In this article, Snehasish CHINARA (ESSEC Business School, Grande Ecole Program – Master in Management, 2022-2025) shares his experience as Customer Finance & Credit Risk Analyst at Airbus, which is a leader in the commercial aviation industry as an original equipment manufacturer (OEM).

About Airbus SAS

Airbus SAS, founded in 1970, is a leading European multinational aerospace corporation with a global presence. Specializing in the design, manufacturing, and delivery of aerospace products, services, and solutions, Airbus has established itself as a cornerstone of innovation and excellence in the aviation industry.

From commercial aircraft to defence and space systems, Airbus covers a wide array of sectors, each driven by cutting-edge technology and a commitment to sustainability. Their iconic product line, including the A320 and A350 families, represents the forefront of efficiency, safety, and performance in aviation.

Beyond manufacturing, Airbus is also deeply engaged in digital transformation, pushing boundaries with initiatives in autonomous flying, AI-driven processes, and greener aviation solutions. As an industry leader, Airbus is committed to decarbonizing the aerospace industry, having set ambitious goals to reduce its environmental footprint through innovations such as sustainable aviation fuels and hydrogen-powered aircraft.

With a global workforce of over 130,000 employees and operations in more than 170 locations worldwide, Airbus continues to be at the heart of the aerospace revolution, shaping the future of flight.Logo of Airbus.

Source: the company.

My Experience as a Customer Finance & Credit Risk Analyst at Airbus

During my time as a Customer Finance & Credit Risk Analyst at Airbus, which was part of my Master in Management degree at ESSEC Business School, I had the opportunity to play a pivotal role in leading financial analyses and supporting high-stakes deal campaigns in the aviation sector. This experience was instrumental in sharpening my analytical and credit risk assessment capabilities, as I worked on transactions exceeding €200M, where each decision carried significant financial implications.

In this role, I focused on developing advanced financial models and internal customer credit rating models, applying methodologies from major credit rating agencies like Moody’s, S&P, and Fitch. These models, built using tools such as Excel, R, and Python, allowed my team to improve the accuracy of risk predictions for over 200 global client companies (mostly airline companies) air. By conducting industry-wide credit risk analyses, I ensured that each deal was supported by a thorough understanding of financial and credit health, helping Airbus mitigate risks and seize opportunities in a highly competitive market.

A key highlight of my work involved analysing the impact of M&A and restructuring activities within the aviation industry. This hands-on experience further honed my ability to deliver comprehensive financial forecasts and credit risk analyses.

One of the most rewarding aspects of my role was the opportunity to present these financial insights directly to senior executives. Communicating complex financial data effectively is crucial when high-value transactions are involved, and this responsibility significantly enhanced my presentation and communication skills. My experience in presenting to top executives helped me not only translate data into actionable strategies but also contributed to the decision-making process at the highest level.

Overall, my role as a Customer Finance & Credit Risk Analyst at Airbus was a formative experience that deepened my expertise in financial modelling, credit risk analysis, and strategic financial communication. It was an invaluable opportunity to contribute to significant aviation industry deals and refine my skills in evaluating financial performance and credit health at a global scale.

My missions

The objective my project was to achieve the following:- Led the migration of Airbus’ internal credit rating model from a manual Excel-based system to an automated and scalable R-based system, improving data processing accuracy and decision-making.

- Educated internal teams on industry-specific financial metrics and KPIs to help them understand the financial health of Airbus’ customers.

- Conducted comprehensive financial health analyses and credit rating evaluations for over 200 global companies, using tools such as Excel, R, and Python.

- Supported marketing and sales campaigns by providing financial insights, risk evaluations, and industry trends to improve Airbus’ position in the aviation sector.

Required Skills and Knowledge

As a Customer Finance & Credit Risk Analyst at Airbus, several key skills and knowledge areas were essential to fulfilling my responsibilities effectively:- Financial Analysis and Modelling: Proficiency in developing financial models and credit rating models was crucial. These models helped me assess the financial health of clients and predict risks. Additionally, I frequently used tools like Excel, R, and Python to develop robust financial models that supported decision-making processes.

- Credit Risk Assessment: Applying methodologies from Moody’s, S&P, and Fitch allowed me to conduct comprehensive credit risk assessments. Understanding credit rating criteria and financial ratios helped me evaluate over 200 global companies in the aviation sector, ensuring accurate risk predictions.

- Industry Knowledge: Understanding the aerospace industry inside and out was essential. I became familiar with the dynamics between OEMs, lessors, airlines, and financial institutions. This helped me make better-informed decisions when assessing the creditworthiness of our clients and providing insights that contributed to Airbus’ overall financial strategies.

- Data Analysis and Reporting: I worked with large datasets to analyse financial performance and assess risk factors. Creating financial reports, dashboards, and presentations helped me convey complex data in a way that was clear and actionable, especially when presenting to senior executives.

- Automation and Process Improvement: One of my major projects involved transitioning our internal credit rating system from Excel to a more efficient R-based platform. This required me to develop a scalable solution that not only improved accuracy but also streamlined the data processing workflow, making everything faster and more reliable.

- Collaboration and Stakeholder Management: Working closely with various teams within Airbus and external partners taught me the importance of effective communication and teamwork. Presenting my financial insights to senior executives also sharpened my ability to convey complex information in a clear, understandable way, ensuring everyone was aligned with our financial strategies.

This diverse set of skills allowed me to support high-value transactions, improve credit risk assessment processes, and contribute to strategic initiatives at Airbus.

What I learned

Key Learning Outcomes of this project :

- Applying Financial Models to Real-World Scenarios: I gained hands-on experience using advanced financial models such as DCF, LBO, and credit rating models. This helped me make informed, evidence-based conclusions to assess credit risk and guide strategic decision-making.

- Enhanced Risk Assessment Skills: I learned how to apply credit rating methodologies from major agencies like Moody’s, S&P, and Fitch. This allowed me to develop a deeper understanding of risk factors affecting both the aviation sector and individual companies, enhancing my ability to forecast risks with greater accuracy.

- Collaboration and Stakeholder Engagement: Collaborating with cross-functional teams within Airbus, I developed strong communication skills, particularly in presenting complex financial insights to senior executives and aligning my work with broader corporate objectives.

- Data-Driven Decision Making: I honed my ability to analyse large datasets, extract meaningful financial insights, and turn them into actionable recommendations. This process strengthened my strategic thinking and ability to contribute to critical business decisions.

- Process Automation and Efficiency Improvement: Leading the automation of the internal credit rating system taught me how to streamline workflows and improve efficiency, significantly reducing the time spent on manual processes while enhancing data accuracy.

Concepts related my Apprenticeship

I explain below three business concepts related my apprenticeship: value chain, credit risk analysis, and financial ratios.

Value Chain

The commercial aviation sector comprises multiple interconnected players, each contributing to different stages of the value chain. The value chain begins with aircraft Original Equipment Manufacturers (OEMs) like Airbus and Boeing, which design and manufacture aircraft. These OEMs negotiate deal terms with airlines and lessors for the sale or lease of aircraft. The deals can range from firm orders, where aircraft are purchased outright, to leasing agreements, where airlines lease aircraft for operational flexibility.

In this value chain, airlines are the primary end users, operating the aircraft to transport passengers (commercial airplane) and freight (cargo airplane). Lessors act as intermediaries, purchasing aircraft from OEMs and leasing them to airlines, offering flexibility in fleet management. Additionally, Maintenance, Repair, and Overhaul (MRO) providers play a critical role in ensuring the safety and performance of aircraft throughout their lifecycle. Financial institutions and credit rating agencies are also integral players, assessing the creditworthiness of the companies involved and financing large-scale aircraft transactions.

The deal-signing process with OEMs often involves complex negotiations on pricing, delivery schedules, and terms of financing. Types of deals include sale agreements, wet or dry leases, and purchase options. The financial arrangements and credit risk evaluations play a pivotal role in securing these deals, ensuring that all parties can fulfil their obligations over the aircraft’s operational life.

Credit Risk Analysis

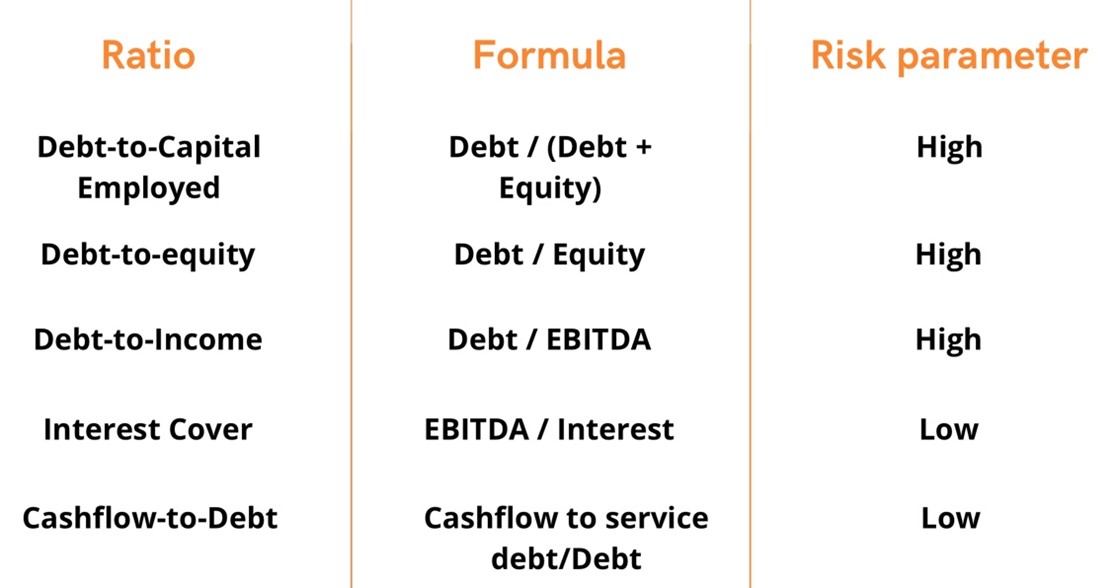

Credit risk analysis is the process of evaluating the likelihood that a borrower or counterparty will default on their financial obligations. In the context of my work at Airbus, credit risk analysis was crucial for understanding the financial health of customers—whether they were airlines, lessors, or MRO service providers. By analysing financial statements, liquidity ratios, and external market factors, we could gauge the risk of default and the overall creditworthiness of these companies.

Credit ratings, provided by the three major credit rating agencies—Moody’s, S&P, and Fitch, are a standardized way to assess a company’s financial health and default risk. These agencies evaluate the financial statements of companies, industry trends, and macroeconomic conditions to assign ratings that range from AAA (lowest risk) to D (in default). Credit ratings are essential for investors and lenders in determining the risk profile of potential investments and for companies like Airbus when structuring deals.

Airbus, like many large corporations, uses internal customer credit rating models alongside external credit ratings to gain deeper insights into the financial stability of its clients. These models allow Airbus to account for industry-specific factors and customer performance metrics that external agencies might overlook. Internal models are particularly valuable in predicting potential risks and making informed decisions about financing, delivery schedules, and long-term contracts, ensuring that Airbus minimizes exposure to credit risk.

Financial Ratios

Financial ratios (key performance indicators (KPIs) for the financial health of a firm) are vital in assessing the financial health of companies in the aviation sector. During my time at Airbus, I focused on analysing these KPIs to evaluate the financial stability and creditworthiness of our customers:

- Liquidity Ratios: Indicators like the current ratio and quick ratio show a company’s ability to meet its short-term obligations. A higher ratio suggests stronger liquidity and a lower risk of financial distress.

- Debt-to-Equity Ratio: This KPI measures the proportion of debt financing relative to equity. A lower debt-to-equity ratio typically indicates a more financially stable company, with less risk of default in turbulent market conditions.

- Profitability Margins: Metrics like net profit margin and EBITDA margin give insights into how efficiently a company is operating. Higher profitability suggests a company can generate sufficient revenue to cover its expenses, even in challenging times.

- Gearing Ratio: A company’s gearing ratio measures its financial leverage and how reliant it is on debt to finance its operations. A higher gearing ratio may indicate increased financial risk.

- Altman Z-Score: This is a composite score used to predict bankruptcy risk, combining profitability, leverage, liquidity, solvency, and activity ratios. It’s particularly useful for assessing companies under financial stress, a key concern in the aviation sector post-COVID-19.

- Cash Flow from Operations: A company’s ability to generate consistent cash flow from its core operations is a strong indicator of financial health. In the aviation sector, where cash flow can be cyclical, maintaining positive cash flow is critical for long-term sustainability.

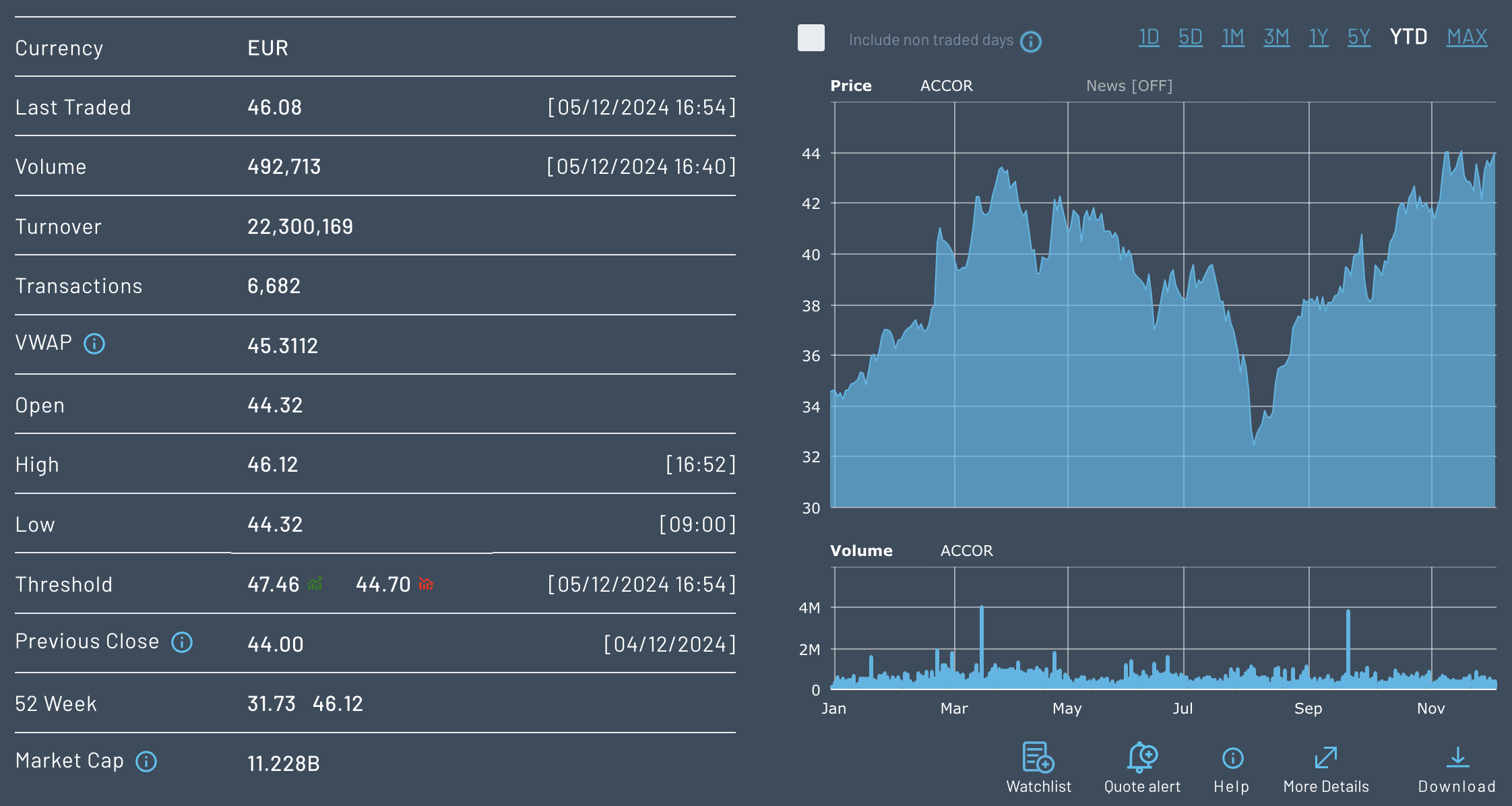

The following table provides some of the important financial ratios used to estimate the risk of a company. High financial risk is implied by high or low measure according to the ratio.

Table 1. Financial ratios

Source: The author.

Ratios are most useful when compared between companies in similar sectors and over time. Multiple measurements may be necessary for each given firm to fully comprehend the financial risk.

Why Should I Be Interested in This Post?

If you are passionate about the aviation sector, finance, and risk management, this role as a Customer Finance & Credit Risk Analyst at Airbus offers an exceptional opportunity to develop a deep understanding of the global aviation market while working on high-impact financial transactions. You’ll be at the forefront of evaluating the creditworthiness of major airlines, lessors, and other key players in the industry, gaining valuable insights into how financial health and risk factors influence large-scale deals.

This position also allows you to hone your skills in advanced financial modeling, risk assessment, and credit rating, using real-world data to drive decision-making on transactions worth millions of euros. The chance to work closely with cross-functional teams, present findings to senior executives, and contribute directly to Airbus’ business strategy ensures that you will grow both technically and professionally.

Additionally, the aviation industry is dynamic, with constant innovations in technology, sustainability initiatives, and global market trends. By working in this role, you’ll be part of a sector that plays a pivotal role in global transportation and trade, offering immense potential for career growth and advancement.

Related posts on the SimTrade blog

Professional experiences

▶ All posts about Professional experiences

▶ Nithisha CHALLA My experience as a Risk Advisory Analyst in Deloitte

▶ Samia DARMELLAH My Experience as a Credit Risk Portfolio Analyst at Société Générale Private Banking

▶ Jayati WALIA My experience as a credit analyst at Amundi Asset Management

Risk

▶ Georges WAUBERT Credit Rating Agencies

▶ Jayati WALIA Credit Risk

▶ Jayati WALIA Value at Risk

▶ Jayati WALIA Stress Testing used by Financial Institutions

▶ Diana Carolina SARMIENTO PACHON Risk Aversion

Useful resources

Allianz Trade Financial Risk

Deloitte Financial Risk

About the author

The article was written in October 2024 by Snehasish CHINARA (ESSEC Business School, Grande Ecole Program – Master in Management, 2022-2025).