My Internship Experience at Kearney

In this article, Jianen HUANG (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021-2023) shares his professional experience as a consulting intern at Kearney.

Kearney

Kearney is a global management consulting firm that specializes in helping clients achieve their strategic goals and solve complex business challenges. With over 95 years of experience, Kearney has built a reputation for delivering innovative solutions that drive lasting results. The firm operates in over 40 countries, serving clients in a range of industries, including consumer goods, healthcare, retail, technology, and transportation. Kearney’s team of experienced consultants bring deep industry knowledge, analytical rigor, and a collaborative approach to every engagement, working closely with clients to understand their unique needs and deliver tailored solutions. With a focus on delivering measurable impact and driving growth, Kearney has earned a trusted reputation as a strategic partner for businesses around the world.

Logo of the Kearney.

Source: Kearney.

My internship

I worked as a part-time assistant and supported the Kearney consulting team based in Shanghai. During the six months internship, I worked on two main projects with clients from two different industries.

The Hainan Free Trade Port is a new special economic zone in China, established in 2020, with a focus on developing a globally competitive, free trade port, and a hub for international trade and investment. The Hainan Free Trade Port aims to promote trade liberalization and facilitation, open up the Chinese economy to international investors, and attract foreign investment. The Chinese government has announced a series of policies and measures to support the development of the Hainan Free Trade Port, including tax incentives, streamlined customs procedures, and relaxed visa policies, making it an attractive destination for international businesses looking to expand in the Asia-Pacific region. With this context, the first client is a state-owned company that was planning to enter the duty-free market. And we have been asked to plan the exhibition and the future expansion.

Quality management is important for businesses to ensure that their products or services consistently meet or exceed customer expectations. By implementing a quality management system, businesses can improve their processes, reduce waste, and increase efficiency, ultimately leading to higher customer satisfaction and increased profitability. Quality management involves establishing processes and procedures to ensure that products or services meet specific standards and requirements, reducing the likelihood of defects or errors that could negatively impact customer satisfaction. By focusing on quality management, businesses can also reduce costs by eliminating waste and inefficiencies in their processes, while building trust and a positive reputation for quality and reliability with their customers. The second project is related to a Chinese intelligence manufacturing player. With the trend of digitalization, the client is now planning to digitalize their quality management system, which includes the digitalization of all stages of the production process. Kearney’s team had been asked to build a QMS for the client and help them enhance their quality control ability.

Financial concepts related my internship

Cost-Benefit Analysis

Cost-benefit analysis is often used in consulting projects to make sound suggestions and convince management. Cost-benefit analysis is a way to evaluate the potential cost and benefit of a potential project. The process involves identifying and quantifying all relevant costs and benefits associated with the project, calculating the net present value of those costs and benefits, and comparing them to determine whether the project is financially viable.

The cost-benefit analysis process includes:

- Identify the project scope: during this stage, the consultants need to not only determine the topic of the analysis, but also identify key stakeholders, key resources, and technics.

- Determine the cost: the cost of a project can include direct and indirect costs, opportunity costs, and potential risks.

- Determine the benefit: a project can bring revenue from the sales, intangible benefits, or advantages we can potentially gain.

- Calculate the result

DCF

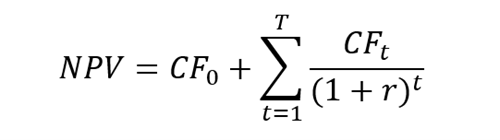

The discounted cash flow method (DCF) is an important financial valuation method that is often used in consulting jobs, and it is one of the most commonly used cost-benefit analysis. It is used to estimate the intrinsic value of an investment based on its series of cash flows. It involves projecting future cash flows, determining the appropriate discount rate, and calculating the net present value (NPV) of those cash flows.

The mathematical formula for the NPV:

CFt = cash flows of each period (from t=0 to t=T)

T = terminal date and number of periods

r = discount rate or interest rate required of the investment (it is the rate of return that the investors expect on their investment).

In a classical project, the initial cash flow, CF0, is usually negative since it is usually the initial investment of the project. The following cash flows, CFt for t=1 to t=T, are usually the profit that generates by the project for each period. The NPV can be rewritten as

In the end, we are comparing the NPV with the initial target we set to evaluate whether we should launch this project. On the other hand, in the case that we have enough resources, we can consider launching all the projects that have NPV greater than 0.

In the consulting project, the consultants usually have been asked to evaluate the value and to show a figure of the benefit of the project in order to convince the management.

Customer Due Diligence (CDD)

In consulting, CDD, or Customer Due Diligence, is a critical component of advisory services provided to clients in industries such as finance, banking, and insurance. Consultants use CDD to assess the risks associated with clients’ customers and to ensure regulatory compliance. CDD helps consultants identify potential financial crimes such as money laundering, terrorist financing, or other fraudulent activities that could pose a risk to their clients. By conducting thorough and systematic customer due diligence, consultants can help their clients mitigate risk, comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, and make informed business decisions. CDD is an essential tool for consultants providing advisory services to clients in highly regulated industries, helping them to build trust, maintain compliance, and protect their reputation.

Related posts on the SimTrade blog

▶ All posts about Professional experiences

▶ Federico DE ROSSI My Internship Experience at AlixPartners in London

Useful resources

About the author

The article was written in April 2023 by Jianen HUANG (ESSEC Business School, Master in Strategy & Management of International Business (SMIB), 2021-2023).