In this article, Nithisha CHALLA (ESSEC Business School, Grande Ecole – Master in Management (MiM), 2021-2024) explains the significance of Anti-Money Laundering (AML) policies.

Introduction

Firstly, what is AML? AML stands for Anti-Money Laundering. It refers to a set of national laws, regulations, and procedures designed to prevent the illegal generation of income through illicit activities and the subsequent integration of these funds into the legitimate financial system.

Primary components of Anti-Money Laundering

Primary components of anti-money laundering include customer due diligence, transaction monitoring, reporting and record-keeping, training, Know Your Customer policy and risk assessment.

Customer Due Diligence (CDD)

Financial institutions are required to perform due diligence on their customers to understand their identity, assess the nature of their financial activities, and identify any potential risks associated with money laundering.

Transaction Monitoring

Regular monitoring of financial transactions is crucial to identify patterns that may indicate suspicious activities. Unusual or large transactions may trigger alerts for further investigation.

Reporting and Record-Keeping

Financial institutions are obligated to maintain records of transactions and report any suspicious activities to relevant authorities. These reports contribute to the overall efforts to combat money laundering.

Training

AML training helps in creating a vigilant workforce capable of identifying and reporting suspicious activities.

Know Your Customer (KYC)

KYC procedures involve verifying the identity of customers to ensure they are who they claim to be. This is a fundamental aspect of preventing money laundering and other financial crimes.

Risk Assessment

Financial institutions conduct risk assessments to evaluate the potential risk of money laundering associated with certain customers, transactions, or business relationships.

Significance of money laundering

Money laundering poses a significant threat to the stability and integrity of the global financial system, making it imperative for financial institutions to prioritize AML training and awareness. This article delves into the importance of AML training, strategies for building a culture of compliance, and the pivotal role technology plays in these efforts. Money laundering, the process of making illegally gained proceeds appear legitimate, is a global concern that affects economies, financial institutions, and societies at large. Anti-Money Laundering efforts are the first line of defense against such illicit activities. One key aspect of these efforts is AML training, a proactive measure aimed at equipping financial professionals with the knowledge and skills needed to detect and prevent money laundering. AML training programs are designed to empower employees at all levels, from frontline staff to senior executives, with the tools to recognize and report suspicious activities. Now that we know the components of AML, what would be the components of an effective AML training program? Without delving into more details here are a few things we could do to make it much more effective.

- Building a Culture of Compliance

- Leveraging Technology for AML Training

- Integration with Onboarding Processes

- Encouraging Reporting and Whistleblowing

- Ongoing Awareness and Leadership Involvement

Common Examples of Money Laundering Techniques

Now that we know the significance of money laundering, we delve deeper into a few examples of money laundering in our day-to-day lives.

Smurfing (Structuring)

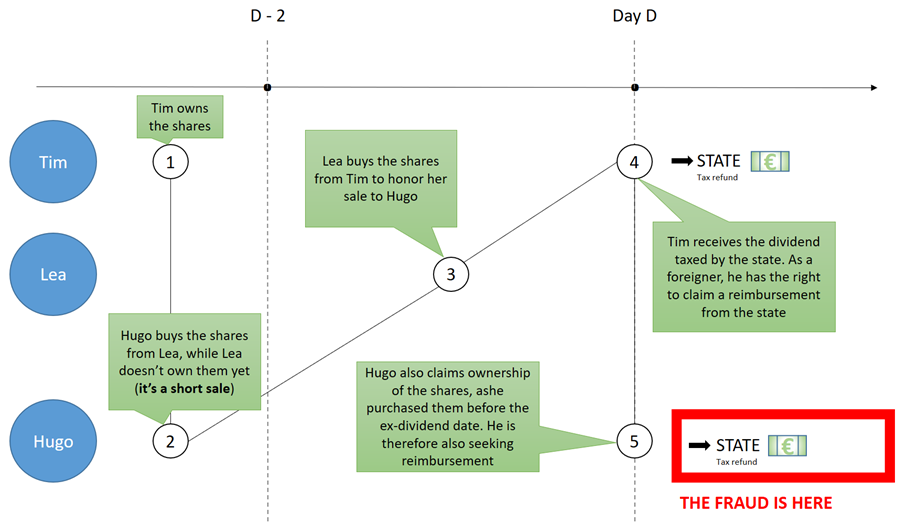

Smurfing, also known as structuring, is a money laundering technique whereby illegal funds are divided into smaller amounts and deposited into multiple bank accounts or financial institutions. This is done to circumvent financial regulations that require banks to report large transactions, typically exceeding a certain threshold.

Cash-Intensive Businesses

These are often exploited as a money laundering method, as they provide a convenient way to mix illicit funds with legitimate income. Criminals can use these businesses to deposit and process their illegal cash, making it difficult for authorities to trace the source. These businesses typically handle large volumes of cash through everyday operations, such as pubs, car washes, or retail shops.

Bulk Cash Smuggling

This is a prominent example of money laundering that involves the physical transportation of large quantities of illicit cash across borders. Criminals exploit this method to avoid the scrutiny of financial institutions and regulatory authorities, thereby circumventing anti-money laundering measures in place.

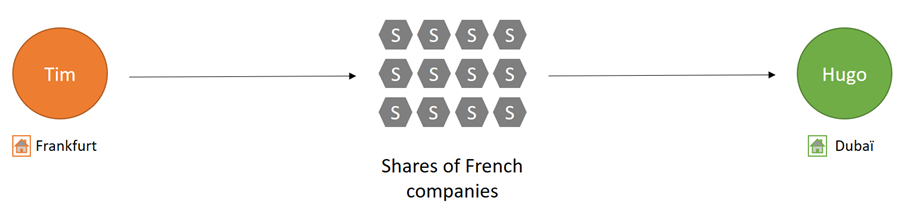

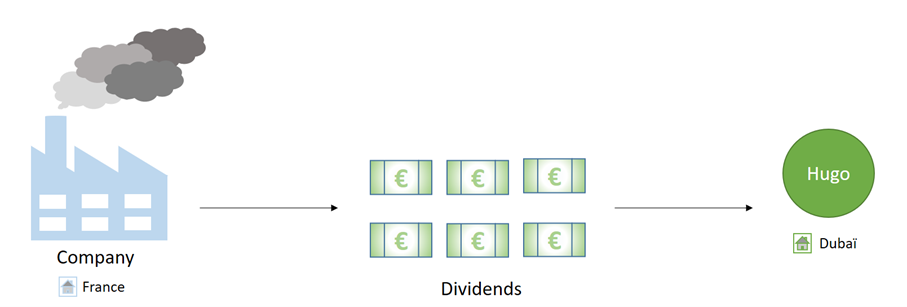

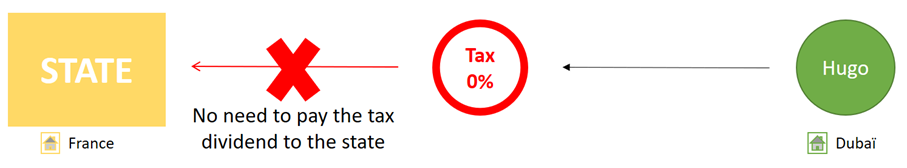

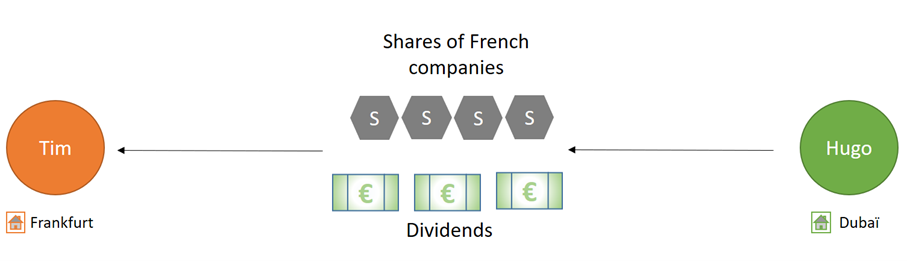

Shell Companies and Trusts

Shell companies and trusts are effective tools used in money laundering schemes, as they offer an intricate façade to disguise illicit funds. By establishing these entities, often in offshore jurisdictions, criminals can cleverly obscure the true origin of their wealth. Both shell companies and trusts exploit gaps in the financial system and international regulations to perpetuate money laundering activities.

Cyber Laundering

Cyber laundering, a burgeoning method of money laundering, takes advantage of the digital world to hide the origin of illegal funds. As technology progresses at breakneck speed, criminals discover new ways to cover their tracks, making it harder for traditional detection methods to catch them.

Statistics

Notable statistics (Napier) on money laundering dated February 2022 are:

- Global financial crime fines handed out in 2021 totaled $9.95bn, down from 2020’s record-breaking figure of $22.86bn, according to a report by AML Intelligence

- Serious and organized crime costs the UK an estimated $50.4 billion a year

- The median amount of money laundered in the US in 2020 was $301,606

- Corruption, bribery, and fraud accounted for a whopping 69.6% of FinCrime fines handed out in 2021

Despite its association with the Silk Road and the dark net, only 1.1% of all cryptocurrency transactions are known to be illicit.

Why should I be interested in this post?

Understanding anti-money laundering principles is not only a regulatory imperative but a strategic necessity in navigating the complex legal environment. This post offers insights into risk management, ethical conduct, and the collaborative efforts required across organizational functions to deal with anti-money laundering. This is especially important for students who would like to work in the financial sector (asset management and wealth management).

Related posts on the SimTrade blog

▶ Micha FISCHER Exchange-traded funds and Tracking Error

▶ Nithisha CHALLA My experience as a Risk Advisory Analyst in Deloitte

▶ Wenxuan HU My experience as an intern of the Wealth Management Department in Hwabao Securities

Useful resources

SAS software History of Anti-Money Laundering

IBM What is anti-money laundering?

Financial crimes enforcement network (US agency) History of anti-money laundering laws

Lexis Nexis Examples of Money Laundering Techniques

Napier 11 FinCrime facts for 2022

About the author

The article was written in February 2024 by Nithisha CHALLA (ESSEC Business School, Grande Ecole – Master in Management (MiM), 2021-2024).