What I learned from my time on the stock market

In this article, Joshua WAN (ESSEC Business School, Global Bachelor of Business Administration, Exchange Student from Stockholm University, Fall 2021) shares what he has learnt in the stock market.

I’m sure many who have chosen the Sim Trade course are active on the stock market and probably have been for some time. But maybe some of you have not yet ventured out on the world’s equity markets and maybe some of you are taking the SimTrade course in order to prepare yourself for trading with your own hard-earned money.

My story

I was 16 years old when I first decided that I wanted to start investing my spare money and saving it for the future. I had started my first year of Business Administration in upper secondary school and a friend told me that you could open an account on Avanza (Sweden’s largest brokerage firm) with your parents’ permission. After handing in all the required paperwork I transferred about €500 that I had left over from my summer job and was ready to do my first trade.

Back then €500 was a lot of money for me but in the context of the stock market it is just peanuts. What I realize now in hindsight is that this relatively small amount of money allowed me to learn valuable lessons about investing and financial markets without having any larger future consequences. I lost a large percentage of this money, but I did learn a lot from my mistakes. I wanted to share what I learned and maybe someone that wants to start investing can use these lessons to avoid making the rookie mistakes that I made.

Do your own research

One of the first things I learned was that you should always try to understand why you are investing in a specific stock and not just go off other people’s advice. I remember one of my friends telling me to invest in a certain company and he showed me the return that he made on the stock. I didn’t know much about the company, its market, and the future challenges. I did not know why I was investing in this company, so it is no surprise that this investment did not turn out very well. Now I’m not saying that you need to do a full fundamental or technical analysis, but you should understand the company you are investing in and why you are investing in it. You can read different recommendations and try to form your own opinion but don’t invest in something just because someone else tells you to.

Don’t be too impulsive and emotional

The aforementioned investment did not go very well, and I quickly found myself in the red. After about 5 months my position had gone down by circa 40%. At this point I decided to sell the stock in what was more of an impulsive emotional decision than a rational one. I did not sell because the company had no upside, I sold because I did not want to see -40% every time I opened the app.

Warren Buffet once said, “The most important quality for an investor is temperament, not intellect” (Sarwa, 2021). He meant that you need to have discipline, patience and that you need to understand that the market will fluctuate. He also goes on to say that humans are irrational and are tempted to make trades when they feel like the market is working against them. Of course, you should not stay onboard a sinking ship but if you have invested in a good company then patience will often pay off.

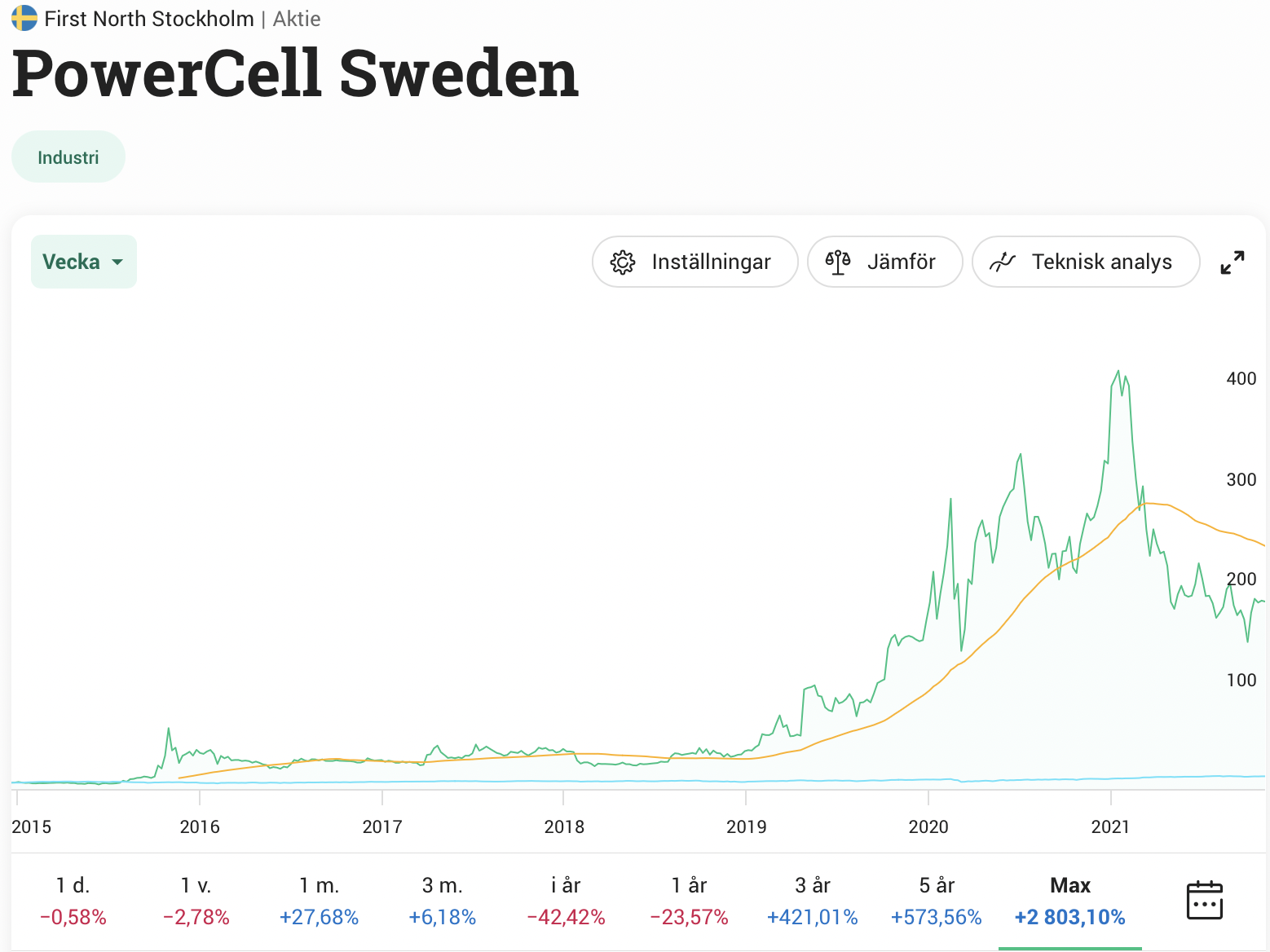

If I would have kept my position in this firm until today, I would have had a return of over 500% and if I would have sold it at the all-time high, I could have had a return of 1,500%. This does however bring me to my next point.

The figure below shows the price evolution of PowerCell Sweden stocks over the period 2015-2021 (the stock investment that I am talking above).

Learn from your mistakes but don’t beat yourself up

Even if you do your research and have patience, you will still have some investments that don’t turn out well and some big opportunities that you will miss. It’s very easy to get hung up on these mistakes but instead of just seeing the negatives you can use this opportunity to try and understand why you made the mistake. By understanding your mistakes, you can lay a foundation for better future decisions. From the investment I previously mentioned I learned the importance of patience and knowledge. I realize now that it would have been a perfect opportunity to buy more shares instead of selling. But even if it doesn’t feel very nice that I missed out on a huge return you can’t beat yourself up over it because there will always be something you could have done better.

Have a strategy

Before you start trading/investing you need to have a strategy. You should know if you are investing long term or short term, low-risk low-return or high-risk high-return or if you are targeting value or growth firms. Of course, you can mix all these strategies and use different ones for different investments, but you need to be aware of what you are doing and why you are doing it. It can also be useful to know how much money you are willing to lose and how much profit you are willing to walk away with so you can manage your position using stop-loss orders and take-profit orders.

Diversification

For many of you this is nothing new, but diversification is one of the most important things to think about when building an investment portfolio. By investing in different industries and different geographical markets, you can minimize the risk that is specific to each firm. Of course, you cannot diversify all risk, after a certain point the diversification effect is marginally decreasing and there is a systematic risk that you cannot diversify away. When I first started, I only owned 2 stocks and I was very heavily weighted in one of them so when this stock went down my whole portfolio also went down. Of course, it was hard to achieve significant diversification with such a small amount of capital, but I have since then learned the importance of diversification. Even on the worst days there is usually one or two stocks in my portfolio that are not in the red.

Some final thoughts

I’m sure most of this is old news to you but I wanted to share what I’ve learned from my early mistakes in case anyone here wants to but has not yet taken the step on to the financial markets. Even if you don’t want to be an active trader and just want to invest in mutual funds and ETFs, these lessons and principles can still be useful.

Related posts on the SimTrade blog

▶ Youssef LOURAOUI Modern portfolio theory

▶ Akshit GUPTA Growth investment strategy

Useful resources

Sarwa (7th October 2021) Top 20 Warren Buffett Quotes To Inspire Your Investment Goals.

About the author

The article was written in November 2021 by Joshua WAN (ESSEC Business School, Global Bachelor of Business Administration, Exchange student from Stockholm University, Fall 2021).