Credit Rating

In this article, Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) elaborates on the concept of Credit Rating.

This reading will help you understand the meaning, types, and importance of credit rating.

Introduction

Credit rating is the measurement of ability of the entity that seeks to borrow money to repay its financial obligation. Credit rating is based on the earning capacity of an entity as well as the history of the repayment of their past obligations. The entity seeking to borrow money can be an individual, a corporation, a state (at a national or federal level for some countries like the US), or a government agency. Credit ratings are used by banks and investors as one of the factors to determine their decision to lend money or not. Banks would develop their own credit analysis to decide to lend or not while investors would rely on the analysis by rating agencies to invest in credit products like commercial papers or bonds.

Rating agencies

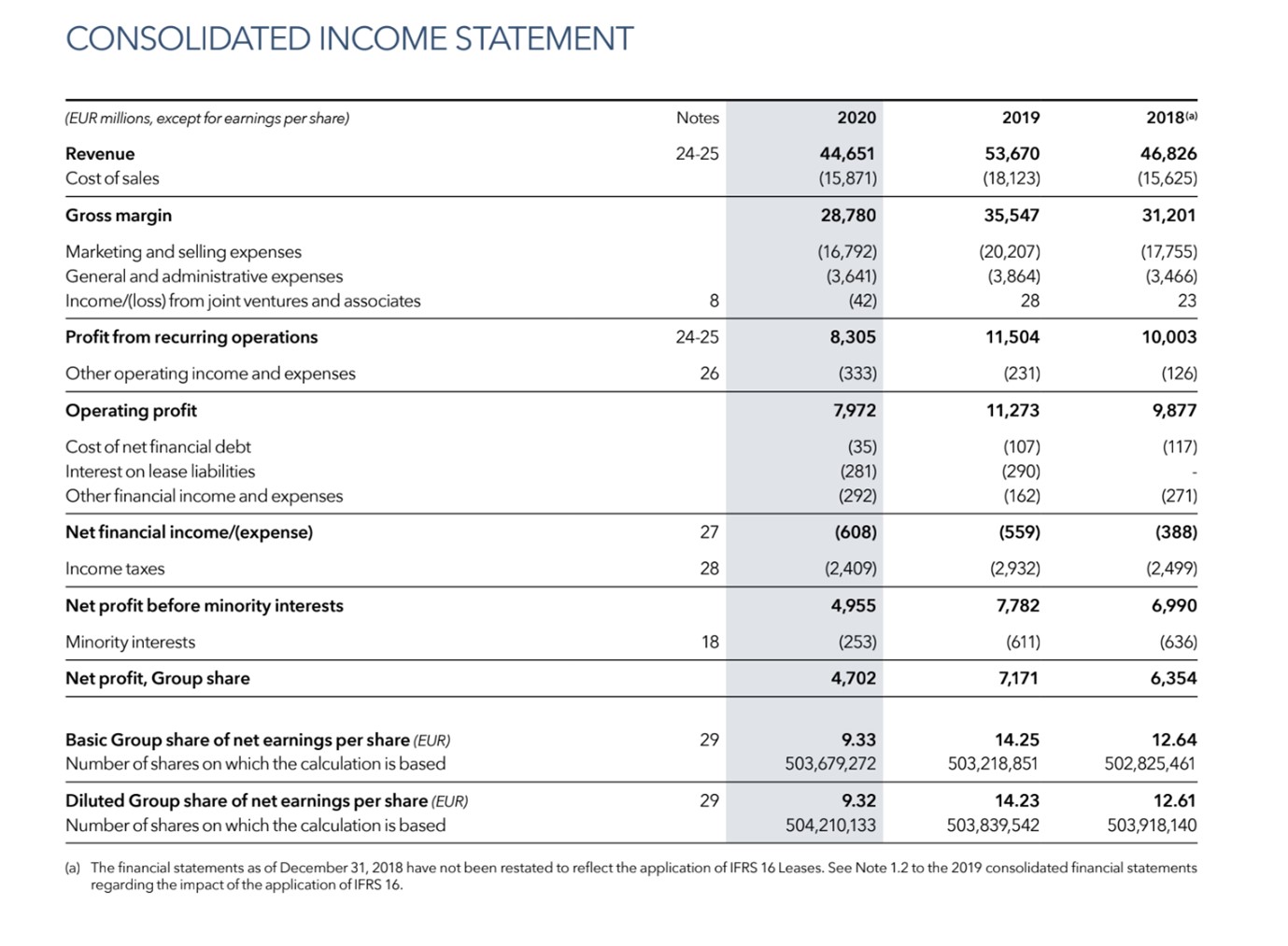

The credit agency calculates the credit rating of an entity by analyzing its qualitative and quantitative attributes. Information can be procured from internal information directly provided by the entity such as financial statements, annual reports, etc. as well as external information such as analyst reports, published news articles, overall industry, etc.

A credit agency is not a part of the deal and therefore does not have any role involved in the transaction and, therefore, is assumed to provide an independent and honest opinion on the credit risk associated by a particular entity seeking to raise money through various means.

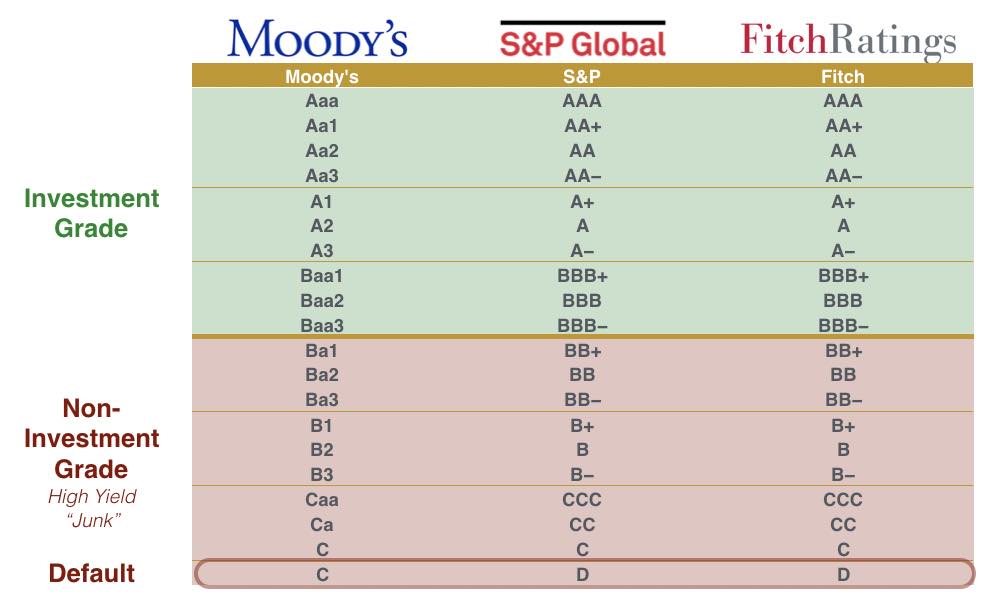

Now, three prominent credit agencies contribute 85% to the overall rating market:

1. Moody’s Investor Services

2. Standard and Poor’s (S&P)

3. Fitch Group

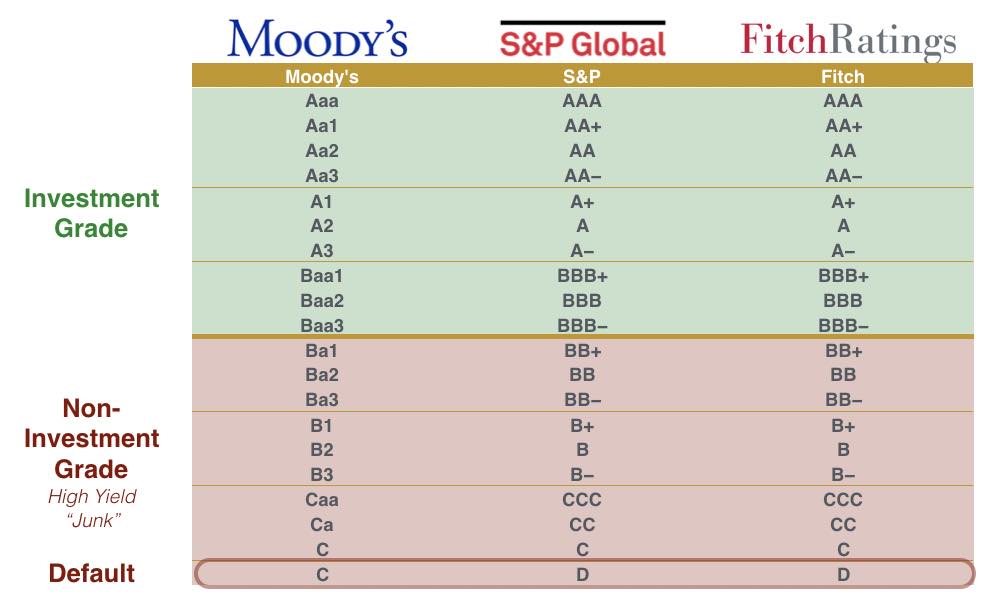

Each agency mentioned above utilizes a unique yet similar rating style to calculate credit ratings like described below,

Types of Credit Rating

Credit rating agencies use their terminology to determine credit ratings. Even so, the terminology is surprisingly similar among the three credit agencies mentioned above. Furthermore, ratings are grouped into two main categories:

Investment grade

These ratings indicate the investment is considered robust by the rating agencies, and the issuer is likely to complete the terms of repayment. As a result, these investments are usually less competitively priced when compared to speculative-grade investments.

Speculative grade

These investments are of a high-risk nature and hence offer higher interest rates to reflect the quality of the investments.

Users of Credit Rating

Credit Ratings are used by multiple entities like the following:

Institutional investors

Institutional investors like pension funds or insurance companies utilize credit ratings to assess the risk associated to a particular investment issuance, ideally with reference to their entire portfolio. According to the rate of a particular asset, it may or not include it in its portfolio.

Intermediaries

Credit ratings are used by intermediaries such as investment bankers, which utilize these ratings to evaluate credit risk and therefore derive pricing for debt issues.

Debt Issuers

Debt issuers like governments, institutions, etc. use credit ratings to evaluate their creditworthiness and to measure the credit risk associated with their debt issuance. These ratings can furthermore provide prospective investors in these organizations with an idea of the quality of the instruments issued by the organization and the kind of interest rate they could expect from such instruments.

Businesses & Corporations

Business organizations can use credit ratings to evaluate the risk associated with certain other organizations with which the business plans to have a future transaction/collaboration. Credit ratings, therefore, help entities that are interested in partnerships or ventures with other businesses to evaluate the viability of their propositions.

Understanding Credit Rating

A loan is a debt, which is the financial obligation with respect to its future repayment by the debtor. A credit rating helps to distinguish between debtors who are more liable to repay the loan compared to debtors who are more likely to be defaulters.

A high credit rating indicates the repayment of the loan by the entity without any possible defaults. A poor credit rating indicates the possibility of the entity defaulting the repayment of loans due to their past patterns with respect to loan repayments. As a result of the strong emphasis on credit rating, it affects an entity’s chance of being approved for a loan and receiving favorable terms for that loan.

Credit ratings apply to both businesses and the government. For example, sovereign credit ratings apply to the national government whereas corporate credit ratings apply for cooperation. On the other hand, credit scores apply only to individuals and are calculated by agencies such as Equifax, Experian, and TransUnion for the citizens of the United States.

Credit ratings can be short-term or long-term. A short-term credit rating reflects the history of an entity’s rating with respect to recent loan repayments and therefore poses a possibility for this borrower to default with its loan repayment when compared to entities with long-term credit ratings.

Credit rating agencies usually assign alphabet grades to indicate ratings. For example, S&P Global has a credit rating scaling from AAA (excellent) to C and D. They consider a debt instrument with a rating below BB to be a speculative-grade or junk bond, indicating they are more likely to default on loans.

Importance of Credit Ratings

Credit ratings for entities are calculated based on due diligence conducted by the rating agencies. While a borrowing entity will aim to have the highest possible credit rating, the rating agencies aim to take a balanced and objective view of the borrowing entity’s financial situation and capacity to honor/repay the debt. Keeping this in mind, mentioned below are the importance of credit ratings for various entities:

For Lending Entities

Credit ratings give an honest image of a borrowing entity. Since no money lender would want to risk giving their money to a risky entity with a high possibility of default from their part, credit ratings genuinely help money lenders to assess the worthiness of the following entity and the risk associated with that entity, therefore helping them to make better investment decisions. Credit ratings act as a safety guard because higher credit ratings assure the safety of money and timely repayment of the same with interest.

For Borrowing Entities

Since credit ratings provide an honest review of a borrower’s ability to repay a loan, borrowers with high credit ratings find it easier to get loans approved by money lenders at interest rates that are more favorable to them. A considerable rate of interest is very important for a borrowing entity because higher interest rates make it more difficult for a borrower to repay the loan and fulfill their financial obligations. Therefore, maintaining a high credit rating is essential for a borrower as it helps them get a considerable amount of relaxation when it comes to a rate of interest for the loan issued to them. Finally, it is also important for a borrower to ensure that their credit rating has a long history of high rating. Just because a credit rating is all about longevity. A credit rating with a long credit history is viewed as more attractive when compared to a credit rating with a short credit history.

For Investors

Credit ratings play a very crucial role when it comes to a potential investor’s decision to invest or not in a particular bond. Now, investors have different risk natures associated with them. In general, investors, who are generally risk-averse in nature, are more likely to invest in bonds with higher credit ratings when compared to lower credit ratings. At the same time, credit ratings help investors, who are risk lovers to differentiate between bonds that are riskier due to the lower credit ratings and invest in them for higher returns at the risk of higher defaults associated with them. Overall, credit ratings help investors make more informed decisions about their investment schemes.

Related posts on the SimTrade blog

▶ Jayati WALIA Credit risk

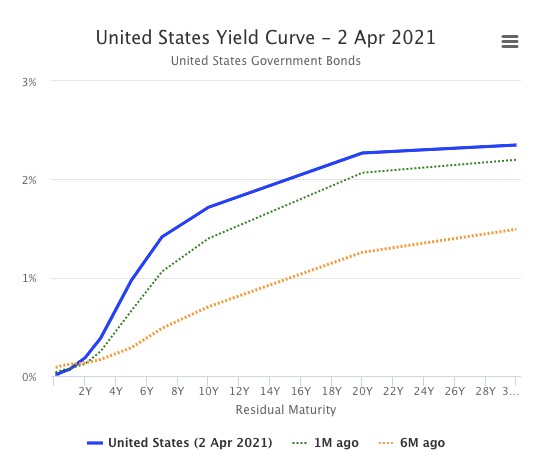

▶ Bijal GANDHI Interest Rates

▶ Rodolphe CHOLLAT-NAMY Credit analyst

▶ Aamey MEHTA My experience as a credit analyst at Wells Fargo

▶ Jayati WALIA My experience as a credit analyst at Amundi Asset Management

▶ Louis DETALLE My professional experience as a Credit Analyst at Société Générale

Useful resources

S&P Global Ratings

Moody’s

Fitch Ratings

About the author

Article written in May 2021 by Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).

Source:

Source:

Source: Datacommons.org

Source: Datacommons.org