Value investment strategy

This article written by Akshit Gupta (ESSEC Business School, Master in Management, 2019-2022) presents the strategy of Value Investing.

Introduction

Value investment strategy is an investment style where investors look for shares that are undervalued by the market. In the companies that are undervalued, the current share price of that company is less than its intrinsic value. Intrinsic value refers to the stocks real value calculated using financial analysis metrics. The financial analysis is based on many factors including the company’s financial performance, free cash flows, future growth potential, historical performance, ratio analysis, market share and the quality of their management. The strategy is a part of fundamental investment style where investors actively seek capital appreciation and dividend returns and have a long-term investment plan.

The value investment strategy is the opposite of growth investment strategy and is considered to be a defensive strategy. A growth investment strategy is an investment style where investors look for companies, industries, sectors, or markets that are rapidly growing and have the future potential to grow at a higher-than-average rate compared to its market or industry average.

A defensive strategy involves buying quality – stocks that possess minimum risk and good returns. Dividend income is crucial for a value investor. A value investor holds onto his/her position in a company until the market realizes the true value of that company, and enjoys the stream of dividend income the company has to offer.

The investors practicing value investment strategy actively look for companies that have good long-term fundamental value. The idea behind the strategy is to buy undervalued stocks, hold the position till the stock prices reach their real or potential level and then exit the position.

Benjamin Graham is regarded as the father of value investment strategy. He is known for authoring many famous books on value investing including ‘The intelligent investor’ in the late 1940’s. He introduced the concepts such as the intrinsic value and the requirement of safety margin when investing in value stocks to the wide audience. Safety margin refers to the difference between the stock’s intrinsic value and the current market price. The more the difference between the two values, the higher the margin of safety the investor has. The high safety margin makes the investment less risky for the investor.

Indicators to practice value investment strategy

An investor practicing value investment style takes into consideration various financial and non-financial metrics based on the fundamentals of a company to compute the intrinsic value of the stock. The non-financial metrics largely depend on the investors experience and personal outlook. It can include management’s credibility, corporate strategy, focus on innovation, etc.

The most commonly used financial tools include:

Financial statements

For a value investor, it is important to study and analyze the financial statements of a company to compute different ratios to understand the company’s financial performance. The ratios that an investor looks for include:

- Price- Earnings ratio: Price to earnings ratio is a fundamental analysis tool that helps an investor to determine how much the current market price of a company is compared to its current earnings per share. A value investor compares the price – to – earnings ratio of a company to the P/E ratio of other firms operating in the same sector to analyze if the stock is underpriced or not.

- Price-book ratio: The P/B ratio is calculated by dividing the company’s current market price to its total book value. The book value of a company is equal to the company’s total assets minus its total liabilities. The P/B ratio of less than 1 means that the company’s current market price is less than its book value, thus the share is undervalued by the market.

- P/E-growth ratio: Price/earnings to growth (PEG) ratio is calculated by dividing the price/earnings ratio of a company by its expected future growth rate. This ratio provides more comprehensive information about the company’s valuation. An PEG ratio of less than 1 signifies that the company’s current price is less than its future expected earnings growth rate. Such a company is considered as undervalued by the market.

- Debt-assets ratio: Debt to assets ratios is calculated by dividing the company’s total debt by its total assets as per the balance sheet. The companies that have a ratio of less than 1 have a sound debt position in their balance sheet and have low chances of default. The company also possesses low risk which is an added advantage for the value investors.

DCF analysis

The value investors also carry out Discounted Cash flow (DCF) analysis to compute the present intrinsic value of the company based on their expected future cash flows. The value investors carry out this analysis since they believe that the present intrinsic value of a company is primarily dependent on its ability to generate good cash flows in the future. The DCF analysis takes into account the time value of money and is calculated by making projections about the free cash flows the company will have in the future and computing a discount rate which is usually the weighted average cost of capital.

Market efficiency

Market efficiency refers to the degree to which all the relevant information about an asset is incorporated in the market prices of that asset. Fama (1970) distinguished three forms of market efficiency: weak, semi-strong, and strong according to the set of information considered (market data, public information, and both public and private information).

In the strong form of the market efficiency hypothesis, the current market price of an asset incorporates all the publicly available information as well as the private or insider information.

The value investment strategy works against the efficient market hypothesis as the investors practicing this strategy always look for stocks that are undervalued or overvalued to execute trades. But value investors improve market efficiency by buying undervalued stocks (pushing the stock price up towards its fundamental value) and selling overvalued stocks (pushing the stock price down towards its fundamental value).

Example of value investors: Warren Buffet

Warren Buffet also referred to as ‘a man who values simplicity and frugality’, is a well-known believer and preacher of value investment strategy. He is a fellow student of Benjamin Graham and most of his investment decisions strongly focus on the principles of value investing and have a mid-term to long-term investment duration.

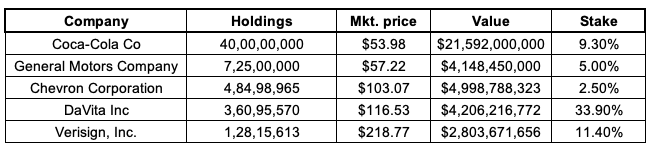

Some of the famous value stocks held by Warren Buffet, as of writing of this article (30/04/2021), includes:

Source: https://www.cnbc.com/berkshire-hathaway-portfolio/

Related posts on the SimTrade blog

▶ Akshit GUPTA Growth investment strategy

▶ Akshit GUPTA Momentum Trading Strategy

Useful Resources

Investopedia article: Introduction to value investing

Corporate finance institute article: A guide to value investing

Relevance to the SimTrade Certificate

The concepts about value investment strategy can be understood in the SimTrade Certificate:

About theory

- By taking the Exchange orders course, you will know more about the different types of orders that you can use to buy and sell assets in financial markets.

- By taking the Market information course, you will understand how information is incorporated into market prices and the associated concept of market efficiency.

About practice

- By launching the Sending an Order simulation, you will practice how financial markets really work and how to act in the market by sending orders.

- By launching the Efficient market simulation, you will practice how information is incorporated into market prices through the trading of market participants and grasp the concept of market efficiency.

About the author

Article written by Akshit Gupta (ESSEC Business School, Master in Management, 2019-2022).