Equity structured products

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) introduces equity structured products, which are complex financial products proposed to investors to benefit from market expectations.

Introduction

Structured products are pre-packaged product offerings which are designed as per the client’s risk-return profile. The returns on the investments in these products are based on the performance of the underlying assets. These underlying assets can include individual assets or indexes in various markets like equities, bonds and commodities, and derivatives on these underlying assets like futures, swaps, and options. The structured products are highly sophisticated products since they are tailor-made as per the client’s requirements and risk/return profile. These products have pre-defined features like maturity date, early – redemption mechanism, coupon payments (fixed or variable coupons), underlying asset, and the degree of capital protection. They can guarantee full or partial capital protection and a flexible degree of leverage as well.

Since these products follow a non-traditional investment strategy and can have different underlying assets, they remain in high demand in different market conditions, either bullish, bearish, stable, volatile, or uncertain. Structured products are normally issued by financial institutions and can either be traded on stock exchanges or over the counter (OTC).

An equity structured products has mainly two components that include:

- Fixed-Income product – A fixed-income security like a Treasury bond which fully or partially protects the capital of the investor.

- Equity Instrument and Derivatives – An equity instrument (which can be a stock or an index option) which provides the additional pay-off of the product. The payoff of the equity instrument is linked to the performance of the underlying asset.

Underlying assets

The equity structured products can provide the investor an exposure to equity-linked products like an option contract on individual share, index, basket of shares, or indices.

The investor benefits from the performance of the underlying asset and is paid by means of regular coupons at specific observation days or a one-off payment at the end of the product life.

Apart from the traditional equities, the underlying asset for the structured products can also include indices like CAC 40, S&P 500, FTSE or any other. They can also be customized as per the investor’s need to include several different equities or indices.

Example of an equity linked structured product

For example, an investor wants to buy a structured product and invest EUR 1,000 for 3 years. She wants capital protection and at the same time, gain an exposure to the stocks of LVMH trading in the French equity markets.

A structurer can buy a 3-year zero-coupon French OAT (government bond) with a par value of EUR 1,000 at price of EUR 901. At maturity the bond will pay the principal amount of EUR 1,000.

For the remaining EUR 99, the structurer buys a call option on the shares of LVMH

trading at EUR 110. This provides the investor with a participation of 90% (i.e., 99/110) in the performance of the share of LVMH, the underlying asset.

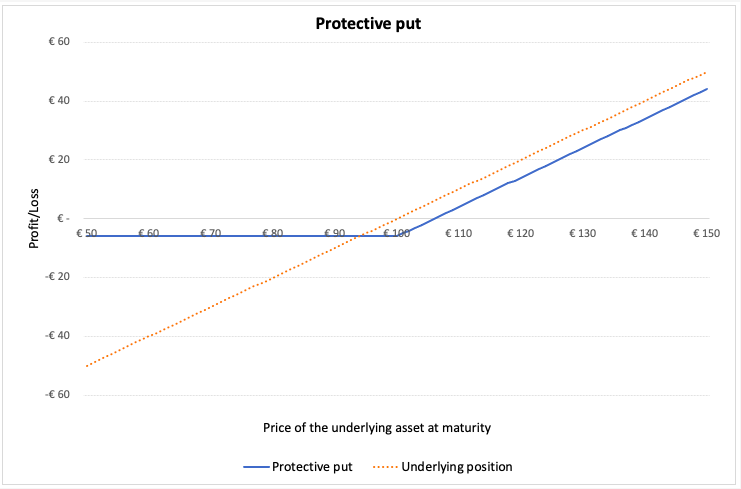

Figure 1. Risk profile of a protective put position.

Source: computation by the author.

Pros and Cons of investing in equity structured products

Pros

- Financial planning: Because of their defined maturity dates, structured products can be timed for costs like educational tuition fees and essential purchases and give investors peace of mind.

- Risk hedging: Structured products generally offer some form of capital protection as a defensive barrier depending on an investor’s preferences. Thus, structured investments are available to minimize risk exposure.

- Market access to diverse assets: Structured products allow investors to gain access to markets and asset classes that are not available through other securities.

- Structured products can provide leveraged exposure to markets.

Cons

- Market Risk: The return from investment can turn to zero or even negative in adverse market conditions

- Liquidity Risk: For structured products, there is only one market maker for the investments and the issuers commit to making a competitive aftersales market in a place that is visible to the investor or their advisory

- Counterparty Risk: Like most investments, structured products are subject to counterparty defaults. Issuer’s credit rating assessment and other information like credit default spreads, balance sheet strength etc. are essential

Useful resources

▶ Oesterreichische Nationalbank (2004), Financial Instruments Structured Products Handbook

Related Posts

▶ Akshit GUPTA History of Options markets

▶ Akshit GUPTA Option Trader – Job description

▶ Akshit GUPTA Options

▶ Akshit GUPTA Option Greeks – Delta

▶ Shengyu ZHENG Reverse convertibles

About the author

Article written in December 2021 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).