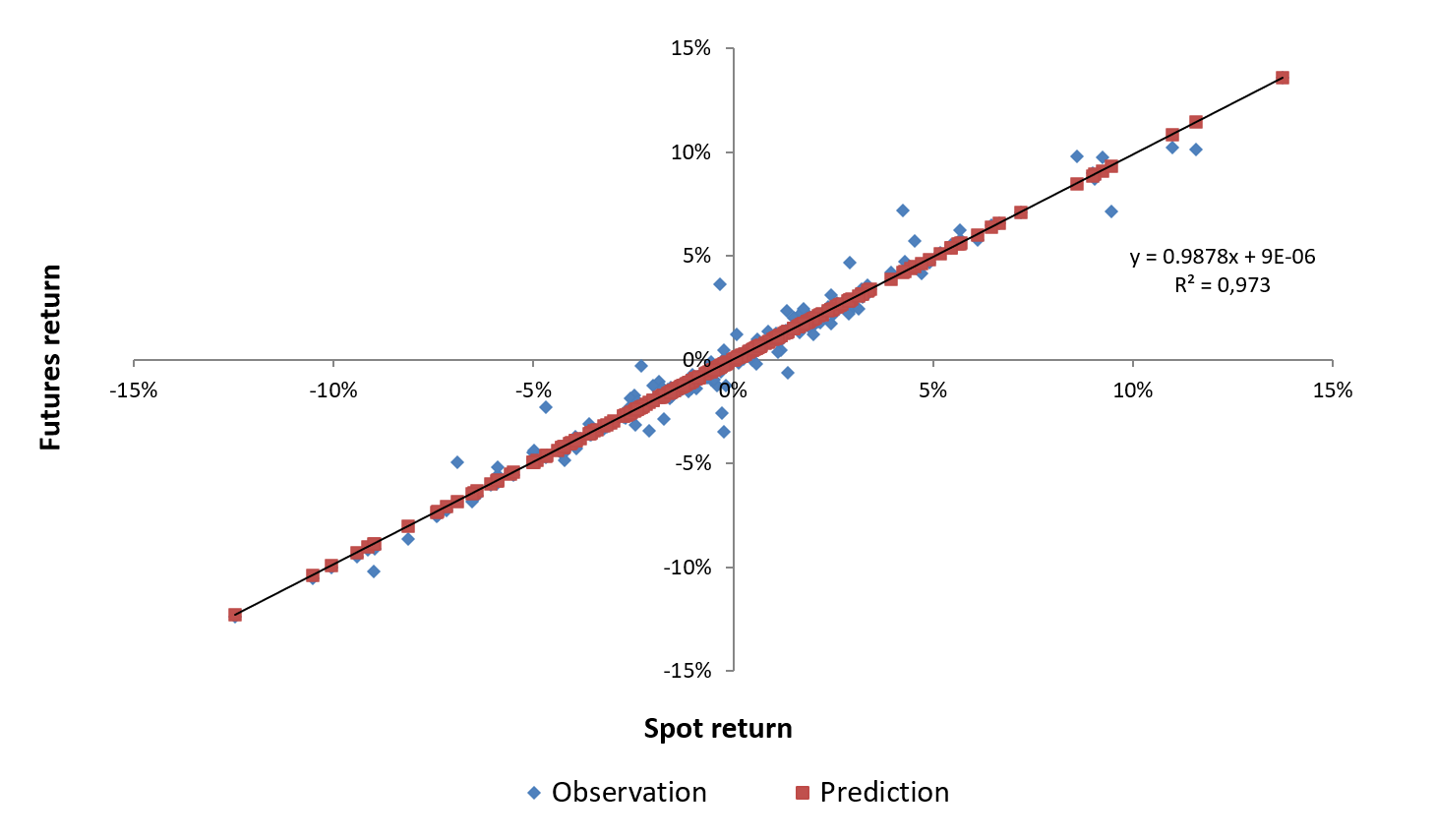

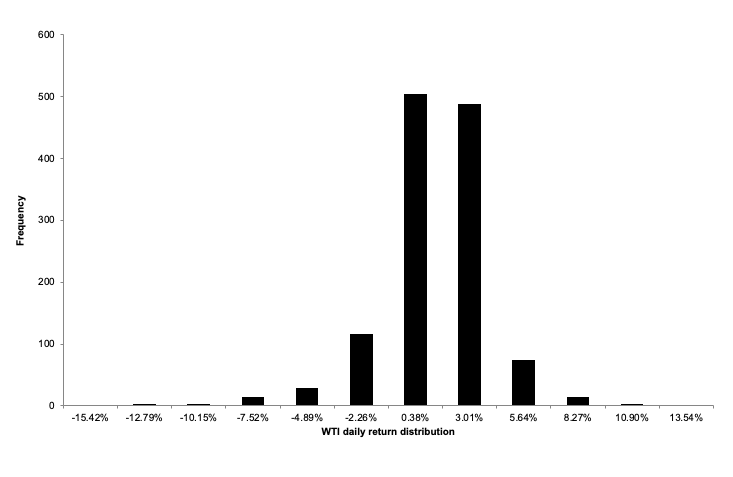

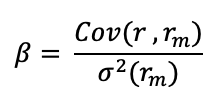

Source: computation by the author (data: Refinitiv Eikon).

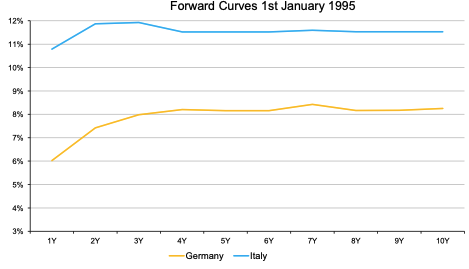

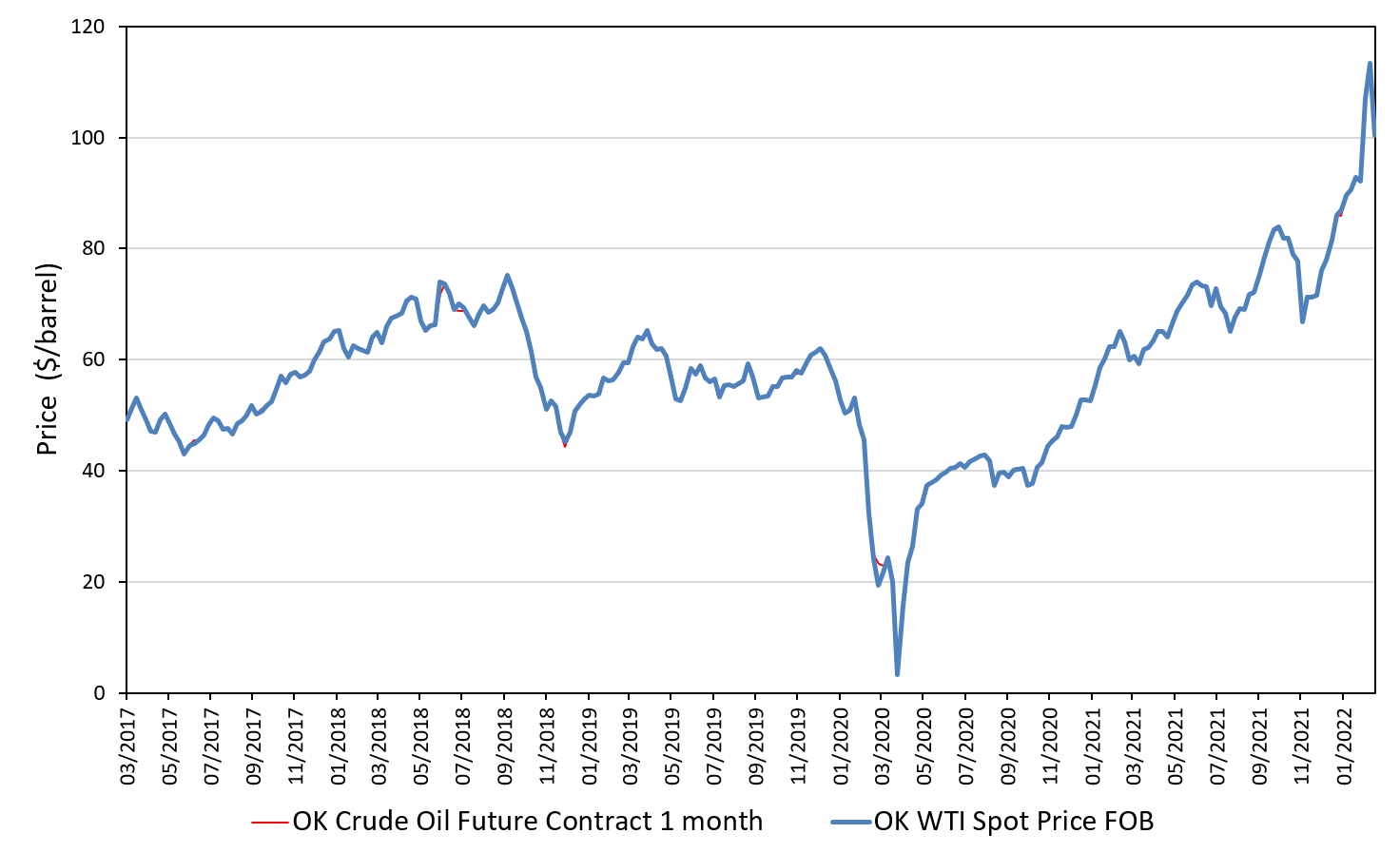

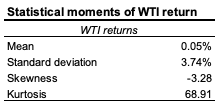

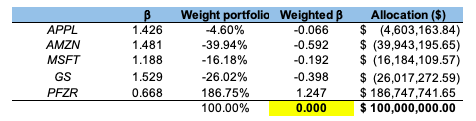

Source: computation by the author (Data: Refinitiv Eikon).

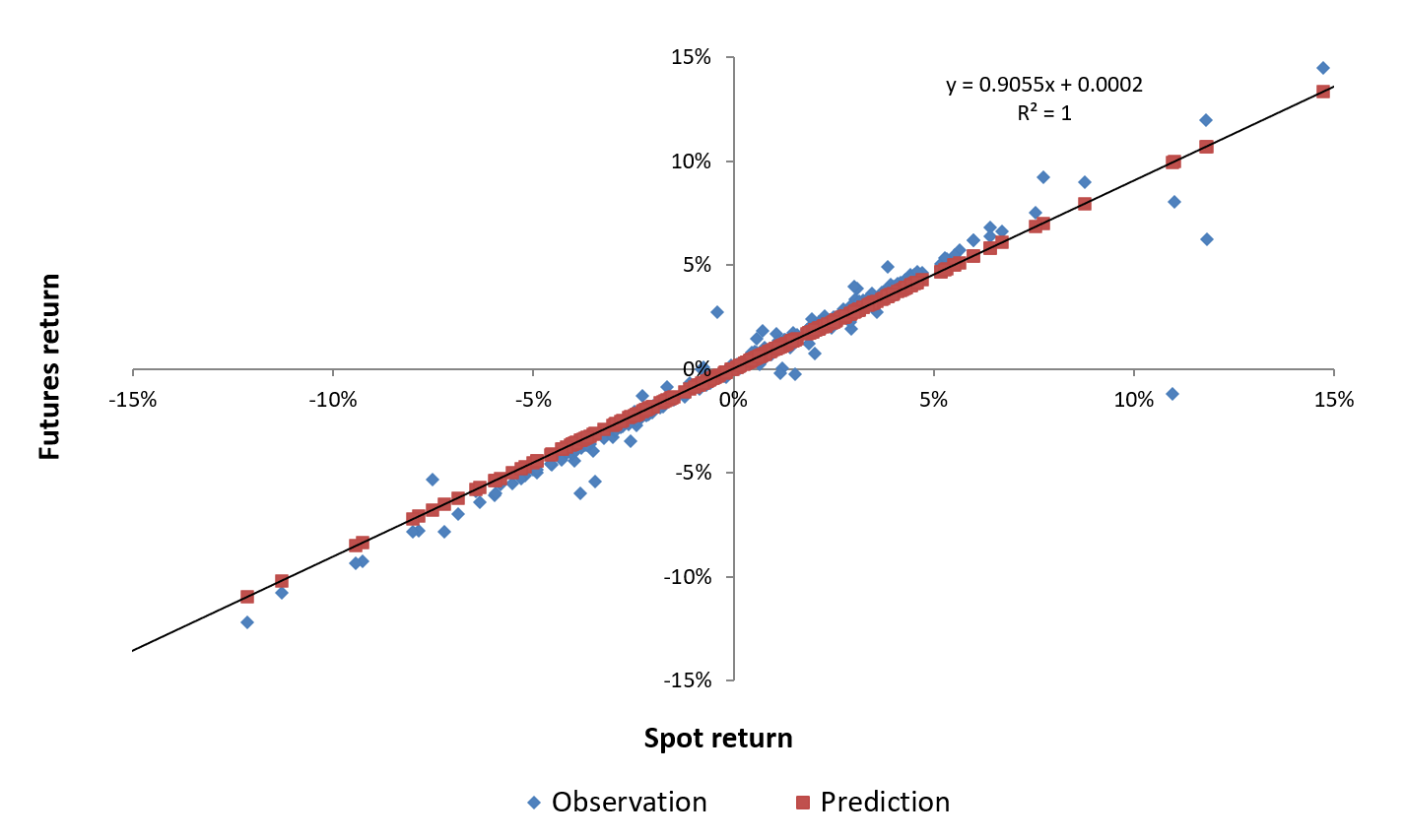

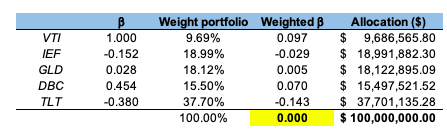

Source: computation by the author (Data: Refinitiv Eikon).

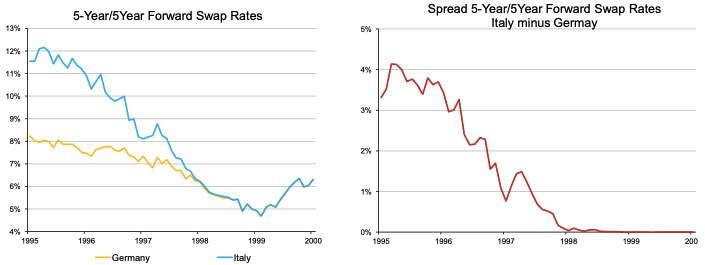

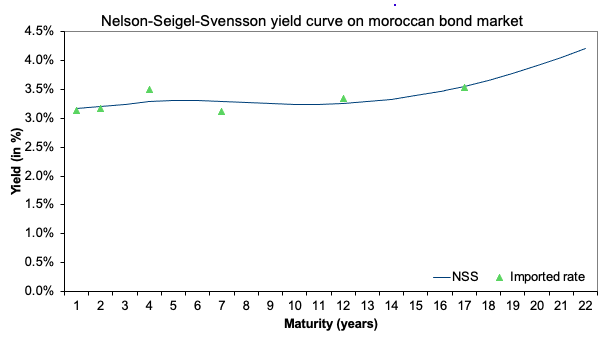

Source: computation by the author (Data: Bloomberg)

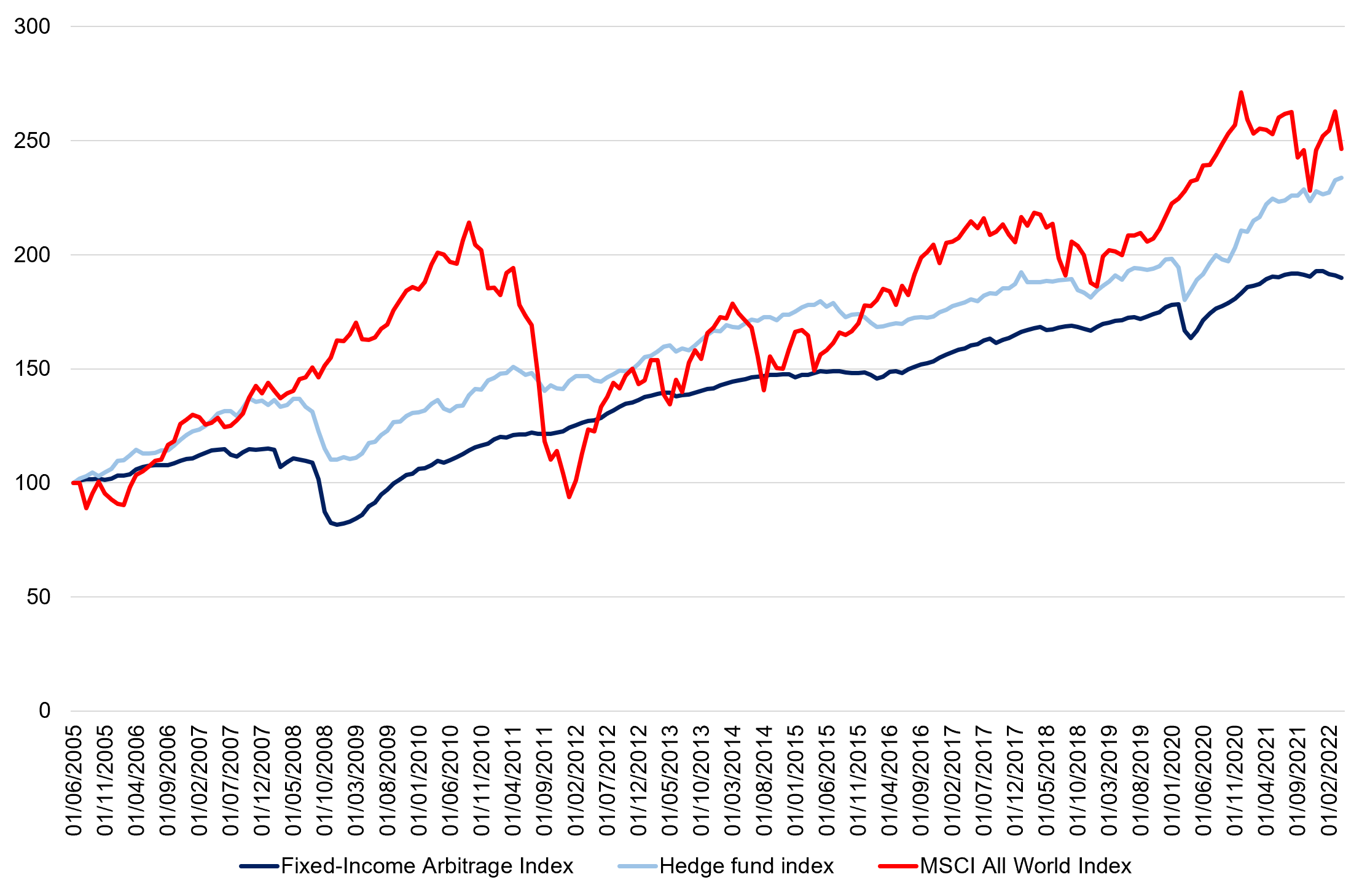

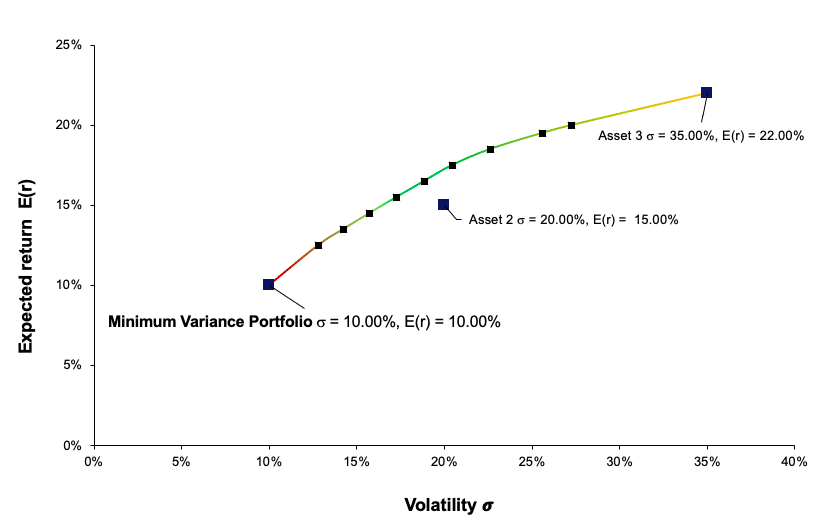

Source: computation by the author (Data: Bloomberg) Source: computation by the author. (Data: Reuters Eikon)

Source: computation by the author. (Data: Reuters Eikon)