The Euro Stoxx 50 index

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023) presents the Euro Stoxx 50 index and details its characteristics.

The Euro Stoxx 50 index

The performance of 50 large-capital companies with headquarters in Eurozone nations is reflected in the Euro Stoxx 50 stock market index. On February 26, 1998, Stoxx Ltd., a partnership between Deutsche Börse AG, Dow Jones & Company, and SIX Group AG, launched it. Companies from a wide range of industries, including the financial, consumer goods, healthcare, and industrial sectors are all included in the index.

Stocks for the Euro Stoxx 50 index are chosen based on market capitalization, liquidity, and sector representation, among other things. Every year in September, the index’s composition is reviewed, and adjustments are made as needed to reflect the state of the market and the performance of the companies.

The free-float market-capitalization-weighted index known as the Euro Stoxx 50. This means that rather than stock price, the index weights each company according to its market capitalization. The index is made available to the investors and traders worldwide and is disseminated in real-time by several financial news outlets.

The Euro Stoxx 50 index’s ticker symbol in the financial sector is “STOXX50E.”

Table 1 below gives the Top 10 stocks in the Euro Stoxx 50 index in terms of market capitalization as of January 31, 2023.

Table 1. Top 10 stocks in the Euro Stoxx 50 index.

Source: computation by the author (data: Yahoo! Finance website).

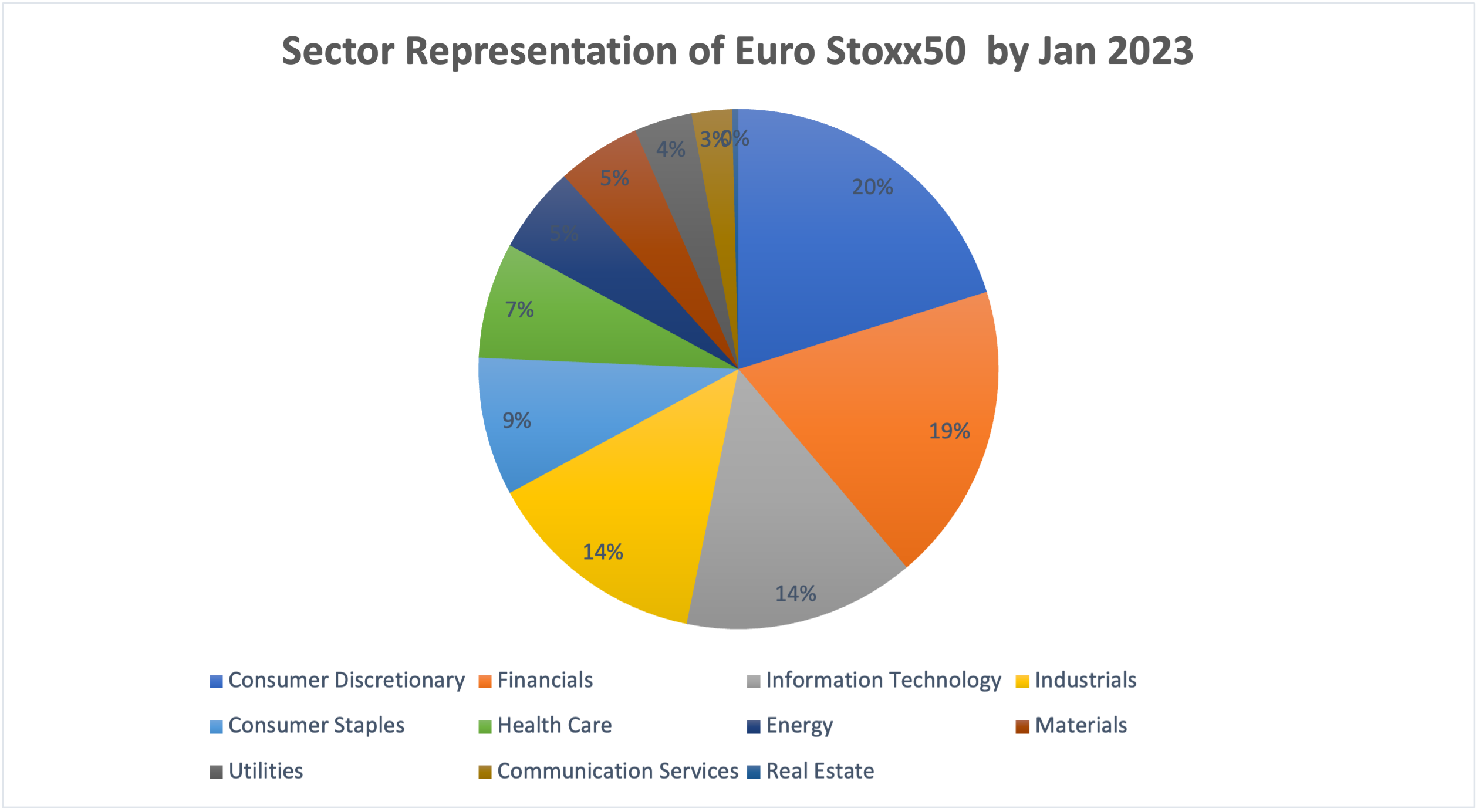

Table 2 below gives the sector representation of the Euro Stoxx 50 index in terms of number of stocks and market capitalization as of January 31, 2023.

Table 2. Sector representation in the Euro Stoxx 50 index.

Source: computation by the author (data: Yahoo! Finance website).

Calculation of the Euro Stoxx 50 index value

The performance of 50 sizable, blue-chip companies from 12 Eurozone nations, including France, Germany, Italy, and Spain, is tracked by the free-floating market-capitalization-weighted Euro Stoxx 50 index. The index, that includes a wide range of industries including financial services, energy, healthcare, consumer goods, and information technology, is intended to represent the performance of the most liquid and actively traded companies in Eurozone.

A free-float market-capitalization-weighted methodology is utilized to calculate the Euro Stoxx 50 index, which means that each company’s weight in the index is determined by its market capitalization adjusted for the shares that are actually traded in the secondary market (float).

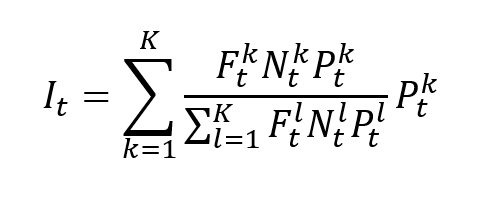

The formula to compute the Euro Stoxx 50 index is given by

where I is index value, k a given asset, K the number of assets in the index, Pk the market price of asset k, Nk the number of issued shares for asset k, Fk the float factor of asset k, and t the time of calculation of the index.

In a float-adjusted market-capitalization-weighted index, the weight of asset k is given by formula can be rewritten as

Use of the Euro Stoxx 50 index in asset management

One of the significant indices in Europe, the Euro Stoxx 50 is quite famous and changes in it can have a big impact on market trends and investor sentiment. Investors and traders worldwide have access to index’s real-time values that are published and distributed by a number of financial news sources. The Euro Stoxx 50 is a crucial resource for investors putting efforts to understand the economic and political climate of the Eurozone and gain access to the equity market there. The index can be used by the asset managers as a benchmark to compare the performance of their portfolio to the overall market and to spot potential risk or opportunity areas.

Benchmark for equity funds

Investors and fund managers frequently use the Euro Stoxx 50 to track the health of the Eurozone economy and assess investment opportunities in the region. It is recognized as the top benchmark for the performance of the Eurozone equity market. It consists of businesses from a range of industries, including consumer goods, technology, and finance. The index is used by asset managers to monitor and assess performance of their portfolios in relation to the overall market.

Financial products around the Euro Stoxx 50 index

There are several financial products tracking performance of the Euro Stoxx 50 index. These products allow investors to get exposure to the European stock market.

- ETFs are investment funds traded on stock exchanges that are designed to track the performance of an index. Several ETFs track the Euro Stoxx 50 index, such as the iShares EURO STOXX 50 UCITS and the Amundi ETF EURO STOXX 50 UCITS

- Index funds based on the Euro Stoxx 50 index also allow investors to track performance of the index. Examples of index funds tracking Euro Stoxx 50 index include the DWS Invest Euro Stoxx 50 Fund and the BNP Paribas Easy Euro Stoxx 50 UCITS ETF.

- Futures and options contracts based on Euro Stoxx 50 index provide investors with the ability to speculate on future performance of the index. For example, Eurex offers futures contracts based on the Euro Stoxx 50 index.

- Certificates are investment products that allow investors to gain exposure to Euro Stoxx 50 index. Societe Generale offers range of certificates linked to the Euro Stoxx 50 index, such as the EURO STOXX 50 Tracker Certificate.

Investors and asset managers may use these financial products to gain exposure to the Euro Stoxx 50 index and manage their portfolios’ risk and return.

Historical data for the Euro Stoxx 50 index

How to get the data?

The Euro Stoxx 50 index is the most common index used in finance, and historical data for the Euro Stoxx 50 index can be easily downloaded from the internet.

For example, you can download data for the Euro Stoxx 50 index from January 3, 1984 on Yahoo! Finance (the Yahoo! code for Euro Stoxx 50 index is ^STOXX50E).

Source: Yahoo! Finance.

You can also download the same data from a Bloomberg terminal.

R program

The R program below written by Shengyu ZHENG allows you to download the data from Yahoo! Finance website and to compute summary statistics and risk measures about the Euro Stoxx 50 index.

Data file

The R program that you can download above allows you to download the data for the Euro Stoxx 50 index from the Yahoo! Finance website. The database starts on January 3, 1984. It also computes the returns (logarithmic returns) from closing prices.

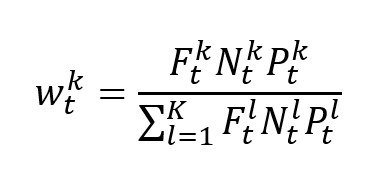

Table 3 below represents the top of the data file for the Euro Stoxx 50 index downloaded from the Yahoo! Finance website with the R program.

Table 3. Top of the data file for the Euro Stoxx 50 index.

Source: computation by the author (data: Yahoo! Finance website).

Evolution of the Euro Stoxx 50 index

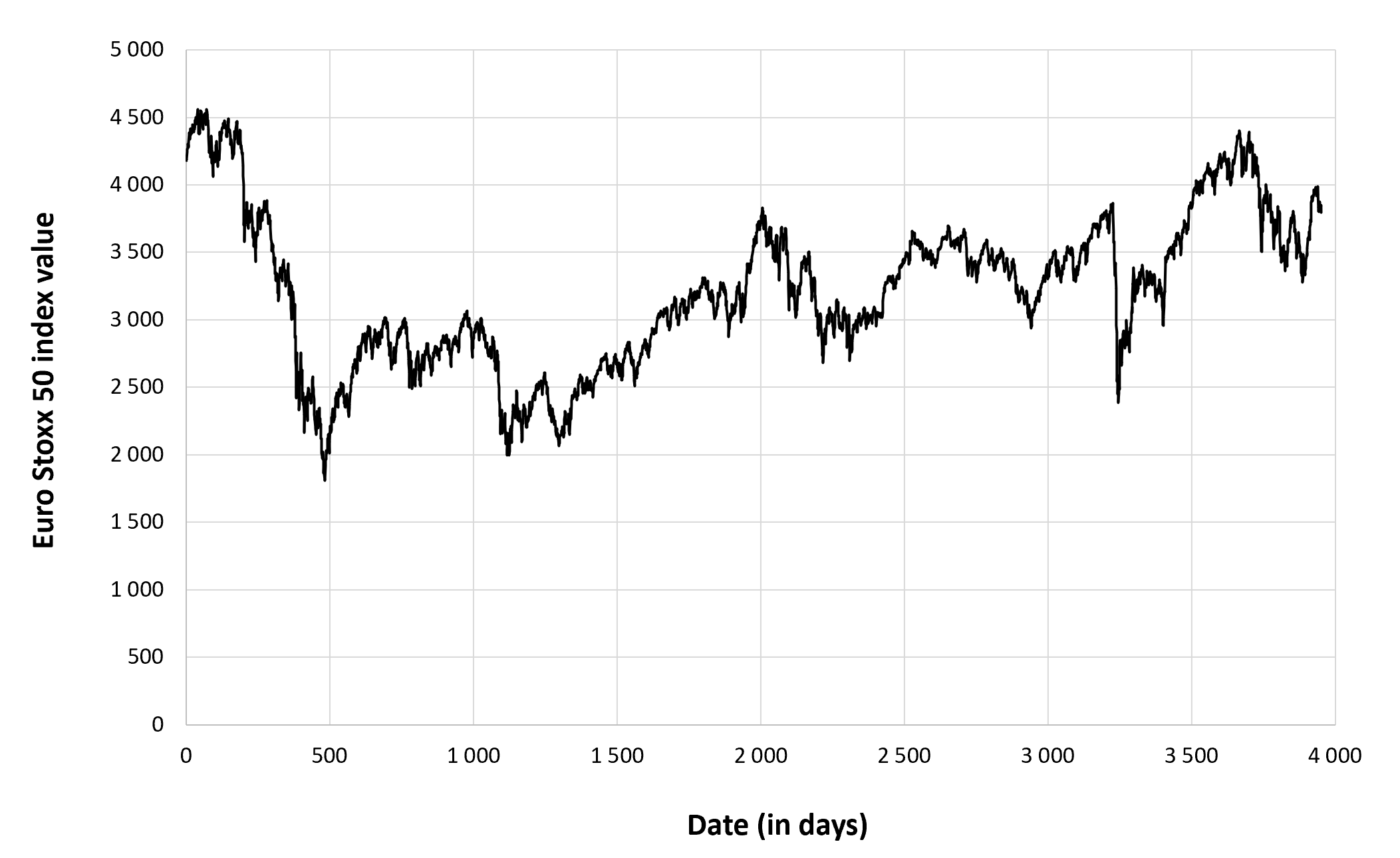

Figure 1 below gives the evolution of the Euro Stoxx 50 index from January 3, 1984 to December 30, 2022 on a daily basis.

Figure 1. Evolution of the Euro Stoxx 50 index.

Source: computation by the author (data: Yahoo! Finance website).

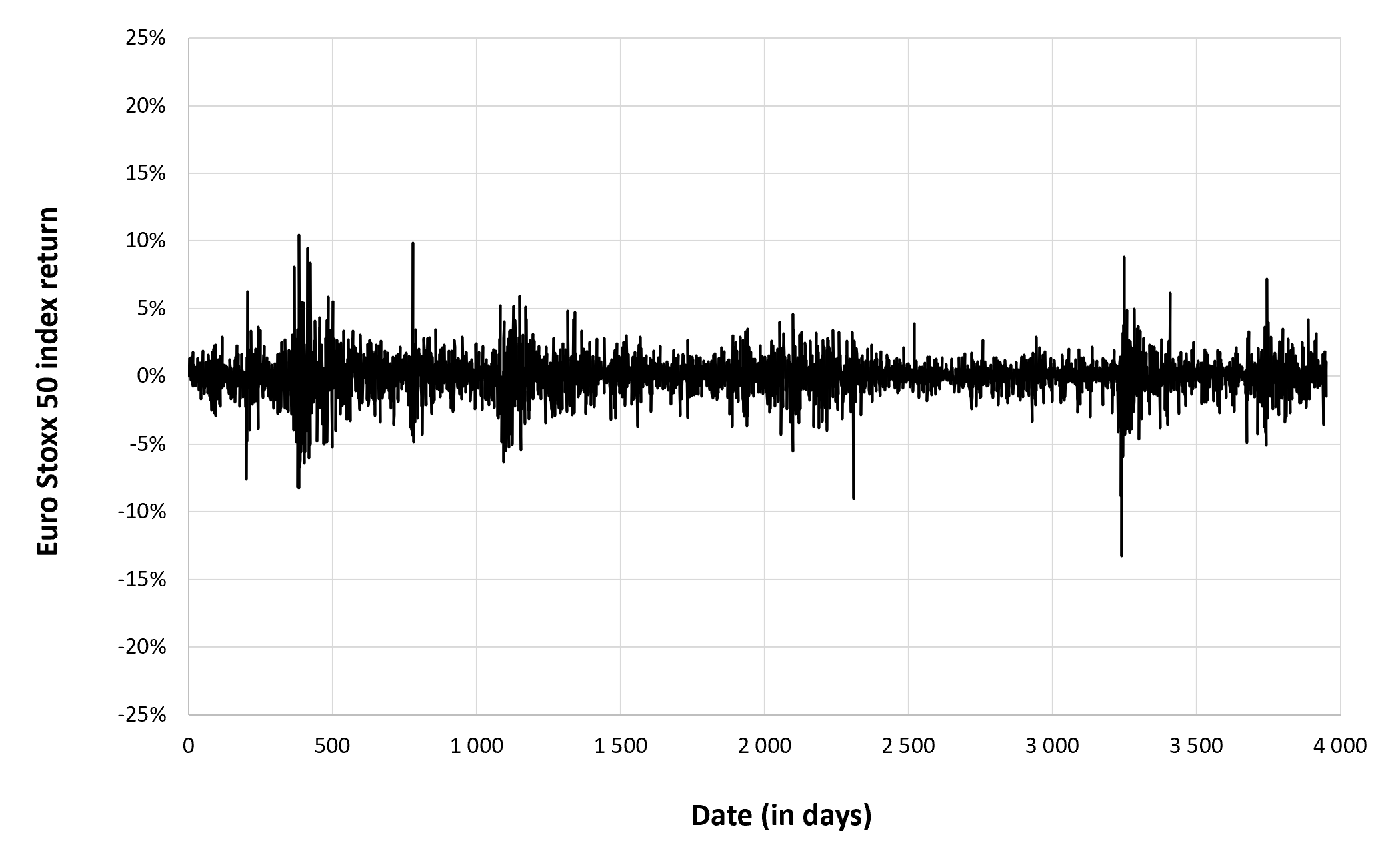

Figure 2 below gives the evolution of the Euro Stoxx 50 index returns from January 3, 1984 to December 30, 2022 on a daily basis.

Figure 2. Evolution of the Euro Stoxx 50 index returns.

Source: computation by the author (data: Yahoo! Finance website).

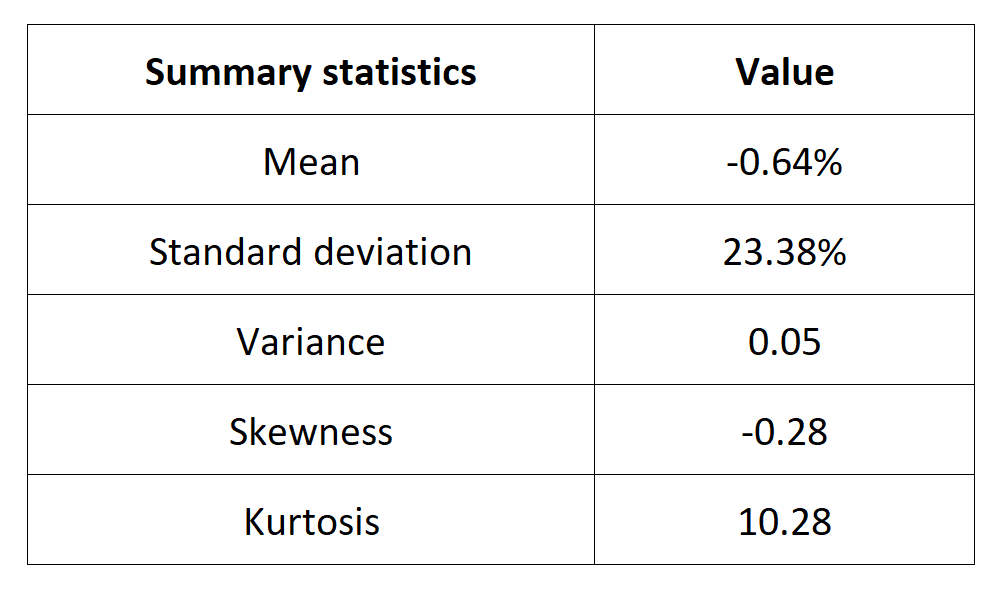

Summary statistics for the Euro Stoxx 50 index

The R program that you can download above also allows you to compute summary statistics about the returns of the Euro Stoxx 50 index.

Table 4 below presents the following summary statistics estimated for the Euro Stoxx 50 index:

- The mean

- The standard deviation (the squared root of the variance)

- The skewness

- The kurtosis.

The mean, the standard deviation / variance, the skewness, and the kurtosis refer to the first, second, third and fourth moments of statistical distribution of returns respectively.

Table 4. Summary statistics for the Euro Stoxx 50 index.

Source: computation by the author (data: Yahoo! Finance website).

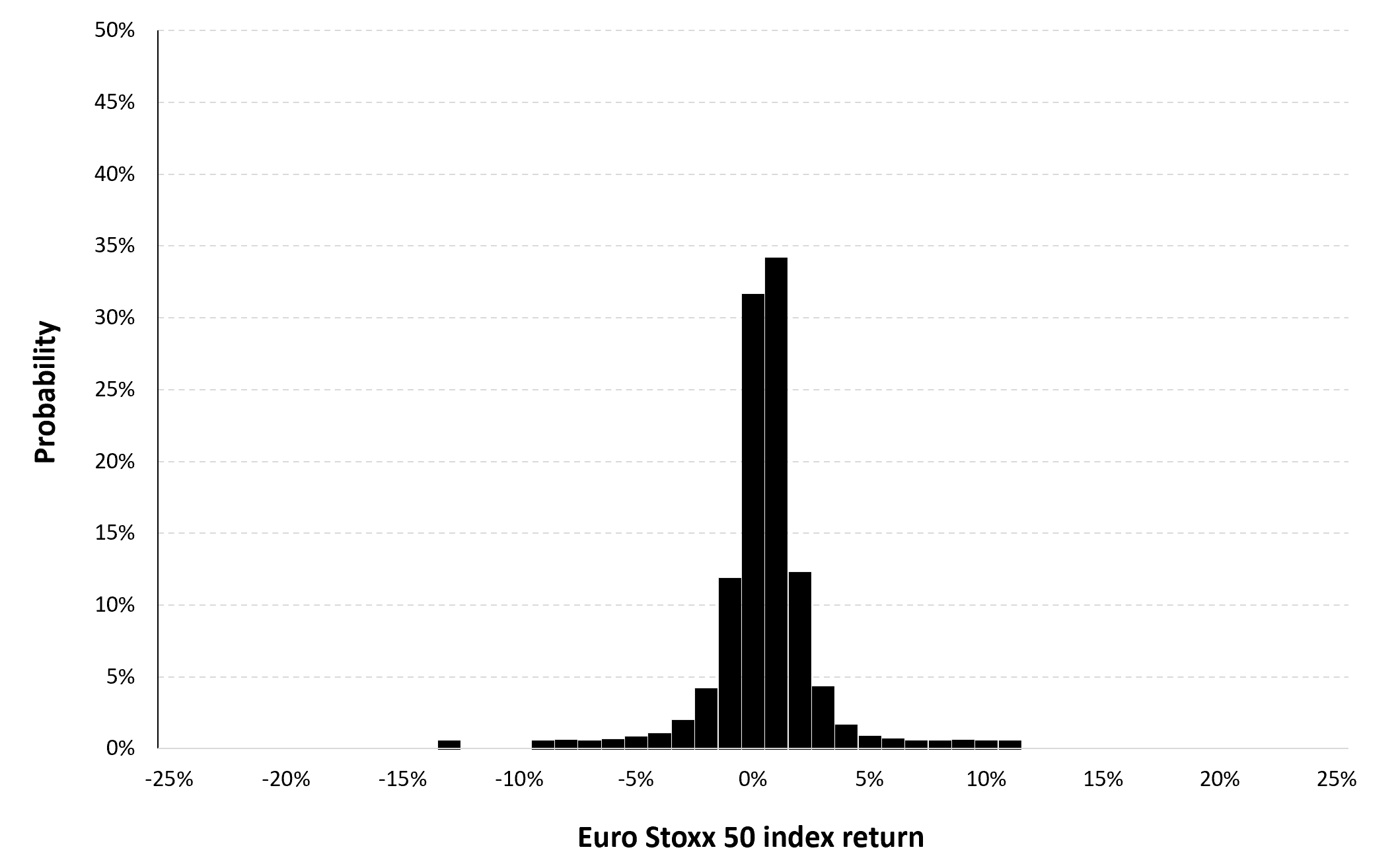

Statistical distribution of the Euro Stoxx 50 index returns

Historical distribution

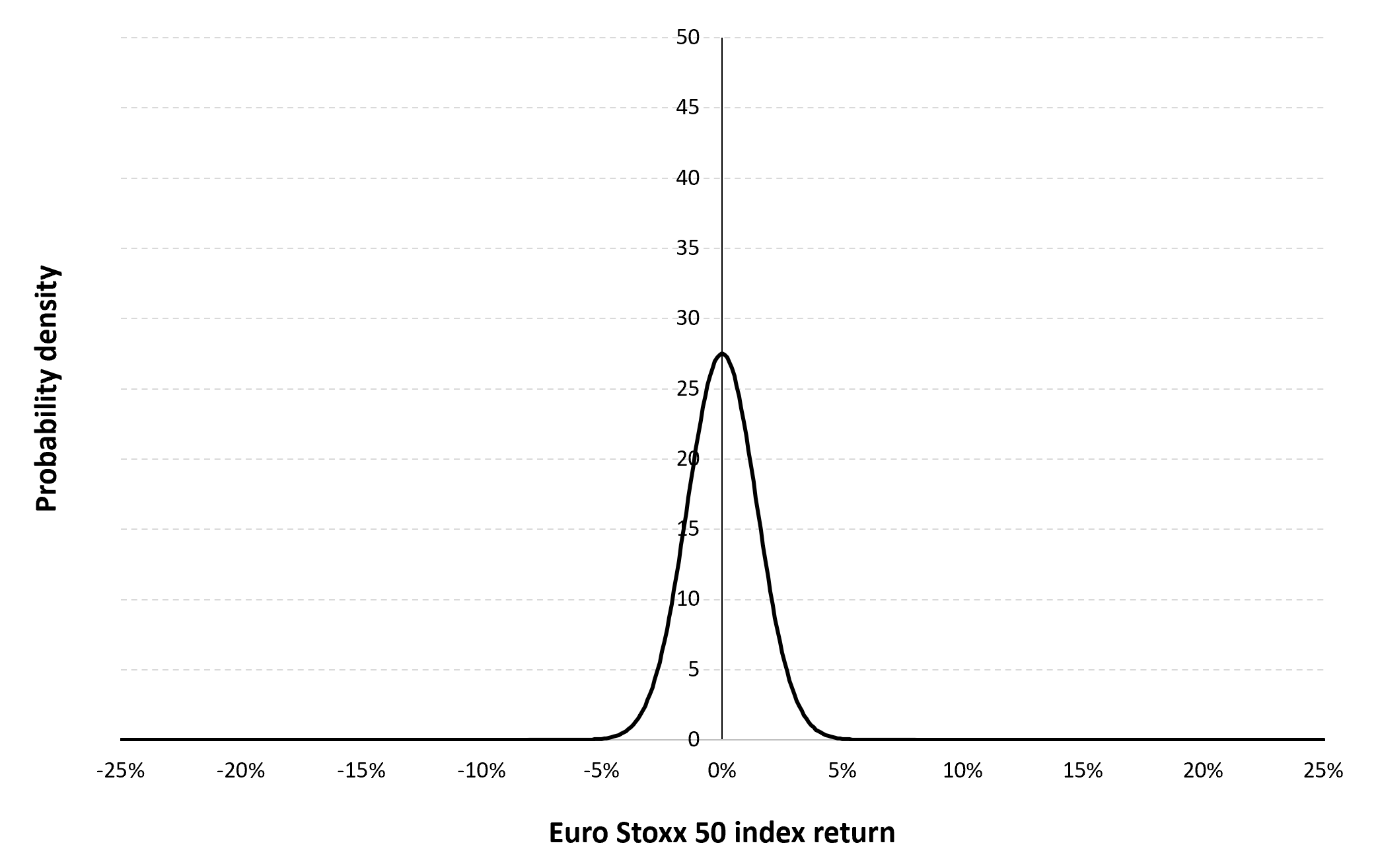

Figure 3 represents the historical distribution of the Euro Stoxx 50 index daily returns for the period from January 3, 1984 to December 30, 2022.

Figure 3. Historical distribution of the Euro Stoxx 50 index returns.

Source: computation by the author (data: Yahoo! Finance website).

Gaussian distribution

The Gaussian distribution (also called the normal distribution) is a parametric distribution with two parameters: the mean and the standard deviation of returns. We estimated these two parameters over the period from January 3, 1984 to December 30, 2022. The mean of daily returns is equal to 0.02% and the standard deviation of daily returns is equal to 1.37% (or equivalently 3.94% for the annual mean and 28.02% for the annual standard deviation as shown in Table 3 above).

Figure 4 below represents the Gaussian distribution of the Euro Stoxx 50 index daily returns with parameters estimated over the period from January 3, 1984 to December 30, 2022.

Figure 4. Gaussian distribution of the Euro Stoxx 50 index returns.

Source: computation by the author (data: Yahoo! Finance website).

Risk measures of the Euro Stoxx 50 index returns

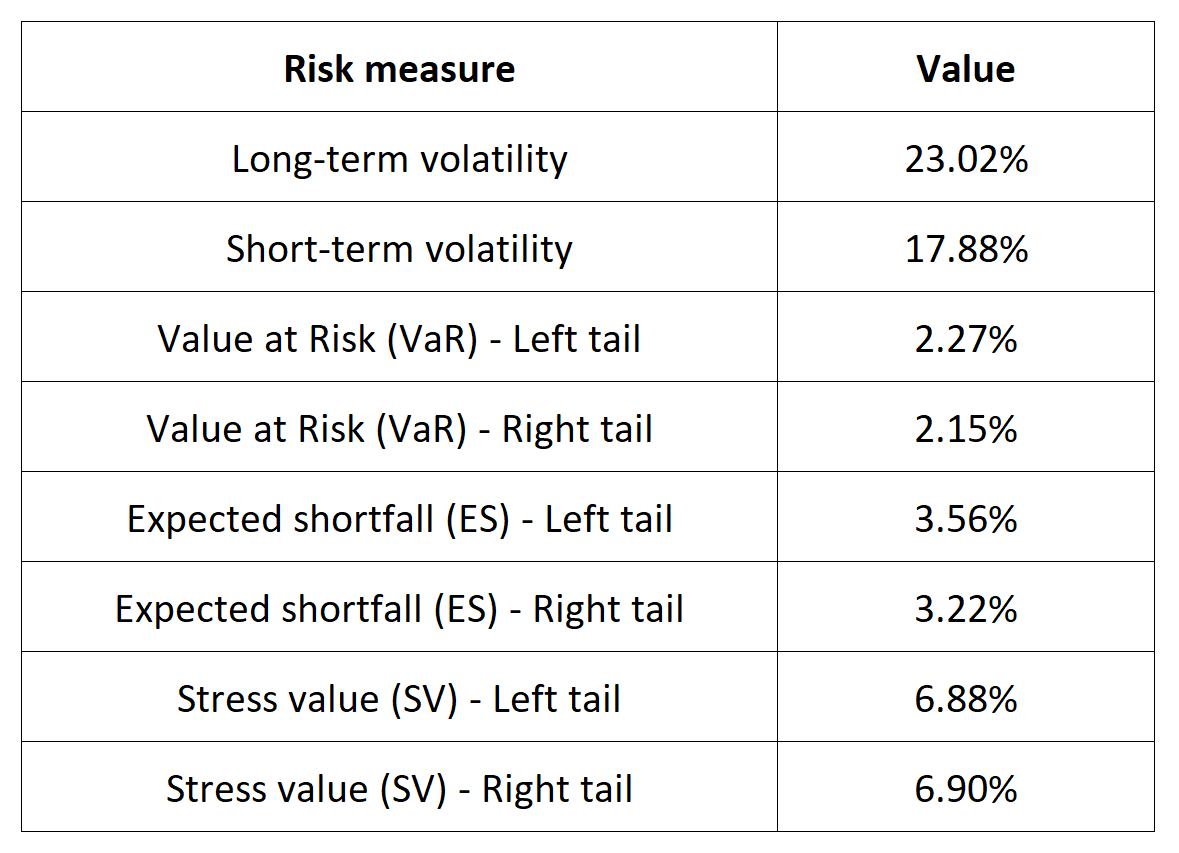

The R program that you can download above also allows you to compute risk measures about the returns of the Euro Stoxx 50 index.

Table 5 below presents the following risk measures estimated for the Euro Stoxx 50 index:

- The long-term volatility (the unconditional standard deviation estimated over the entire period)

- The short-term volatility (the standard deviation estimated over the last three months)

- The Value at Risk (VaR) for the left tail (the 5% quantile of the historical distribution)

- The Value at Risk (VaR) for the right tail (the 95% quantile of the historical distribution)

- The Expected Shortfall (ES) for the left tail (the average loss over the 5% quantile of the historical distribution)

- The Expected Shortfall (ES) for the right tail (the average loss over the 95% quantile of the historical distribution)

- The Stress Value (SV) for the left tail (the 1% quantile of the tail distribution estimated with a Generalized Pareto distribution)

- The Stress Value (SV) for the right tail (the 99% quantile of the tail distribution estimated with a Generalized Pareto distribution)

Table 5. Risk measures for the Euro Stoxx 50 index.

Source: computation by the author (data: Yahoo! Finance website).

The volatility is a global measure of risk as it considers all the returns. The Value at Risk (VaR), Expected Shortfall (ES) and Stress Value (SV) are local measures of risk as they focus on the tails of the distribution. The study of the left tail is relevant for an investor holding a long position in the Euro Stoxx 50 index while the study of the right tail is relevant for an investor holding a short position in the Euro Stoxx 50 index.

Why should I be interested in this post?

For a number of reasons, management students (as future managers and individual investors) should learn about the Euro Stoxx 50 index. It is made up of businesses from 11 different Eurozone nations that operate in a variety of industries, including banking, technology, and healthcare. The Euro Stoxx 50 index is a key benchmark for the European equity market, which is one of the world’s largest market. Understanding how the index is constructed, how it performs, and the companies that make up the index is important for anyone studying finance or business in Europe or interested in investing in European equities. Students interested in careers in investment banking, asset management, or global business may find this information useful.

Individual investors can assess the performance of their own investments in the European equity market with the Euro Stoxx 50 index. Last but not least, a lot of asset management firms base their mutual funds and exchange-traded funds (ETFs) on the Euro Stoxx 50 index which can considered as interesting assets to diversify a portfolio. Learning about these products and their portfolio and risk management applications can be valuable for management students.

Related posts on the SimTrade blog

About financial indexes

▶ Nithisha CHALLA Financial indexes

▶ Nithisha CHALLA Calculation of financial indexes

▶ Nithisha CHALLA The business of financial indexes

▶ Nithisha CHALLA Float

Other financial indexes

▶ Nithisha CHALLA The S&P 500 index

▶ Nithisha CHALLA The FTSE 100 index

▶ Nithisha CHALLA The DAX 30 index

▶ Nithisha CHALLA The CAC 40 index

▶ Nithisha CHALLA The IBEX 35 index

About portfolio management

▶ Youssef LOURAOUI Portfolio

▶ Jayati WALIA Returns

About statistics

▶ Shengyu ZHENG Moments de la distribution

▶ Shengyu ZHENG Mesures de risques

Useful resources

Academic research about risk

Longin F. (2000) From VaR to stress testing: the extreme value approach Journal of Banking and Finance, N°24, pp 1097-1130.

Longin F. (2016) Extreme events in finance: a handbook of extreme value theory and its applications Wiley Editions.

Business

Wikipedia History of Euro Stoxx 50

Capital What is the Euro Stoxx Index Definition?

Deutsche Börse Xetra EURO STOXX 50® Index derivatives

Data

Yahoo Finance Euro Stoxx 50 index

About the author

The article was written in April 2023 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023).