Cost of goods sold

In this article, Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) explains Cost of goods sold.

This read will help you understand in detail the meaning and components of cost of goods sold along with relevant examples.

Introduction

Cost of goods sold (COGS) refers the sum of all costs directly related to the production of the goods. It is fundamentally very similar to cost of sales and hence synonymously used. Some examples of items that make up COGS include,

- Cost of raw materials

- Direct labor costs

- Heat and electricity charges

- Overheads

Components and Formula

The COGS is calculated using the following formula,

COGS = (Beginning Inventory + Purchases) – Ending Inventory

• Beginning Inventory is the total value of the inventory left over or not sold from the previous year.

• Cost of goods is the sum of all costs directly related to the production of the goods or the purchase value of the same (in case of retailer or distributor)

• Ending inventory is the total value of the remaining inventory that was not sold till the end of the financial year. This number is carried forward to next year.

Example: LVMH

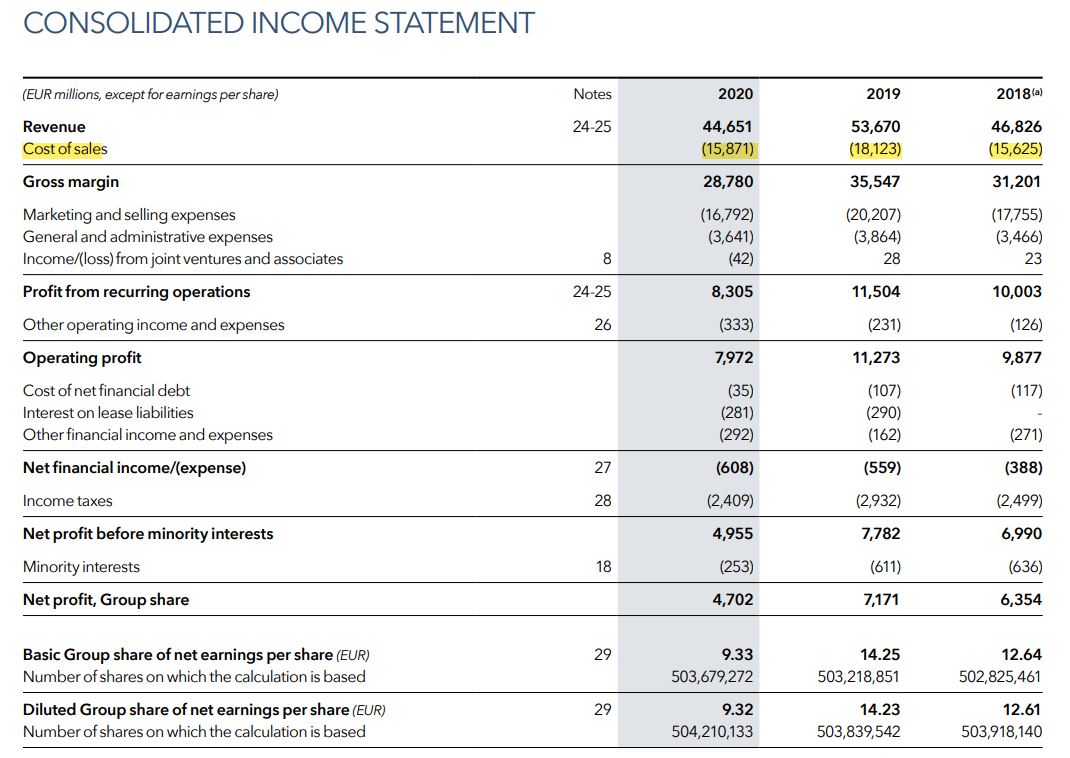

Let us once again take the example of LVMH. The French multinational company LVMH Moët Hennessy Louis Vuitton was founded in 1987. The company headquartered in Paris specializes in luxury goods and stands at a valuation of $329 billion. It is a consortium of 75 brands controlled under around 60 subsidiaries. Here, you can find a snapshot: 2018, 2019 and 2020.

In the income statement, COGS is placed just below revenue (Link to the blog) to easily compare the numbers and derive the gross margin. For example, in the snapshot of LVMH income statement below, the cost of sales for the year 2020 is 15,871 million euros for the revenue of 44,651 million euros resulting in a gross margin of 28,780 million euros.

Direct costs vs indirect costs

Direct cost refers to the costs that are directly associated with the production of goods and services. They are generally variable in nature as they fluctuate depending upon the production. Some examples of direct costs include, raw materials, direct labour, manufacturing supplies, fuel, power, wages, etc. Most importantly, direct costs are the ones that can be directly assigned to the product or service.

Indirect costs are those which cannot be assigned to one specific product or service. These costs are those that apply to more than one business activity. For example, rent, employee salary, utility and administrative expenses, overheads, etc. These costs may be fixed or variable in nature.

COGS vs operating costs

Operating costs are expenses that are not directly related to the production of goods or services. The operating expenses are a separate line item in the income statement, and they include indirect costs like salaries, marketing, rent, utilities, legal and admin costs, etc.

It is important to classify the costs correctly as either COGS or operating. This will help managers differentiate well between the two and effectively build a budget for the same.

Related posts on the SimTrade blog

▶ Bijal GANDHI Income statement

▶ Bijal GANDHI Revenue

About the author

Article written in May 2021 by Bijal GANDHI (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).