The NASDAQ index

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023) presents the NASDAQ index and details its characteristics.

The NASDAQ index

NASDAQ was first founded in 1971 and it is an American stock exchange. By market capitalization of shares traded it is the second-largest stock exchange in the world after the New York Stock Exchange (NYSE). As many of the technology and growth companies are listed on the exchange it is a popular benchmark for them. It has around 3000 companies listed on it, including some of the world’s top technology companies like Microsoft, Amazon, Facebook and Google.

The NASDAQ index is a market capitalization-weighted index that tracks the performance of the stocks listed on the NASDAQ exchange. It is widely used by investors and financial analysts to gauge the performance of the technology sector and the broader US economy.

Interestingly, there is a sister index, the Nasdaq Financial 100 that consists only of financial stocks. Both indices debuted together in 1985. The Nasdaq Financial 100 index was given more attention in the early years. However, the Nasdaq-100 has gained popularity over time due to the expansion of tech companies.

How is the NASDAQ index represented in trading platforms and financial websites? The ticker symbol used in the financial industry for the NASDAQ index is “NDAQ”.

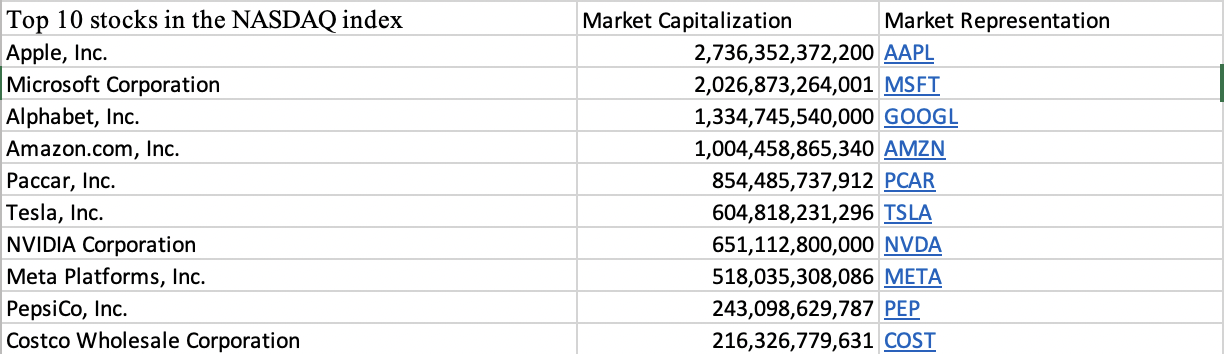

Table 1 gives the Top 10 stocks in the NASDAQ index in terms of market capitalization as of August 26, 2022.

Table 1. Top 10 stocks in the NASDAQ index.

Source: computation by the author (data: NASDAQ! financial website).

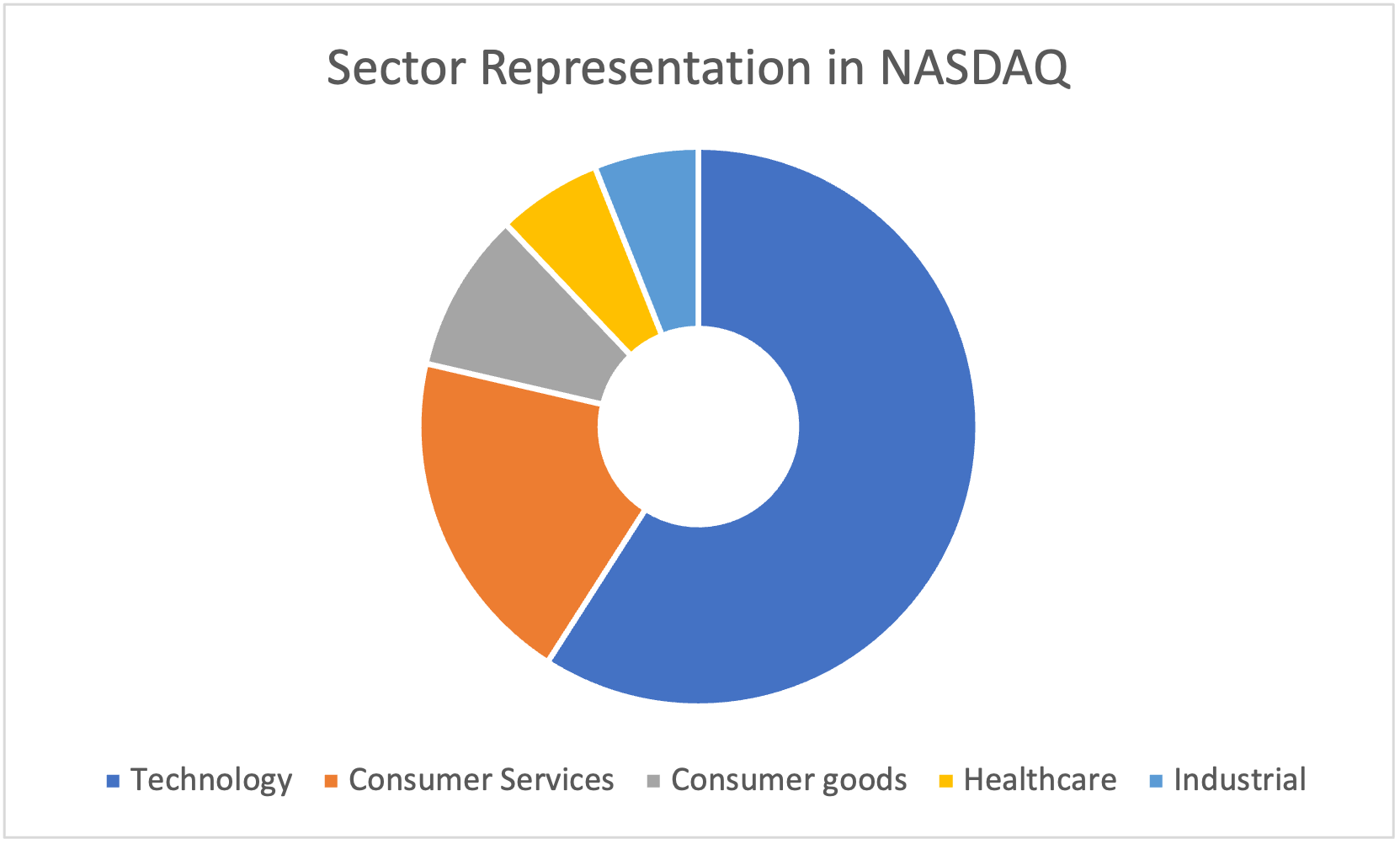

Table 2 gives the sector representation of the NASDAQ index in terms of number of stocks and market capitalization as of January 31, 2023.

Table 2. Sector representation in the NASDAQ index.

Source: computation by the author (data: ETmoney!).

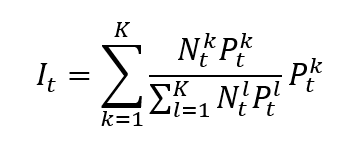

Calculation of the NASDAQ index value

The NASDAQ index is a value-weighted index (also called a market-capitalization- weighted index). This means the larger companies have a greater impact on the index than the smaller companies.

At the end of each trading day the value of the NASDAQ index is determined in real-time and can be used as a benchmark for the performance of the index’s constituent companies’ current market prices.

The formula for a market-capitalization-weighted index is given by

Where I is the index value, k a given asset, K the number of assets in the index, Pk the market price of asset k, Nk the number of issued shares for asset k, and t the time of calculation of the index.

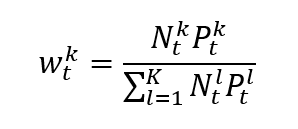

In a market capitalization-weighted index, the weight of asset k is given by formula can be rewritten as

which clearly shows that the weight of each asset in the index is its market capitalization of the asset divided by the sum of the market capitalizations of all assets.

Note that the divisor, whose calculation is based on the number of shares, is typically adjusted for events such as stock splits and dividends. The divisor is used to ensure that the value of the index remains consistent over time despite changes in the number of outstanding shares.

Use of the NASDAQ index in asset management

Given that the index is used for performance measuring it is widely used for constructing and analyzing investment portfolios. This index’s primary use is to create investment strategies, mitigate risk, and assess portfolio performance. Investors and asset managers utilize this index as a useful index to measure the overall performance of the market. It is mainly used for benchmarking, passive investing, active management and risk management.

Benchmark for equity funds

There are several indices that are used as a benchmark for equity funds, but the NASDAQ index is notable for its emphasis on businesses that invest in the technology sector, growth stocks, or both. It is primarily used to compare their performance to the overall market or a particular industry. Additionally, it gives investors a way to contrast the performance of various equity funds with various investment strategies or objectives.

While there are many advantages to using indexes as benchmarks, there are also some disadvantages and restrictions. For instance, benchmarks may not always be indicative of the precise investment goals or risk profile of a fund. Furthermore, benchmarks may be distorted by elements like the size or makeup of the companies included in the index.

Financial products around the NASDAQ index

Investors of all levels can invest in the Nasdaq-100 in a variety of ways, including through ETFs, mutual funds, options, futures, and annuities. ETFs that track the Nasdaq-100 are the easiest way to invest in the index. The ETF gives you exposure to all the 100 largest non-financial companies through a single investment. One of the most well-known ETFs that tracks the Nasdaq-100 index is the Invesco QQQ ETF and the First Trust NASDAQ-100 Technology Sector ETF (QTEC). The Nasdaq-100 is regarded as the best way to invest in some of the top non-financial companies listed on the Nasdaq because of its track record of strong index performance.

The Nasdaq-100 includes foreign stocks as well, unlike the S&P 500. Again, unlike the S&P 500, the Nasdaq-100 only permits non-financial companies to list on it. As of April 2023, a few of the international stocks that are a part of the Nasdaq-100 are Baidu from China, Ryanair from Ireland, Garmin from Cayman Island, and Infosys from India.

Index funds that attempt to track the Nasdaq Composite include Fidelity Investments’ FNCMX mutual fund and ONEQ exchange-traded fund. For investors looking for broad exposure to the stock market with relatively low fees, index funds are a popular option.

Historical data for the NASDAQ index

How to get the data?

The NASDAQ index is the most common index used in finance, and historical data for the NASDAQ index can be easily downloaded from the internet.

For example, you can download data for the NASDAQ index from January 5, 1972 on Yahoo! Finance (the Yahoo! code for NASDAQ index is ^IXIC).

Source: Yahoo! Finance.

You can also download the same data from a Bloomberg terminal.

R program

The R program below written by Shengyu ZHENG allows you to download the data from Yahoo! Finance website and to compute summary statistics and risk measures about the Nasdaq index.

Data file

The R program that you can download above allows you to download the data for the Nasdaq index from the Yahoo! Finance website. The database starts on January 2, 1992. It also computes the returns (logarithmic returns) from closing prices.

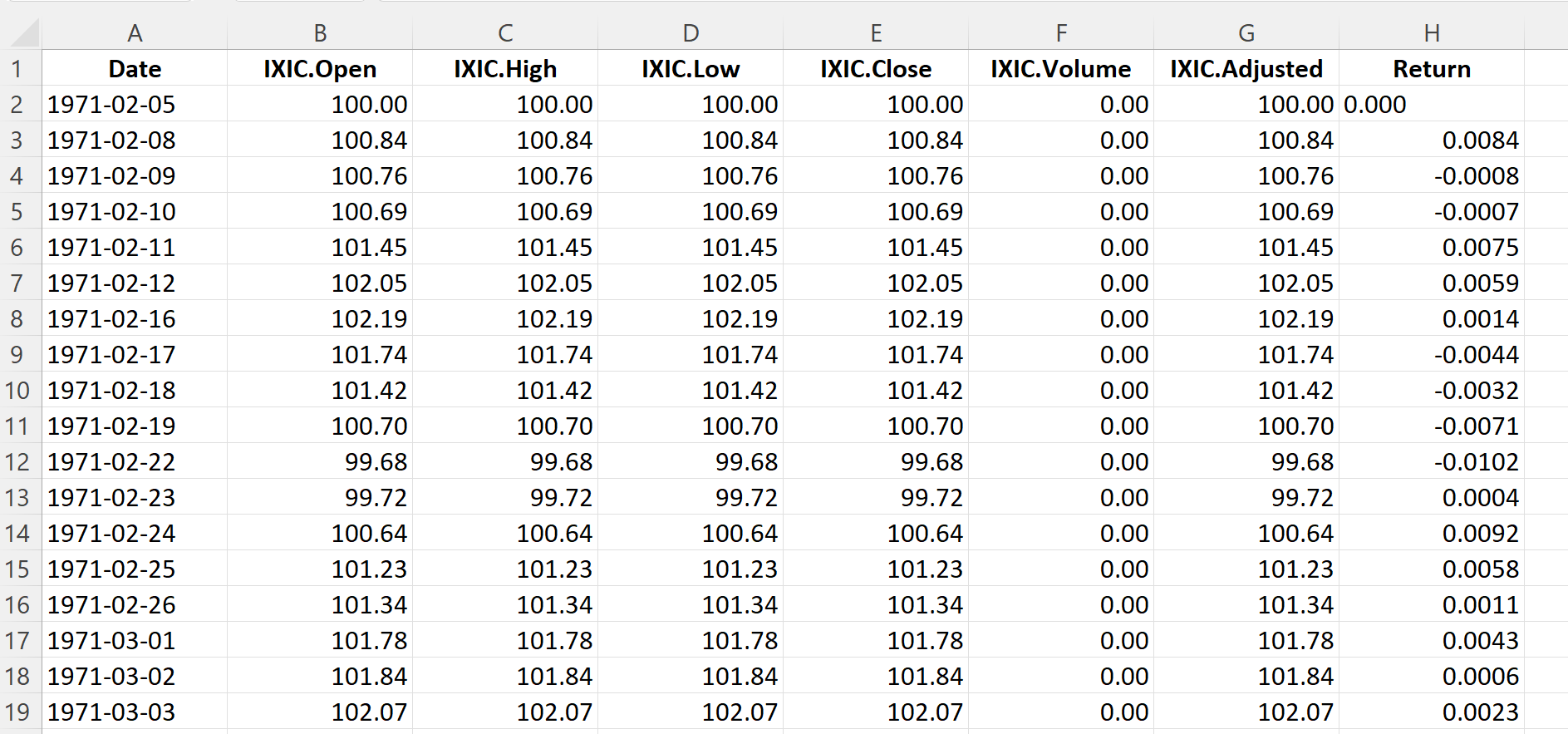

Table 3 below represents the top of the data file for the Nasdaq index downloaded from the Yahoo! Finance website with the R program.

Table 3. Top of the data file for the Nasdaq index.

Source: computation by the author (data: Yahoo! Finance website).

Summary statistics for the Nasdaq index

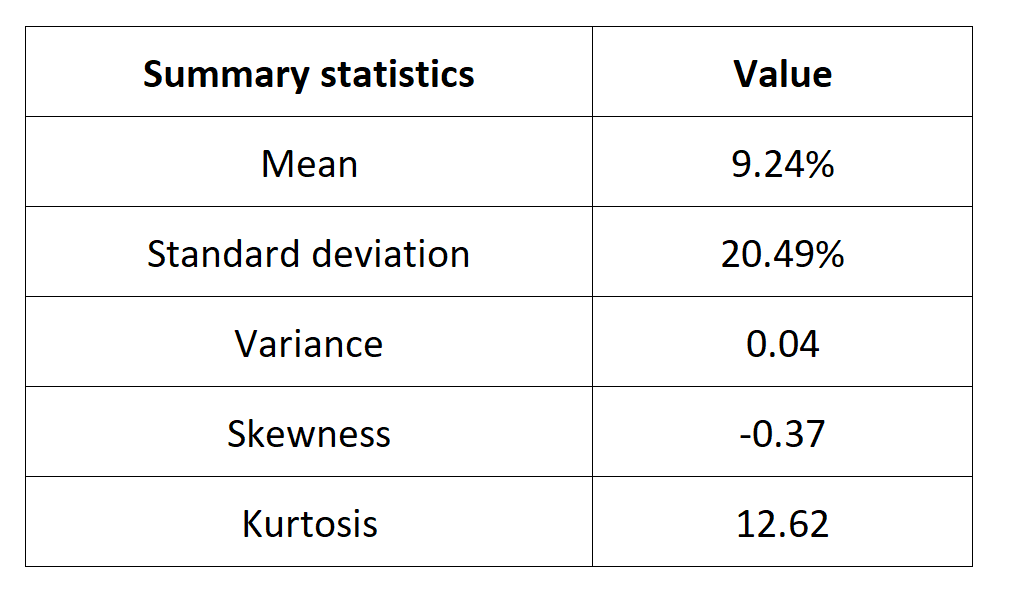

The R program that you can download above also allows you to compute summary statistics about the returns of the Nasdaq index.

Table 4 below presents the following summary statistics estimated for the Nasdaq index:

- The mean

- The standard deviation (the squared root of the variance)

- The skewness

- The kurtosis.

The mean, the standard deviation / variance, the skewness, and the kurtosis refer to the first, second, third and fourth moments of statistical distribution of returns respectively.

Table 4. Summary statistics for the Nasdaq index.

Source: computation by the author (data: Yahoo! Finance website).

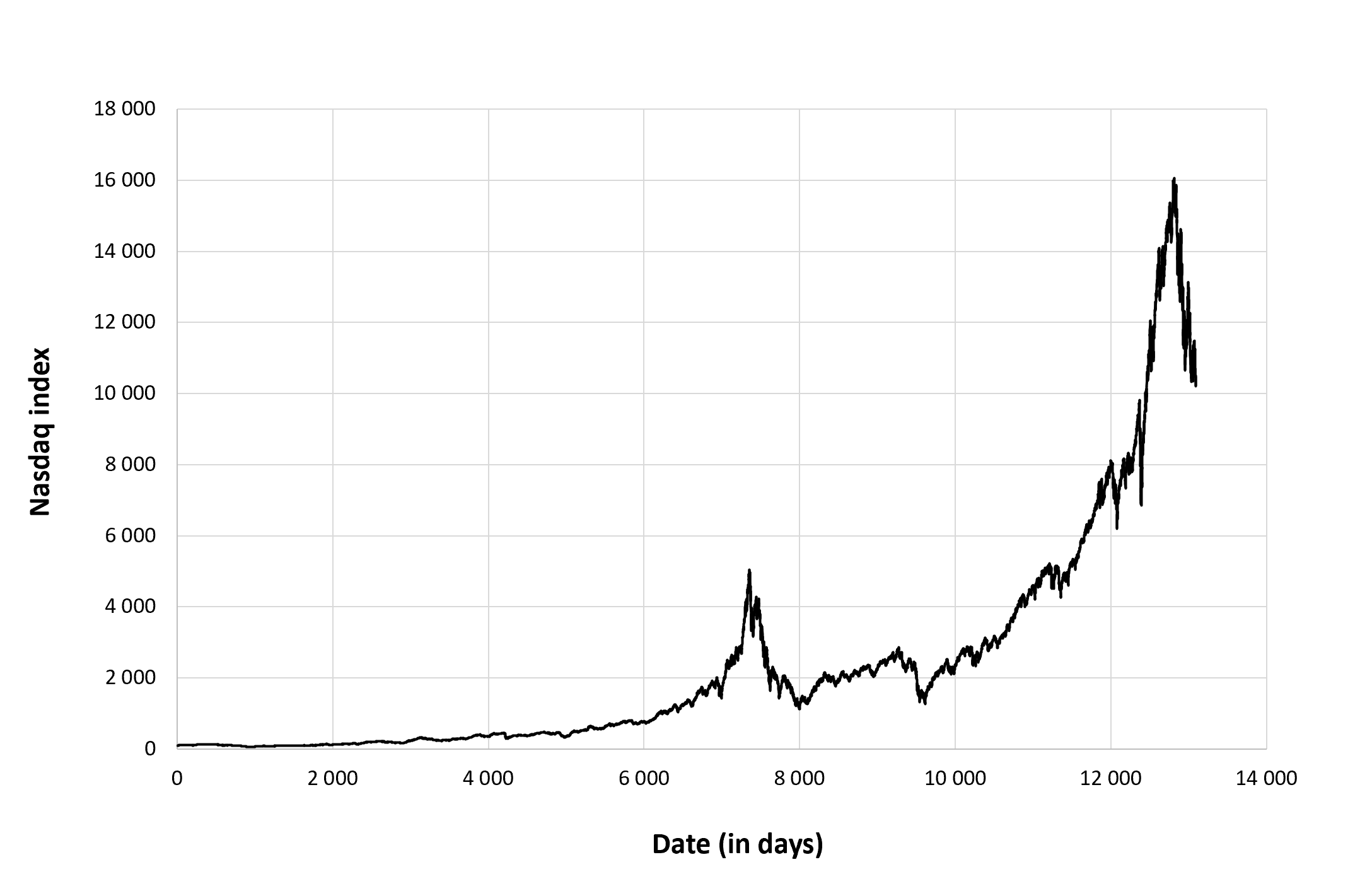

Evolution of the Nasdaq index

Figure 1 below gives the evolution of the Nasdaq index from January 2, 1992 to December 30, 2022 on a daily basis.

Figure 1. Evolution of the Nasdaq index.

Source: computation by the author (data: Yahoo! Finance website).

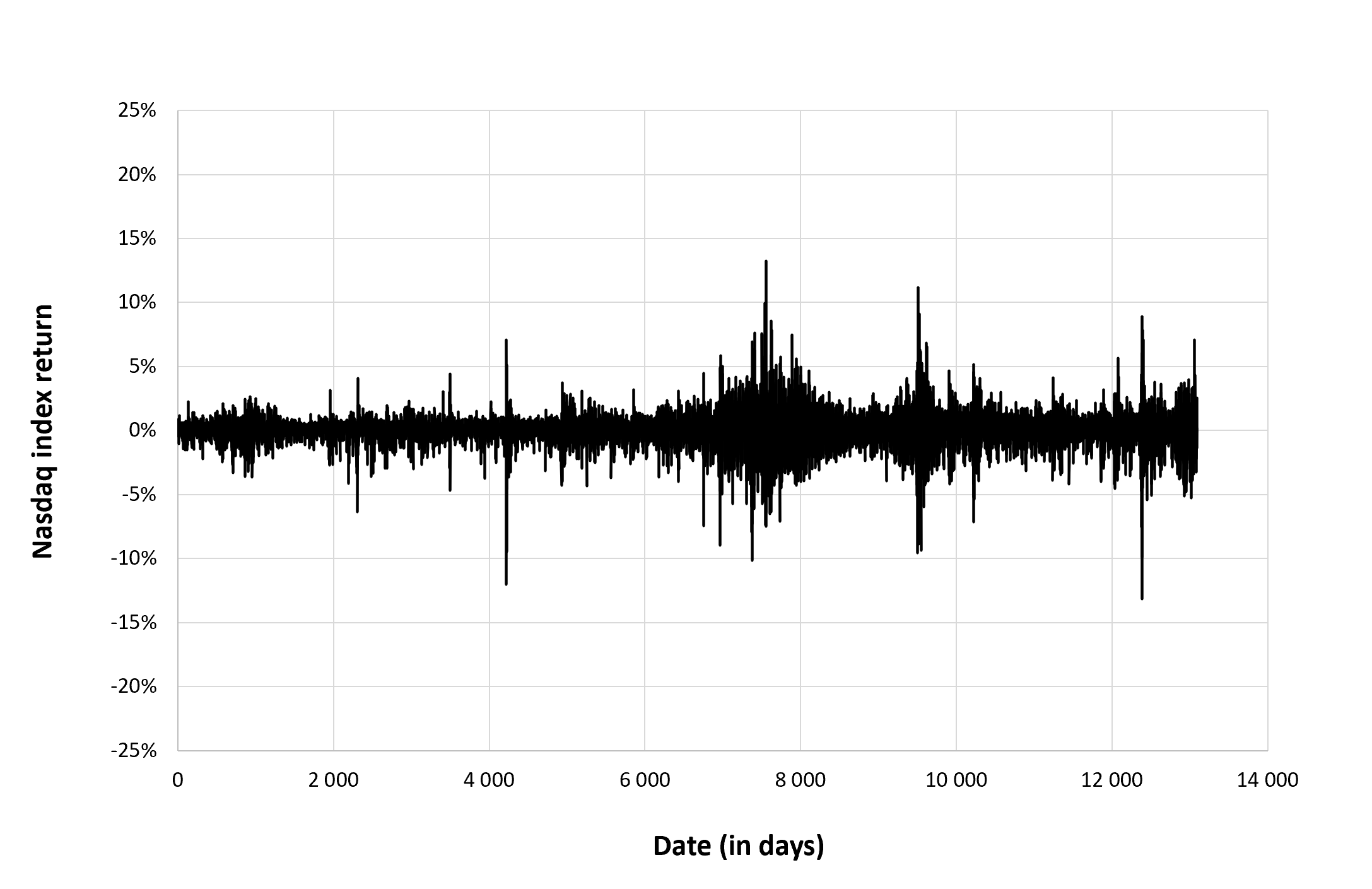

Figure 2 below gives the evolution of the Nasdaq index returns from January 2, 1992 to December 30, 2022 on a daily basis.

Figure 2. Evolution of the Nasdaq index returns.

Source: computation by the author (data: Yahoo! Finance website).

Statistical distribution of the Nasdaq index returns

Historical distribution

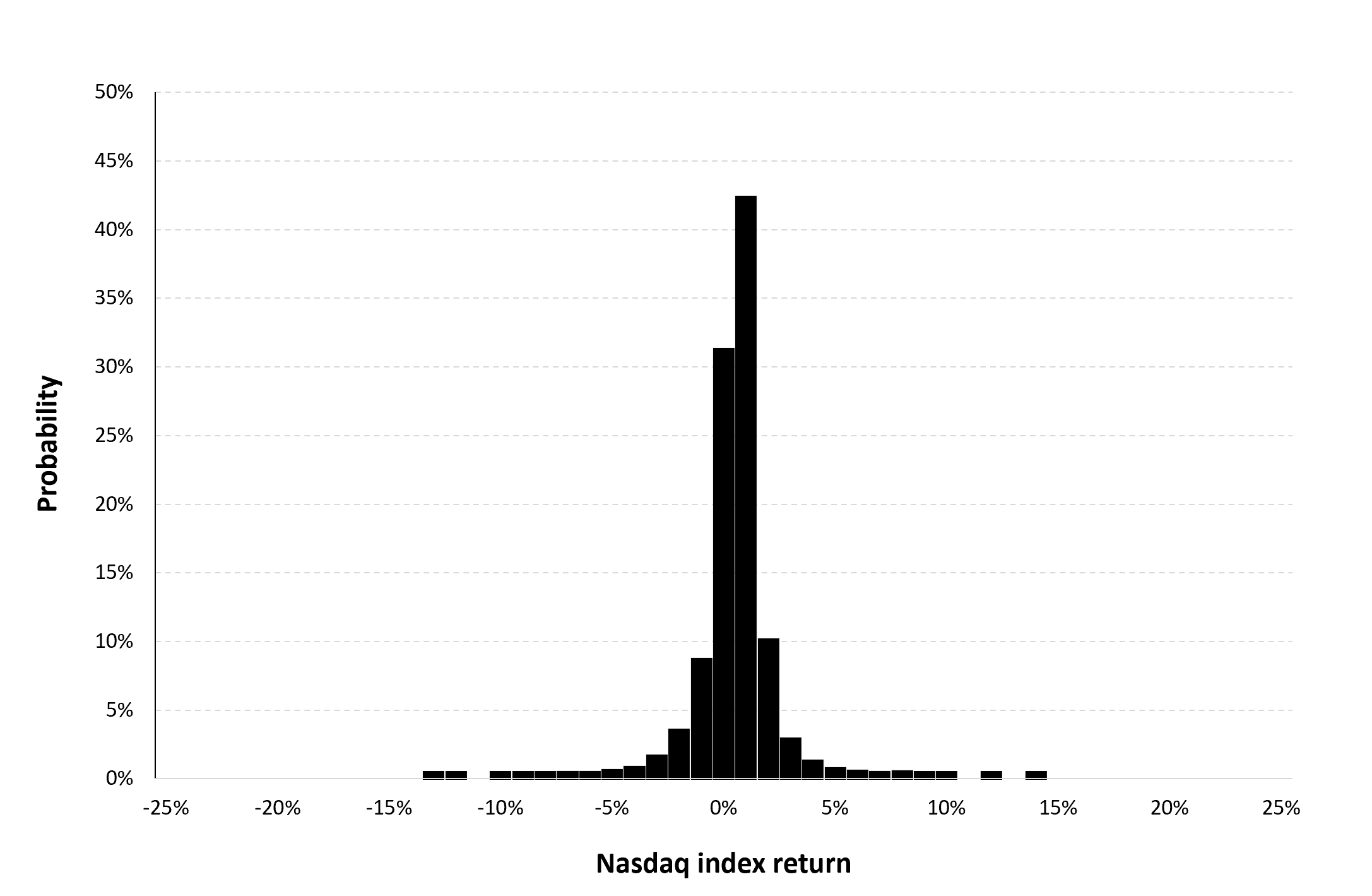

Figure 3 represents the historical distribution of the Nasdaq index daily returns for the period from January 2, 1992 to December 30, 2022.

Figure 3. Historical distribution of the Nasdaq index returns.

Source: computation by the author (data: Yahoo! Finance website).

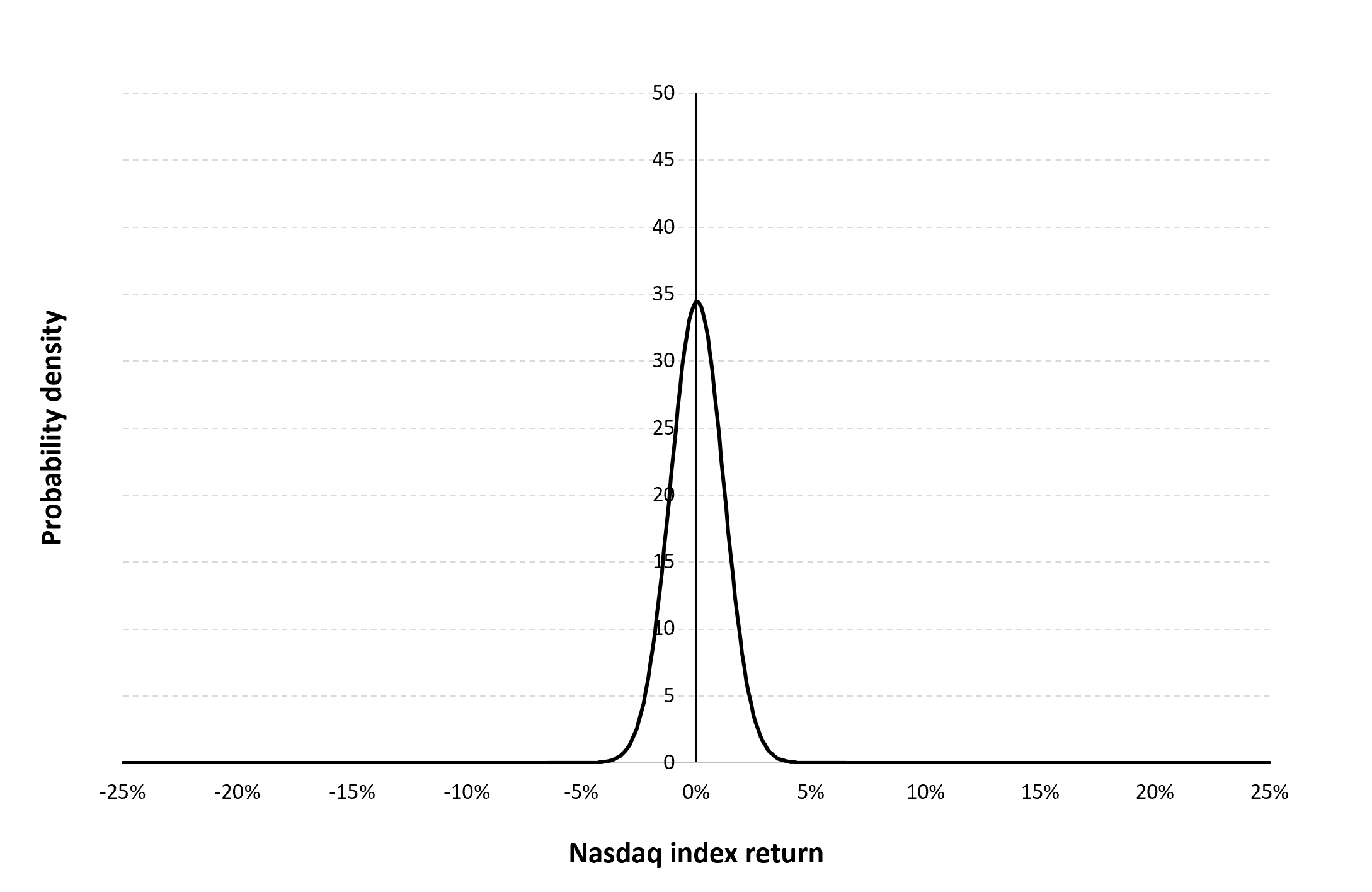

Gaussian distribution

The Gaussian distribution (also called the normal distribution) is a parametric distribution with two parameters: the mean and the standard deviation of returns. We estimated these two parameters over the period from January 2, 1992 to December 30, 2022. The mean of daily returns is equal to 0.02% and the standard deviation of daily returns is equal to 1.20% (or equivalently 5.88% for the annual mean and 19.38% for the annual standard deviation as shown in Table 3 above).

Figure 4 below represents the Gaussian distribution of the Nasdaq index daily returns with parameters estimated over the period from January 2, 1992 to December 30, 2022.

Figure 4. Gaussian distribution of the Nasdaq index returns.

Source: computation by the author (data: Yahoo! Finance website).

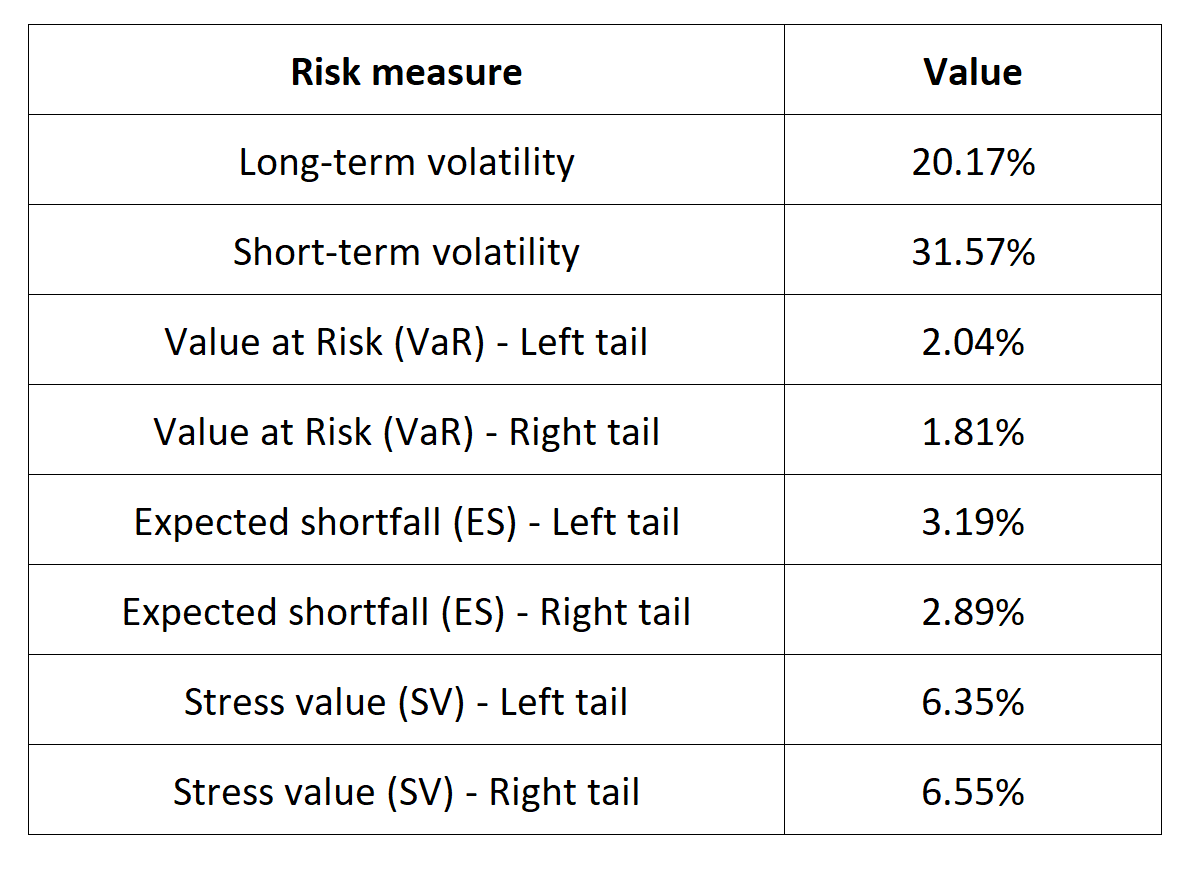

Risk measures of the Nasdaq index returns

The R program that you can download above also allows you to compute risk measures based the returns of the Nasdaq index.

Table 5 below presents the following risk measures estimated for the Nasdaq index:

- The long-term volatility (the unconditional standard deviation estimated over the entire period)

- The short-term volatility (the standard deviation estimated over the last three months)

- The Value at Risk (VaR) for the left tail (the 5% quantile of the historical distribution)

- The Value at Risk (VaR) for the right tail (the 95% quantile of the historical distribution)

- The Expected Shortfall (ES) for the left tail (the average loss over the 5% quantile of the historical distribution)

- The Expected Shortfall (ES) for the right tail (the average loss over the 95% quantile of the historical distribution)

- The Stress Value (SV) for the left tail (the 1% quantile of the tail distribution estimated with a Generalized Pareto distribution)

- The Stress Value (SV) for the right tail (the 99% quantile of the tail distribution estimated with a Generalized Pareto distribution)

Table 5. Risk measures for the Nasdaq index.

Source: computation by the author (data: Yahoo! Finance website).

The volatility is a global measure of risk as it considers all the returns. The Value at Risk (VaR), Expected Shortfall (ES) and Stress Value (SV) are local measures of risk as they focus on the tails of the distribution. The study of the left tail is relevant for an investor holding a long position in the Nasdaq index while the study of the right tail is relevant for an investor holding a short position in the Nasdaq index.

Why should I be interested in this post?

For a number of reasons, ESSEC students should learn about the Nasdaq index. The performance of tech-oriented companies is tracked by this stock market index, which is first and foremost well-known and respected. Gaining a deeper understanding of the US stock market and the businesses that fuel its expansion requires knowledge of the Nasdaq index. Management students can assess the performance of their own investments and those of their organization by comprehending the Nasdaq index and its components. Last but not least, a lot of businesses base their mutual funds and exchange-traded funds (ETFs) on the Nasdaq index.

Related posts on the SimTrade blog

About financial indexes

▶ Nithisha CHALLA Financial indexes

▶ Nithisha CHALLA Calculation of financial indexes

▶ Nithisha CHALLA The business of financial indexes

▶ Nithisha CHALLA Float

About other US financial indexes

▶ Nithisha CHALLA The DJIA index

▶ Nithisha CHALLA The S&P 500 index

▶ Nithisha CHALLA The Russell 2000 index

▶ Nithisha CHALLA The Wilshire 5000 index

About portfolio management

▶ Jayati WALIA Returns

▶ Youssef LOURAOUI Portfolio

About statistics

▶ Shengyu ZHENG Moments de la distribution

▶ Shengyu ZHENG Mesures de risques

Useful resources

Academic research about risk

Longin F. (2000) From VaR to stress testing: the extreme value approach Journal of Banking and Finance, N°24, pp 1097-1130.

Longin F. (2016) Extreme events in finance: a handbook of extreme value theory and its applications Wiley Editions.

Data: Yahoo! Finance

Yahoo! Finance Data for the Nasdaq index

Data: Bloomberg

Bloomberg Data for the Nasdaq index

About the author

The article was written in April 2023 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023).