Interest rates

In this article, Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022) explains in detail about Interest Rates.

In this article, Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022) explains in detail about Interest Rates.

This read will help you understand the impact of rising and falling interest rates and their relationship with the stock and the bond markets.

Definition of Interest Rates

Interest rate is the cost charged by the lender to the borrower for the amount borrowed. The buzz over interest rate is real as it has a huge impact on not just the stock markets but also the overall economy. It is therefore important to understand how the interest rates are set and influenced by different factors.

Economic policy

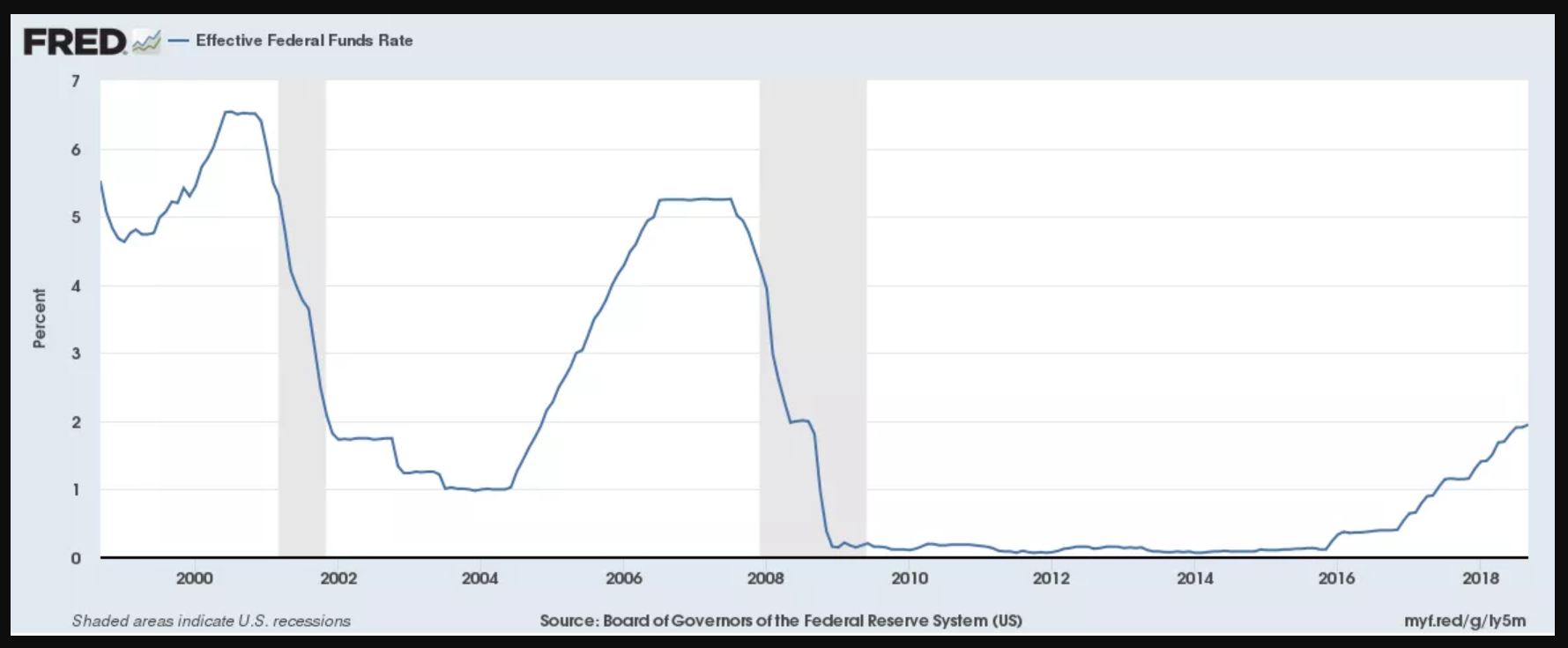

The primary goal of any nation would be to attain maximum levels of employment, stability in prices, and economic growth. To achieve these goals, the Central Bank uses the interest rates as a switch to either curb inflation or achieve growth. The federal funds rate is the rate at which banks borrow money from each other overnight. The federal body sets the target for the federal funds rate and any deviations from this target has a ripple effect over the entire economy and thereby on the stock markets. The graph below portrays the trajectory of the effective federal funds rate from 1998 to 2018.

Impact of rising interest rates

In the US, the Federal Reserve increases the federal funds rate in order to make borrowing money more expensive for banks. The Central Bank manages this through open market operations using government securities like Treasury bills, notes and bonds. It sells the Treasury securities in order to increase the interest rates. The banks therefore would charge a higher rate to their customers. With an increase in interest rates, the consumers will now have less money to spend due a decrease in their disposable income (due to a higher cost to obtain credit). An increase in interest rates may impact the demand for goods and services. The prices may fall and thereby help the federal body curb inflation. A further rise will start impacting businesses directly. This is because businesses borrow money from banks for their operations. Rise in interest rates will discourage business spending which may not just slow down the growth of one company but the entire economy. The negative impact on the revenues and profits of a company will eventually reflect in the stock prices.

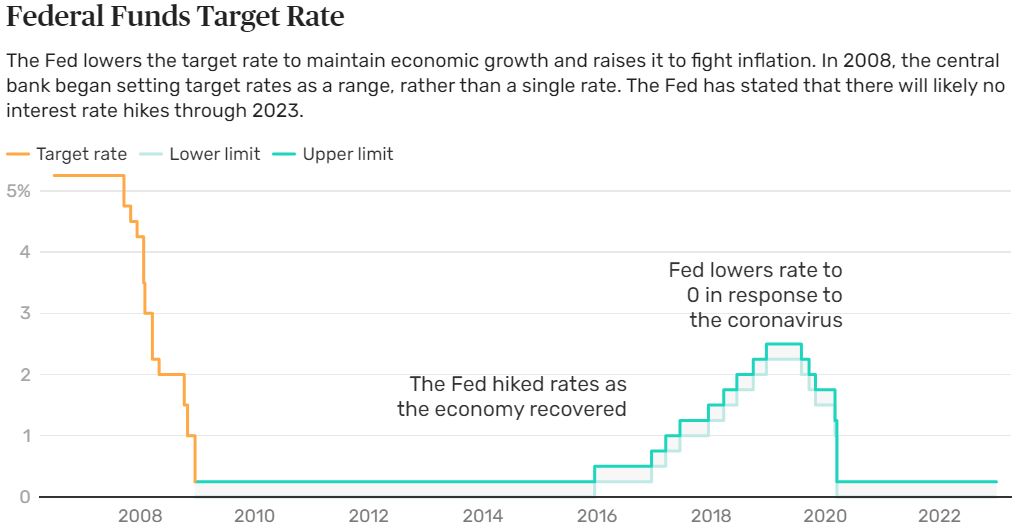

Source: Federal Reserve & Balance.com

Source: Federal Reserve & Balance.com

Impact of falling interest rates

Apart from the interest rate at which the banks borrow from one another, the Central Bank also set the reserve requirements for the banks. The reserve requirement is the percentage of deposits a bank is obliged to keep on hand each night. The Fed can also lower the reserve requirements in case it wants to encourage lending to businesses and households in the economy. Similarly, during a slump in the economy, the federal reserve may also stimulate activity by cutting down the federal funds rate. An increase in the borrowing by businesses would act as a catalyst for growth. This is because businesses would enjoy operations, expansions, and acquisitions at a cheaper rate. A lower interest rate will also result in higher consumer spending. The revenues and profits for businesses will rise thereby impacting the stock prices positively.

Relation between interest rates and stock market prices

A higher interest rate would mean higher debt costs for companies, which may result in a decrease in the projected future cash flows for stockholders. This will lower the stock price of that company and if similar situations occur in other companies in the economy, the whole stock market may decline. Not just the existing debt costs, but an interest rate hike may also discourage borrowing for expansionary measures. However, this may not be the case with all sectors. Some sectors like the financial industry may benefit from an increase in the interest rate as they can now charge more for lending. The impact cannot just be financial but also psychological. A reduction in the stock prices may also set off a bout of panic selling due to fear and uncertainty. The investors and businesses may lose confidence and would now not be willing to make any risky investments.

Relation between interest rates and bond market prices

Bond prices and interest rates have an inverse relationship: as interest rates rise, bonds prices fall and vice versa. This is because with an increase in interest rates, the cost of borrowing will also increase resulting in a decrease in demand for existing bonds which yield lower returns. Similarly, with a decrease in interest rates, companies will now issue new bonds at lower interest rates for their projects. The demand for high yielding bonds will increase and so would the prices of these bonds. The longer the maturity of a bond, the more the bond value would be subjected to fluctuations. Short-term bonds are less affected by the interest rate changes. Long-term bonds are more affected by the interest rate changes. Technically, this effect is captured by the duration measure of a bond.

Conclusion

Interest rates not just affect businesses and investors but also all individuals of the nation. They play a major role in deciding the fate of both investments and the economy and therefore it is important to understand its role and impact.

Related posts on the SimTrade blog

Useful resources

About the author

Article written in April 2021 by Bijal Gandhi (ESSEC Business School, Master in Management, 2019-2022).