My experience of Account Manager in the office real estate market in Paris

In this article, Clément KEFALAS (ESSEC Business School, Global Bachelor of Business Administration, 2021) shares his working experience as an Account Manager at Ubiq.

Ubiq: A company disrupting the market

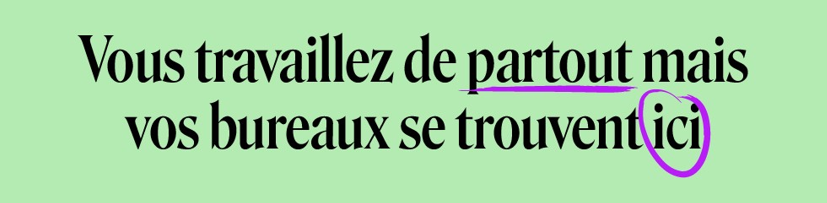

Ubiq was founded in 2012. At that time, it was known as “Bureaux A Partager” (a French expression meaning “office to share”). This digital startup comes from the brilliant mind of Clément Alteresco when he faced a problem of unoccupied seats in its offices at Fabernovel (a strategic consulting firm). He thought that it was a real waste of space and even if he did not think of making profits from it, he could at least try to create value!

Source: Ubiq

Source: Ubiq

This is why, Clément began by conceiving a shared Excel File with a planning and spread it amongst his network. The idea was to enable people to come to work for free in Fabernovel’s office and who knows, maybe creating synergies through exchanges and shared moments. It was then non-lucrative and totally selfless. However, it generated lot of interest and Clément wanted more than a standard employee’s life. Therefore he decided to launch his own digital platform: “Bureaux A Partager”.

The concept was easy: a website on which people would try to find their coworkers or on which people would be looking for their new offices. It was basically the “Airbnb” of the Flex office. You could forget your 3/6/9 bail, now was the time for the day-to-day contract that you could end in less than a month!

Source: Ubiq

Source: Ubiq

It worked out well and in 2017, a team of about 15 people were working on the project. Clément then decided to diversify and launched Morning, the main concurrent of Wework in Paris. If he was not working on Bureaux A Partager anymore, the project kept going and became more and more mature.

Needless to say that the Covid crisis hit hard the office real estate market. The home office is definitely a restraint to the rent of offices, it also became a huge opportunity for Ubiq and a big step forward for the Flex office.

Indeed, since March 2020, we have been talking about the new methods of working and about the new role of the office in the world of tomorrow.

It is not a reflex anymore to go to the office on a working day. There must be more than just creating an environment dedicated to work. Now, the workplace is more about generating synergies, bonds and company culture than about providing an efficient and professional atmosphere.

What a great opportunity for a marketplace that offers every kind of offices with every kind of contracts than such a disorganized market which is reinventing itself.

Thus, Bureaux A Partager could not miss such an opportunity! This is why, with the help of its main shareholder, Nexity, Bureaux A Partager changed its name in “Ubiq” in June 2021.

It also changed its value proposition and recruited new talents to carry such an ambitious project.

In July and September 2021, Ubiq peaked with its 2 biggest records of revenues !

My recruitment as an account manager

Thanks to ESSEC, I had the opportunity to join Ubiq (at that time Bureaux A Partager) in January 2020 for a two-year apprenticeship in the sales team. Indeed, in the Global BBA program, the students are allowed to sign a 24 months apprenticeship contract instead of doing a 6 months internship. It results in them making one more semester in a professional environment and thus, ending with a Master 1 Degree in 4,5 years of studies.

This specific path gives the student the opportunity to involve himself in a long-term professional mission. He will get considered by its company as a normal employee and will be responsible for key missions. This is a really professionalizing program that I would definitely recommend. It also has the advantage of being a real asset on the CV when companies are asking for a professional experience longer than a single internship.

The job I was recruited for was: Account Manager. It is a function that is key in every sales team. The Account Manager will be responsible for the existing clients while the Business Developer will seek for new clients.

The main objective is to build a long term, professional, trust-based relationship with its B2B

clients.

Most of the requirements for the job are soft skills. The Account Manager works in Customer service which means that the mission consists mainly in communicating with clients.

Expected skills from the Account Manager would be:

- curious

- open-minded

- motivated

- excellent interpersonal skills

- autonomy

- rigor

In terms of hard skills, the Account Manager must master Excel, understand sales dashboards, write, and talk clearly and professionally.

My experience as an Account Manager

At first, I had to get to learn the job and to understand the market. This is why I was assigned in the prospect team, seeking for new clients willing to find offices. In other words, I was trying to stimulate the traffic on the platform through looking for the demand side of the market. It was not why I had been recruited for and this mission surprised me, but I then understood that it was part of the training. How could I work on the offer side of the market and help our partners to market their real estate assets if I did not understand the need of their own customers? I spent few months in the “Demand” team and if it could be at some point repetitive and tough, it was definitely formative, and helped me a lot in the continuation of my mission.

At some point, I finally reached my final position: account manager towards the Offer. It was mainly business-to-business (B2B) since the actors that wanted to rent their places, were most of the time companies and not private individuals.

The idea of creating a long-term relationship with the clients was really satisfying. Every customer had its own problematic and its own needs and still the final objective remained the same. The path to reach it though, was always different from one company to another.

Most of my interactions were by phone and email but I still had few opportunities to meet my clients. It was always interesting to have a quick talk with them in person. These meetings were most of the time the beginning of a stronger partnership based on mutual trust. Inspiring, I wish I had the opportunity to meet all of my clients this way.

I learned a lot throughout this professional experience.

First, I learned a lot about myself. It is really tough to know if you like customer service until you do it. The first sales call is always frightening and stressful but in the end, it is only a conversation with a stranger. It might not be a good experience but it can’t hurt.

The most satisfying aspect of the job is to see yourself getting better from a sales call to another. After few weeks, you do not ask yourself twice before picking up the phone. It is part of your job and you’re used to it. Unexpected problems might always happen but most of the interactions are smooth. At the end of this 24months apprenticeship, every sales call was a real delight. I knew my speech perfectly, could answer any question and managed to lead the conversation where I needed it to go. Handling the pressure was the trickiest and the funniest part.

Once an Account Manager masters his job, he faces constant self-esteem boosts. Indeed, his daily mission consists in leading discussions in a known environment about a mastered topic and with clients that require his help.

This mission enlightened me on the fact that being good at his job is not about intrinsic skills but more about perseverance. My learning was permanent, and I kept being better and better until my last day.

The different archetypes of clients

Through these two years of customer service, I had the opportunity to talk with many different actors of the office real estate market. My clients were from different ages, gender, origins, etc. And yet, we could classify each of them in four different major types.

The Satisfied

The most pleasant customer and the most common one. The satisfied client enjoys the service proposed by the account manager and has nothing to complain about. He doesn’t always get straight to the point because the Satisfied enjoys exchanging with the account manager. He is a loyal client that will not hesitate to solicit the account manager every time he requires help.

The Negotiator

Nor satisfied or unsatisfied, the negotiator will try to grab any opportunity to find himself a better deal than proposed at first. If it is not through monetary gain, this customer will seek for an exclusive treatment or relationship. At some point, we could be wondering if the final objective is to get a real benefit or just to feel special. If the account manager can most of the time propose a solution to his request, the negotiator would not necessarily end the relationship in a situation of an unmet need.

The Busy

Certainly the most boring customer, this archetype just doesn’t have time to give to the account manager. Every interaction comes with the feeling of bothering the client and thus, the exchanges are really short. Only the required information is given. Once the contract between both parts is signed, the client expects everything to work fine without further interventions. At least there is no waste of time.

The Unsatisfied

Fortunately, this is the profile that is the least met by the account manager. Basically, the client is not happy with our services and whatever the efforts the account manager might try to do, they will never meet the client’s needs. This discontent often comes from a misunderstanding of the partnership or from a request that cannot be fulfilled. Sometimes, the conflict might begin with a mistake from the account manager. Although, once the error is recognized, then everything possible will be done to repair the damage. This is by far the most interesting archetype that requires a lot of patience and diplomacy.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Louis DETALLE A quick review of the M&A – Real Estate job…

▶ Ghali EL KOUHENE Asset valuation in the Real Estate sector

▶ Akshit GUPTA Sales – Job description

▶ Suyue MA Expeditionary experience in a Chinese investment banking boutique

▶ Raphaël ROERO DE CORTANZE In the shoes of a Corporate M&A Analyst

▶ Bijal GANDHI Operating profit

Useful resources

Ubiq www.ubiq.fr

About the author

The article was written in October 2021 by Clément KEFALAS (ESSEC Business School, Global Bachelor of Business Administration, 2021).

For any further information about the office real estate market or about client relationship management, feel free to email Clément Kéfalas at: b00730327@essec.edu.