In this article, Lilian BALLOIS (ESSEC Business School, Bachelor in Business Administration (BBA), 2019-2023) explains about Private Equity fund strategies.

Reminder: What is Private Equity?

Private Equity entails investors directing capital into privately held enterprises that are not publicly traded on stock exchanges. Private Equity firms manage investors’ funds, which are utilized to secure ownership stakes in these companies, fostering their growth, innovation, or resolution of financial challenges. In exchange, investors anticipate yielding profits upon exiting the investment, typically within a span of 5 to 8 years.

Private equity thus offers a way for companies to receive strategic financing and for investors to earn returns on their investments, in an alternative way to traditional investments.

But how do you know which funds to invest in?

Decoding Success: How to choose the perfect Private Equity Investment Strategy

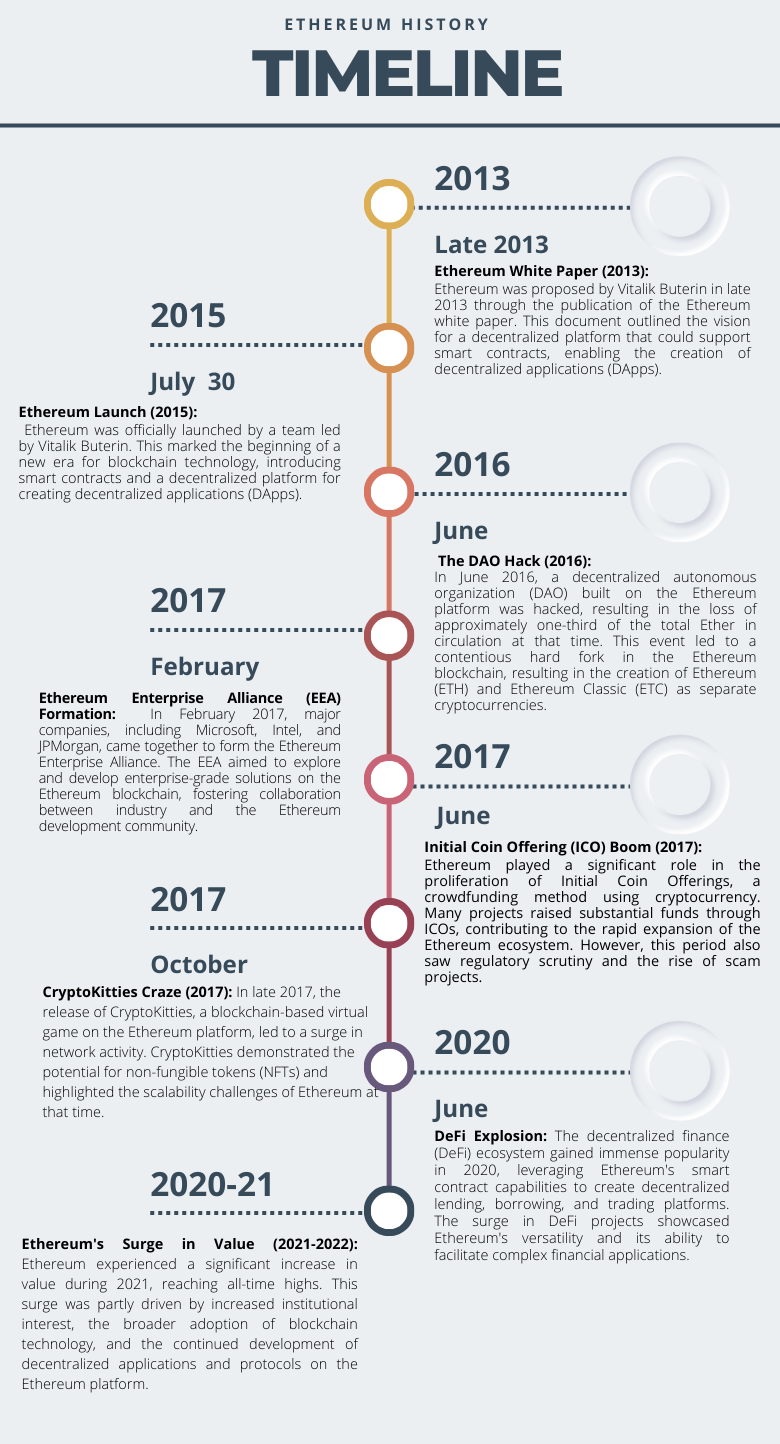

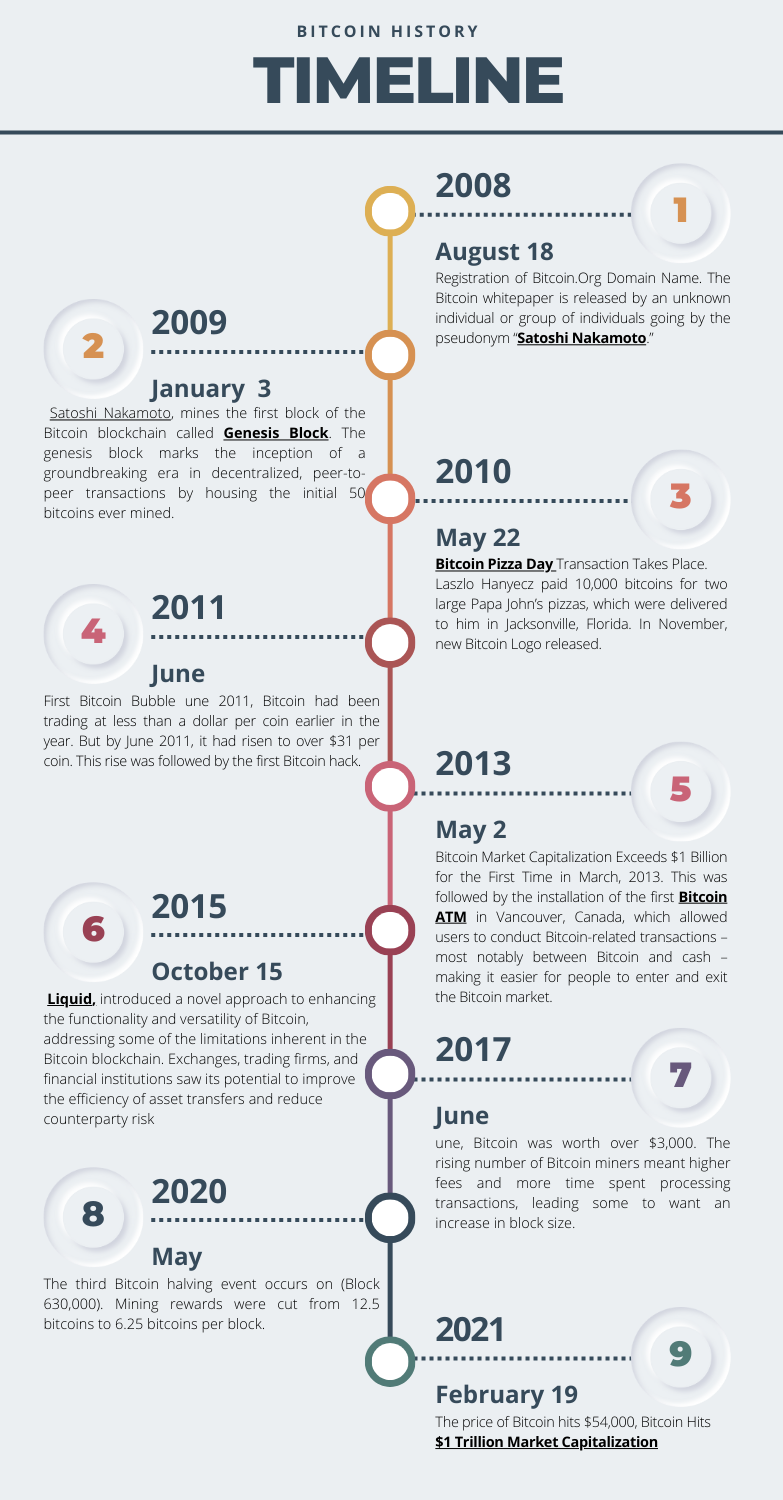

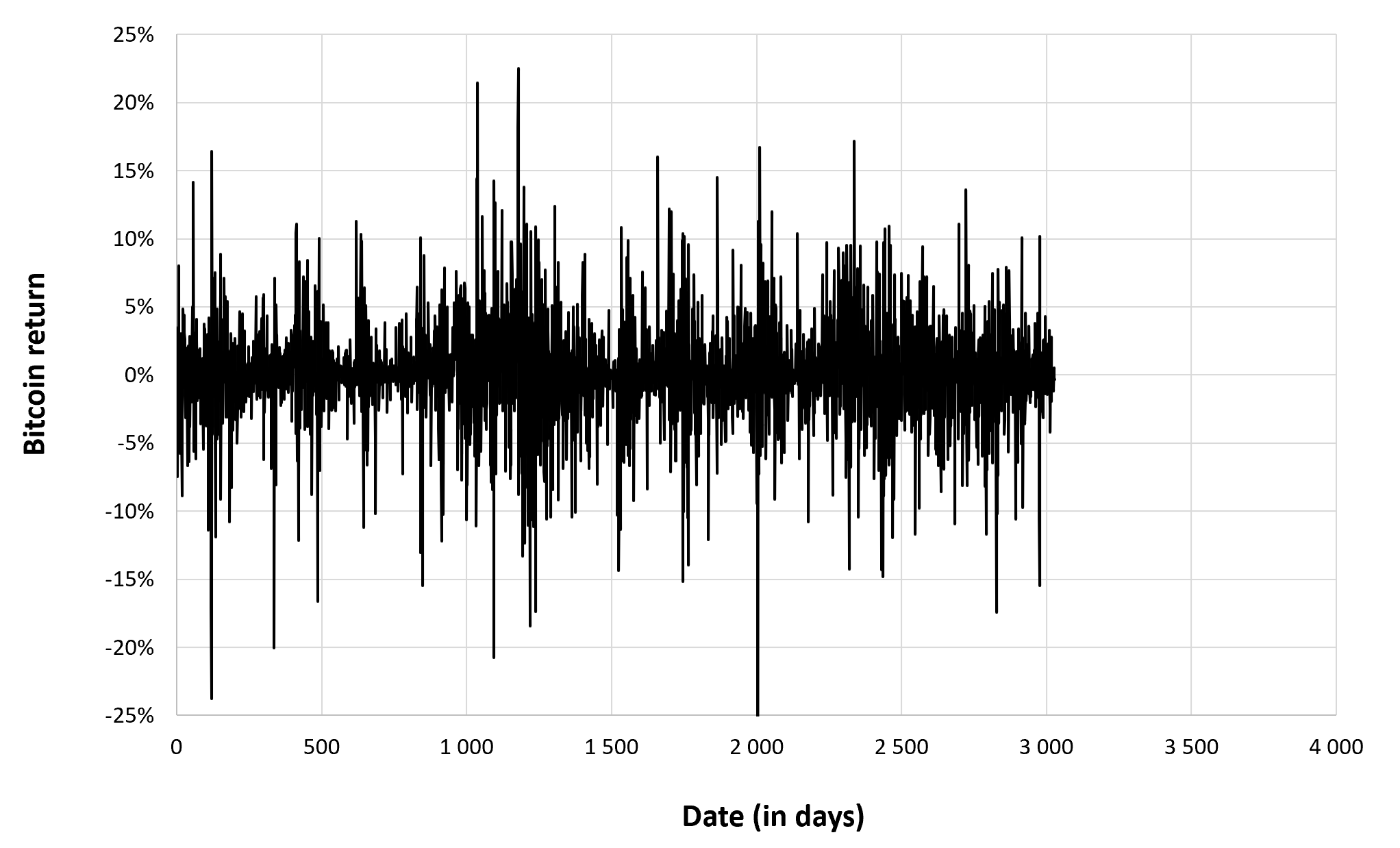

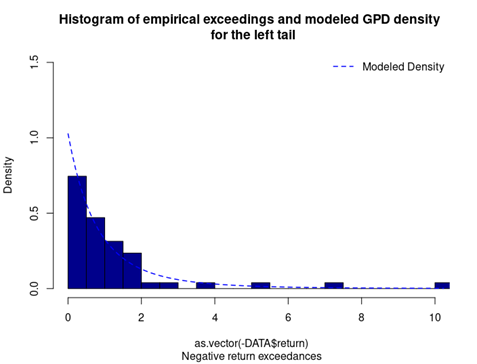

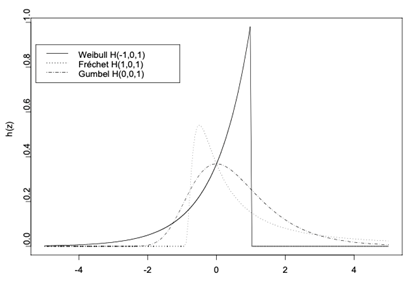

Aligning Investments with the Company Lifecycle

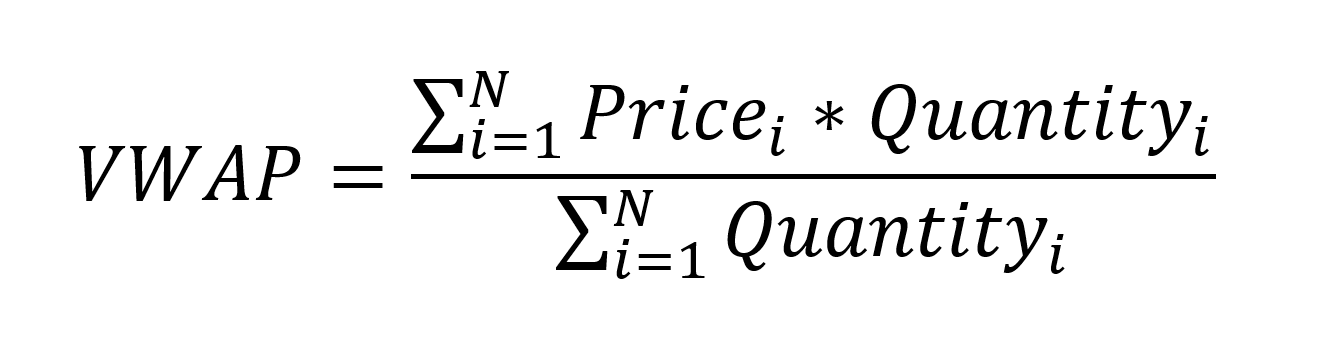

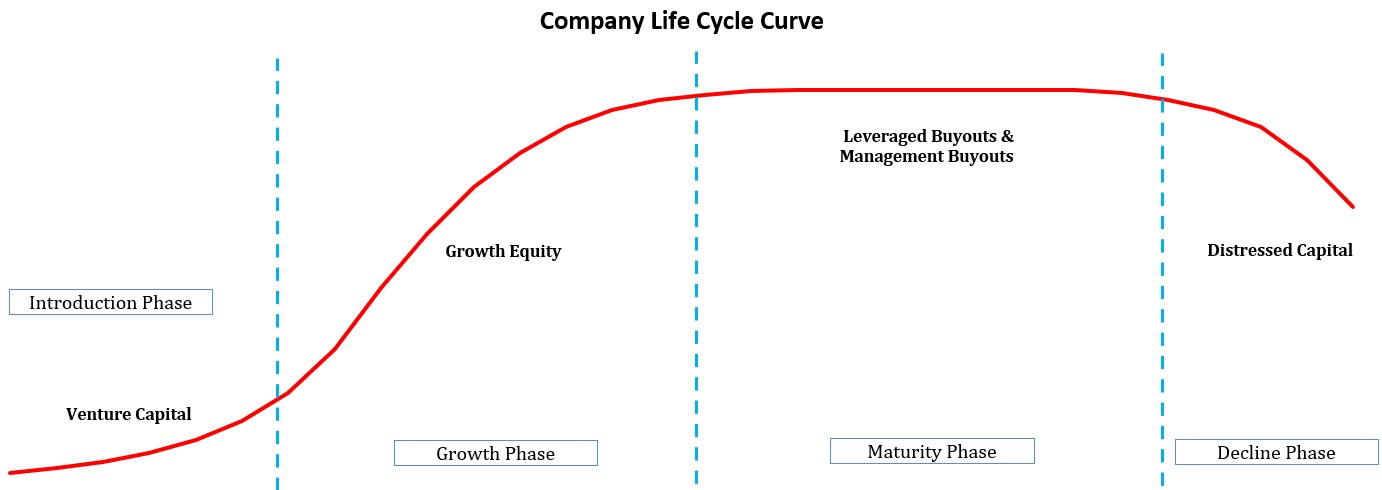

Private equity investments are aligned with various stages of a company’s lifecycle (Cf. chart below). In the early stages, venture capital provides funding for startups to assist in innovation and growth. As companies mature, growth equity offers expansion capital to fuel further development and market penetration. In the maturity stage, private equity often engages in leveraged buyouts (LBOs) to acquire established companies, implementing operational enhancements and strategic changes to boost efficiency and profitability. Finally, distressed capital may be deployed to support struggling businesses, offering resources and expertise to facilitate turnaround efforts.

Company life cycle.

Source: The author

Venture Capital: at the Introduction Phase

Venture Capital is a private equity and financing approach focused on supporting early-stage startups and high-potential businesses. Investors, including affluent individuals, investment banks, and angel investors, contribute funds to fuel the growth of these companies. Apart from monetary contributions, investors may also offer technical or managerial expertise. An illustrative example of Venture Capital at work is Uber, which in 2010 received its initial major funding of $1.3 million led by First Round Capital. Shortly after, in early 2011, it raised $11 million in a Series A funding round led by Benchmark. With these funds, Uber expanded its operations to various cities in the United States and abroad, including Paris, where the concept originated. By December of 2011, Uber secured $37 million in Series B financing from Menlo Ventures, Jeff Bezos, and Goldman Sachs, further fuelling its global expansion and technological advancements.

Growth Equity: at the Growth Phase

Growth equity is a less speculative form of financing, aids companies in their expansion phase. Unlike venture capital, growth equity is directed at already profitable and mature businesses with minimal debt. This type of funding, commonly involving minority ownership through preferred shares, facilitates strategic business growth, such as entering new markets or acquiring other companies, with a balanced risk-return profile. Adyen, a prime example, initially self-funded, but experienced exponential growth after securing $250M in Series B funding led by General Atlantic in 2014. This injection of capital significantly accelerated Adyen’s trajectory, leading to its successful IPO on Euronext in June 2018, with a market capitalization of €7.1B. Adyen’s subsequent revenue surge to €721.7 million in 2022 further underscores the potency of growth equity in fuelling sustained business growth.

Leveraged Buyouts & Management Buyouts: during the Maturity Phase

Leveraged Buyouts

Leveraged Buyouts (LBOs) funds combine investment funds with borrowed capital to acquire companies, aiming to enhance profitability. By leveraging creditors’ and investors’ money, the fund manager has more capital to purchase larger companies, either outright or by securing a majority stake for strategic control. The term “leveraged buyout” reflects the use of borrowed funds to afford larger acquisitions, potentially resulting in substantial returns if the strategies pay off. An instance of an LBO is Elon Musk’s acquisition of Twitter, Inc. Despite initial resistance from Twitter’s board, who employed a “poison pill” strategy to deter hostile takeovers, Musk’s persistent pursuit led to the acceptance of his buyout offer of $44 billion on April 25.

Management Buyouts

Management Buyouts (MBOs) are transactions in which the existing management team of a company acquires a significant ownership stake or complete ownership of a business. In a MBO, the current managers collaborate with a private equity firm to purchase the business from its existing owners. This transaction is common when a company’s management team believes they can run the business more effectively or exploit growth opportunities better than the current ownership structure allows. The MBO of Dell Inc. in 2013 stands out as one of the largest and most significant in history. With a valuation reaching approximately $24.9 billion. The company’s founder, Michael Dell, partnered with Silver Lake Partners to reclaim control of the company he had founded. The move allowed Dell to implement long-term strategies and make pivotal decisions without the immediate pressures of quarterly earnings reports, facilitating a more nimble and adaptable approach to the rapidly evolving tech landscape.

Distressed Capital: at the Decline Phase

Distressed capital consists in lending to companies facing financial crises and to take control of businesses during bankruptcy or restructuring processes. The strategy involves purchasing distressed companies at a lower price, turn them around, and eventually sell them. Distressed capital carries inherent risk due to investing in financially challenged companies. For example, in May 2020, Hertz Global Holdings, filed for Chapter 11 bankruptcy due to the impact of the COVID-19 pandemic on its business, which saw a significant decline in travel demand. During its bankruptcy proceedings, Hertz secured funding from distressed debt investors to support their operations and restructuring efforts. This financing came from a consortium of lenders and institutional investors, providing Hertz with the liquidity needed to continue operations, pay essential expenses, and navigate the bankruptcy process.

Timeless Investing: Optimizing Portfolios through Vintage Year Diversity

What are “Vintage Years”?

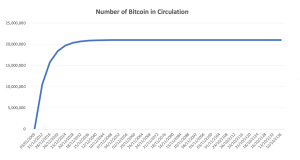

“Vintage years” refer to specific time periods during which a fund was raised or initiated. Each vintage year represents a cohort of funds that were raised and deployed within a similar timeframe. These vintage years are often used by investors and analysts to track the performance of funds over time, as funds raised in the same vintage year may encounter similar market conditions and economic environments, which can affect their overall performance and returns.

Mitigating market cycles

Private equity has demonstrated superior performance compared to public equity throughout market cycles. However, returns are subject to fluctuations based on the phase of the business cycle. For instance, if a fund initiates investments during a downturn, it is likely to encounter a broader array of distressed and undervalued assets, with the potential for profitable exits when the market peaks. Conversely, a fund entering the market at its highpoint may face challenges as assets are likely to be expensive and may risk undervaluation upon entering public markets during the exit phase.

Given the unpredictability of market timing, diversification across vintages serves as a strategic approach to dampen this cyclical risk. This approach aims to create a more stable return profile that mirrors the overall characteristics of the asset class.

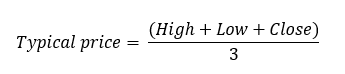

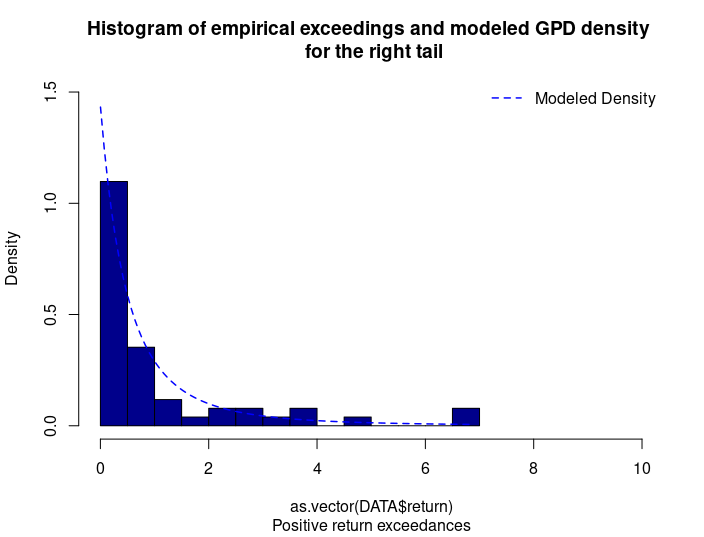

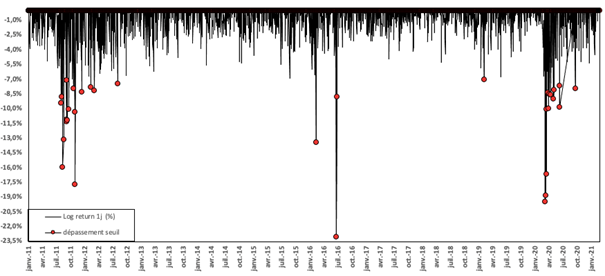

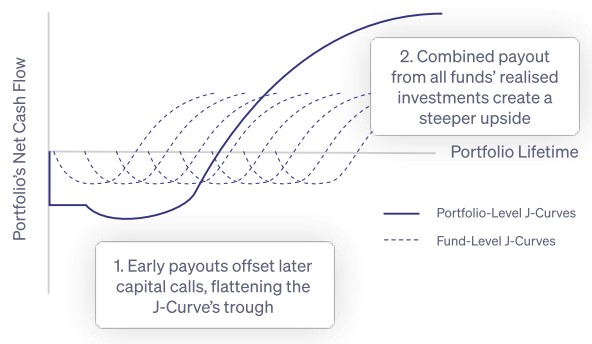

Establishing a self-sustaining portfolio

Company life cycle.

Source: The author

As written above, funds can diversify through various vintages. This strategy allows to generate returns from an earlier vintage, which are reinvested as commitments for a subsequent vintage. In doing so, a self-funding portfolio is cultivated, steadily appreciating in value over time.

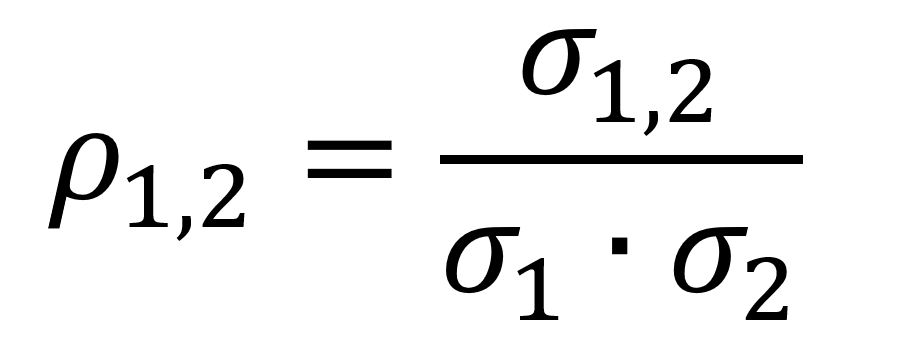

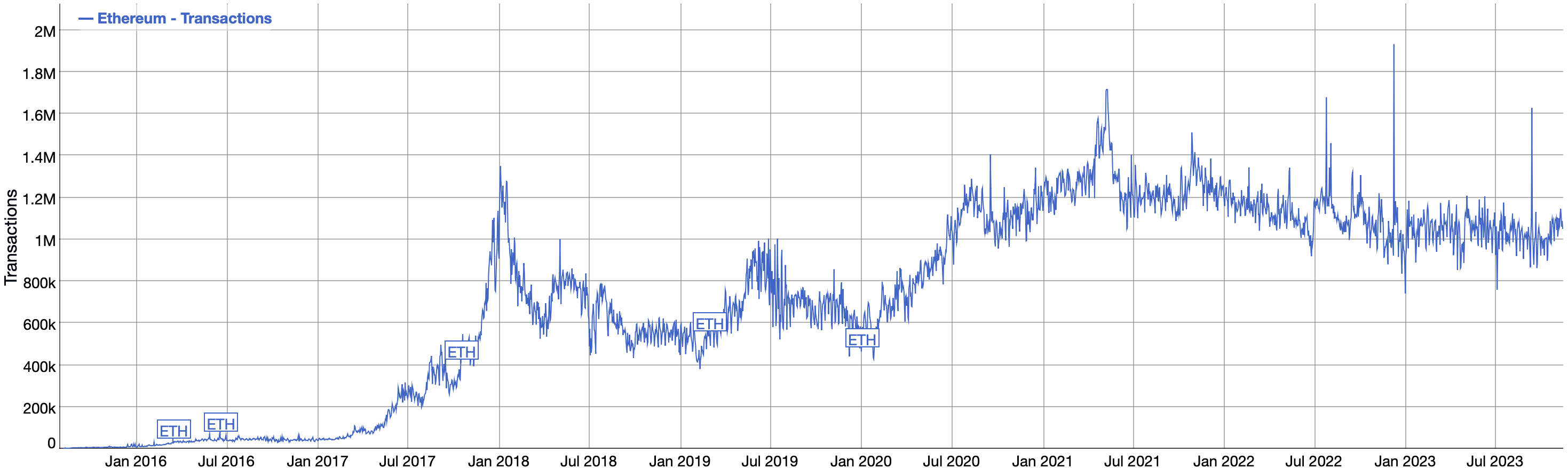

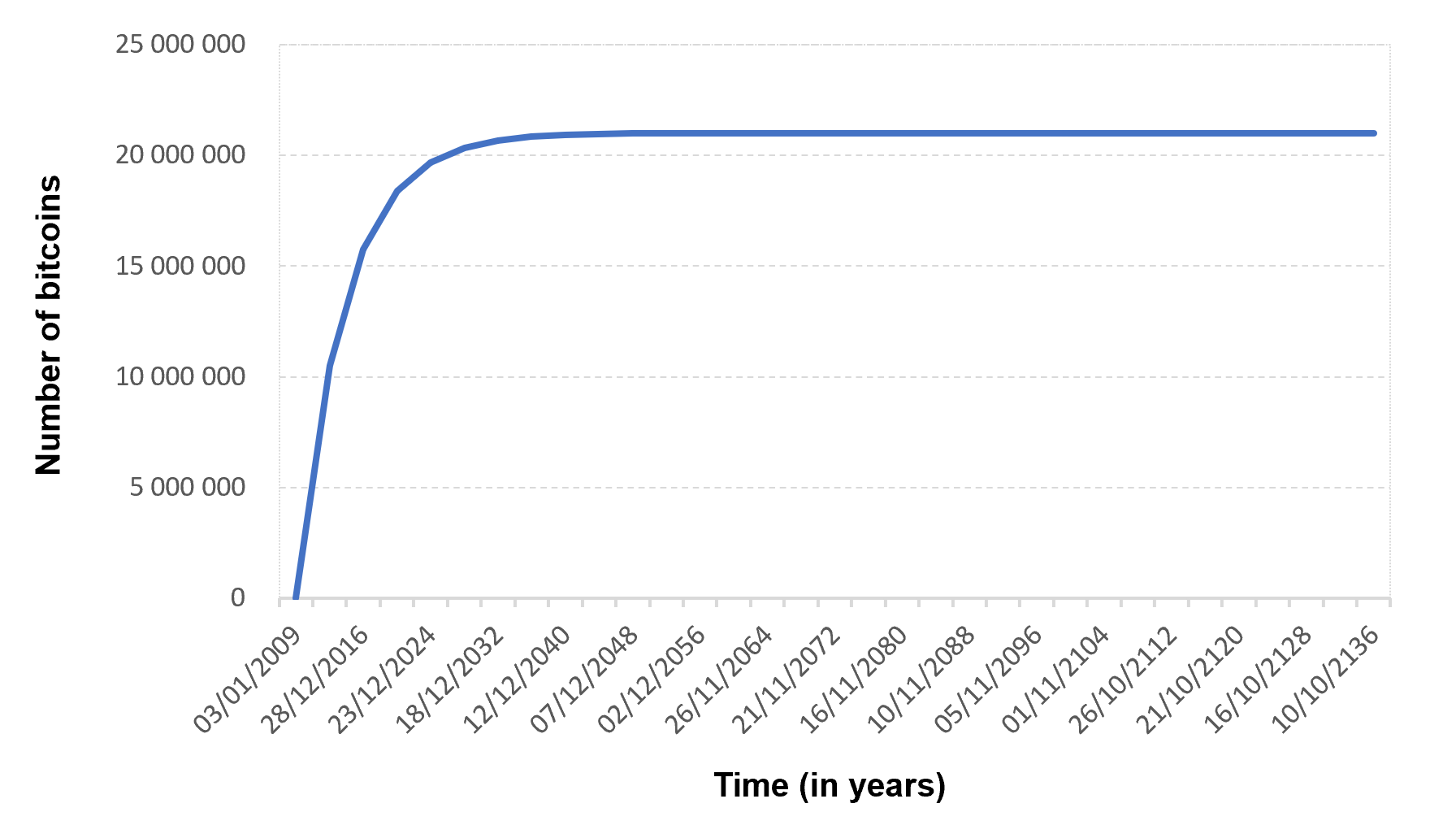

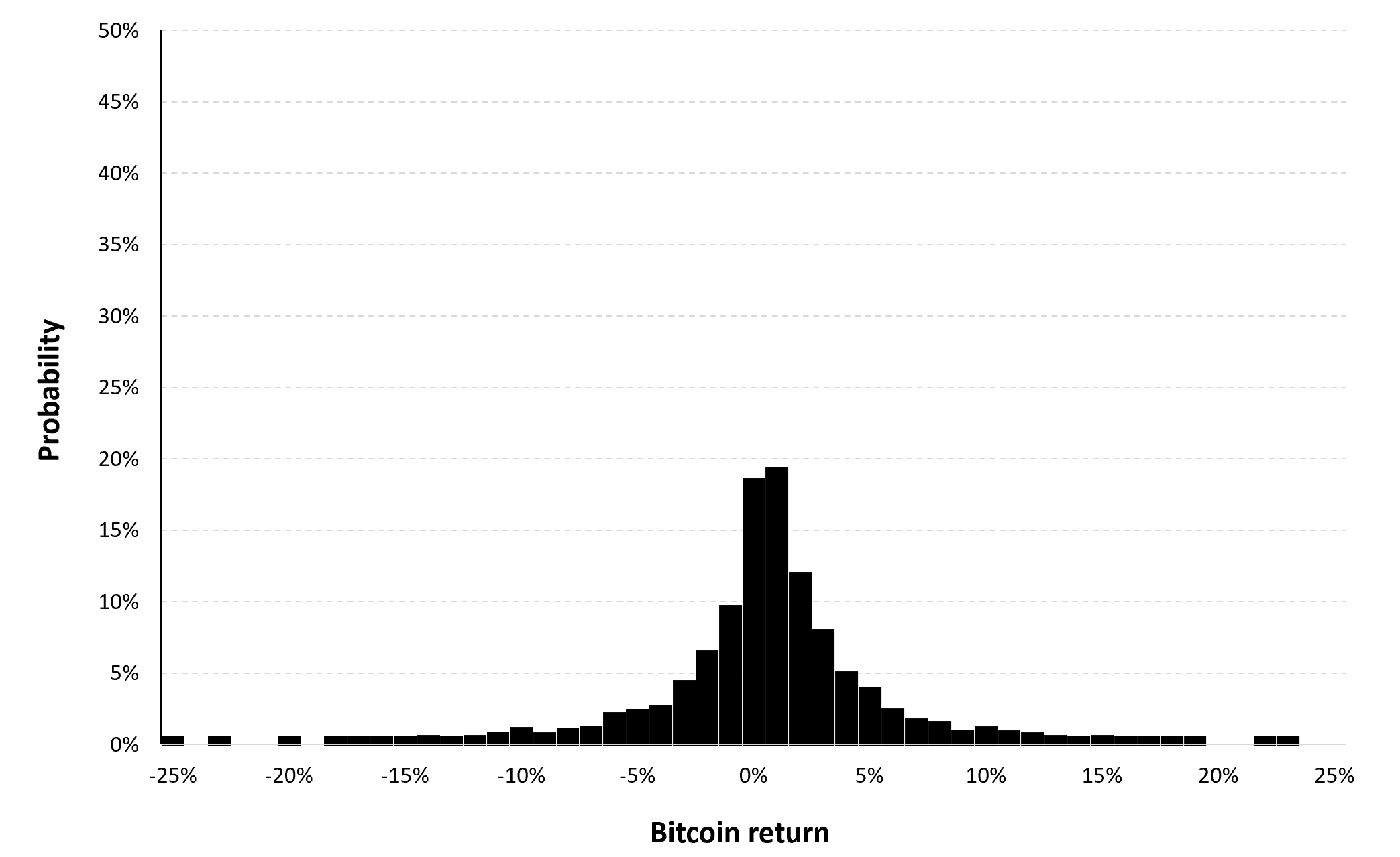

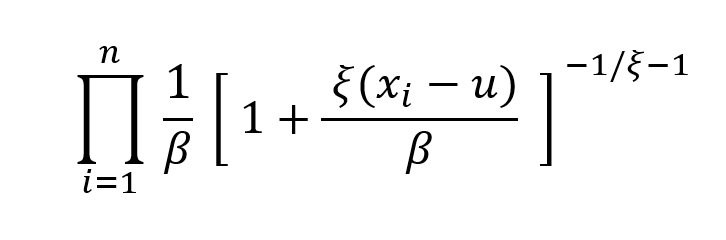

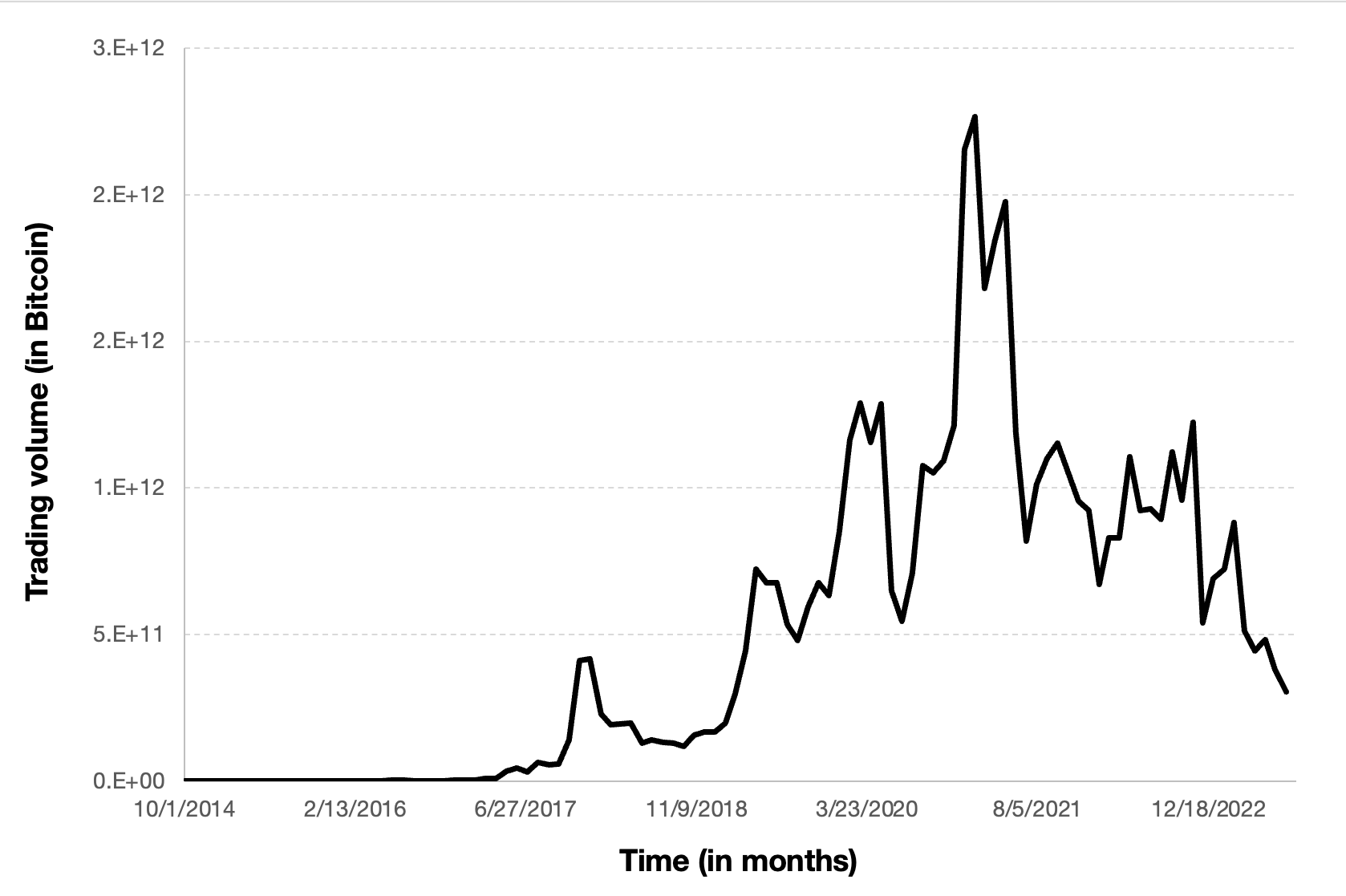

Exploring Sectors of Private Equity Investments

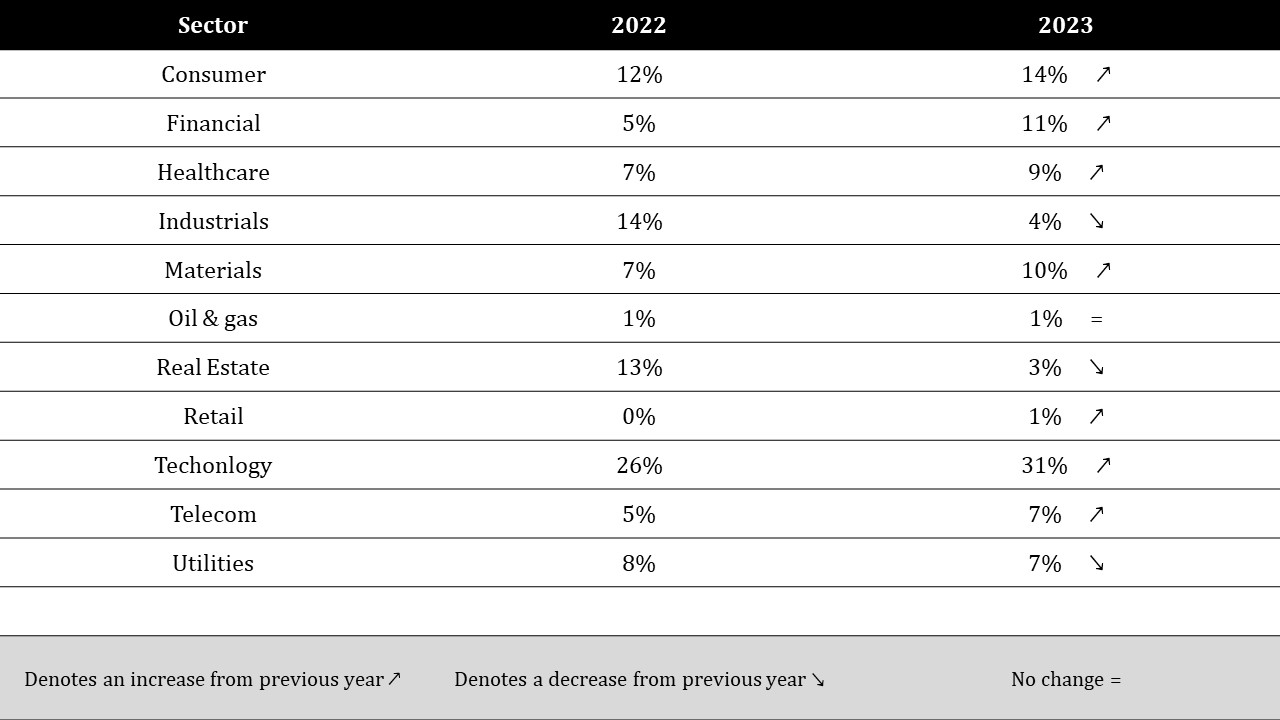

In 2023, technology continued to lead private equity investments, capturing a significant 31% share of total investments. Cloud-related ventures, especially enterprise Software as a Service (SaaS), remained appealing, fueled by expectations of sustained growth. Additionally, the rapid adoption of machine learning, driven by global enterprises integrating generative Artificial Intelligence (GenAI) into operations, signaled a broader trend towards innovation.

Consumer-focused investments, accounting for 14% of total investments, saw a focus on low-risk ventures in the food and agribusiness sector. Sustainable farming, combined agriculture, and timber ventures stood out, driven by increasing emphasis on environmental sustainability and responsible resource management.

In addition, financial services (11%) and health sectors (9%) saw significant private equity activity. In finance, investments spanned various subsectors, reflecting a pursuit of diverse opportunities. Meanwhile, health sector niches like enterprise imaging solutions and voice-based diagnostics attracted attention, driven by innovation in medical technology platforms, highlighting the sector’s transformative potential.

PE deals by sector.

Source: Moonfare

The private equity landscape in 2023 featured a diverse range of investment opportunities, with technology dominating while consumer, financial services, and health sectors also drew significant interest, providing distinct pathways for growth and value generation.

Why should I be interested in this post?

This post offers a comprehensive overview of private equity investing. It defines private equity and explores various investment strategies such as venture capital, growth equity, leveraged buyouts, management buyouts, and distressed capital, providing practical insights into their roles at different stages of a company’s lifecycle. Additionally, the post discusses the concept of vintage years and their significance in tracking fund performance over time, highlighting the importance of portfolio diversification and risk management.

Related posts on the SimTrade blog

▶ Louis DETALLE A quick presentation of the Private Equity field…

▶ Louis DETALLE A quick review of the Growth Capital…

▶ Louis DETALLE A quick review of the Venture Capitalist’s job…

▶ Matisse FOY Key participants in the Private Equity ecosystem

▶ Marie POFF Film analysis: The Wolf of Wall Street

Useful resources

Academic References

Martin, J. and R. Manac (2022) Varieties of funds and performance: the case of private equity, The European Journal of Finance, 28(18) 1819–1866.

EVCA (2007) Guide on Private Equity and Venture Capital for Entrepreneurs

Caselli, S. and M. Zava (2022) Private Equity and Venture Capital Markets in Europe

Specialized Press

Investment Strategies in private equity

Barber F. and M. Goold (2023) The strategic secret of private equity Harvard Business Review

Private Equity Pulse: key takeaways from Q4 2023

Financial Times Private Equity

Wall Street Journal Private Equity

About the author

The article was written in February 2024 by Lilian BALLOIS (ESSEC Business School, Bachelor in Business Administration (BBA), 2019-2023).