The DJIA index

In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023) presents the Dow Jones Industrial Average (DJIA) index and details its characteristics.

The DJIA index

The Dow Jones Industrial Average (DJIA) index was created on May 26, 1896, by Charles Dow and Edward Jones, the co-founders of Dow Jones & Company. It is publicly known as the Dow Jones index or the Dow in general. The DJIA is currently owned and managed by The Wall Street Journal.

It is a stock market index in the United States which represents the performance of 30 large-capitalization publicly traded companies. Today, it is no longer limited to just industrial companies like how it was initially and includes stocks from a variety of sectors, such as technology, healthcare, and finance.

Who decides about the selection of stocks in the index? The Wall Street Journal, which owns the index, selects the stocks based on a variety of factors, such as the company’s size and reputation, and the representation of the industries.

The DJIA is a price-weighted index, which means that each stock’s weight in the index is determined by its price per share rather than its market capitalization such as the S&P 500 index (see below for the technical details). The DJIA is published and disseminated in real-time by various financial news outlets and can be accessed by investors and traders around the world.

How is the DJIA index represented in trading platforms and financial websites? The ticker symbol used in the financial industry for the DJIA index is “DJI”.

Table 1 gives the Top 10 stocks in the DJIA index in terms of market capitalization as of January 19, 2023.

Table 1. Top 10 stocks in the DJIA index.

Source: computation by the author (data: Motley Fool financial website).

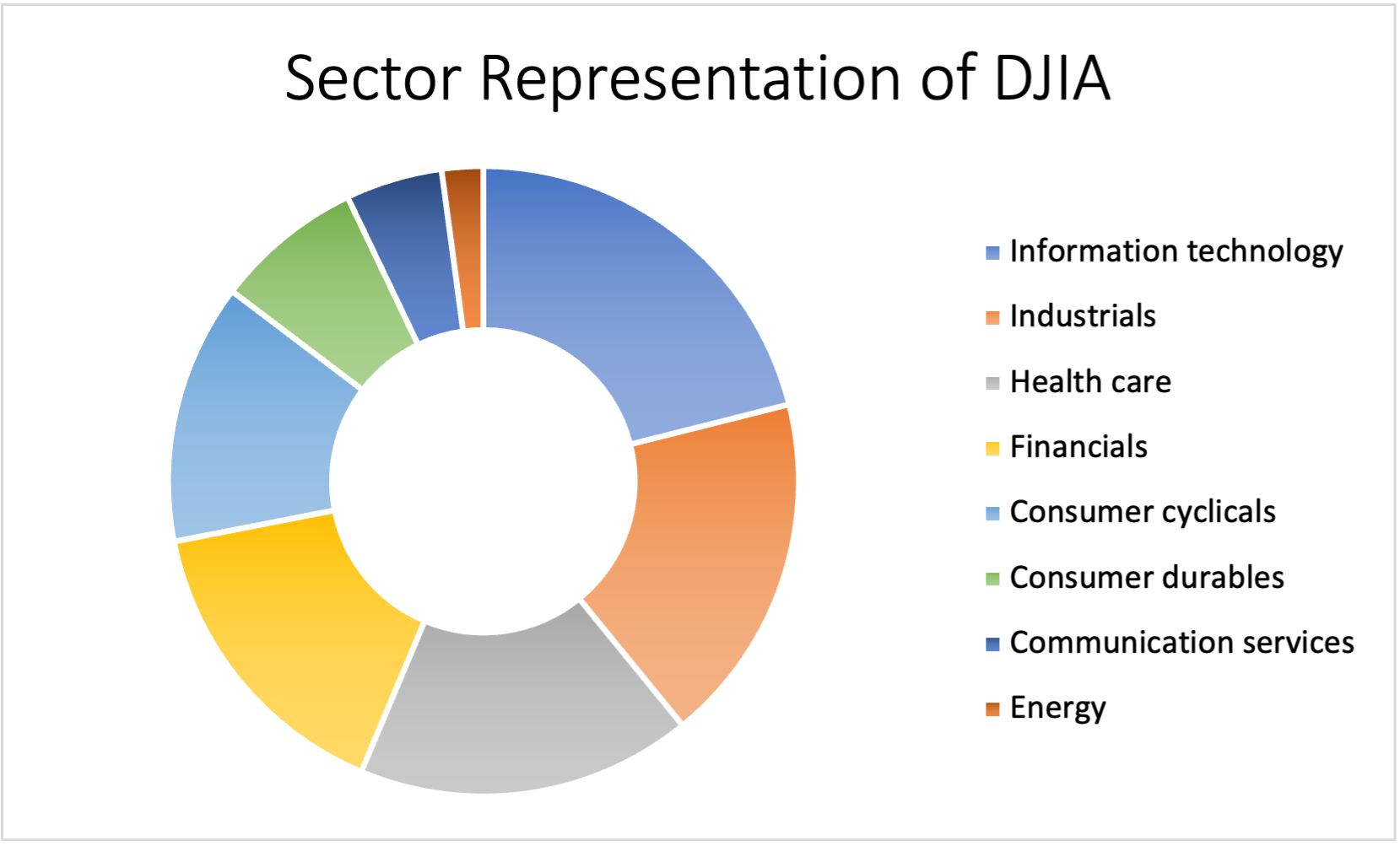

Table 2 gives the sector representation of the DJIA index in terms of number of stocks and market capitalization as of January 31, 2023.

Table 2. Sector representation in the DJIA index.

Source: computation by the author (data: Wikipedia).

Calculation of the DJIA index value

As a price-weighted index, the DJIA has a greater impact on the index value when the stock prices of companies are higher. The DJIA index value is determined solely based on stock prices, disregarding any dividends that the companies that make up the index have paid.

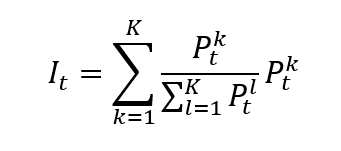

The formula for a price-weighted index is given by

where I is the index value, k a given asset, K the number of assets in the index, Pk the market price of asset k, and t the time of calculation of the index.

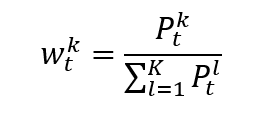

In a price-weighted index, the weight of asset k is given by the following formula

which clearly shows that the weight of each asset in the index is its market price divided by the sum of the market prices of all assets.

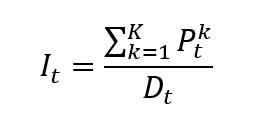

Note that the divisor, which is equal to the number of shares, is typically adjusted for events such as stock splits and dividends. The divisor is used to ensure that the value of the index remains consistent over time despite changes in the number of outstanding shares. A more general formula may then be:

Where D is the divisor which is adjusted over time to account for events such as stock splits and dividends.

Use the DJIA index in asset management

As we all know, investors frequently use the DJIA index as a benchmark. The DJIA index is used by asset managers to compare the returns on their investments to market returns. Given that it is an index that gauges market performance, it supports investors in carrying out key asset management tasks like passive investments, the capacity to assess corporate risk, asset allocation, portfolio management, etc. But we should always be aware that the DJIA does not encompass all markets and industries in the US. As a result, whenever we evaluate the performance of the US market, we should always take other indexes such as the S&P 500 index and the Russell 2000 into account.

Benchmark for equity funds

Now how do we decide if DJIA is a benchmark for equity funds in the US market? Precisely by seeing if the index indicates all the sectors and industries in the market. Since the DJIA is a price-weighted index and only takes the top 30 companies into account, it is not typically used as a benchmark for the entire US market. We should also take into account other diverse indexes, such as the S&P 500 or the Russell 2000, which offer a more complete representation of the market, if we need a benchmark for the entire US market.

Financial products around the DJIA index

There are a number of financial products centered around the DJIA index that can offer investors some insight, as we are aware that it measures the performance of sizable publicly traded companies listed on the New York Stock Exchange (NYSE) and the Nasdaq. I listed the main financial products associated with the DJIA index through which investors can access the index as below:

- Exchange-Traded Funds, Options Contracts, Futures Contracts, Index funds and Mutual funds.

- ETFs are the investment funds that are traded like stocks. The SPDR Dow Jones Industrial Average ETF (DIA) and the ProShares Ultra Dow30 ETF are two examples of ETFs that track the DJIA index (DDM)

- Futures and Options Contracts allow investors to buy or sell the DJIA index at a specific price and date in the future. Primarily to combat market volatility, to generate income through trading strategies, or to make predictions about the index’s future course

- Mutual funds and index funds tend to focus more on investing in firms that are included in the DJIA index or attempt to replicate the performance of the index by purchasing the same stocks that make up the index

Historical data for the DJIA index

How to get the data?

The DJIA index is the most common index used in finance, and historical data for the DJIA index can be easily downloaded from the internet.

For example, you can download data for the DJIA index from January 2, 1992 on Yahoo! Finance (the Yahoo! code for DJIA index is ^DJI).

Source: Yahoo! Finance.

You can also download the same data from a Bloomberg terminal.

R program

The R program below written by Shengyu ZHENG allows you to download the data from Yahoo! Finance website and to compute summary statistics and risk measures about the DJIA index.

Data file

The R program that you can download above allows you to download the data for the DJIA index from the Yahoo! Finance website. The database starts on January 2, 1992. It also computes the returns (logarithmic returns) from closing prices.

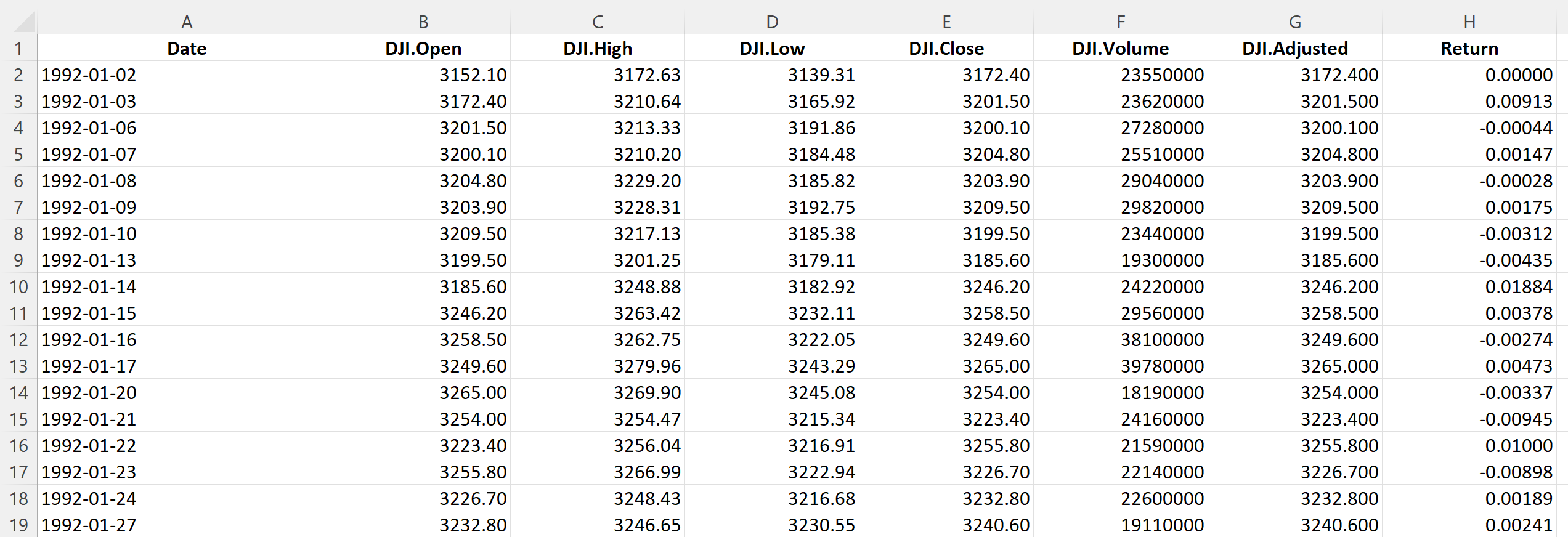

Table 3 below represents the top of the data file for the DJIA index downloaded from the Yahoo! Finance website with the R program.

Table 3. Top of the data file for the DJIA index.

Source: computation by the author (data: Yahoo! Finance website).

Summary statistics for the Dow Jones index

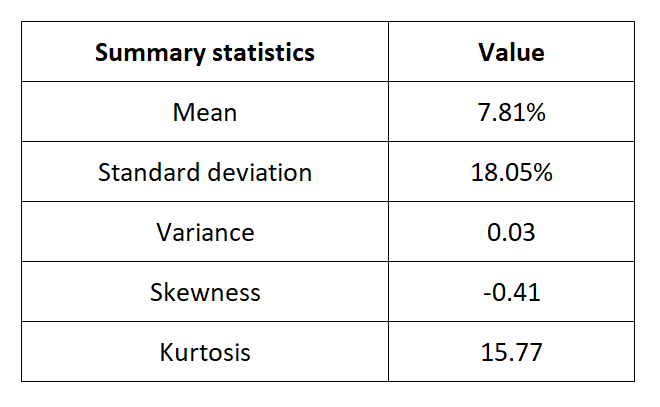

The R program that you can download above also allows you to compute summary statistics about the returns of the Dow Jones index.

Table 4 below presents the following summary statistics estimated for the Dow Jones index:

- The mean

- The standard deviation (the squared root of the variance)

- The skewness

- The kurtosis.

The mean, the standard deviation / variance, the skewness, and the kurtosis refer to the first, second, third and fourth moments of statistical distribution of returns respectively.

Table 4. Summary statistics for the Dow Jones index.

Source: computation by the author (data: Yahoo! Finance website).

Evolution of the Dow Jones index

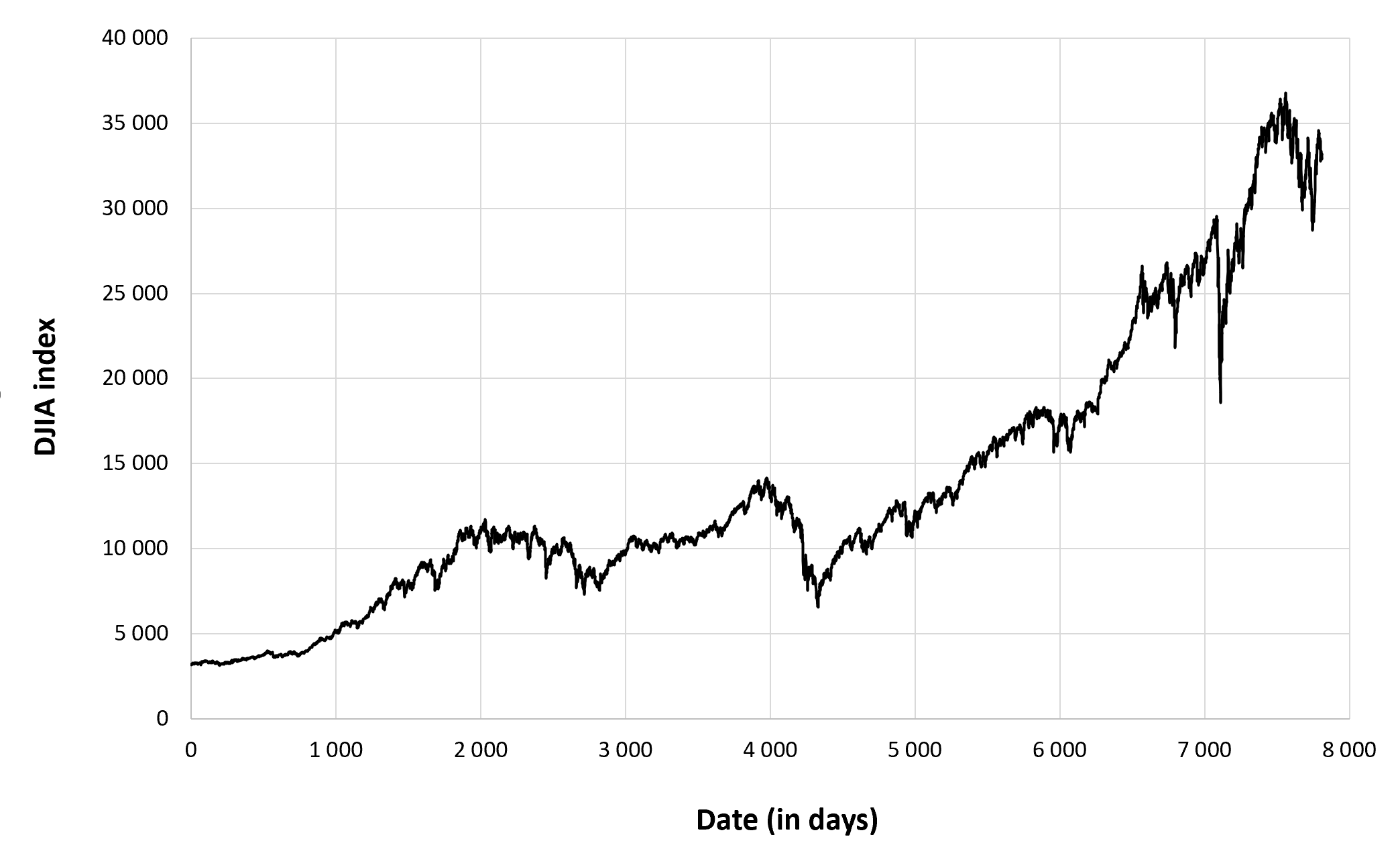

Figure 1 below gives the evolution of the Dow Jones index from January 2, 1992 to December 30, 2022 on a daily basis.

Figure 1. Evolution of the Dow Jones index.

Source: computation by the author (data: Yahoo! Finance website).

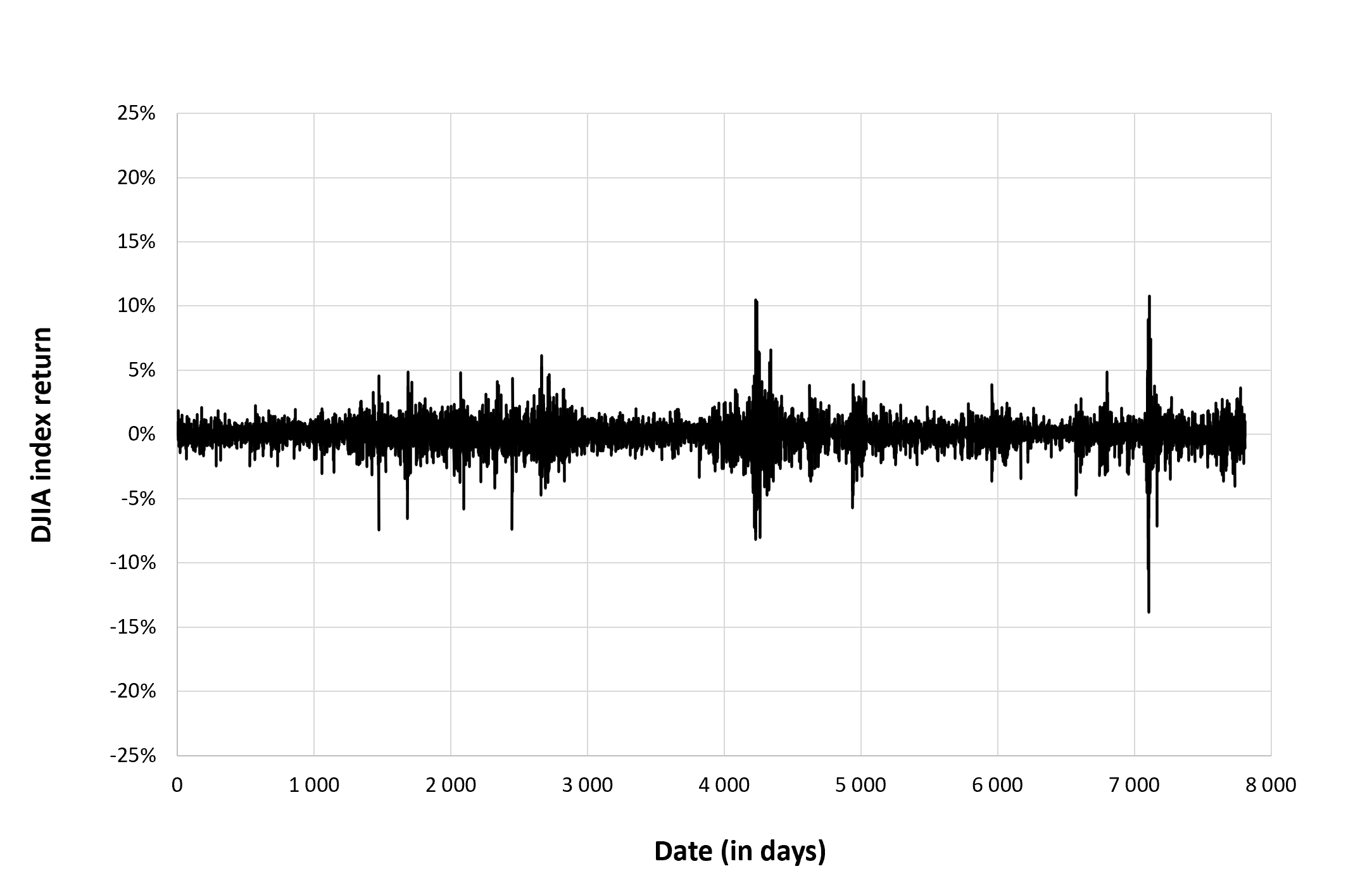

Figure 2 below gives the evolution of the Dow Jones index returns from January 2, 1992 to December 30, 2022 on a daily basis.

Figure 2. Evolution of the Dow Jones index returns.

Source: computation by the author (data: Yahoo! Finance website).

Statistical distribution of the Dow Jones index returns

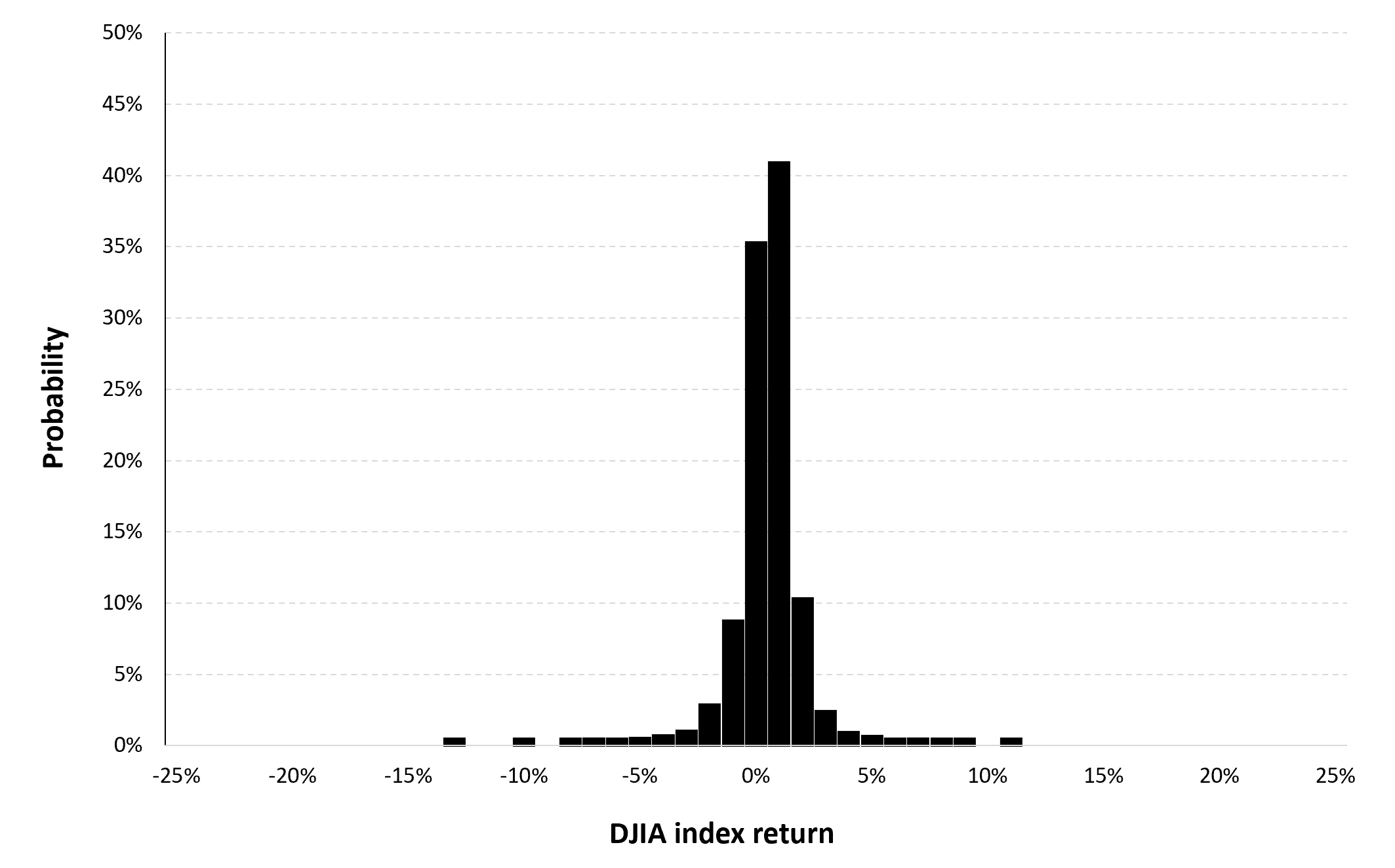

Historical distribution

Figure 3 represents the historical distribution of the Dow Jones index daily returns for the period from January 2, 1992 to December 30, 2022.

Figure 3. Historical distribution of the Dow Jones index returns.

Source: computation by the author (data: Yahoo! Finance website).

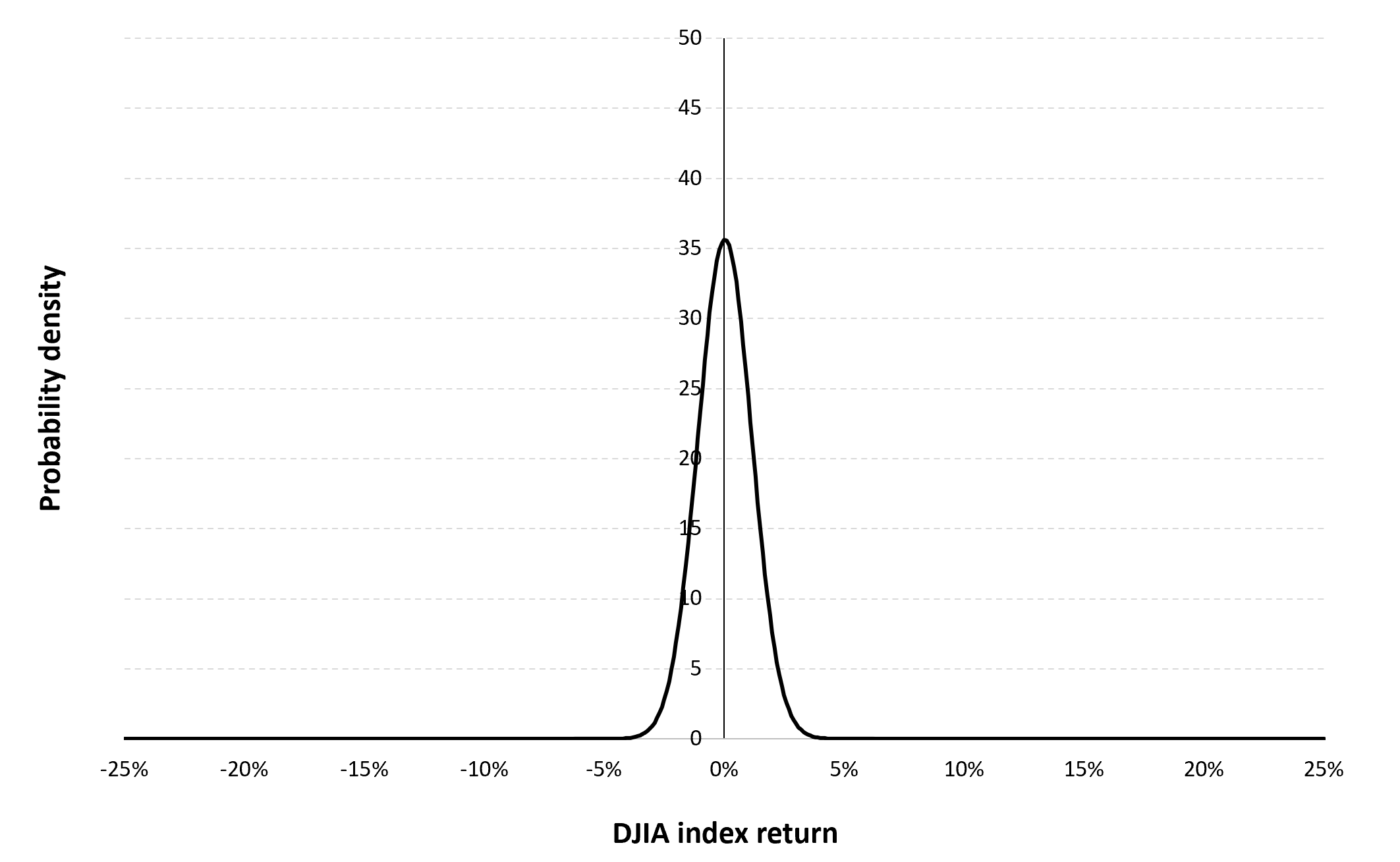

Gaussian distribution

The Gaussian distribution (also called the normal distribution) is a parametric distribution with two parameters: the mean and the standard deviation of returns. We estimated these two parameters over the period from January 2, 1992 to December 30, 2022. The mean of daily returns is equal to 0.02% and the standard deviation of daily returns is equal to 1.20% (or equivalently 5.88% for the annual mean and 19.38% for the annual standard deviation as shown in Table 3 above).

Figure 4 below represents the Gaussian distribution of the DJIA index daily returns with parameters estimated over the period from January 2, 1992 to December 30, 2022.

Figure 4. Gaussian distribution of the Dow Jones index returns.

Source: computation by the author (data: Yahoo! Finance website).

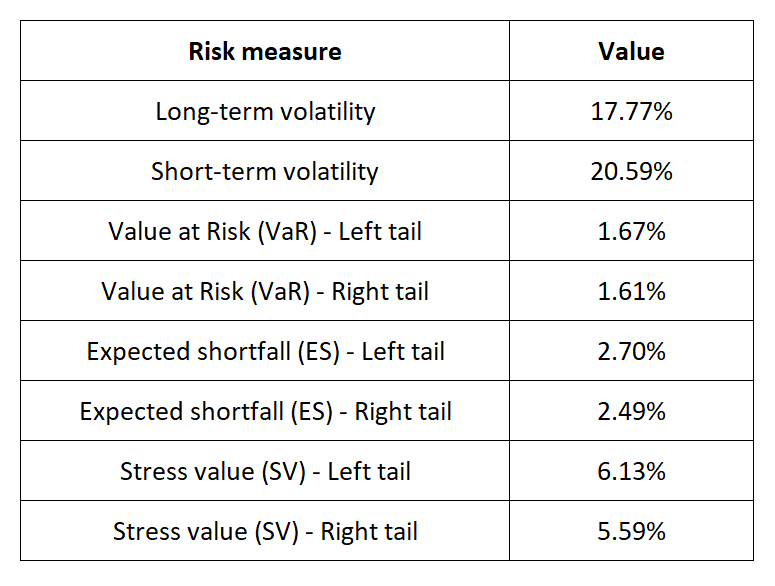

Risk measures of the Dow Jones index returns

The R program that you can download above also allows you to compute risk measures about the returns of the Dow Jones index.

Table 5 below presents the following risk measures estimated for the Dow Jones index:

- The long-term volatility (the unconditional standard deviation estimated over the entire period)

- The short-term volatility (the standard deviation estimated over the last three months)

- The Value at Risk (VaR) for the left tail (the 5% quantile of the historical distribution)

- The Value at Risk (VaR) for the right tail (the 95% quantile of the historical distribution)

- The Expected Shortfall (ES) for the left tail (the average loss over the 5% quantile of the historical distribution)

- The Expected Shortfall (ES) for the right tail (the average loss over the 95% quantile of the historical distribution)

- The Stress Value (SV) for the left tail (the 1% quantile of the tail distribution estimated with a Generalized Pareto distribution)

- The Stress Value (SV) for the right tail (the 99% quantile of the tail distribution estimated with a Generalized Pareto distribution)

Table 5. Risk measures for the Dow Jones index.

Source: computation by the author (data: Yahoo! Finance website).

The volatility is a global measure of risk as it considers all the returns. The Value at Risk (VaR), Expected Shortfall (ES) and Stress Value (SV) are local measures of risk as they focus on the tails of the distribution. The study of the left tail is relevant for an investor holding a long position in the S&P 500 index while the study of the right tail is relevant for an investor holding a short position in the S&P 500 index.

Why should I be interested in this post?

For a number of reasons, ESSEC students should learn about the Dow Jones index. The performance of 30 large-cap American companies is tracked by this stock market index, which is first and foremost well-known and respected. Gaining a deeper understanding of the US stock market and the businesses that fuel its expansion requires knowledge of the Dow Jones index. Management students can assess the performance of their own investments and those of their organization by comprehending the Dow Jones index and its components. Last but not least, a lot of businesses base their mutual funds and exchange-traded funds (ETFs) on the Dow Jones index.

Related posts on the SimTrade blog

About financial indexes

▶ Nithisha CHALLA Financial indexes

▶ Nithisha CHALLA Calculation of financial indexes

▶ Nithisha CHALLA The business of financial indexes

▶ Nithisha CHALLA Float

About other US financial indexes

▶ Nithisha CHALLA The S&P 500 index

▶ Nithisha CHALLA The NASDAQ index

▶ Nithisha CHALLA The Russell 2000 index

▶ Nithisha CHALLA The Wilshire 5000 index

About portfolio management

▶ Jayati WALIA Returns

▶ Youssef LOURAOUI Portfolio

About statistics

▶ Shengyu ZHENG Moments de la distribution

▶ Shengyu ZHENG Mesures de risques

Useful resources

Academic research about risk

Longin F. (2000) From VaR to stress testing: the extreme value approach Journal of Banking and Finance, N°24, pp 1097-1130.

Longin F. (2016) Extreme events in finance: a handbook of extreme value theory and its applications Wiley Editions.

Data: Yahoo! Finance

Yahoo! Finance Data for the DJIA index

Data: Bloomberg

Bloomberg Data for the DJIA index

About the author

The article was written in April 2023 by Nithisha CHALLA (ESSEC Business School, Grande Ecole Program – Master in Management, 2021-2023).