ETFs in a changing asset management industry

In this article, Youssef LOURAOUI (ESSEC Business School, Global Bachelor of Business Administration, 2016-2020) talks about his research conducted in the field of investing.

As a way of introduction, ETFs have been captivating investors’ attention in the last 20 years since their creation. This financial innovation has shaped how investors place their capital.

Definition

An ETF can be defined as a financial product that is based on a basket of different assets, to replicate the actual performance of each selected investment. An ETF has more or less the same proportion of the underlying components of the basket, depending on the style of management of the asset manager. ETFs represent nearly 90% of the asset under management of the global Exchange Traded Products (ETP).

History

The first ETF was the Standard and Poor’s Depository Receipts (SPDR) introduced in 1993. It appears to be an optimized product that enables investors to trade it like a stock, with a price that fluctuates during the day (not like mutual funds whose value is known at the end of the day only). The main advantage of ETFs for investors is to diversify their investment with lower fees than buying each underlying asset separately. The most important ETFs in the market are the ones with the lowest expense ratio as it is a crucial point to attract money from investors in the fund.

Types of ETF

ETFs can be segmented in different types according to the asset class, geography, sector, investment style among other criteria. According to Blackrock’s classification (2021), the overall ETF market can be divided into the following classes:

- Stock ETFs track a certain stock market index, such as the S&P 500 or NASDAQ.

- Bond ETFs offer exposure to a wide selection of fixed income instruments.

- Sector and industry ETFs invest in a particular industry such as technology, healthcare, or financials.

- Commodity ETFs track the price of a commodity such as oil, gold, or wheat.

- Style ETFs are devoted to an investment style or market capitalization focus such as large-cap value or small-cap growth.

- Alternative ETFs offer exposure to the alternative asset classes and invest in strategies such as real estate, hedge funds and private equity.

- Foreign market ETFs follow non-U.S. markets such as the United Kingdom’s FTSE 100 index or Japan’s Nikkei index.

- Actively managed ETFs aim to provide a certain outcome to maximize income or outperform an index, while most ETFs are designed to track an index.

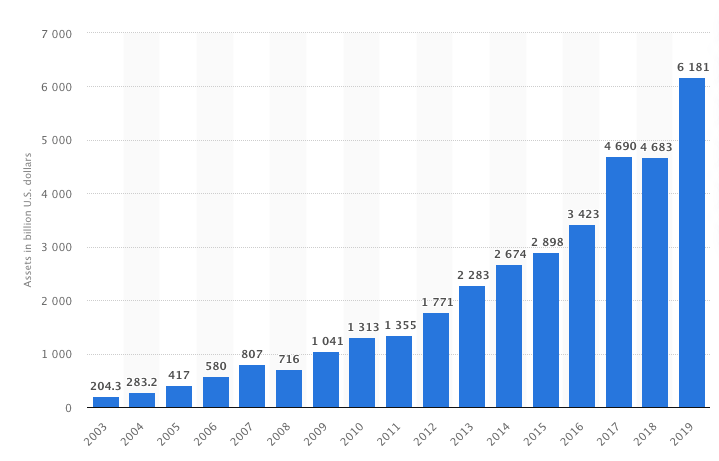

Figure 1. Volume of the ETF market worldwide 2003-2019.

Source: Statista (2021).

Figure 1 represents the volume of the ETF market worldwide over the period 2003-2019. With over 6,970 ETFs globally as of 2019 (Statista, 2021), the ETF industry is growing at an increasing pace, recording a thirty-fold increase in terms of market capitalization in the 17-year timeframe of the analysis. It reflects the growing appetite of investors towards this kind of financial instruments as they offer the opportunity for investors to invest virtually in every asset class, geographical region, sector, theme, and investment style (BlackRock, 2021).

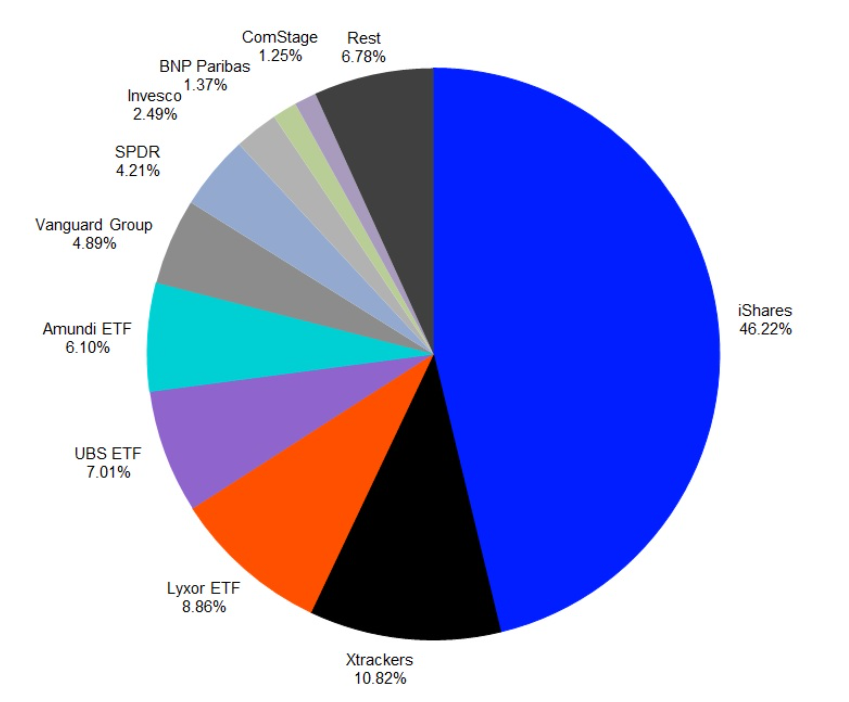

iShares (BlackRock), Xtrackers (DWS) and Lyxor (Société Générale) can also be highlighted as key players of the ETF industry in Europe. As shown in Figure 2, Lyxor (a French player) is ranked 3rd most important player with nearly 9% of the overall European ETF market (Refinitiv insights, 2019). iShares represents nearly eight times the weight of Lyxor, which is slightly above the average of the overall European ETF volume in dollars.

Figure 2. Market share at the promoter level by Assets Under Management (March 31, 2019)

Source: Refinitiv insights (2019).

It goes without saying that the key player worldwide remains BlackRock with nearly 1/3 of the global ETF market capitalization. According to Arte documentary, BlackRock is without a doubt a serious actor of the ETF industry as shown in Figure 2 with an unrivaled market share in the European and global ETF market. With more than 7 trillion of asset under management, BlackRock is the leading powerhouse of the asset management industry.

Benefits of ETF

The main benefits of investing in ETFs is the ability to invest in a diversified and straightforward manner in financial markets by owning a chunk of an index with a single investment. It allows investors to position their wealth in a reference portfolio based on equities, bonds or commodities. It also helps them to create a portfolio that suits their needs or preferences in terms of expected return and risk and also liquidity as ETFs can be bought and sold at any moment of the day. Finally, ETFs also allow investors to implement long/short strategies among others.

Risks

Market risk is an essential component to fully understand the risk of owning an ETF. According to the foundations of the modern portfolio theory (Markowitz, 1952), an asset can be deconstructed into two risk factors: an idiosyncratic risk inherent to the asset and a systematic risk inherent to the market. As an ETF are composed of a basket of different assets, the idiosyncratic risk can be neutralized by the effect of diversification, but the systematic risk, also called the market risk is not neutralized and is still present in the ETF.

In terms of risk, we can mention the volatility risk arising from the underlying assets or index that the ETF tries to replicate. In this sense, when an ETF tries to emulate the performance of the underlying asset, it will also replicate its inherent risk (the systematic and non-systematic risk of the underlying asset). This will have a direct impact on the overall risk-return characteristic of investors’ portfolio.

The second risk, common to all funds and that can have a significant impact on the overall performance, concerns the currency risk when the ETF owned doesn’t use the same currency as the underlying asset. In this sense, when owning an ETF that tracks another asset that is quoted in another currency is inherently, investors bears some currency risk as the fluctuations of the pair of currencies can have a significant impact on the overall performance of the position of the investor.

Liquidity risk arises from the difficulty to buy and sell a security in the market. The more illiquid the market, the wider the spreads to compensate the market maker for the task of connecting buyers and sellers. Liquidity is an important concern when picking an ETF as it can impact the performance of the portfolio overall.

Another risk particular to this instrument, is what is called the tracking error between the ETF value and its benchmark (the index that the ETF tries to replicate). This has a significant impact as, depending on the overall dispersion, the mismatch in terms of valuation between the ETF and the benchmark can impact the returns of investors’ portfolio overall.

Passive management and the concept of efficient market

Most ETFs corresponds to “passive” management as the objective is just to replicate the performance of the underlying assets or the index. Passive management is related to the Efficient Market Hypothesis (EMH), assuming that the market is efficient. Passive fund managers aim to replicate a given benchmark believing that in efficient markets active fund management cannot beat the benchmark on the long term.

Passive fund managers invest their funds by:

- Pure replication of the benchmark by investing in each component of the basket (vanilla ETF)

- Synthetic reproduction of the benchmark by replicating the basket with derivatives products (like futures contracts).

An important concept is market efficiency (also known as the informational efficiency), which is defined as the ability of the market to incorporate all the available information. Efficient market is a state of the market where information is rationally processed and quickly incorporated in the market price.

It is in the heart of the preoccupations of fund managers and analysts to unfold any efficiency in the market because the degree of efficiency impacts their returns directly (CFA Institute, 2011). Fama (1970) proposed a framework analyzing the degree of efficiency in a market. He distinguishes three forms of market efficiency (weak, semi-strong and strong) which correspond to the degree in which information is incorporated in the prices. Earning consistently abnormal returns based on trading with information is the opposite view of what an efficient market is.

- The weak form of market efficiency refers to information composed of past market data (past transaction prices and volumes). In a weakly efficient market, past market information is already included in the current market price, and investors will not be able to distinguish any pattern or prediction of future prices based on past data.

- The semi-strong of market efficiency refers to publicly available information. This includes market data (as in the week form) and financial disclosed data (financial accounts published by firms, press articles, reports by financial analysts, etc.). If a market is considered in the semi-strong sense, then it must be in a weak sense as well. In this context, there is no additional gain in determining under or overvalued security as all the public data is already incorporated in the asset price.

- The strong of market efficiency refers to all information (both public and private). Markets are strongly efficient when they reflect all the available information at any time in the asset prices.

Related posts on the SimTrade blog

▶ Micha FISCHER Exchange-traded funds and Tracking Error

▶ Youssef LOURAOUI Passive Investing

Useful resources

Academic resources

Fama, E. (1970) “Efficient Capital Markets: A Review of Theory and Empirical Work” Journal of Finance 25(2), 383–417.

Business

Arte documentary (2014) “Ces financiers qui dirigent le monde: BlackRock”.

BlackRock (January 2021) ETF overview.

Refinitiv insights (2019) Concentration of the major players in the European ETF market.

About the author

The article was written in February 2021 by Youssef LOURAOUI (ESSEC Business School, Global Bachelor of Business Administration, 2016-2020).

2 thoughts on “ETFs in a changing asset management industry”

Comments are closed.