Activist Funds

This article written by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022) introduces activist funds which is a type of fund based on shareholder activism to influence a company’s board and top management decisions.

Introduction

Activist funds use an investment strategy where they buy shares in a publicly listed company with the aim to influence a company’s board and top management decisions. A large shareholding provides the activist fund with high power to influence the decision making of these firms at the management level. The aim of an active fund is to push for decisions or changes that would increase the share price and thus, the value of its portfolio.

Activist funds target companies which are poorly managed or have untapped value which if explored, can lead to significant increase in the stock price. They typically buy the equity shares of these companies which provides them with ownership and the rights to vote during the shareholders’ General Meetings to influence the board and top management decisions. Activist funds propose and help implement changes that favourably impact the stock prices and helps them to generate absolute market returns that are generally higher than the market benchmarks. These changes include changes in business strategy, operational decisions, capital structure, corporate governance and the day-to-day practices of the management.

Activist investors are normally seen operating either a private equity firm or a hedge fund and specialising in specific industries or businesses. High-net worth individuals and family offices are majorly involved in activist investing as they have access to huge investments and expertise.

Benefits of activist funds

Like other types of hedge funds and private equity firms, activist funds aim at providing their clients (investors) with investments managed in an efficient manner to optimize expected returns and risk. They try to generate alpha on the clients’ investment by actively participating in company’s board and top management decisions. So, activist funds are often acknowledged as the alternative funds in the asset management industry.

Concerns associated with activist funds

Although the investments in activist funds are handled by professionals and can generate absolute performance, they also come with some concerns for the investors. Some of the commonly associated concerns with activist fund investments are:

- Narrow-sighted approach – Activist funds invest in companies with the aim to maximize the shareholder’s wealth. The approach has serious concerns as it doesn’t fully take into account the effects of the decision on the company’s workers and society.

- Investment horizon – The investment horizon of activist funds is not very well defined as the changes propose d by the funds can either take shape immediately or may run over a couple of years before the effects are seen.

Example of activist fund

GameStop – Shareholder activism

The infamous GameStop stock rally that happened in 2021 drew people’s attention from around the world and it became the talk of the town. During the same time, the company also went through a change in its management. The event sheds light on the importance and impact of shareholder activism in today’s world.

Ryan Cohen is a famous activist investor who declared 10% stock ownership in GameStop through his investment firm, RC Ventures, in September 2020. This named him amongst the company’s biggest individual investor. He saw a huge opportunity for video games in the e-commerce market and wanted GameStop to evolve from a gaming company to a technology company and also change from traditional brick-and-mortar stores to online channels. To implement the changes, he made efforts to privately engage with the firm to review their strategic vision and change the company’s business model via . But the efforts yielded little success, following which he sent an open letter to the company’s Board of Directors (A copy of the letter can be seen below)

Ryan Cohen Letter to the Board of GameStop in November 2020

The letter was taken seriously by the company’s management and Ryan Cohen was appointed on the Board of Directors of the company in January 2021. Later, he was promoted as the Chairman of the Board to reshape the company’s strategic vision to become a technology-driven business rather than merely a gaming company.

Useful resources

Academic resources

Pedersen, L. H., 2015. Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined. Princeton University Press, Chapter 7, Discretionary Equity Investing.

Business resources

Business Insider Article on GameStop

Frick W. (2016) The Case for Activist Investors Harvard Business Review, 108–109.

Desjardine M., R. Durand (2021) Activist Hedge Funds: Good for Some, Bad for Others? Knowledge@HEC.

Related posts on the SimTrade blog

▶ Akshit GUPTA Asset management firms

▶ Akshit GUPTA Macro funds

▶ Akshit GUPTA Hedge funds

▶ Youssef LOURAOUI Introduction to hedge funds

About the author

Article written in August 2022 by Akshit GUPTA (ESSEC Business School, Grande Ecole Program – Master in Management, 2019-2022).

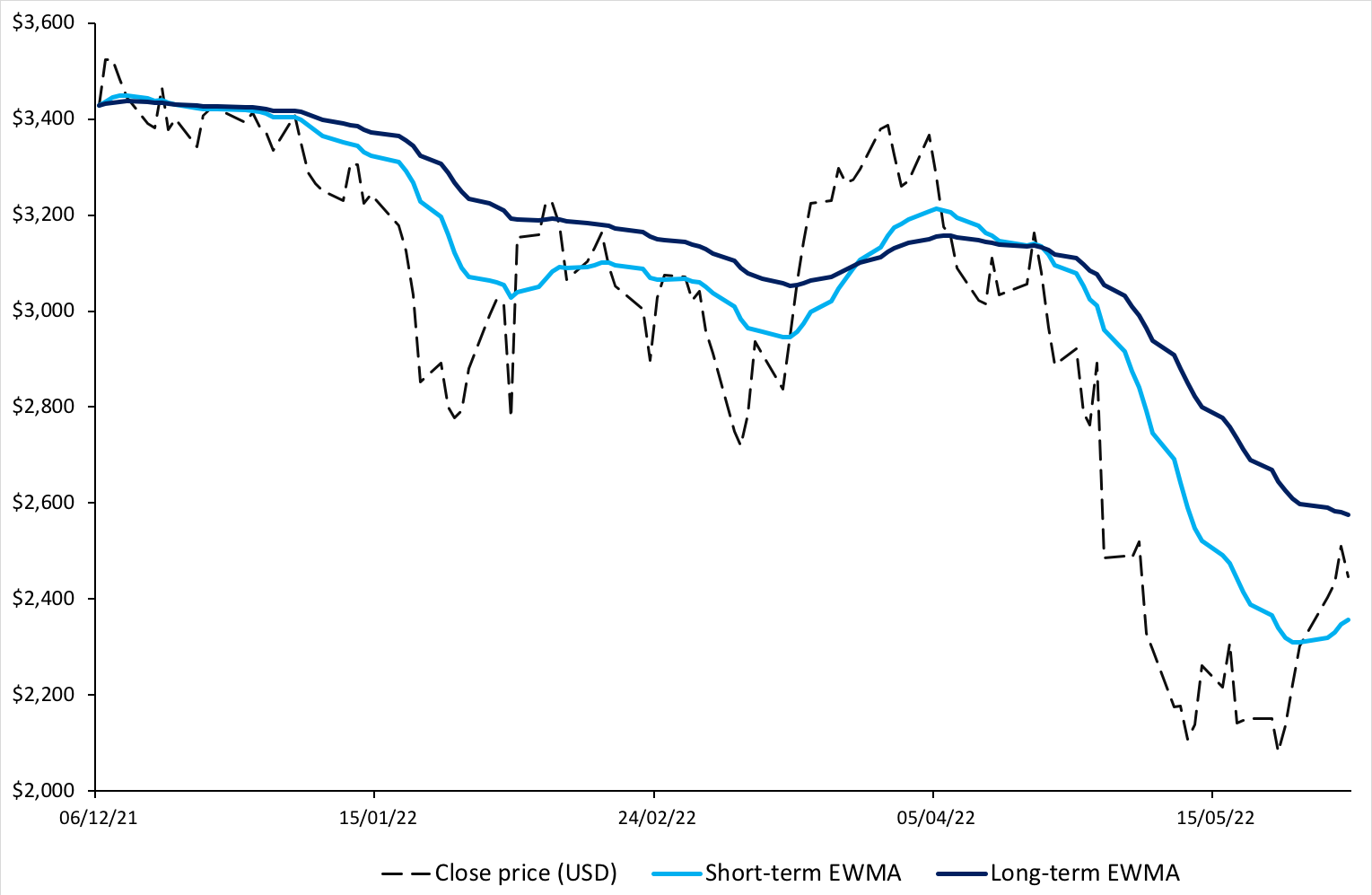

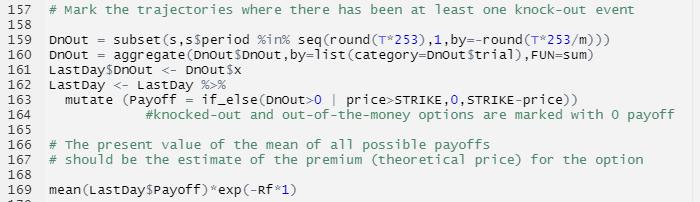

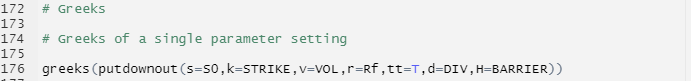

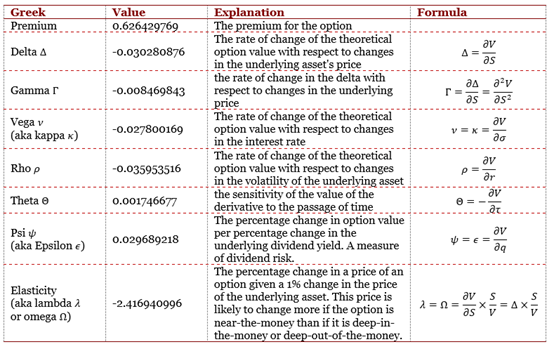

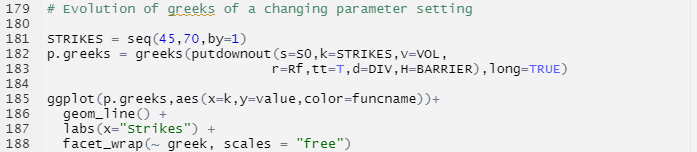

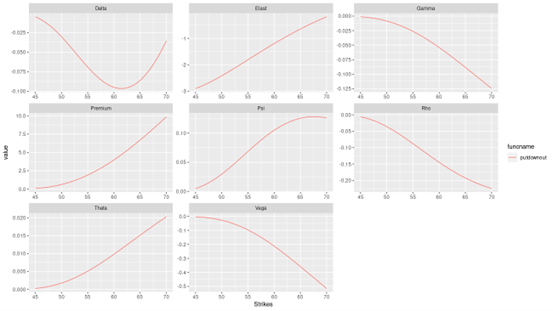

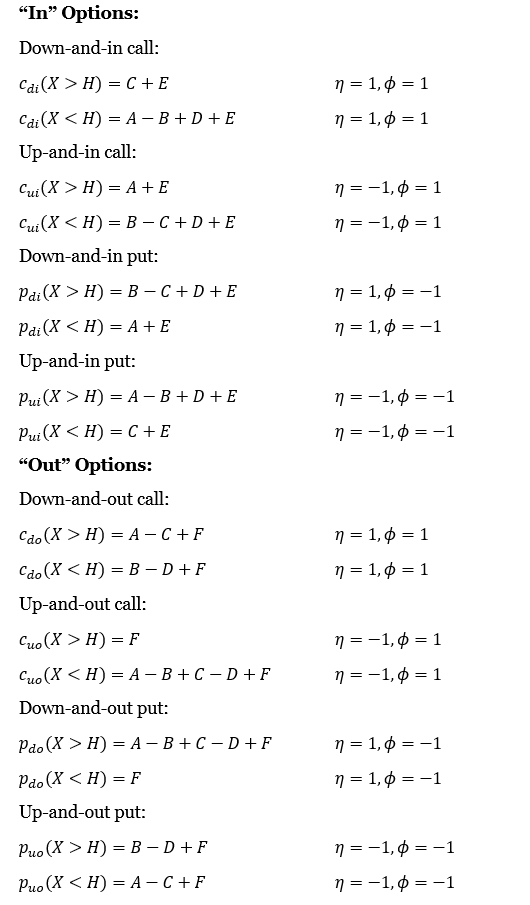

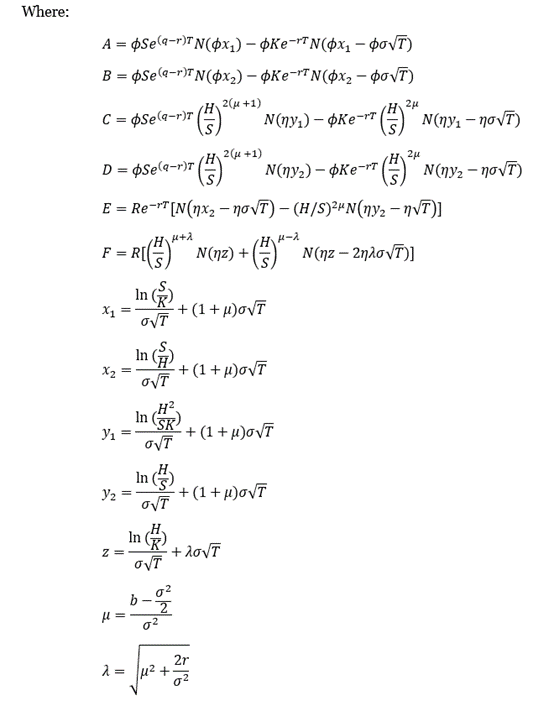

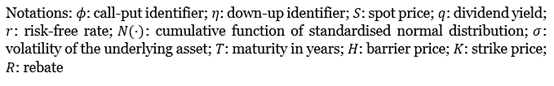

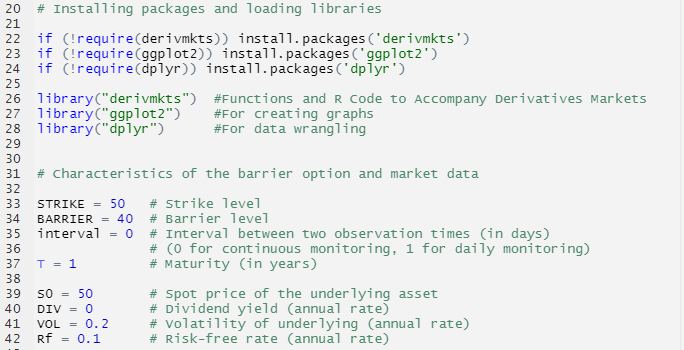

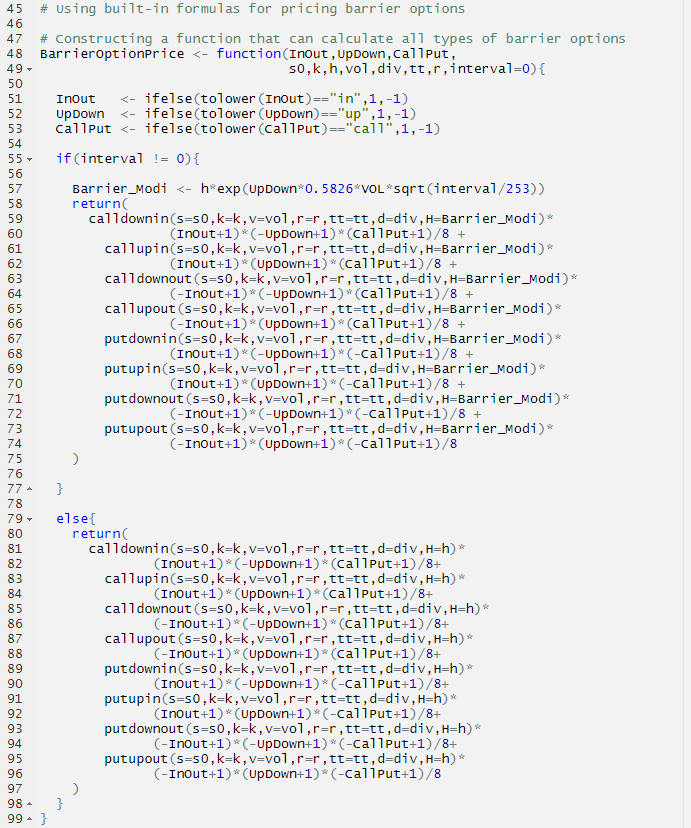

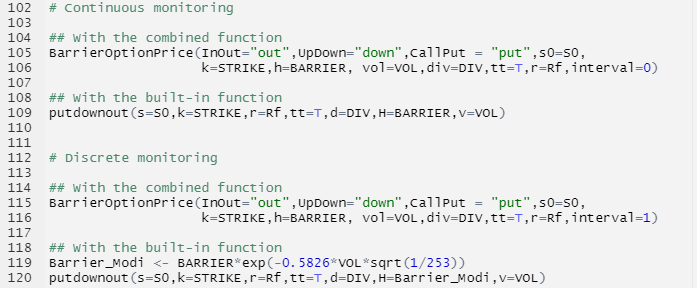

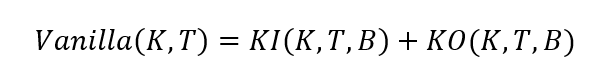

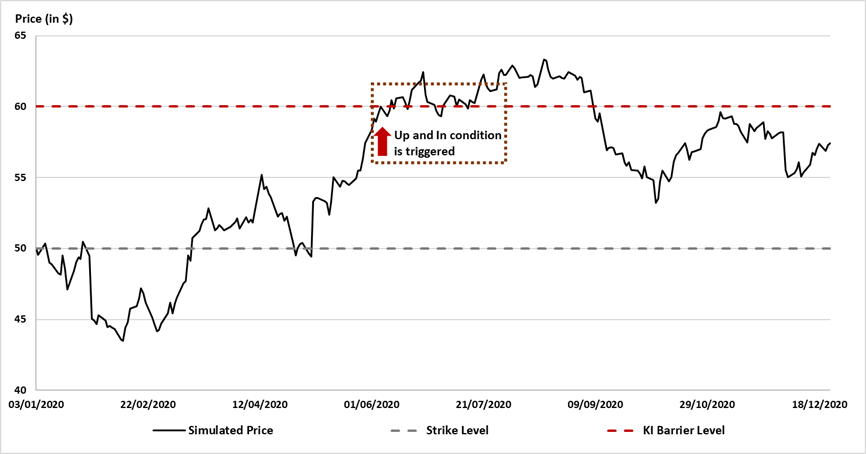

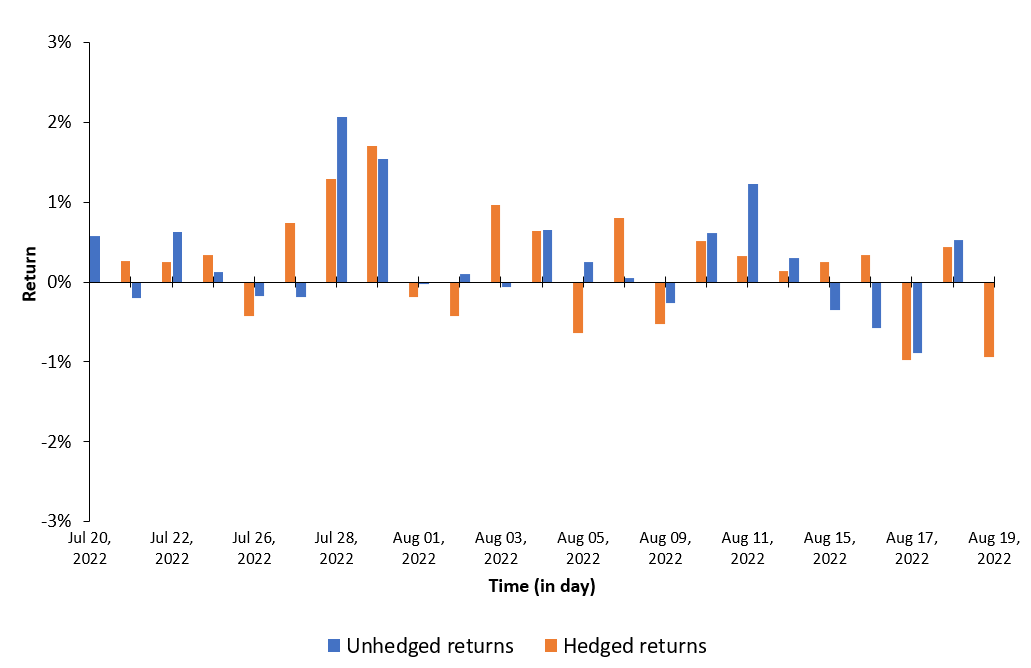

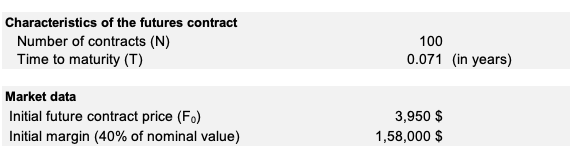

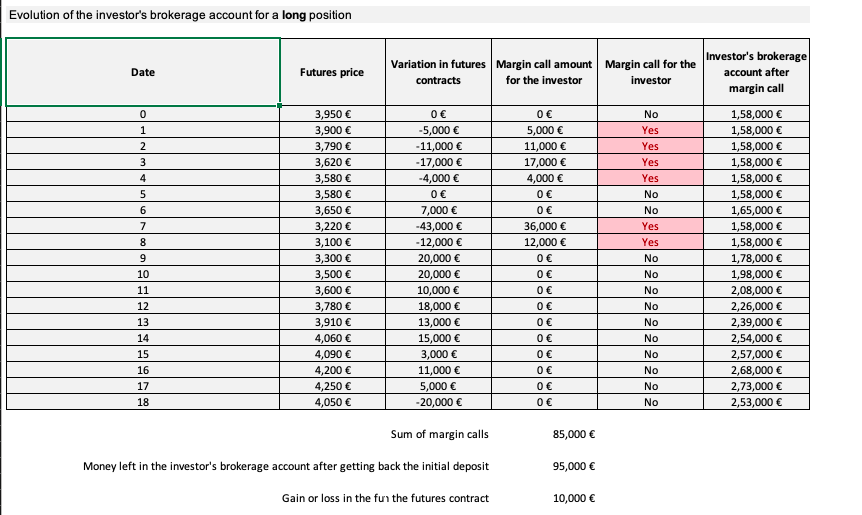

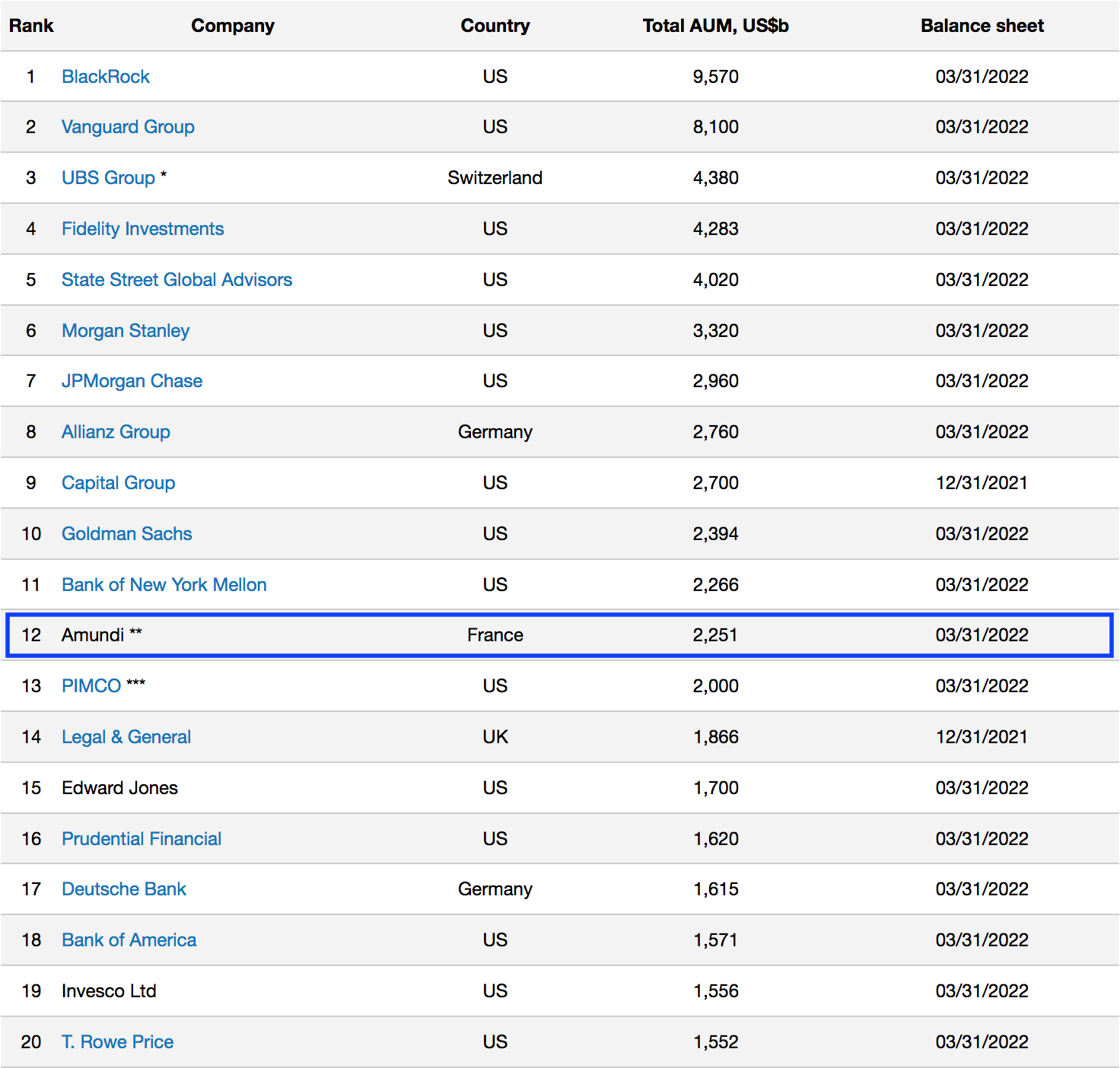

Source : computation by the author.

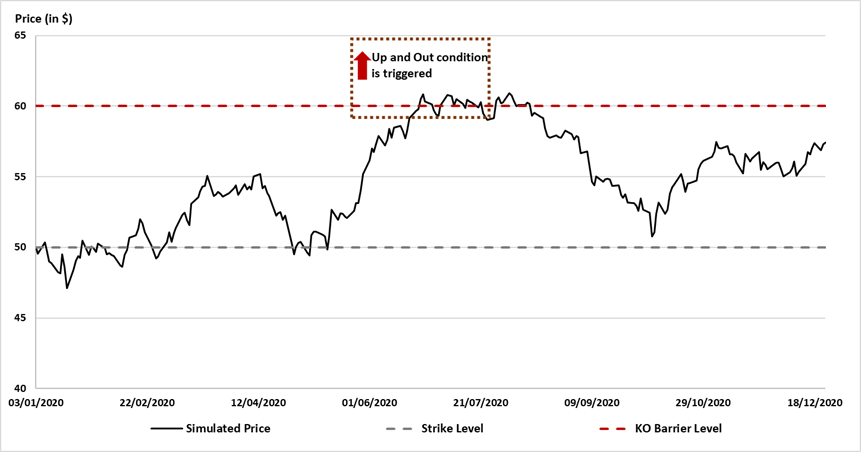

Source : computation by the author.

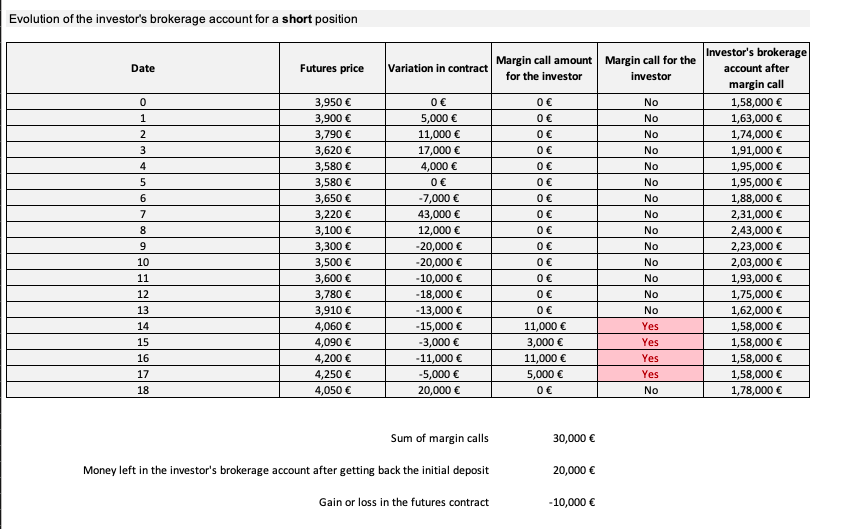

Source: www.advratings.com

Source: www.advratings.com Source: Amundi

Source: Amundi

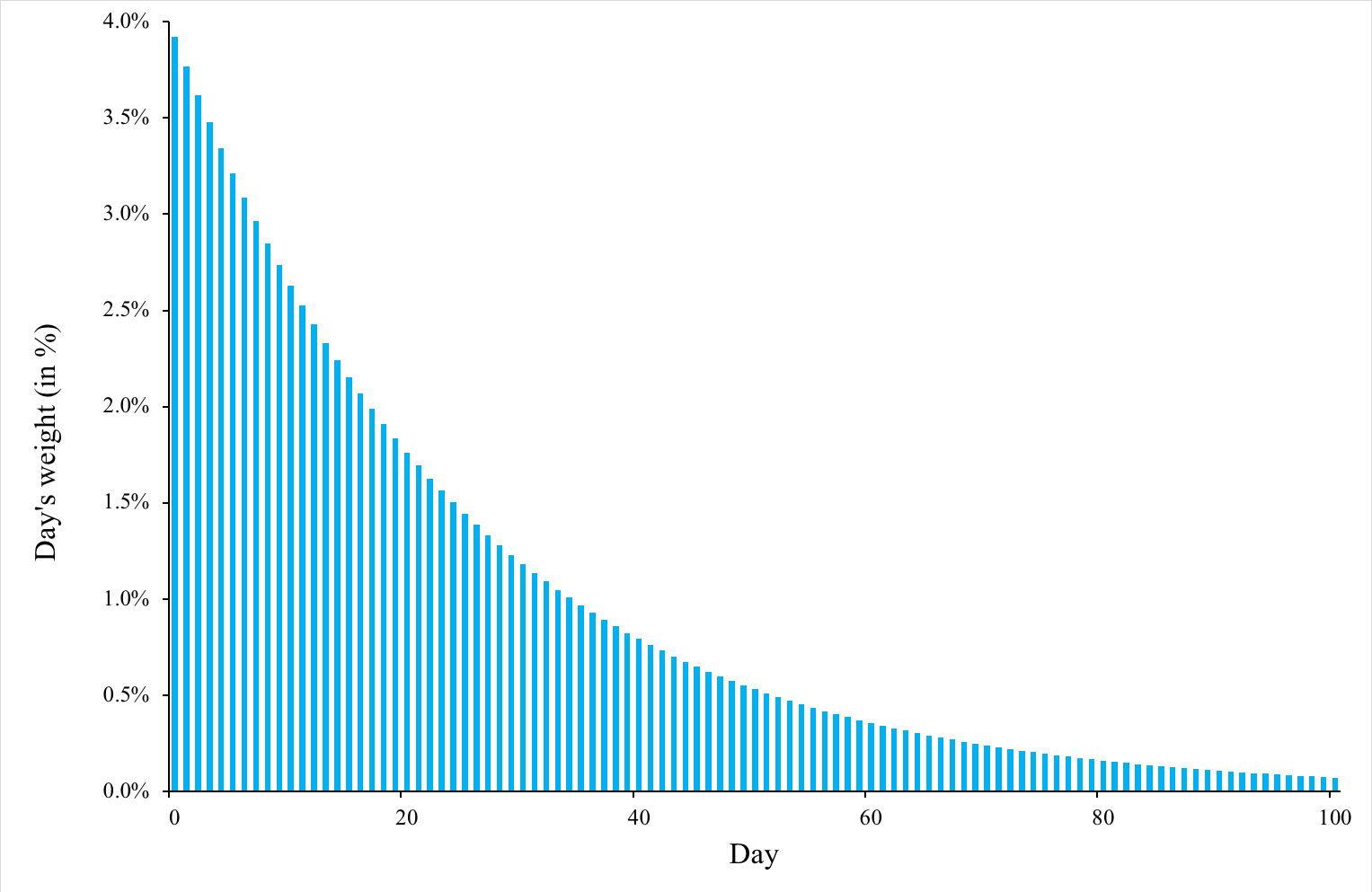

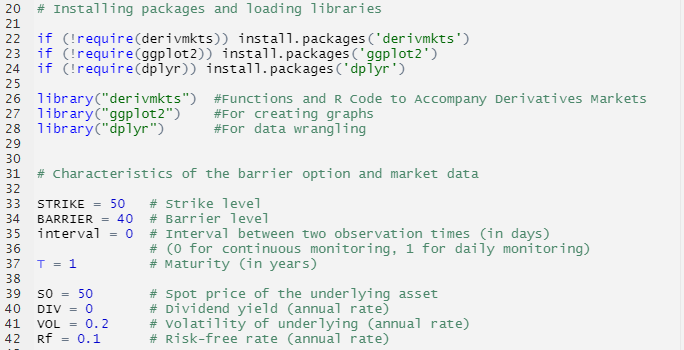

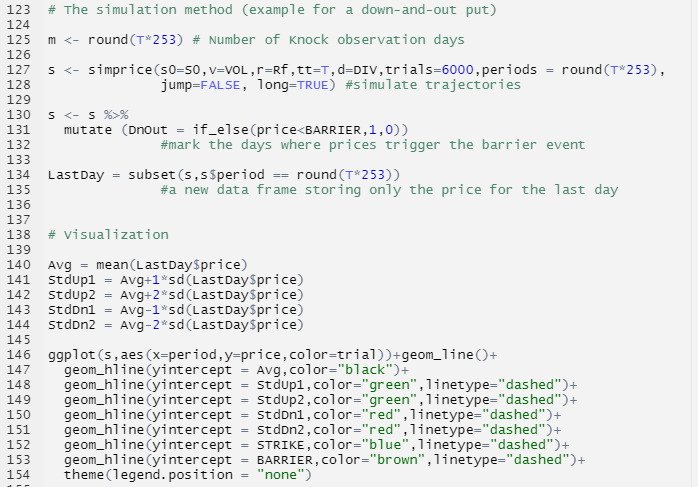

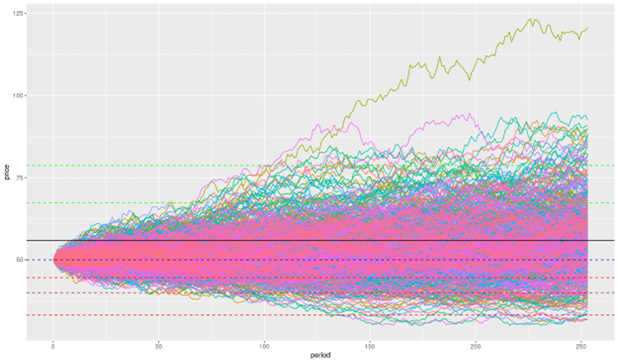

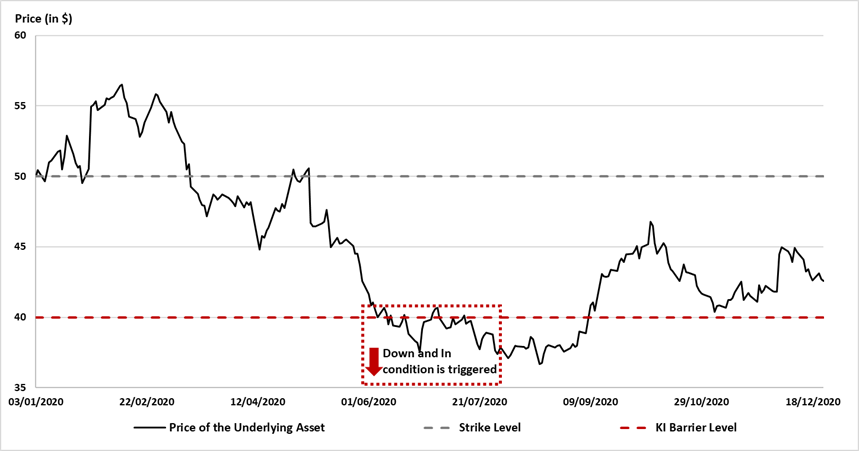

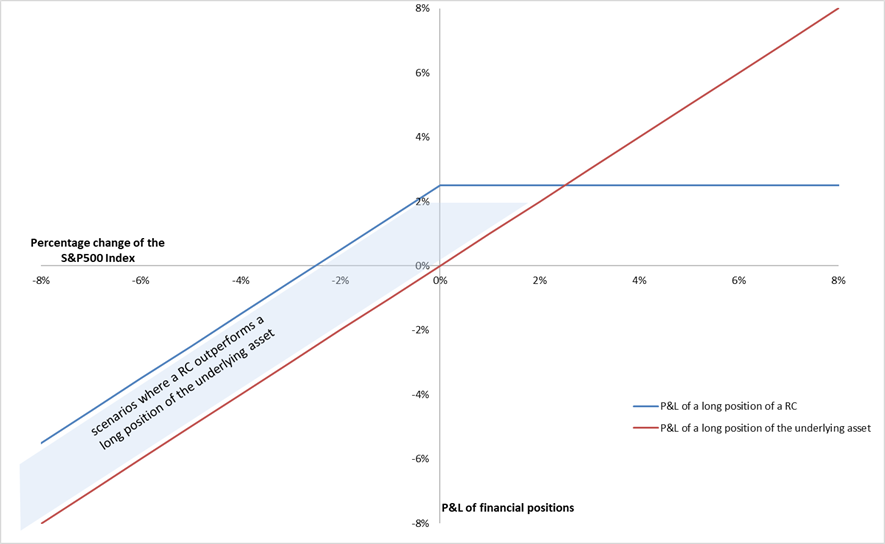

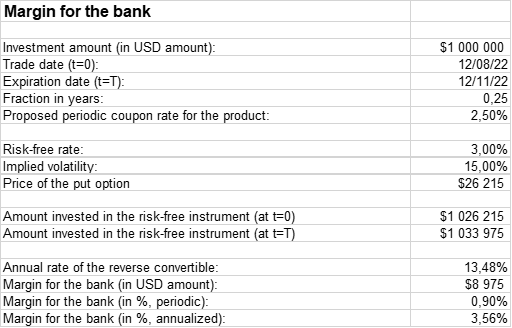

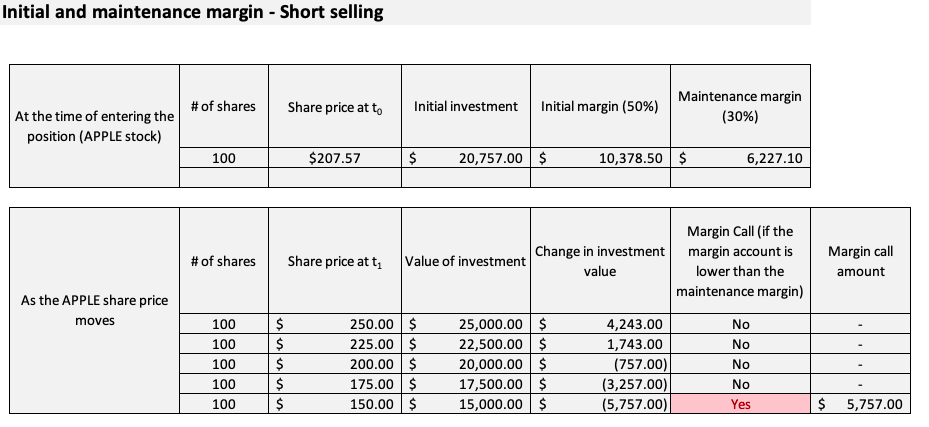

Source: Computation by author.

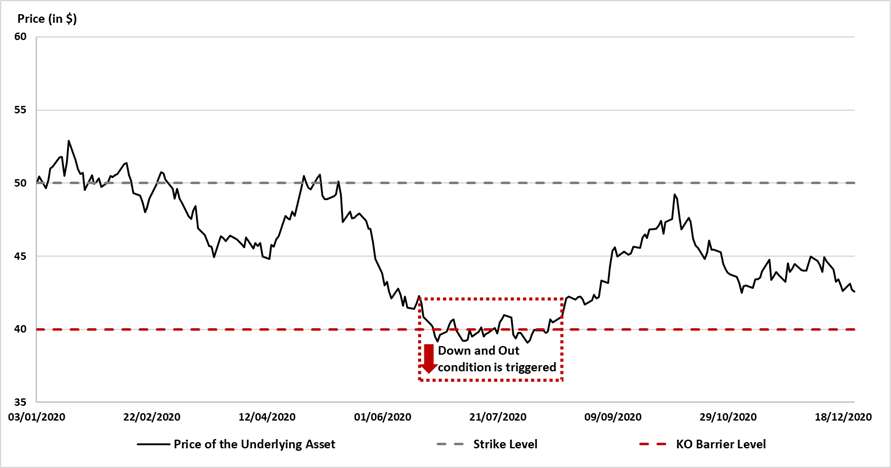

Source: Computation by author.