Understanding financial derivatives: forwards

In this article, Alexandre VERLET (ESSEC Business School, Master in Management, 2017-2021) explains why financial markets invented forwards and how they function.

What’s a forward?

A forward is a derivative that is rather simple to understand. To illustrate the principle, let’s say you own a farm that you want to sell since you’re fed up with living in the countryside. However, you will have to wait until harvest time (i.e. a year) to get the best price (around 100,000 euros). But bad weather can ruin your plans. To protect yourself against these risks, you can use a financial product: a forward contract!

With a forward contract, you will be able to fix your selling price today (105,000 euros), but you will only receive the money in a year’s time, when you sell the farm. This is an ideal solution that solves all your problems at once. If you look at it another way, the risk that the price of your farm will fall in a year’s time is no longer borne by you, but by the natural or legal person with whom you have concluded the forward contract; this is also known as the counterpart. So, whether the price of your farm rises to 120,000 euros or falls to 80,000 euros, your forward contract guarantees that you will be able to resell it at 105,000 euros in a year’s time. However, you have a small question: why did you sign a contract for 105,000 euros when the farm is valued at 100,000 euros?

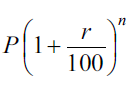

Well, because time is money. We can use the compound interest formula to determine the exact value of this “higher amount”, where P is the principal, r is the interest rate and n is the number of years.

Yes, in the world of money, time has a price. That’s why you get interest when you put money into your savings account, and that’s why you pay interest (usually at a higher rate) when you borrow money from your bank. For the same reason, in your forward contract, the amount you will receive in one year is 100,000.(1+0.05)1, or 105,000 euros, if we assume an interest rate of 5%.

To summarise, a forward contract can be defined as a firm commitment between two counterparties to buy or sell a specified quantity of an asset (the underlying) at a given date (the maturity date) and at a price (the strike price) agreed in advance.

Let’s take a closer look at this definition. We have the term “firm commitment”, which distinguishes forwards from another family of derivatives: options, where the commitment is optional. We can also note the term “underlying”, a clue that we are in the presence of a derivative product which, as its name indicates, is derived from another asset. The maturity date distinguishes our forward contract from a spot contract, in which the transaction is carried out immediately (the stock market is an example of a spot market). But this definition does not allow us to distinguish forwards from other contracts that are very similar to them, namely futures contracts. Indeed, the main difference between forwards and futures is that forwards are traded over-the-counter, or OTC, while futures are traded on organised markets.

The forwards market

The origin of forwards is very old, as they do not require the establishment of an organised market. Today, they occupy an important place in the range of financial instruments used by market operators. In fact, the forwards market has been globalised, but it is mainly concentrated in large financial institutions.

In theory, a forward contract is negotiated between two participants with opposing needs. In practice, however, the transaction is usually between a client and a broker, with the broker indirectly linking parties with opposing needs. The brokers here are often the large global banking institutions. Clients are financial institutions, multinationals, governments, and non-governmental organisations. Despite the common perception, derivatives can be of real use to companies. For example, to fix the price of a future sale or order, a company may use a forward contract. This is because forwards, like other derivatives, were originally designed as insurance or, more precisely, as a hedge against market risks. But, of course, they can also be used as powerful speculative instruments

Foreign exchange forwards

As we have seen, forwards are widely used in the foreign exchange market. And there is a historical reason for this. In 1971, President Richard Nixon decided to put an end to the fixed exchange rate system that had been put in place in 1944 after the war. This decision led to an unprecedented increase in volatility (price variation) in the currency market. Increased volatility means increased bonuses but also increased risks, which means that instruments are needed to reduce or even neutralise these risks.

This is where currency forwards come in. Imagine that you have just been promoted to the head of a company. On your first business trip, you manage to secure $600 million in orders. The problem is that you won’t receive the money for six months. In the meantime, a change in the EUR/USD exchange rate could wipe out your already tight margins. The solution? A currency forward, obviously! Let’s assume that the current EUR/USD rate is 1.2. Through your bank, you set up an exchange rate forward for an amount of 600 million dollars (i.e. 500 million euros). Six months later, the EUR/USD exchange rate has risen to 1.3 and your client pays you the 600 million dollars as stated in the contract. However, since the EUR/USD rate is 1.3, the 600 million dollars is now worth only 450 million euros, instead of 500 million euros. Fortunately, you have been careful, and the currency forward will save you from losing EUR 50 millions.

Equity forwards and index forwards

Equities are also widely used as underlyings in forwards. We speak of equity forwards, but the Anglo-Saxon equivalent, “equity forward”, is also widely used. The most common forwards contracts are for the most liquid stocks (i.e. the stocks with the highest trading volumes). Equity forwards can be used for hedging purposes in order to neutralise price changes in an underlying asset, in this case a stock. Like other derivatives, forwards can also be used as speculative tools.There are also many forwards contracts on stock indices, such as the CAC 40. These contracts are generally very popular with investors because they are very liquid.

Interest rate forwards

Interest rates are not to be outdone. Indeed, there are forwards on interest rates. They work in much the same way as equity forwards.

However, Forward Rate Agreements (FRAs) are interest rate forwards that fix an interest rate today for a period of time starting at a future date. In terms of volume, these contracts surpass all the forwards we have discussed so far. So let’s take a look at FRAs, which, along with interest rate swaps, are the most widely used derivatives in the financial markets of any kind. But first, let’s try to understand what an FRA is and where it can be useful.

Let’s assume that you want to buy a flat in London. You have just found a particularly interesting property. Unfortunately, it will not be available for sale for another three months. What’s more, you want to finance this acquisition with a loan that you will repay in the short term, i.e. in six months. It should be noted that the UK has just gone through a serious economic crisis, which has led the central banks to reduce interest rates to a particularly low level. But the economic situation is improving rapidly and the financial press is now reporting an imminent rise in interest rates.

In short, we need to take out a loan in three months’ time, at today’s interest rate. We want to repay the loan in six months. The three months of waiting and the six months of repayment mean that our financing package is spread over nine months. This is exactly what a three-by-nine FRA is all about, where you borrow money in three months and pay it back in six months at today’s interest rate. However, it is very important to note that in the financial markets, the interest rates used are usually market rates, or reference rates. The LIBOR rate is the most widely used for this purpose. LIBOR, which stands for London Interbank Offer Rate, is the interest rate at which international banks based in London lend the dollar to other banks. These banks are said to be exchanging Eurodollars. All dollar currencies traded outside the United States are referred to as Eurodollars.

Other types of forwards

There are, of course, other types of forwards besides those mentioned above. First of all, there are commodity forwards. Among precious metals, gold is of course the most famous representative of this category of forwards. Among the energy forwards, we find, not surprisingly, crude oil forwards. The imagination of financial engineers being very fertile, we have seen the emergence of more and more exotic product categories, notably climate forwards. Here, the underlyings can be temperature, rainfall or even wind speed. In the event of a hurricane, some people might be making money out of it!

Useful resources

Related posts on the SimTrade blog

▶ Verlet A. Understanding financial derivatives: options

▶ Verlet A. Understanding financial derivatives: futures

▶ Verlet A. Understanding financial derivatives: swaps

About the author

This article was written in May 2021 by Alexandre VERLET (ESSEC Business School, Master in Management, 2019-2022).

2 thoughts on “Understanding financial derivatives: forwards”

Comments are closed.